Do You Get Tax Relief On Company Pension Contributions Verkko 6 huhtik 2023 nbsp 0183 32 Key points Tax relief on employer contributions is given by allowing pension contributions to be deducted as a legitimate business expense Deductions

Verkko 3 huhtik 2023 nbsp 0183 32 If you re paying into a pension through your employer your employer will take 80 of your pension contribution from your salary technically known as Verkko Tax relief if you don t pay tax If you earn less than the Personal Allowance 163 12 570 in the tax year 2023 24 and so don t pay tax you might or might not get tax relief if

Do You Get Tax Relief On Company Pension Contributions

Do You Get Tax Relief On Company Pension Contributions

http://www.icsuk.com/wp-content/uploads/2019/06/PensionContributions-1.png

Tax Relief On Pension Contributions Greenway Financial Advisors

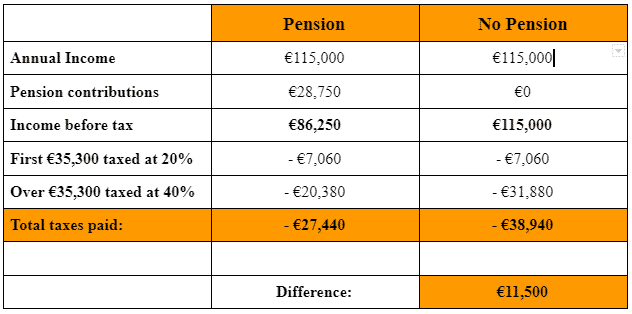

https://greenwayfinancialadvisors.ie/wp-content/uploads/2021/04/compare_tax_relief.png

Can I Get Tax Relief On Pension Contributions Financial Advisers

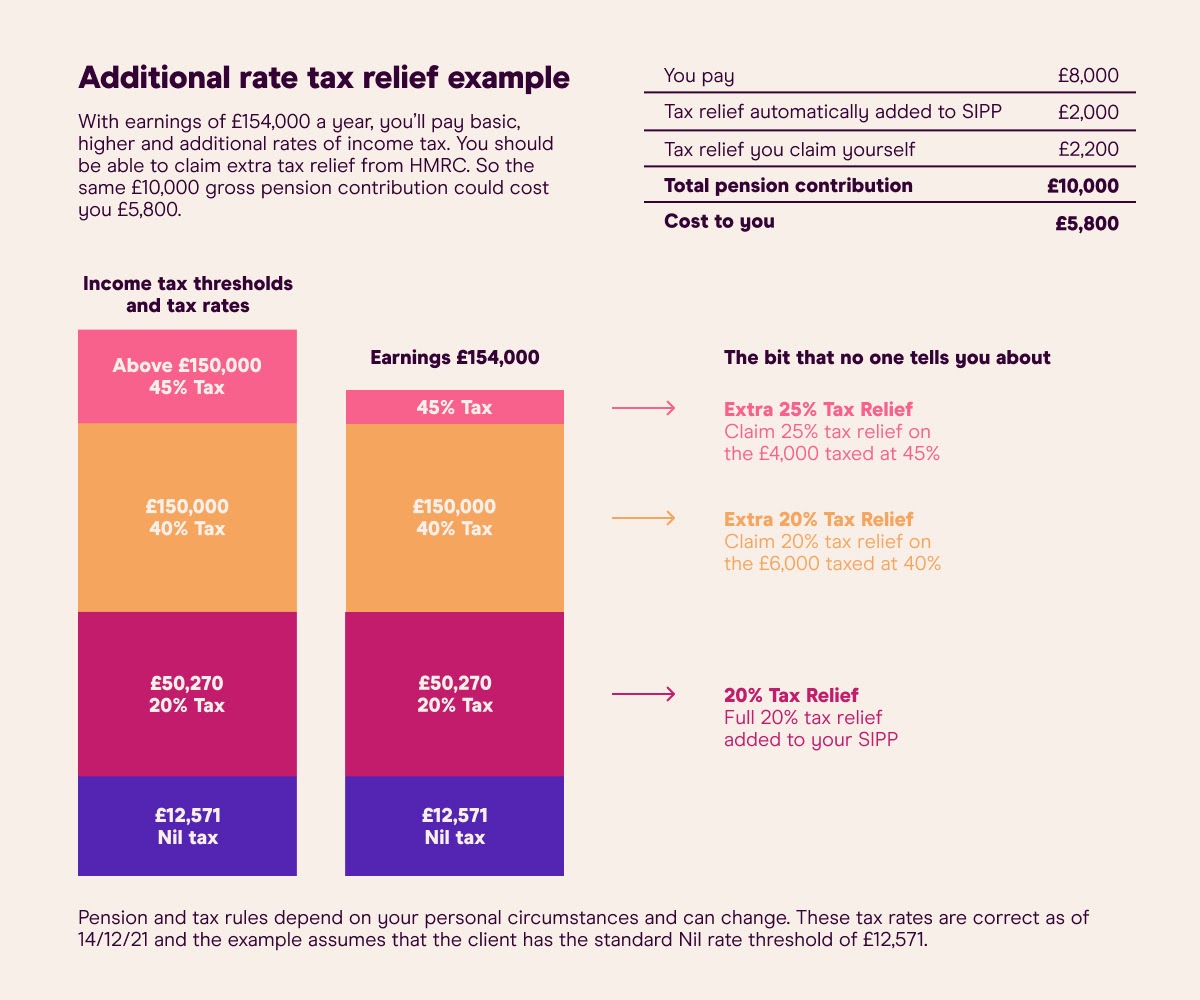

https://www.insightifa.com/wp-content/uploads/2022/12/Tax-Relief-On-Pensions.jpg

Verkko Tax relief on employer pension contributions When are contributions to a registered pension scheme by an employer allowable as a deduction in computing trade profits Verkko 13 huhtik 2023 nbsp 0183 32 Company and employer contributions are not restricted however they must satisfy the wholly and exclusively requirement to receive tax relief Company

Verkko You can get tax relief on private pension contributions worth up to 100 of your annual earnings You ll either get the tax relief automatically or you ll have to claim it Verkko That s because you ll be able to claim extra tax relief on your pension contributions if they have been deducted from net pay contributions taken after tax has been paid You re probably aware that any

Download Do You Get Tax Relief On Company Pension Contributions

More picture related to Do You Get Tax Relief On Company Pension Contributions

Pension Tax Relief On Pension Contributions Freetrade

https://assets-global.website-files.com/62547917cb5599e815e4d83b/62547917cb559944a8e4de15_61b89c21239fee52c5e81153_hqoO9fMryTKRpnpdV2ZiIxT7ZDJC5fHBX_liGusogxuhBXP3ILsovEpqBXxBHX0sXCQy79MiLRIAaEXmK1c2vJcBYleshZHHX7Jsfqdd-7hM7hPmIZC3zDfhut2hKggUXHvAHoah.jpeg

Pension Contributions And Tax Relief For Limited Company Owners

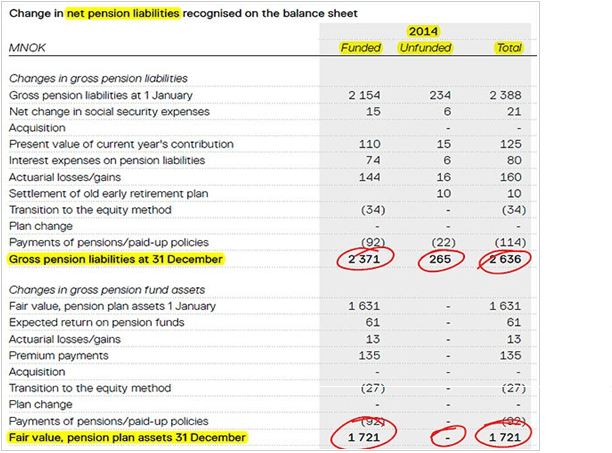

https://business-accounting.net/wp-content/uploads/2021/07/image-KlTH0EOa2kw13BtJ.png

Tax Relief On Pension Contributions Optimise

https://www.optimiseaccountants.co.uk/wp-content/uploads/2016/01/Pen-scaled.jpg

Verkko 13 toukok 2022 nbsp 0183 32 Simply put any pension contribution you make as an employer to a registered pension scheme in respect of any director or employee will receive Verkko you get 163 10 tax relief A total of 163 80 goes into your pension Use MoneyHelper s contributions calculator to work out how much you and your employer will put in Tax

Verkko 12 toukok 2016 nbsp 0183 32 Overview You can get tax relief on most contributions you make to registered pension schemes some overseas pension schemes You can t claim relief Verkko 9 tammik 2023 nbsp 0183 32 Because an employer contribution counts as an allowable company pension scheme business expense your company receives tax relief against

TidyCloud Tax Relief On Pension Contributions

https://www.tidycloud.co.uk/wp-content/uploads/2022/05/Tax-Relief-on-Pension-Contributions-1536x864.jpg

Clive Owen LLP Claiming Higher Rate Tax Relief For Pension Contributions

https://www.cliveowen.com/wp-content/uploads/2020/12/Claiming-higher-rate-tax-relief-for-pension-contributions-and-gift-aid-donations.jpg

https://www.mandg.com/.../insights-library/tax-relief-employer

Verkko 6 huhtik 2023 nbsp 0183 32 Key points Tax relief on employer contributions is given by allowing pension contributions to be deducted as a legitimate business expense Deductions

https://www.which.co.uk/money/pensions-and-retirement/personal-pensi…

Verkko 3 huhtik 2023 nbsp 0183 32 If you re paying into a pension through your employer your employer will take 80 of your pension contribution from your salary technically known as

Claiming Tax Relief On Pension Contributions Thompson Taraz Rand

TidyCloud Tax Relief On Pension Contributions

Tax Relief On Pension Contributions Relief At Source TaxAssist

The Benefits Of Company Pension Contributions

Company Pension Contributions For Directors JF Financial

Tax Relief On Pension Contributions Gooding Accounts

Tax Relief On Pension Contributions Gooding Accounts

Pensions Everything You Need To Know For Retirement

Are Your Employees Making The Most From Pension Tax Relief

Tax Relief On Your Pension YouTube

Do You Get Tax Relief On Company Pension Contributions - Verkko You 5 of your qualifying earnings Qualifying earnings include your salary but not dividend income You ll also get tax relief on your and your company s