Check Progress Of Marriage Allowance Claim Manage an existing benefit payment or claim Sign in to your account report changes find out about overpayments or appeal a decision Includes existing Universal Credit and tax

The quickest way to apply for Marriage Allowance is online You ll get an email confirming your application within 24 hours Start now Other ways to apply If you cannot apply You can claim Married Couple s Allowance in your Self Assessment tax return If you don t complete a Self Assessment tax return contact HMRC Opens in a new window

Check Progress Of Marriage Allowance Claim

Check Progress Of Marriage Allowance Claim

https://www.jp-accountancy-services.com/wp-content/uploads/2020/09/pexels-caio-45960-scaled.jpg

Marriage Allowance 1Accounts

https://1accountsonline.co.uk/wp-content/uploads/2022/08/Copy-of-Starting-a-business-after-redundancy-blog.png

Quick Tips Making Use Of The Marriage Allowance Holden Associates

https://holdenassociates.co.uk/wp-content/uploads/2022/05/10Z41rqkKkYmzhi5m2C2ew-pexels-heiner-204993-scaled.jpg

Find out whether you re eligible to claim marriage allowance the tax break which could allow married couples to earn an extra 252 in 2024 25 plus other tax breaks available for married couples and civil If you applied for Marriage Allowance through HMRC directly and your refund is not showing as claimable on your Personal Tax Account please contact us by

Get a tax break worth up to 1 250 If you re married or in a civil partnership and under 89 years old you may be entitled to a 1 260 tax break called the marriage tax allowance something around 2 1 How to claim The person giving up part of their personal allowance needs to make the claim and as part of doing this can make claims for earlier years also It will be

Download Check Progress Of Marriage Allowance Claim

More picture related to Check Progress Of Marriage Allowance Claim

Marriage Tax Allowance Claim My Tax

https://www.claim-mytax.co.uk/wp-content/uploads/2020/08/iStock-1124667812-1030x687done-e1597313971678-842x551.jpg

We Thought We Were Dealing With HMRC Marriage Allowance Claimants

https://media.product.which.co.uk/prod/images/original/gm-ea70f900-b044-49c4-9cec-4b2f0f2e683c-marriage-allowance-april-2020.jpeg

What Is The Marriage Allowance And How Do You Claim It Limited

https://www.limitedcompanyhelp.com/wp-content/uploads/2017/10/dreamstime_m_511781-e1507999361624-1024x538.jpg

Can I claim marriage allowance for previous years If you have only just heard of the tax break don t worry Eligible couples can backdate their claim to include You can check your eligibility and apply on GOV UK Search Marriage Allowance to find out more To benefit from the tax relief one partner must have income

How to claim Taxpayers can either claim by contacting HMRC direct or via their self assessment tax return This is relevant for accountants as your clients may already be receiving the allowance via Millions of married couples still to claim No paperwork is required Complete the form securely online Lifetime tax reduction of up to 10000 This is a paid for service you

Travelling Allowance To The Officials Deployed For Election Duty

https://www.staffnews.in/wp-content/uploads/2022/09/travelling-allowance-to-the-officials-deployed-for-election-duty-claim-form.jpg

Marriage Allowance Claim Your 252 Tax Rebate

https://www.pattersonhallaccountants.co.uk/wp-content/uploads/2023/02/Marriage-Allowance-1024x576.jpg

https://www.gov.uk/browse/benefits/manage-your-benefit

Manage an existing benefit payment or claim Sign in to your account report changes find out about overpayments or appeal a decision Includes existing Universal Credit and tax

https://www.gov.uk/apply-marriage-allowance

The quickest way to apply for Marriage Allowance is online You ll get an email confirming your application within 24 hours Start now Other ways to apply If you cannot apply

Marriage Allowance Should I Claim Alpha Business Services

Travelling Allowance To The Officials Deployed For Election Duty

Expense Claim Form In Excel Basic Forms General Accounting Office

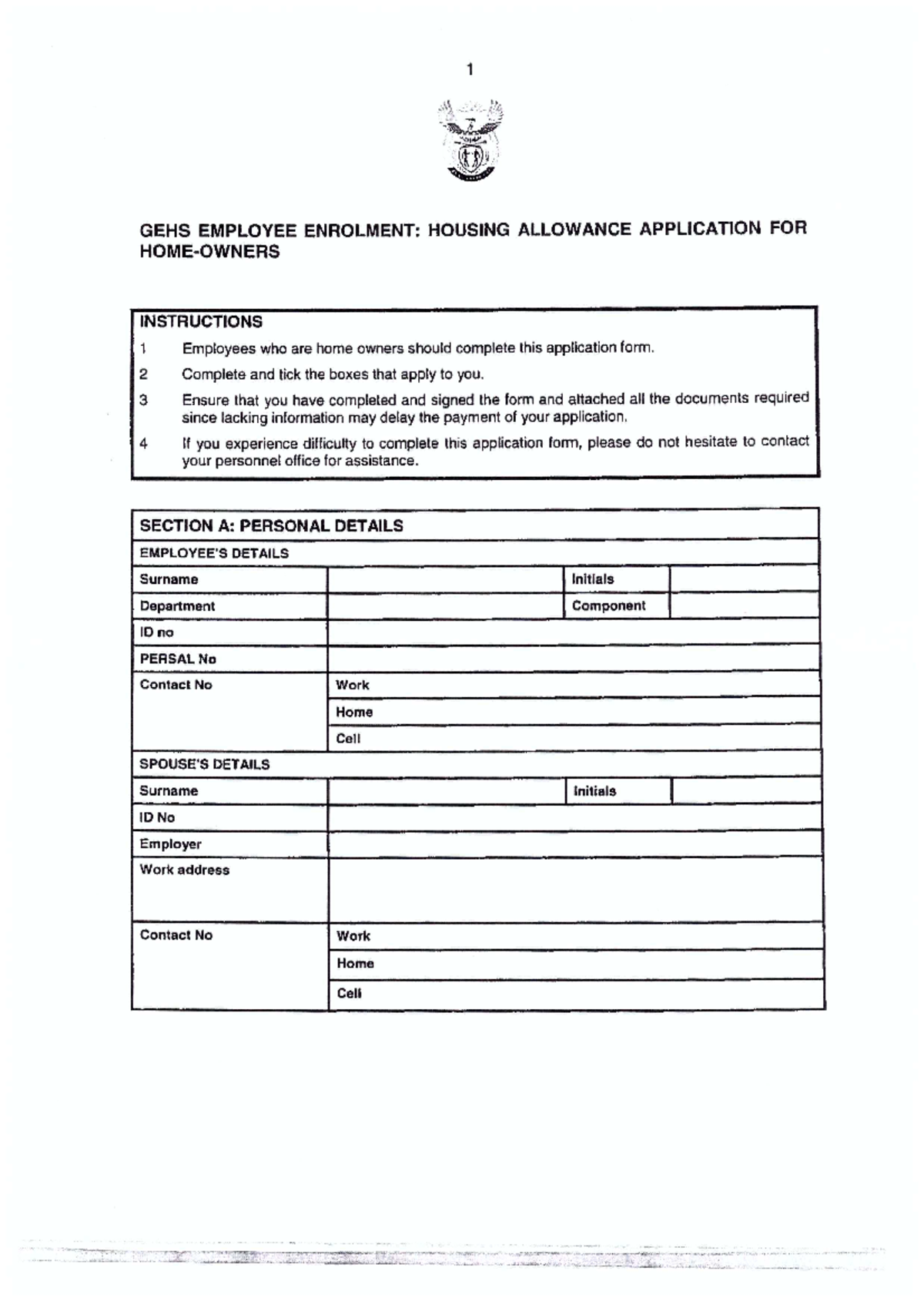

Housing Allowance Form For Homeowners HRM2601 Studocu

How To Claim Your Marriage Allowance Within The Shorter Period

Application For Medical Allowance Issuance Sample SemiOffice Com

Application For Medical Allowance Issuance Sample SemiOffice Com

TidyCloud HMRC Urges Eligible Couples To Claim Marriage Allowance

Marriage Allowance TI Accountancy Ltd

Marriage Tax Allowance Claim How To Claim Marriage Allowance

Check Progress Of Marriage Allowance Claim - If you applied for Marriage Allowance through HMRC directly and your refund is not showing as claimable on your Personal Tax Account please contact us by