Does Discount Have Gst Verkko 28 jouluk 2023 nbsp 0183 32 Since the value of taxable supply is the transaction value GST is leviable on the value after deducting the discounts However not all discounts offered by the supplier to their customers are allowed as deductions from the value

Verkko 2 jouluk 2019 nbsp 0183 32 Legal Provisions for GST on Discounts Discounts are generally given by supplier to boost sales or encourage the buyer to pay promptly Treatment of discounts is defined in Section 15 3 of CGST Act 2017 The section states that The value of supply shall not include any discount which is given Verkko 30 jouluk 2019 nbsp 0183 32 Discounts like trade discount quantity discount etc are part of the normal trade and commerce therefore pre supply discounts i e discounts recorded in the invoice have been allowed to be excluded while determining the taxable value What transaction value will exclude

Does Discount Have Gst

Does Discount Have Gst

https://help.tallysolutions.com/docs/te9rel66/Tax_India/gst/images/discount_printout.gif

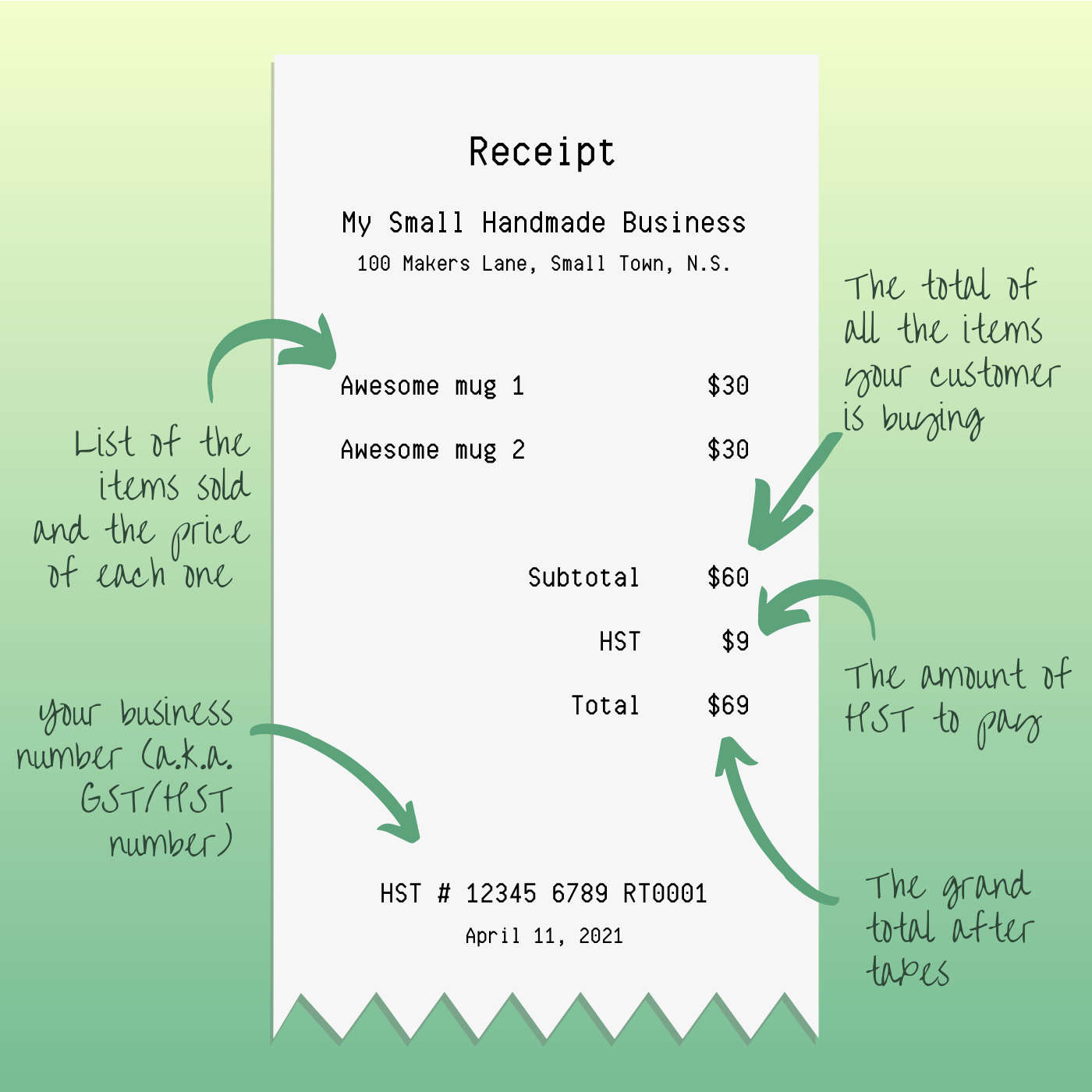

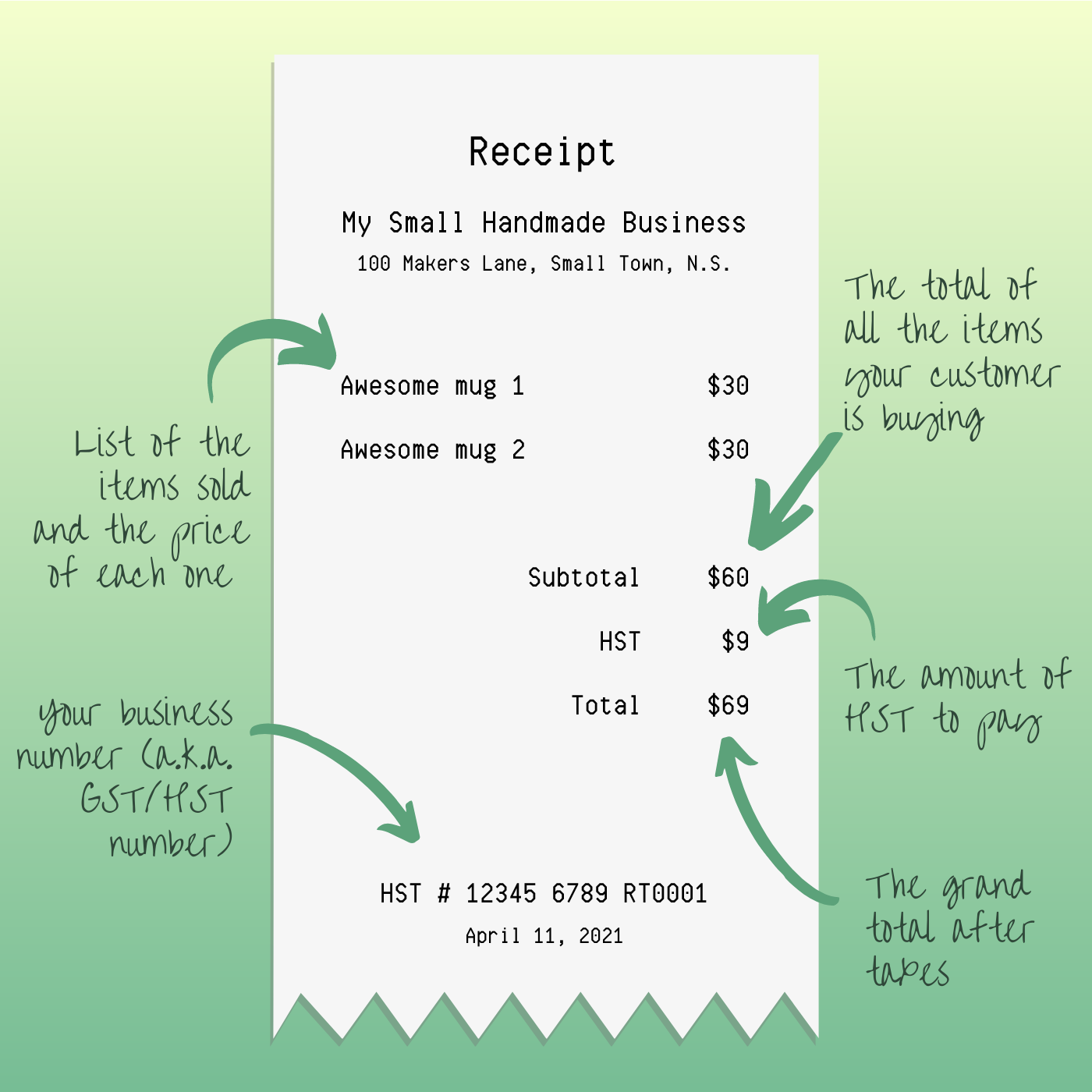

A Beginner s Guide To Charging Sales Tax In Canada Everything Makers

https://www.workshopmag.com/content/images/2021/03/HST-Receipt.png

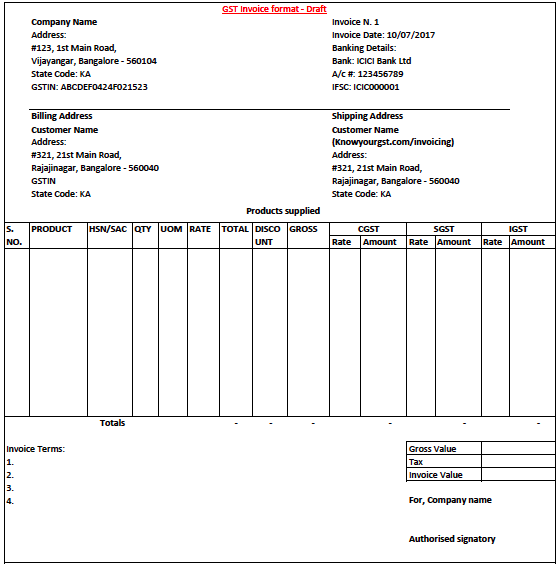

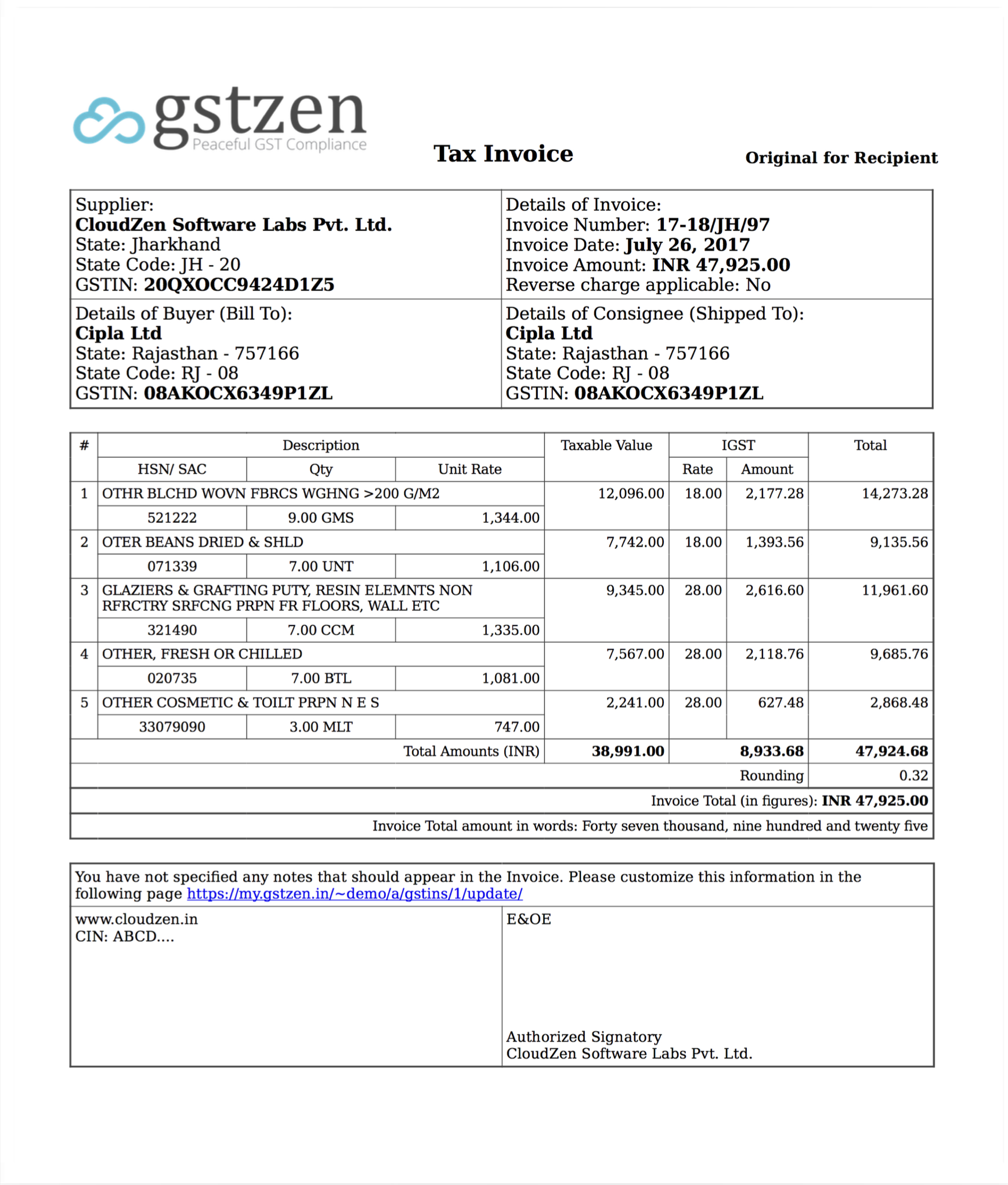

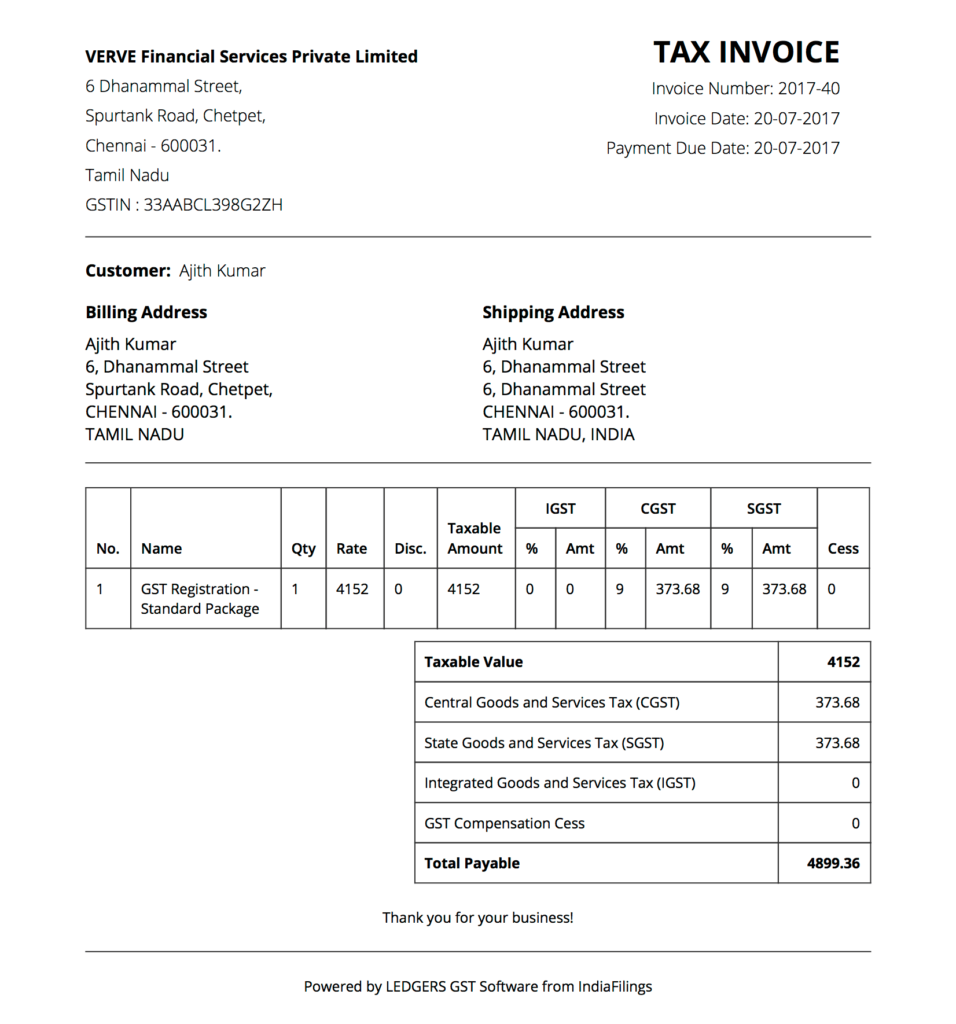

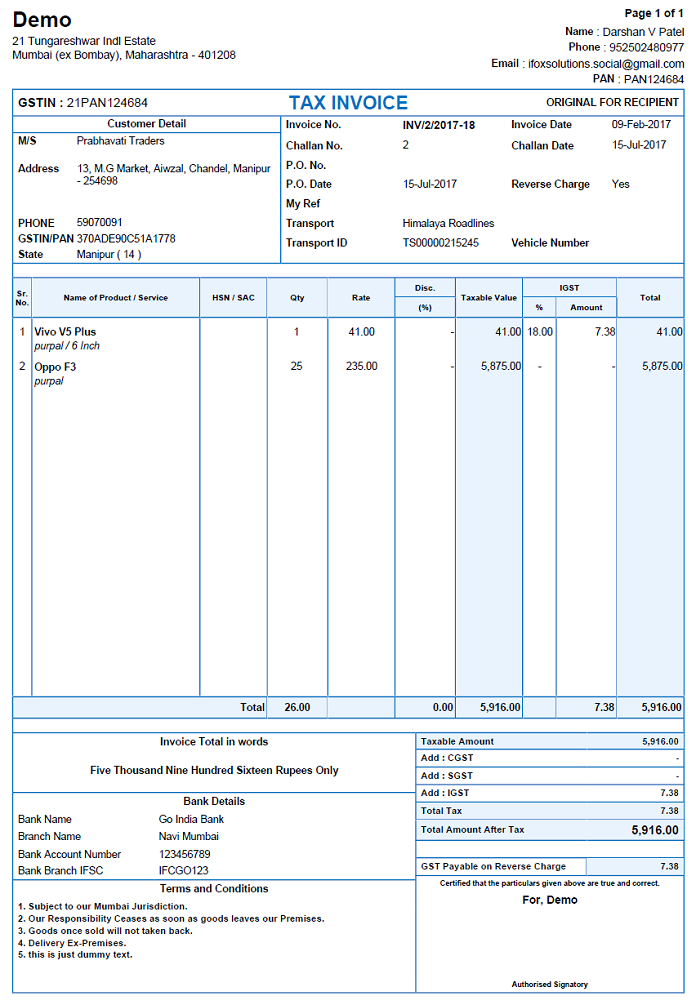

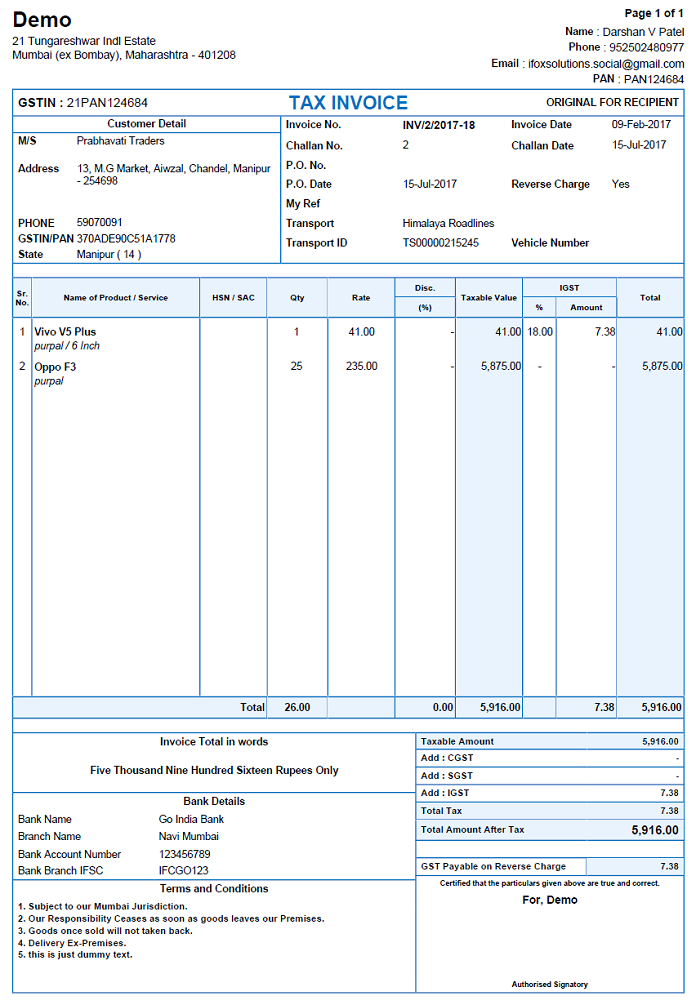

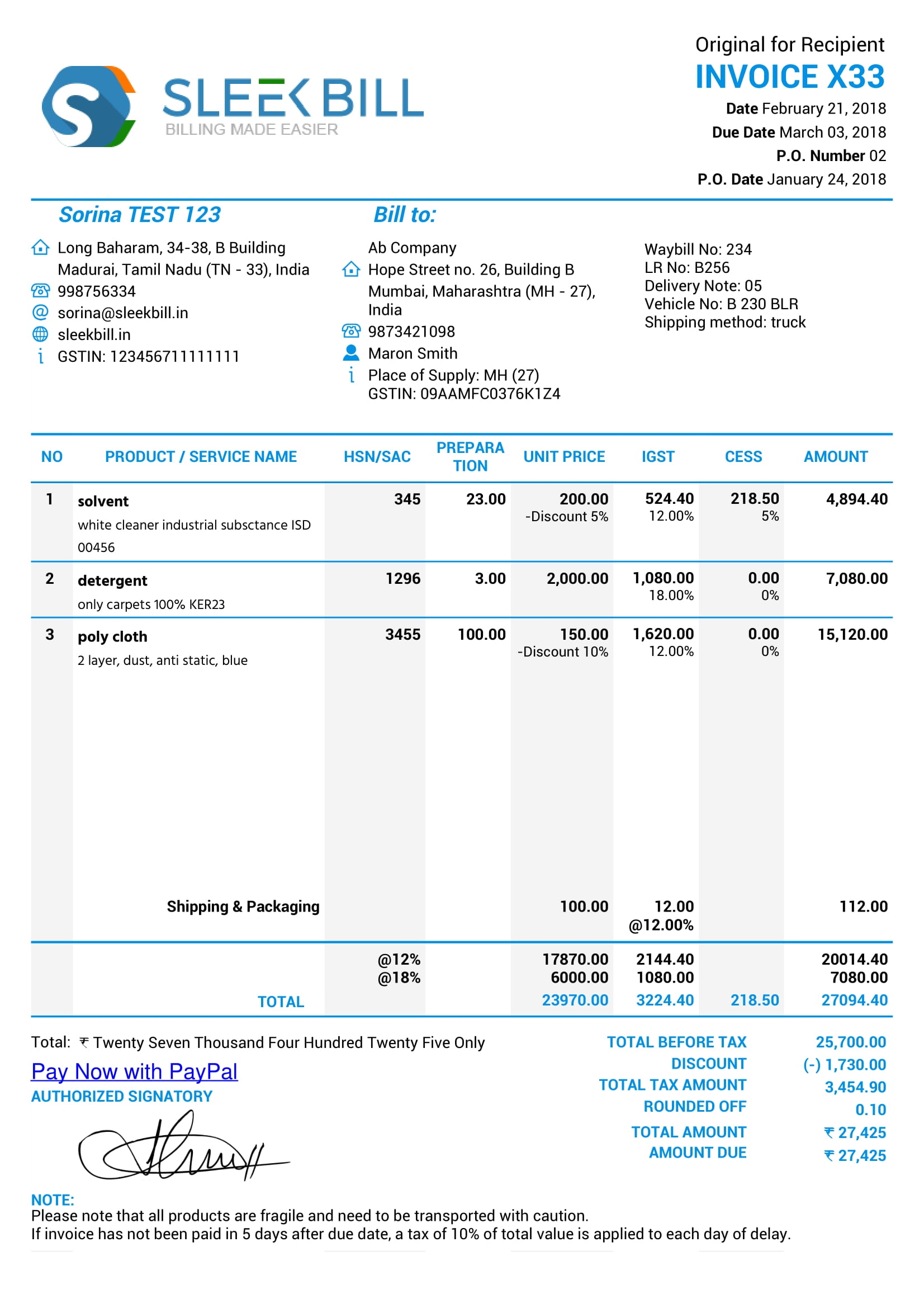

Invoicing Under GST Rules Tax Corner

https://d494qy7qcliw5.cloudfront.net/s/img/20170906124223/TAX_INVOICE_IN00012_ClearTax-11-1024x1012.jpg

Verkko 26 hein 228 k 2021 nbsp 0183 32 Discounts under GST regime Sec 15 of the CGST Act 2017 reproduced below deals with the provision of discount as under The value of the supply shall not include any discount which is given a Before or at the time of the supply if such discount has been duly recorded in the invoice issued in respect of Verkko You are selling goods to your customer at 100 excluding GST The sale will be subjected to a discount of 10 should your customer pay within 30 days from the date of the tax invoice GST is chargeable on the net price after the prompt payment discount i e 90 of the selling price excluding GST GST to be charged 7 x 90 6 30

Verkko Discounts that are given before or at the time of sale can be deducted from transaction value at the time of sale no GST will be levied on the same However such discounts shall be mentioned in the tax invoice Verkko 18 jouluk 2023 nbsp 0183 32 Some countries have introduced GST exemptions or reduced GST rates on essential goods and services or have implemented GST credits or rebates to help offset the impact of GST on lower income

Download Does Discount Have Gst

More picture related to Does Discount Have Gst

How To Generate GST Tax Invoice KnowyourGST

https://www.knowyourgst.com/media/uploads/pulkit%40psca.co.in/2017/05/12/gst-invoice-format.png

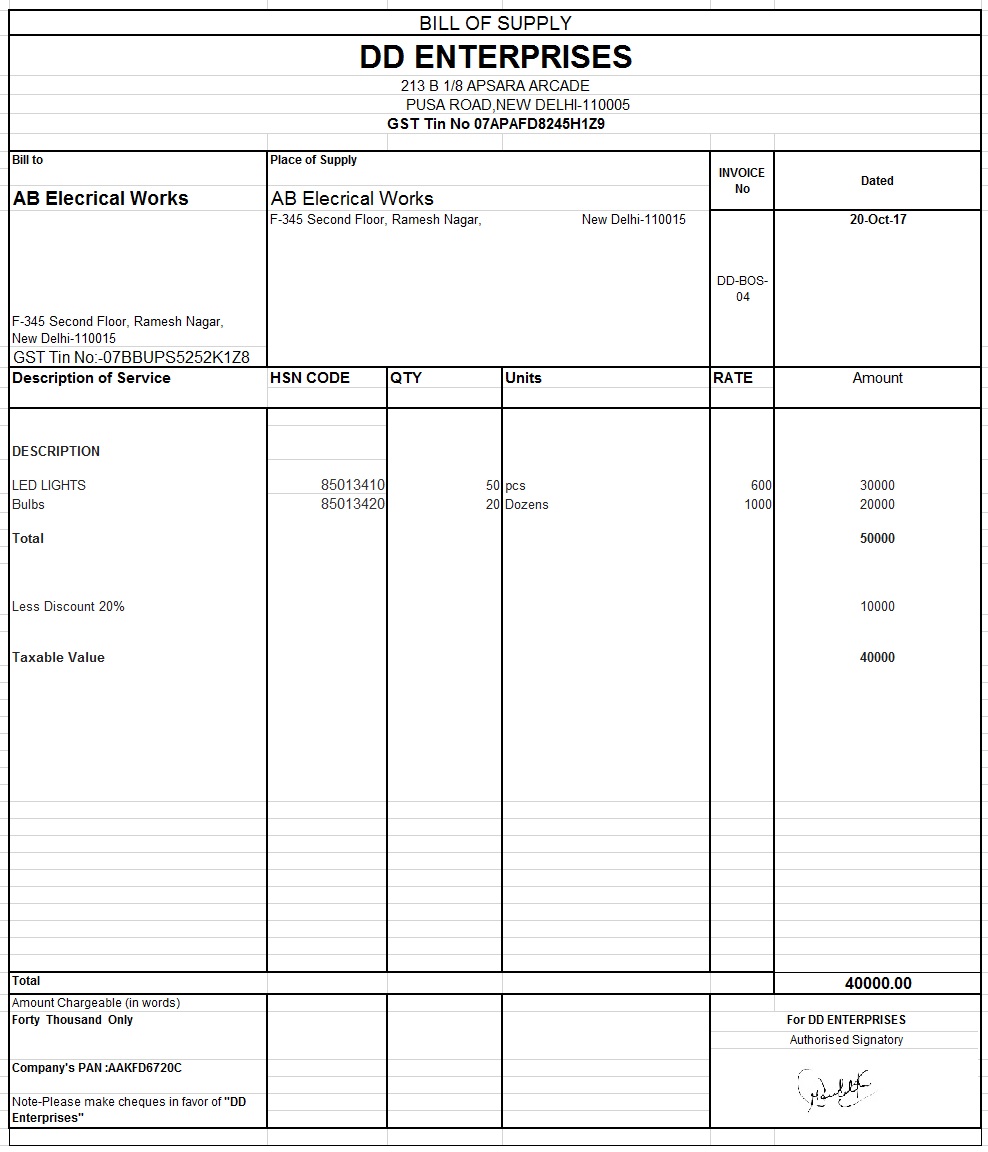

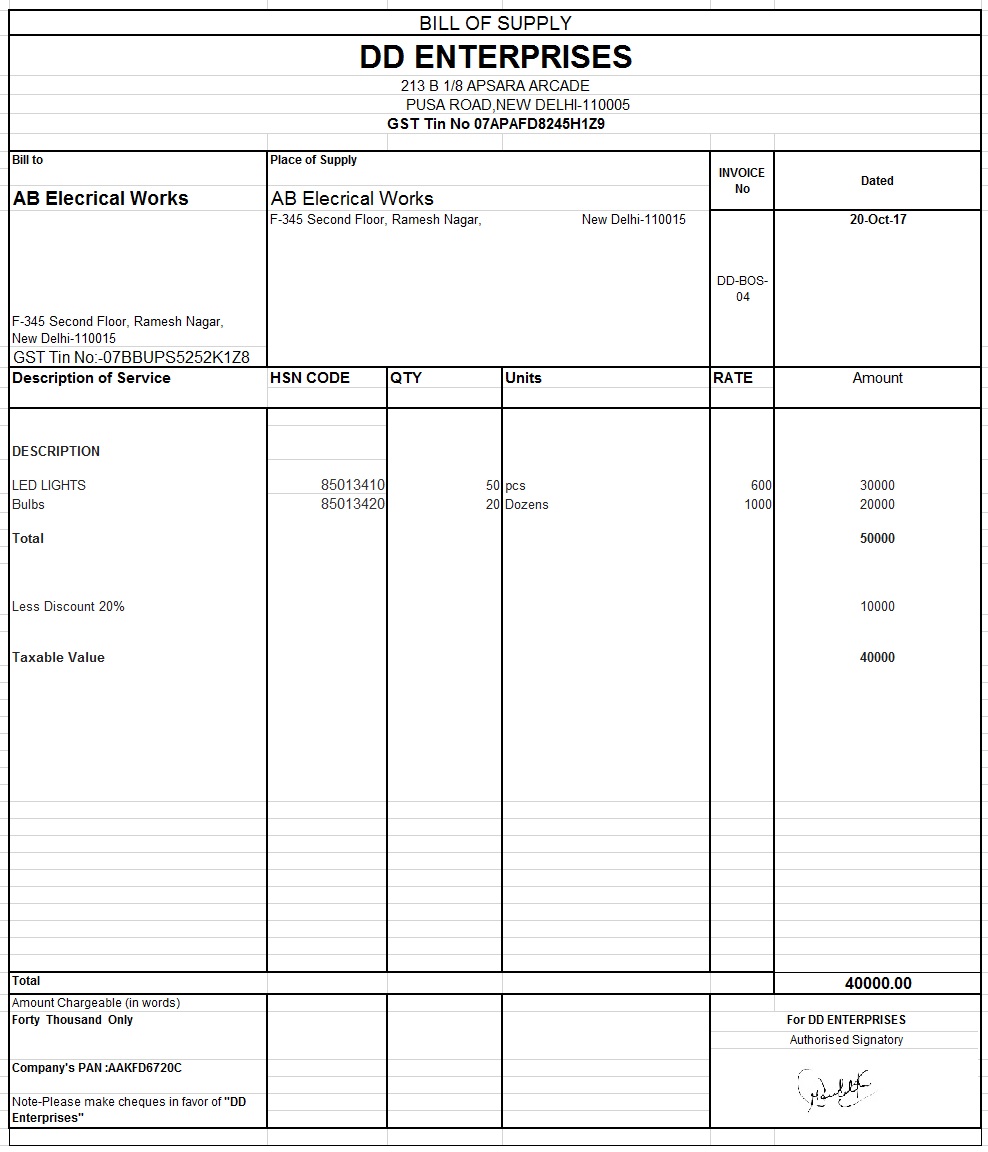

What Is A Bill Of Supply Under GST Learn By Quicko

https://assets.learn.quicko.com/wp-content/uploads/2020/04/Sample-Bill-of-Supply1-1536x1468-1-1024x979.jpg

Invoicing Taxuncle

https://emailer.tax2win.in/assets/guides/gst/GST-Invoice.jpg

Verkko 22 maalisk 2021 nbsp 0183 32 GST HST with Early Payment Discounts and Late Payment Penalties As an incentive to improve cash flow many companies offer early payment discounts to their customers such as 2 10 net 30 terms i e two percent discount if paid in 10 days otherwise payment is due in 30 days Verkko 9 huhtik 2017 nbsp 0183 32 If you receive or provide a rebate you may need to adjust the amount of GST you ve claimed or paid or treat the rebate as a separate sale depending on the circumstances A rebate may also be called a trade incentive payment trade discount trade price rebate volume rebate promotional rebate incentive rebate cooperative

Verkko 18 syysk 2023 nbsp 0183 32 Tax treatment of Discounts under GST In today s business environment discount is the sharpest weapon for promoting a product or brand Pattern of discount ordinarily can be divided into two typeS Types of discounts Let us understand some of the landmark judgments in this regard Verkko Discounts given before or at the time of supply will be allowed as deduction from transaction value Such discounts must be clearly mentioned on the invoice Discounts given after supply will be allowed only if It is mentioned in the agreement entered into before sale AND

What Is Bill Of Supply In GST GST Invoice Format

https://d77da31580fbc8944c00-52b01ccbcfe56047120eec75d9cb2cbd.ssl.cf6.rackcdn.com/485b7f1b-2c80-4ca8-a490-5c85fec897fa/gst-bill-of-supply.jpg

GST Number Search Online Taxpayer GSTIN UIN Verification

https://assets1.cleartax-cdn.com/s/img/2019/06/26122707/GST-Number-Search-Tool-Screenshot.png

https://tax2win.in/guide/treatment-discounts-gst

Verkko 28 jouluk 2023 nbsp 0183 32 Since the value of taxable supply is the transaction value GST is leviable on the value after deducting the discounts However not all discounts offered by the supplier to their customers are allowed as deductions from the value

https://gsthero.com/gst-on-discounts-legal-provisions-pre-post-sale...

Verkko 2 jouluk 2019 nbsp 0183 32 Legal Provisions for GST on Discounts Discounts are generally given by supplier to boost sales or encourage the buyer to pay promptly Treatment of discounts is defined in Section 15 3 of CGST Act 2017 The section states that The value of supply shall not include any discount which is given

GST Invoice Format Overview GSTZen

What Is Bill Of Supply In GST GST Invoice Format

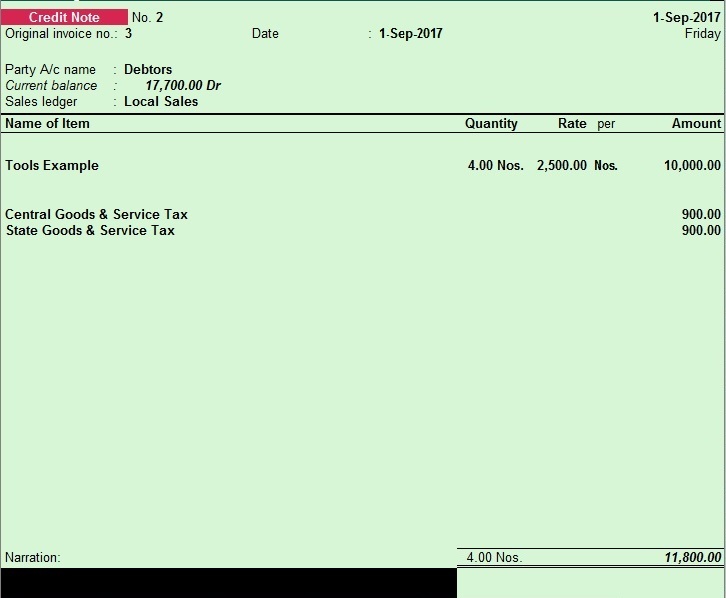

How To Create A Sales Return Credit Note Entry Under GST Regime

GST Invoice Formats

GST Invoice Bill Format Invoice Rules Tally Solutions

GST Software Go GST Bill Best GST Billing Software India

GST Software Go GST Bill Best GST Billing Software India

Gst Example Of Invoices Invoice Template Ideas

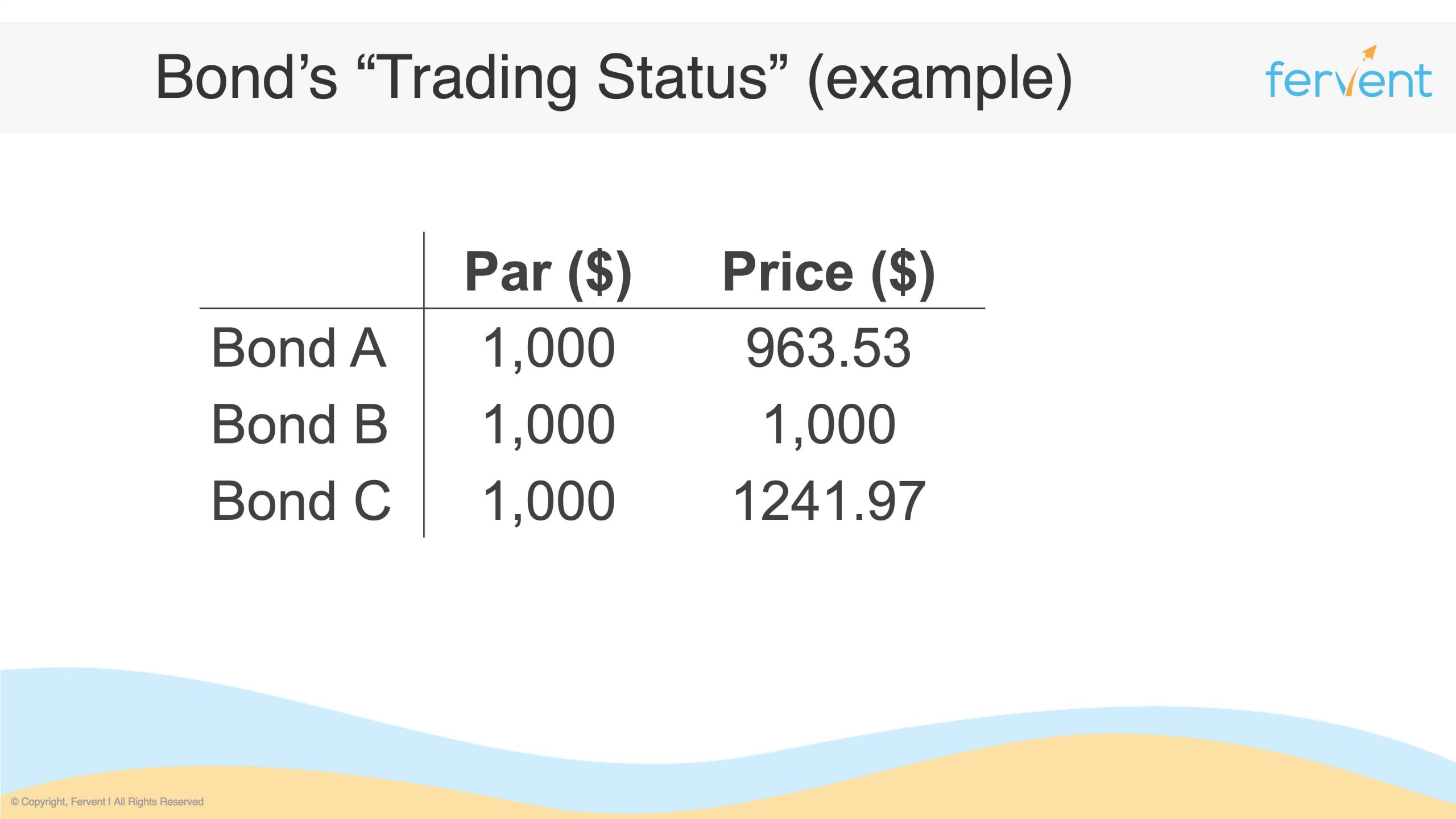

Discount Vs Premium Bonds Trading Status Explained

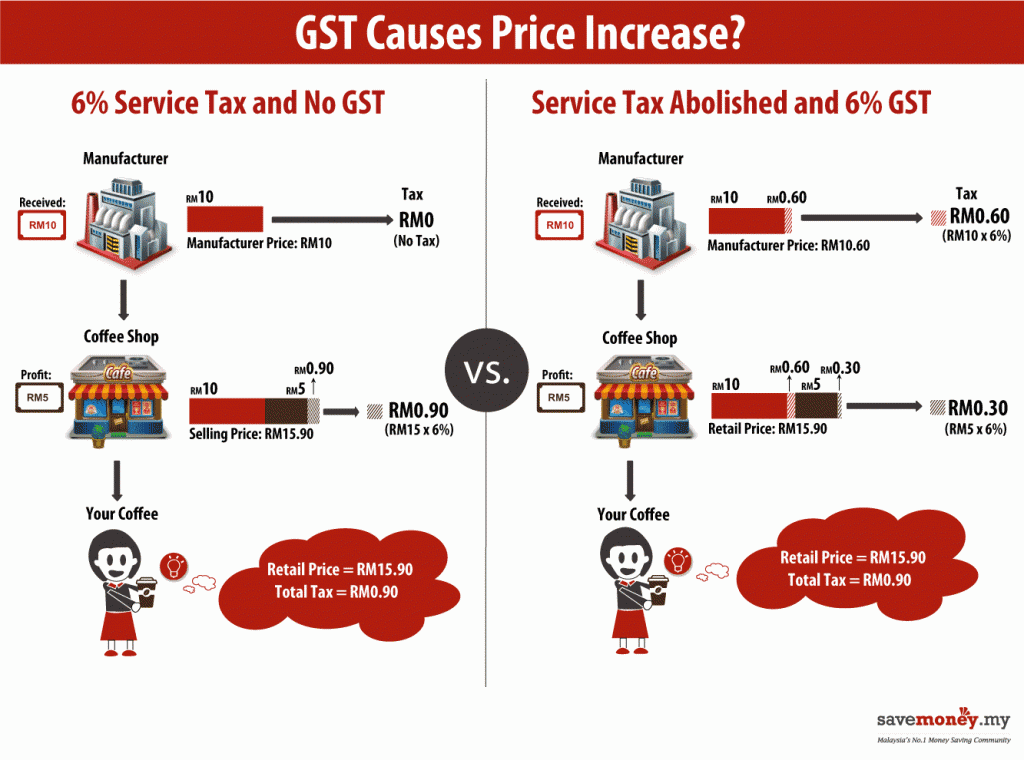

Bicara How Does GST Work

Does Discount Have Gst - Verkko 9 huhtik 2017 nbsp 0183 32 How GST applies to rebates you pay and receive and other trade incentive payments that are common in manufacturing wholesaling and retailing How GST applies to rebates Making an adjustment because of a rebate Accounting for a rebate as a separate sale