Tax Rebate On Interest Earned Web 22 f 233 vr 2023 nbsp 0183 32 22 February 2023 No changes from last year From 1 March 2015 2016 tax year a final withholding tax at a rate of 15 will be charged on interest from a

Web However under Section 244A of the Income Tax Act the IT department must pay an interest of 0 5 of the refund amount per month or part thereof This means your Web 19 mai 2022 nbsp 0183 32 19 May 2022 The interest earned or accrued on a National Savings Certificate NSC is taxable For taxation purposes it should be added to the taxable

Tax Rebate On Interest Earned

Tax Rebate On Interest Earned

https://www.pdffiller.com/preview/535/27/535027308/large.png

Solved The Times interest earned TIE Ratio Shows How Well Chegg

https://d2vlcm61l7u1fs.cloudfront.net/media/cd6/cd60d29a-bd4e-443e-8b90-887f0b5c3342/phpcb0juA.png

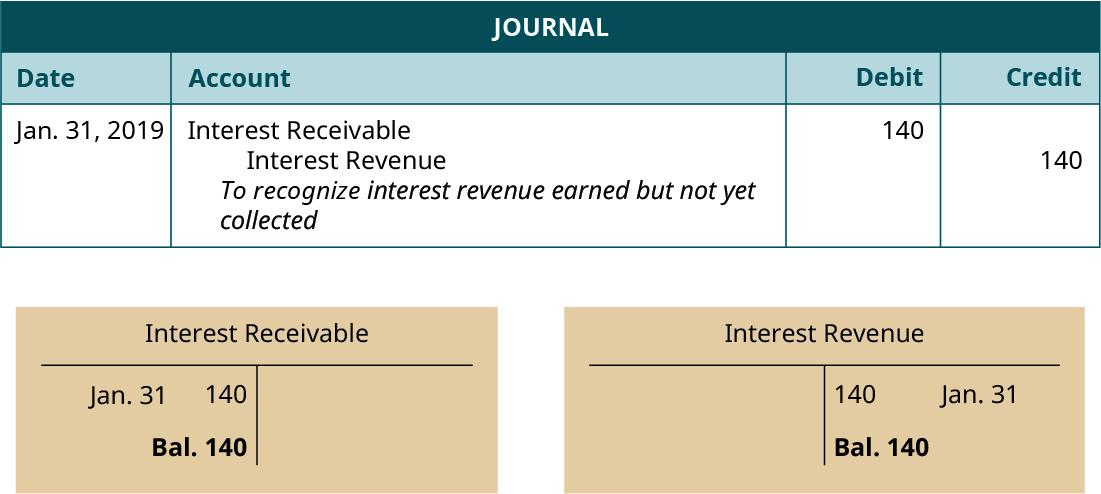

Fill In The T accounts For Each Situation And Label E SolvedLib

https://img.homeworklib.com/questions/059c8e60-70c8-11ea-b2e0-a3023fcedbbe.png?x-oss-process=image/resize,w_560

Web 17 juil 2019 nbsp 0183 32 The deduction is available for interest earned up to a maximum amount of Rs 10 000 Here are the types of interest incomes Web Interest Exemption Local Interest Individuals under 65 years of age R23 800 per annum Individuals over 65 years of age R34 500 per annum Interest earned by a non

Web 26 avr 2023 nbsp 0183 32 Interest from a savings account is taxed at your earned income tax rate for the year As of the 2022 tax year those rates ranged from 10 to 37 If your net investment income NII or Web 17 janv 2023 nbsp 0183 32 The tax year threshold for married taxpayers filing jointly is 118 100 for 2022 and 126 500 for tax year 2023 In What Year Is Interest Taxable Interest income becomes taxable when it s actually paid to

Download Tax Rebate On Interest Earned

More picture related to Tax Rebate On Interest Earned

2007 Tax Rebate Tax Deduction Rebates

https://i.pinimg.com/originals/ba/b1/ac/bab1aca6df77531e309ff2affe669be8.jpg

Tax Rebate For Individual Deductions For Individuals reliefs

https://2.bp.blogspot.com/-g9VZoH0Ab_0/XFpOxmUGmyI/AAAAAAAAFUM/ICy1j3WB8_stsbqaWTnl-lNqcgayVPNBACLcBGAs/s1600/rebate%2Bunder%2Bsection%2B87A%2Bafter%2Bbudget%2B2019.png

1 10 Adjusting Entry Examples Financial And Managerial Accounting

https://psu.pb.unizin.org/app/uploads/sites/236/2020/07/fig1.11.15.jpeg

Web Interest from a South African source earned by any natural person under 65 years of age up to R23 800 per annum and persons 65 and older up to R34 500 per Web 27 juin 2023 nbsp 0183 32 Interest income Interest received by or accrued to an individual is taxable However an exemption applies to the first ZAR 23 800 of local interest income ZAR 34 500 for taxpayers who are 65 years of

Web That means you could invest up to R350 000 R530 000 if over 65 in a South African fixed deposit or savings account at 6 5 per annum and receive interest income that is tax Web Section 80TTA of the Income Tax Act 1961 provides a deduction of up to INR 10 000 on the income earned from interest on savings made in a bank co operative society or post

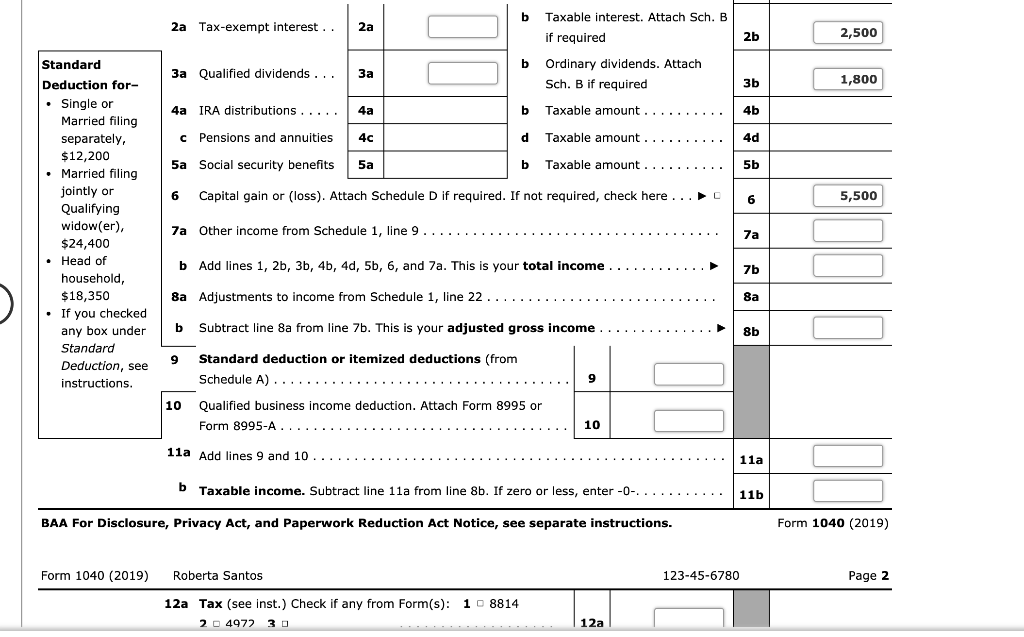

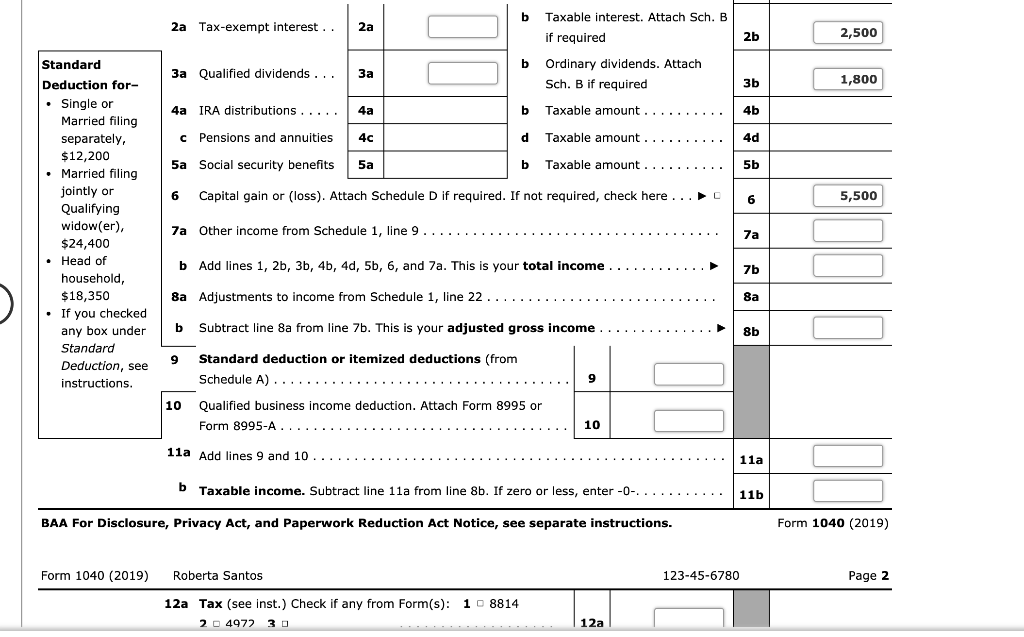

Note This Problem Is For The 2019 Tax Year Roberta Chegg

https://media.cheggcdn.com/media/c54/c54c699b-1ff2-4410-8234-f0b6939293d7/phpYdpXPF.png

How To Check Whether You Are Eligible For The Tax Rebate On Rs 5 Lakhs

https://myinvestmentideas.com/wp-content/uploads/2019/02/Tax-Rebate-under-section-87A-for-Rs-5-Lakhs-Taxable-Income-Illustration-1-rev.jpg

https://www.sars.gov.za/tax-rates/income-tax/interest-and-dividends

Web 22 f 233 vr 2023 nbsp 0183 32 22 February 2023 No changes from last year From 1 March 2015 2016 tax year a final withholding tax at a rate of 15 will be charged on interest from a

https://www.idfcfirstbank.com/finfirst-blogs/finance/is-tax-refund...

Web However under Section 244A of the Income Tax Act the IT department must pay an interest of 0 5 of the refund amount per month or part thereof This means your

Time Interest Earned Ratio Interpretation BrisakruwCherry

Note This Problem Is For The 2019 Tax Year Roberta Chegg

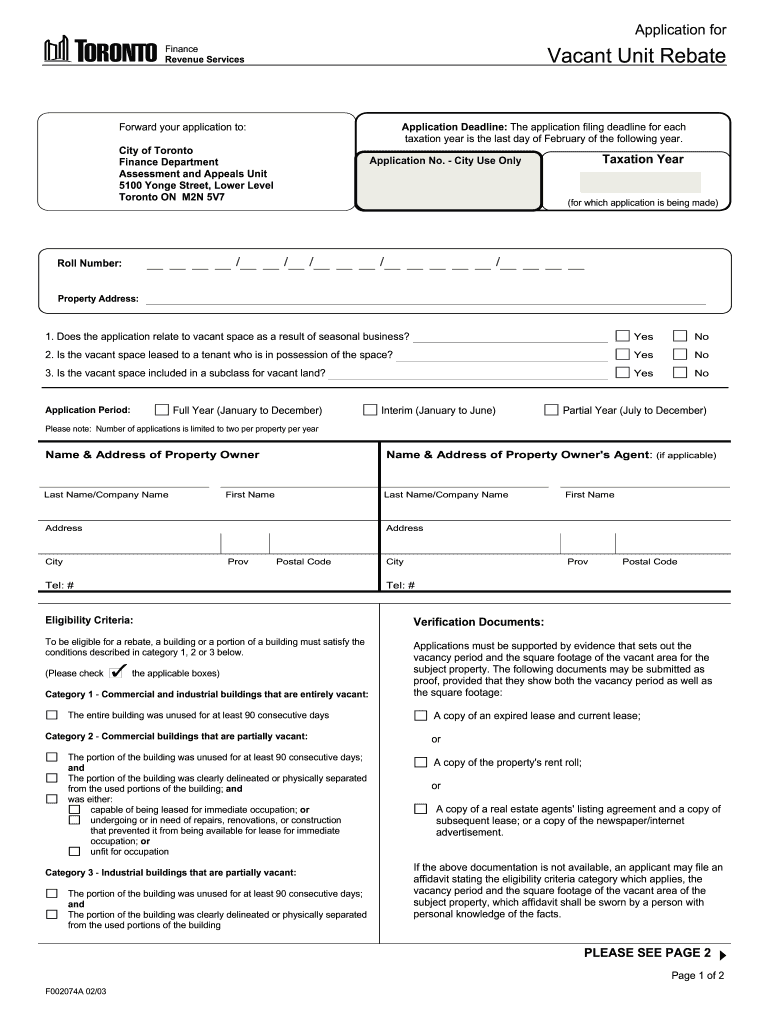

Rebate Form Template Fill Out And Sign Printable PDF Template SignNow

Deferred Tax And Temporary Differences The Footnotes Analyst

Home Loan EMI And Tax Deduction On It EMI Calculator

Property Tax Rebate Application Printable Pdf Download

Property Tax Rebate Application Printable Pdf Download

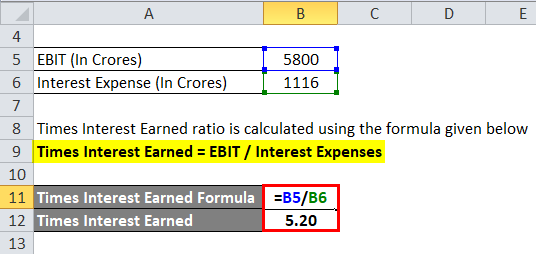

Times Interest Earned Ratio Formula Examples With Excel Template

Tax Rebate Under Section 87A Investor Guruji Tax Planning

Times Interest Earned Formula Calculator Excel Template

Tax Rebate On Interest Earned - Web 27 juin 2023 nbsp 0183 32 Tax rebates A taxpayer is entitled to so called tax rebates that are deducted from tax payable The rebates have the effect of establishing tax thresholds below