Does Discount Include Gst Learn how to charge and account for GST when you provide discounts and rebates such as prompt payment discounts and volume rebates

Section 15 3 of the CGST Act 2017 similar provision exits in SGST UTGST Act 2017 stipulates that the value of the supply shall not include any discount subject to the GST on Discounts Legal Provisions Discounts are generally given by supplier to boost sales or encourage the buyer to pay promptly Treatment of discounts

Does Discount Include Gst

Does Discount Include Gst

https://image6.slideserve.com/11412495/treatment-of-discount-under-gst-section-n.jpg

Discount Issues In GST YouTube

https://i.ytimg.com/vi/yfdxBXej6_0/maxresdefault.jpg

GST Return When To File GST Due Dates Other Important Dates

https://okcredit-blog-images-prod.storage.googleapis.com/2020/11/gst12.jpg

Discounts subsidies and incidental costs paid by the provider are examples of taxable inclusions that may affect the total amount for which GST is charged Discover the different types of post sale discounts and incentives offered in trade practices along with their implications and treatment for GST Learn how to

Discounts under GST regime Sec 15 of the CGST Act 2017 reproduced below deals with the provision of discount as under The value of the supply shall not Discounts given after supply will be allowed only if certain conditions are satisfied Please read part II of this article which deals with discounts and impact of GST along with

Download Does Discount Include Gst

More picture related to Does Discount Include Gst

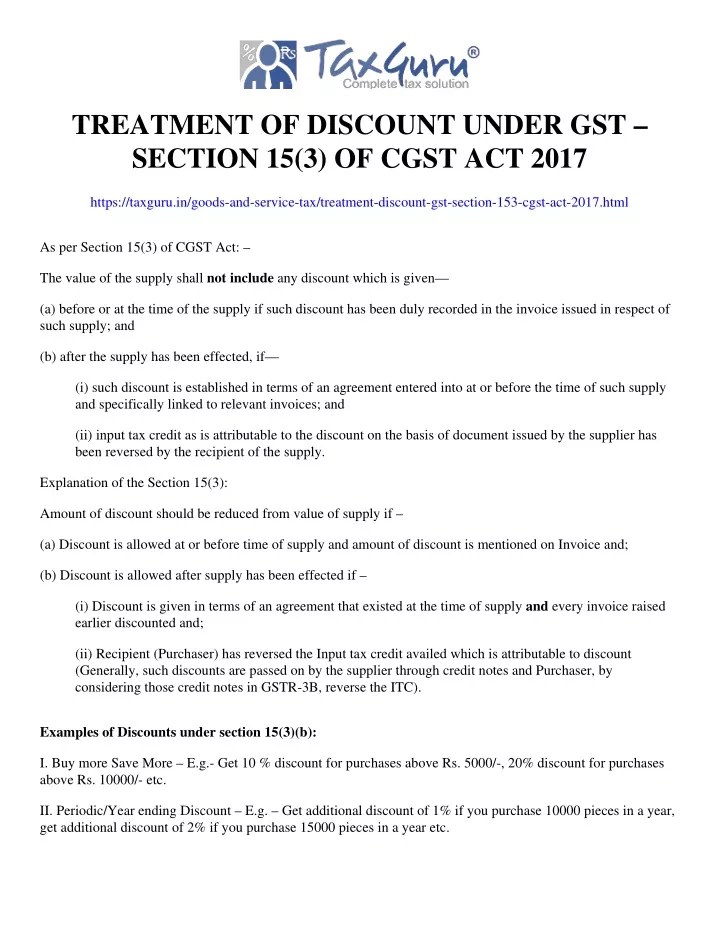

Item Level Discount Under GST In Tally Prime Chapter 27 Tally Prime

https://i.ytimg.com/vi/XTIOGHiHQy4/maxresdefault.jpg

Quarterly GST Updates April 2021 To June 2021 Including Covid 19

https://taxconcept.net/wp-content/uploads/2019/06/gst-discount-1.png

GST Discount Based Question YouTube

https://i.ytimg.com/vi/AmqZ1Av7EcU/maxresdefault.jpg

GST laws treat trade discounts equally to cash discounts Cash discounts are recorded in books while trade discounts are not Trade discounts are typically used for wholesale Vide Circular No 92 11 2019 GST dated 07 03 2019 CBIC had clarified on taxability of various offer of discounts incentives viz free samples and gifts buy one

Discounts offered by suppliers to customers including staggered discount under Buy more save more scheme and post supply volume discounts For example a coupon for 1 off the selling price includes 5 for the GST 1 5 105 12 for the HST 1 13 113 where the rate of 13 applies 13 for the

How The Spectrum Stimulus Credit Can Help You Pay For Internet

https://media.marketrealist.com/brand-img/wapUbf4_F/0x0/spectrum-1-1624379844504.jpg

Discount And GST Mathematics Quizizz

https://quizizz.com/media/resource/gs/quizizz-media/questions/96cad142-2fdf-4240-9fa9-21e0bbb85204

https://www.iras.gov.sg/.../gst-on-discounts-and-rebates

Learn how to charge and account for GST when you provide discounts and rebates such as prompt payment discounts and volume rebates

https://icmai.in/.../IDT/Article_GST/112_1803_21.pdf

Section 15 3 of the CGST Act 2017 similar provision exits in SGST UTGST Act 2017 stipulates that the value of the supply shall not include any discount subject to the

Treatment Of Discount Free Gift Samples In GST How To Show Discount

How The Spectrum Stimulus Credit Can Help You Pay For Internet

Discount Code For Custom Writings Custom Writing Essay Writing Help

GST Sale Invoice With Additional Charge Like Discount On Sale Packing

EFFECT OF DISCOUNT IN GST

Government May Offer 2 Discount On GST For All Digital Payments

Government May Offer 2 Discount On GST For All Digital Payments

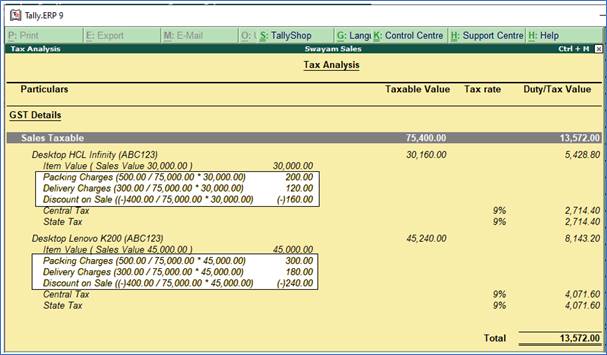

Discount If The Rate Of GST Is 5 Find i The Amount Paid By The Buyer

GST What Does GST Mean Slang

Gst Code List Malaysia Paul Gibson

Does Discount Include Gst - Discounts given after supply will be allowed only if certain conditions are satisfied Please read part II of this article which deals with discounts and impact of GST along with