Discount Received Journal Entry What is Discount Allowed and Discount Received Journal Entries 1 Discount Allowed Example 2 Discount Received Example Discount Allowed in Cash Book Discount Received in Trial Balance Difference Between Discount Allowed and Discount Received Advantages Conclusion Recommended Articles

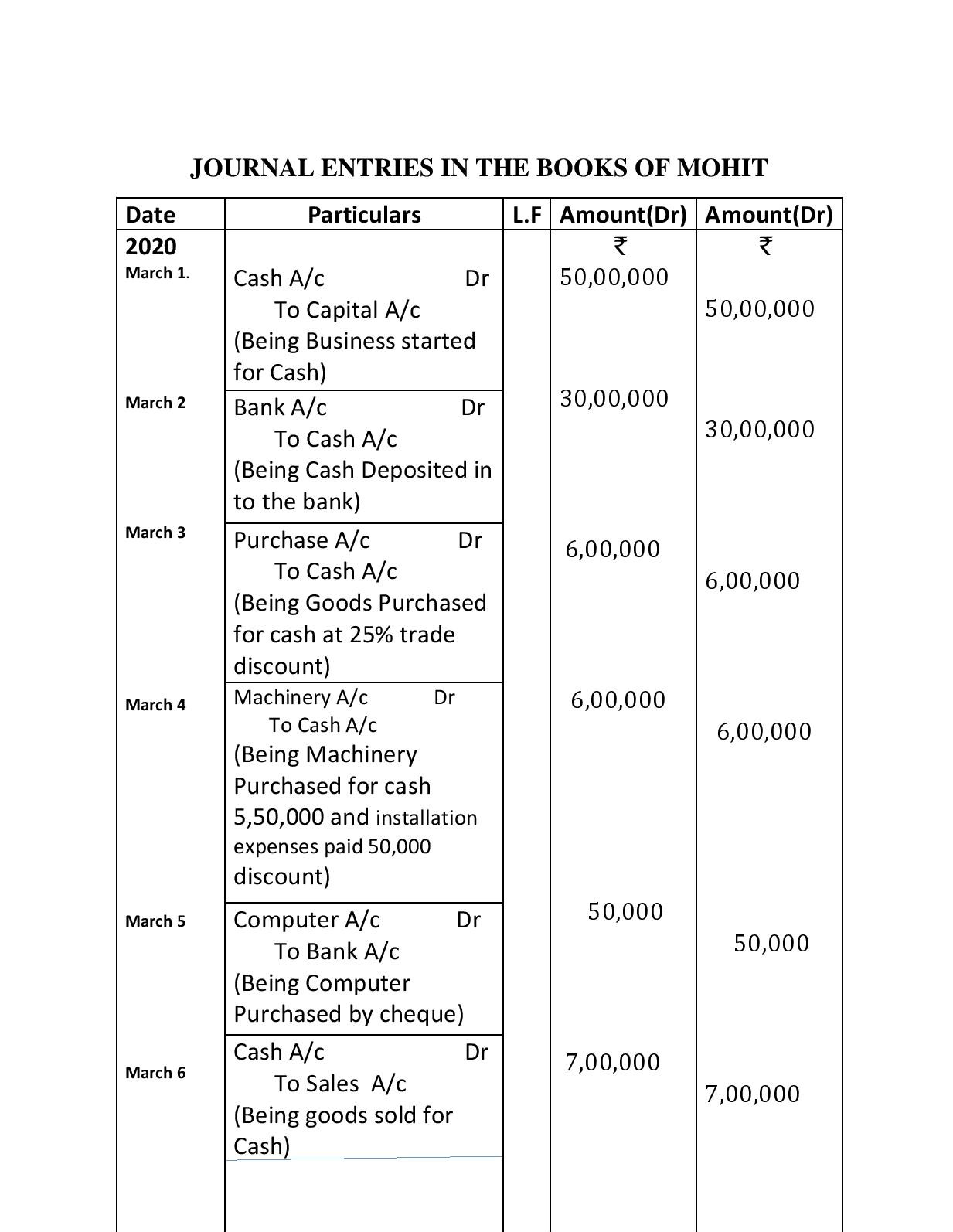

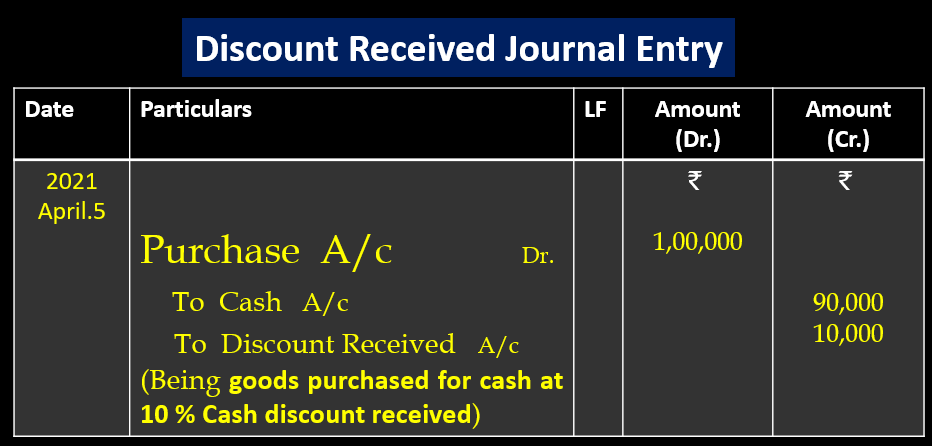

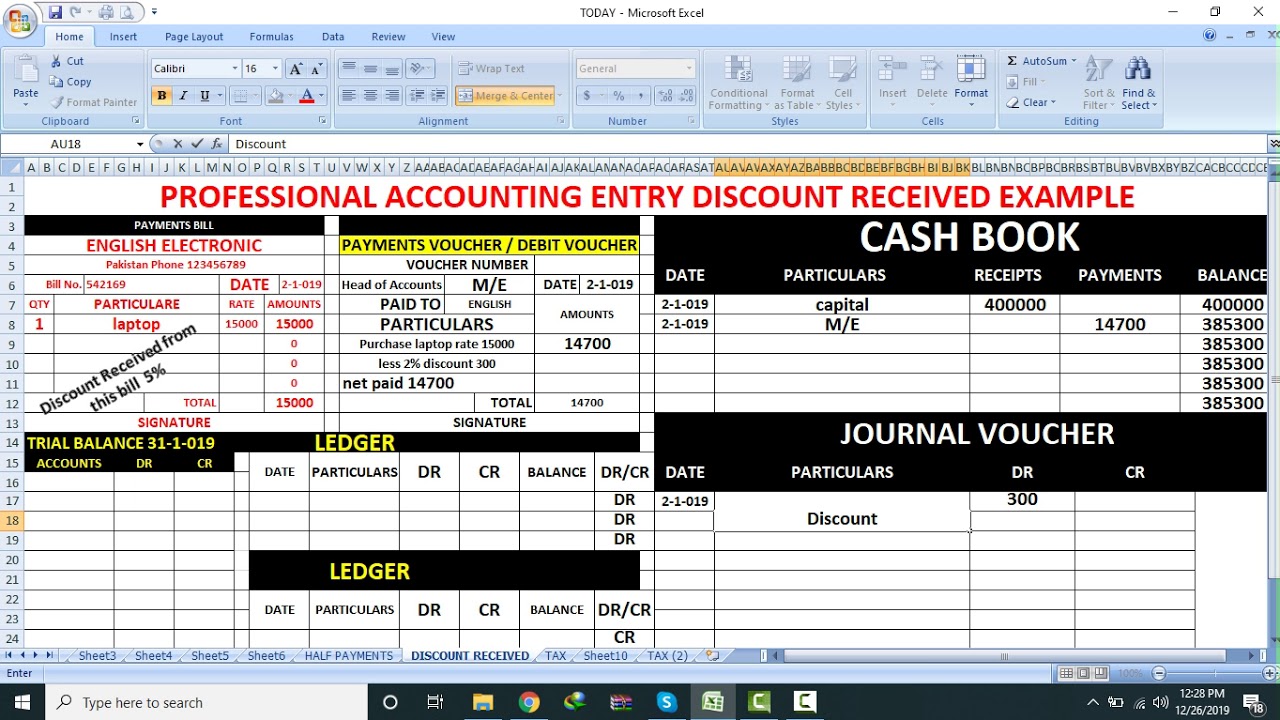

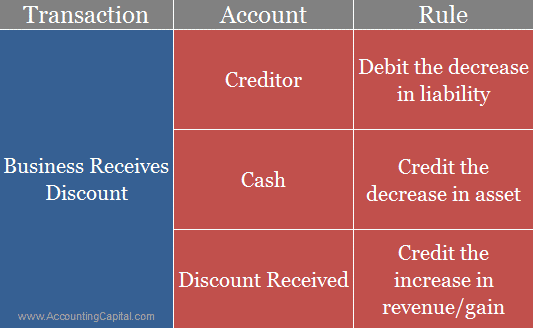

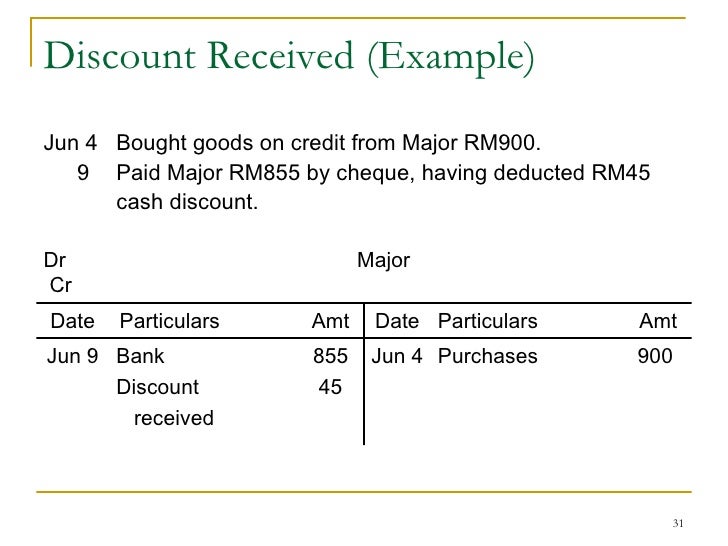

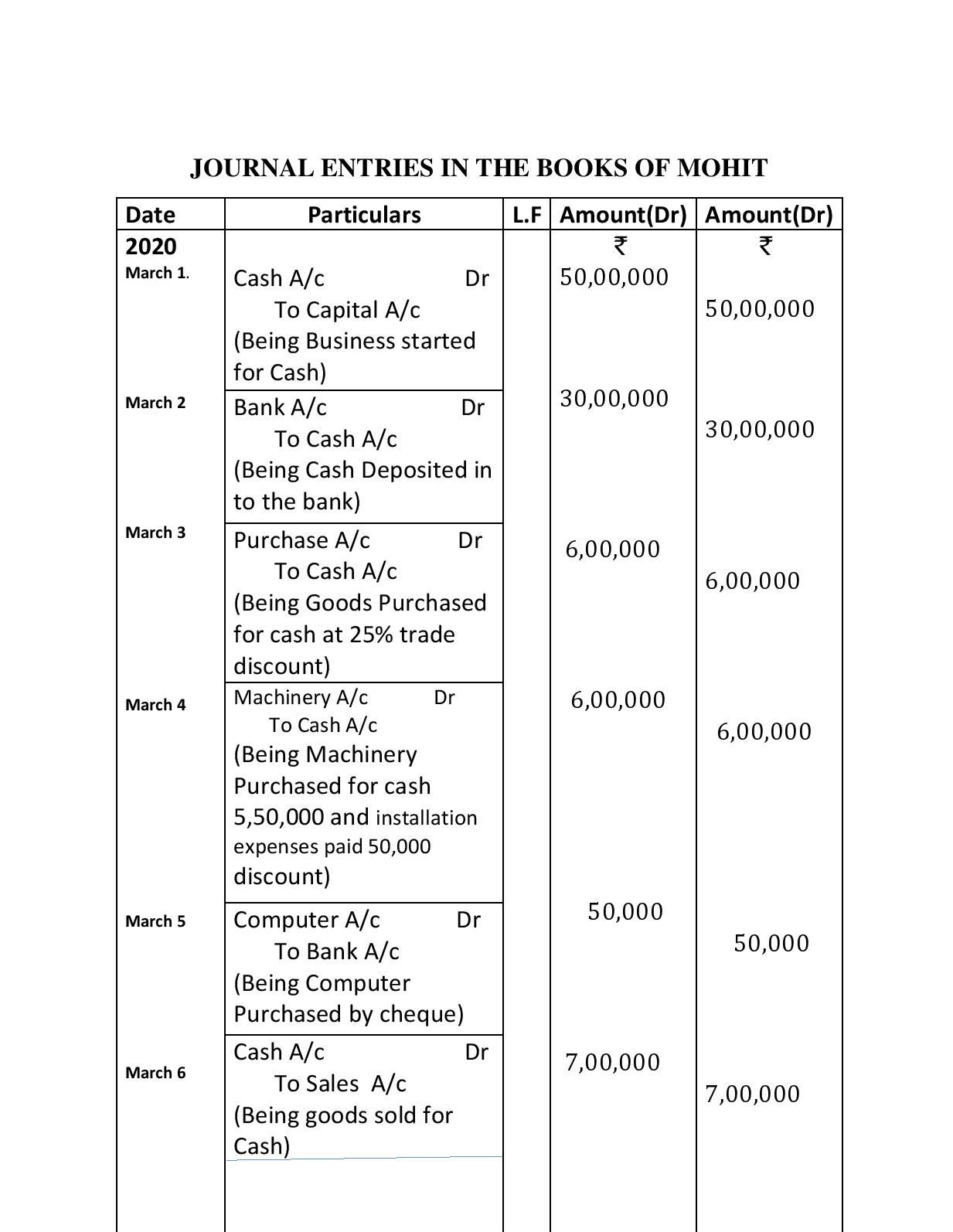

Overview Some suppliers may provide a discount when the company makes an early payment e g within 10 days of credit purchase Likewise when the company receives the discount by paying the suppliers during the discount period it needs to make a proper journal entry for the discount received What is a Compound Journal Entry Solution B Discount Received When at the time of purchase or paying cash any concession is received from the Solution A Trade Discount The discount provided by the seller to its customers at a fixed percentage on the listed Solution Goods purchased

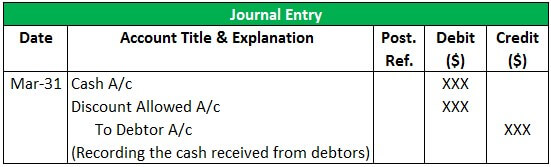

Discount Received Journal Entry

Discount Received Journal Entry

https://jkbhardwaj.com/wp-content/uploads/2021/01/JOURNALLEDGER-trial-balance-and-final-accounts-page-003-5.jpg

Journal Entry For Discount Allowed And Received GeeksforGeeks

https://media.geeksforgeeks.org/wp-content/uploads/20220414185625/discallowq-660x316.PNG

Discount Allowed And Discount Received Journal Entries With Examples

https://www.wallstreetmojo.com/wp-content/uploads/2020/07/Discount-Allowed-and-Discount-Received-Journal-Entry-1.1.jpg

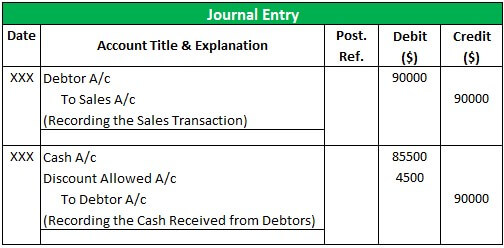

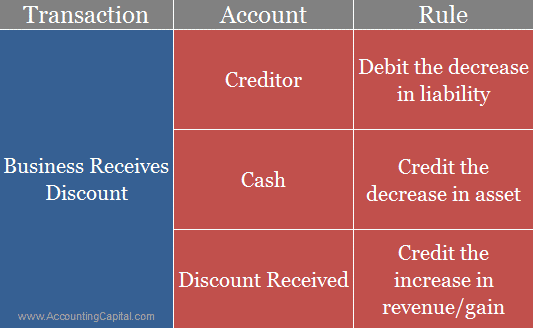

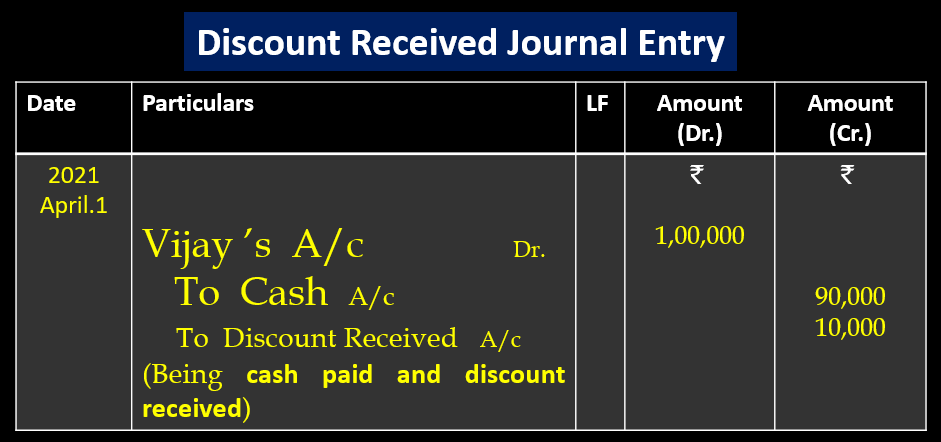

Journal Entry for Cash Discount Cash discount is an expense for the seller and income for the buyer It is therefore debited in the books of the seller and credited in the books of the buyer Example On 5 March 2016 A Co sold merchandise to X Retailers for 5 000 on credit Credit Discount Received Income Statement Crediting discount received has the effect of reducing gross purchases by the amount of cash discount received Consequently payables are debited to reduce their balance to the amount that is expected to be paid to them i e net of cash discount

Example BMX LTD as part of its purchases promotion campaign has offered to sell their bikes at a 10 discount on their listed price of 100 If customers pay within 10 days from the date of purchase they get a further 5 cash discount Bike LTD purchases a bike from BMX LTD and pays within 10 days of the date of purchase The entry to record the receipt of cash from the customer is a debit of 950 to the cash account a debit of 50 to the sales discount contra revenue account and a 1 000 credit to the accounts receivable account Thus the net effect of the transaction is to reduce the amount of gross sales

Download Discount Received Journal Entry

More picture related to Discount Received Journal Entry

Discount Received Journal Entry

https://jkbhardwaj.com/wp-content/uploads/2022/02/Screenshot-817.png

Journal Entries DISCOUNT RECEIVED JOURNAL ENTRY YouTube

https://i.ytimg.com/vi/FiV643Gikio/maxresdefault.jpg

Discount Allowed And Discount Received Journal Entries With Examples

https://www.wallstreetmojo.com/wp-content/uploads/2020/07/Discount-Allowed-and-Discount-Received-Journal-Entry-1.4.jpg

Journal Entries of Accounting for Sales Discounts The two journal entries as shown below At the time of origination of the sales the seller has no idea whether the buyer will avail of the sales discounts by paying off the outstanding amount early or making the full payment on the due date The following journal entries show the treatment of purchase discounts depending on whether the discount has been availed or not It can be seen that only cash discount is reflected in the journal entries as well as the financial statements whereas trade discounts associated with purchases are not recorded

[desc-10] [desc-11]

What Is The Journal Entry For Discount Received Accounting Capital

https://www.accountingcapital.com/wp-content/uploads/2018/08/Explanation-and-rules-for-journal-entry-for-discount-received.png

Discount Received Journal Entry Cash Purchase Of Goods Double Entry

http://image.slidesharecdn.com/accweek4-101212004354-phpapp01/95/acc-week-4-31-728.jpg?cb=1292114699

https://www.wallstreetmojo.com/discount-allowed-and-discount-received

What is Discount Allowed and Discount Received Journal Entries 1 Discount Allowed Example 2 Discount Received Example Discount Allowed in Cash Book Discount Received in Trial Balance Difference Between Discount Allowed and Discount Received Advantages Conclusion Recommended Articles

https://accountinginside.com/discount-received-journal-entry

Overview Some suppliers may provide a discount when the company makes an early payment e g within 10 days of credit purchase Likewise when the company receives the discount by paying the suppliers during the discount period it needs to make a proper journal entry for the discount received

Journal Entry Problems And Solutions Format Examples

What Is The Journal Entry For Discount Received Accounting Capital

Journal Entry For Discount Received Examples TutorsTips

Journal Entry Of Discount Received And Discount Allowed In Accounting

Discount Received Journal Entry Cash Purchase Of Goods Double Entry

Cash Discount Received Double Entry Bookkeeping

Cash Discount Received Double Entry Bookkeeping

Discount Received Journal Entry Bhardwaj Accounting Academy

Journal Entry For Discount Received Examples TutorsTips

Discount Allowed Archives Tutor s Tips

Discount Received Journal Entry - The entry to record the receipt of cash from the customer is a debit of 950 to the cash account a debit of 50 to the sales discount contra revenue account and a 1 000 credit to the accounts receivable account Thus the net effect of the transaction is to reduce the amount of gross sales