Day Care Tax Credit The child and dependent care credit CDCC is a tax credit for parents or caregivers to help cover the cost of qualified care

Learn how to claim the child and dependent care credit if you paid expenses for the care of a qualifying individual to work or look for work Find out the income limit While claiming daycare expenses toward a tax credit won t defray all the costs associated with child care it can help reduce them significantly This article will break down what the daycare tax credit is

Day Care Tax Credit

Day Care Tax Credit

https://www.coursehero.com/qa/attachment/19127768/

NICMA News

https://nicma.org/CMSPages/GetFile.aspx?guid=0086776c-de1e-4135-81a5-b96a29375ace

Brandon Woodard On Twitter Excited To Be In Overland Park To Watch

https://pbs.twimg.com/media/FXFN0apWQAEeikp.jpg:large

Taxpayers who are paying someone to take care of their children or another member of household while they work may qualify for child and dependent care credit Your eligibility to claim the child and dependent care credit will depend on the amount you paid to care for a qualifying child spouse or other dependent Find out how the child

The child and dependent care credit is a tax credit offered to taxpayers who pay out of pocket expenses for childcare The credit provides relief to individuals and spouses who pay for Take advantage of the 2021 child care credit and receive a refundable tax credit of up to 8 000 This tax season an often overlooked tax credit could put up to 8 000 back in families

Download Day Care Tax Credit

More picture related to Day Care Tax Credit

Child Care Expenses Tax Credit Colorado Free Download

https://www.formsbirds.com/formimg/child-care-rebate-form/3306/child-care-expenses-tax-credit-colorado-l2.png

Child Tax Credit Payments 06 28 2021 News Affordable Housing

https://www.columbiahousingsc.org/plugins/show_image.php?id=2685

Daycare Center Ideas Daycare Setup Daycare Organization Daycare

https://i.pinimg.com/originals/a6/6a/c6/a66ac6a932b601e863d17aa326a063a6.jpg

What is the child and dependent care credit This credit allows taxpayers to reduce their tax by a portion of their child and dependent care expenses The credit may be claimed If you paid someone to care for a child who was under age 13 when the care was provided and whom you claim as a dependent on your tax return you may qualify for the Child

Child and Dependent Care Credit Expenses In 2021 for the first time the credit is fully refundable if the taxpayer or the taxpayer s spouse if married filing jointly had a The child tax credit is a nonrefundable tax credit available to taxpayers with dependent children under the age of 17 The credit can reduce your tax bill on a dollar

What Is A Tax Credit Tax Credits Explained

https://media.valuethemarkets.com/img/Whatisataxcredit__685660f27b96fbc6e0edb67eb5c59039.jpg

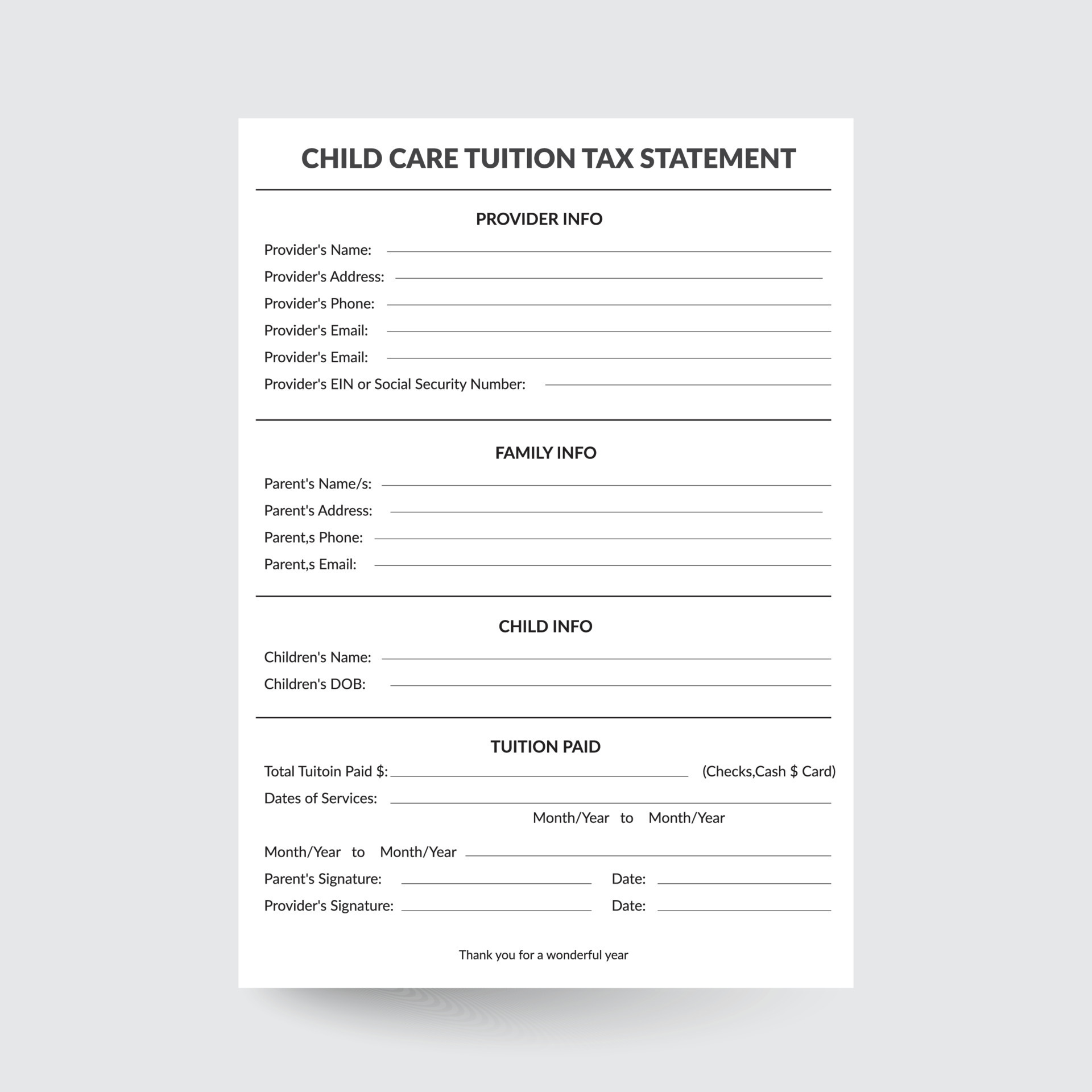

5 Best Photos Of Child Care Provider Tax Form Daycare Provider Tax Db

https://www.latestrebate.com/wp-content/uploads/2023/02/5-best-photos-of-child-care-provider-tax-form-daycare-provider-tax-db-1243x2048.jpg

https://www.nerdwallet.com/article/tax…

The child and dependent care credit CDCC is a tax credit for parents or caregivers to help cover the cost of qualified care

https://www.irs.gov/taxtopics/tc602

Learn how to claim the child and dependent care credit if you paid expenses for the care of a qualifying individual to work or look for work Find out the income limit

ChildCare Tax Statement Child Tax Statement Daycare Tax Form Daycare

What Is A Tax Credit Tax Credits Explained

AGH Health Care Tax Credit Is Your Business Eligible

Daycare Tax Statement End Of Year Tuition Report For Parents

One stop Guide To Child Tax Credit Resources SaverLife

Earned Income Tax Credit EITC Get Your Payment IL

Earned Income Tax Credit EITC Get Your Payment IL

Tax Accounting Services Lee s Tax Service

Tax Credit Universal Credit Impact Of Announced Changes House Of

How To Apply For Health Care Tax Credit PicsHealth

Day Care Tax Credit - The child and dependent care credit is a tax credit offered to taxpayers who pay out of pocket expenses for childcare The credit provides relief to individuals and spouses who pay for