Energy Credit For Insulation 2022 The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide

Through December 31 2022 the energy efficient home improvement credit is a 500 lifetime credit As amended by the IRA the energy efficient home improvement A More information on the energy efficient home improvement credit and residential clean energy property credit is available for tax professionals building

Energy Credit For Insulation 2022

Energy Credit For Insulation 2022

https://www.energy.gov/sites/default/files/2023-01/Pro-spray-insulation-Thumbnail.jpg

Retain More Heat With Roof Insulation This Winter

https://ledegarroofing.com/wp-content/uploads/2023/02/ledegar-roofing-company-roof-insulation-spray-foam.jpg

Michigan Residential Insulation Rebates 2022 The Modern Pros

https://modernpros.com/wp-content/uploads/2022/02/insulation-of-attic-with-fiberglass-cold-barrier-and-insulation-material-thermal-insulation-attic.jpg

Under the Consolidated Appropriations Act of 2021 the renewable energy tax credits for fuel cells small wind turbines and geothermal heat pumps now feature a The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by providing federal tax credits and deductions that will help reduce energy costs and demand as we

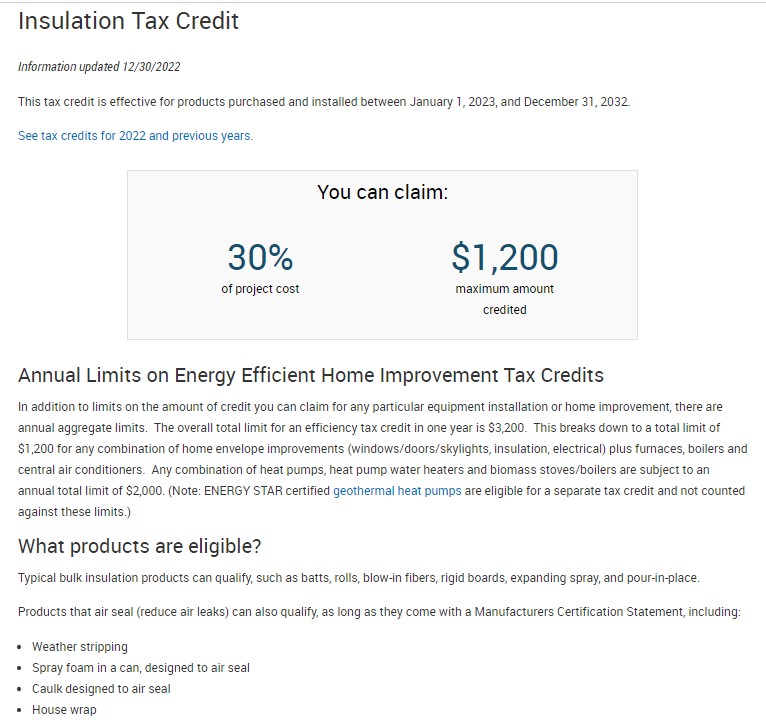

Energy Efficient Home Improvement Credit The Energy Efficient Home Improvement Credit is now equal to 30 of what homeowners pay for various types of Energy improvements to your home such as solar or wind generation biomass stoves fuel cells and new windows may qualify you for credits expanded in 2022 If you make

Download Energy Credit For Insulation 2022

More picture related to Energy Credit For Insulation 2022

SPRAY FOAM DIFFERENCES Foam Insulation Review

http://foaminsulationreview.com/wp-content/uploads/2020/04/Spray-Foam-Insulation.jpg

HOMEOWNER REBATES AND TAX CREDITS FOR 2023 Radiant Barrier USA

https://www.radiantbarrierusa.com/wp-content/uploads/2023/01/01.02.2023-HEEHRA-Supporting-Doc-for-Insulation.jpg

What You Need To Know About Energy Efficient Property Credits

https://tax.thomsonreuters.com/blog/wp-content/uploads/sites/17/2022/11/AdobeStock_440097569-scaled.jpeg

Federal tax credits can help you cover the cost of insulation saving you money on energy and keeping your home more comfortable There s been a lot of buzz about the newly expanded A Consumers can visit this IRS page on the Energy Efficient Home Improvement Credit Q What products are eligible for tax credits Solar panels for electricity from a provider

In August 2022 the Inflation Reduction Act amended two credits available for energy efficient home improvements and residential clean energy equipment so that For qualifying property placed in service after 2022 the nonbusiness energy property credit has been expanded and renamed as the energy efficient home

Home Insulation Tips For Better Energy Conservation Greener Ideal

https://i1.wp.com/greenerideal.com/wp-content/uploads/2012/04/home-insulation-e1407981353887.jpg?fit=1024%2C560&ssl=1

Radiant Barrier Insulation Nipodhook

https://i5.walmartimages.com/asr/a238cd68-b3d7-42d1-92b5-91ff30229346.1d37d2100de05e52c5dbb7d2a7e50ec1.jpeg

https://www.irs.gov/newsroom/irs-releases...

The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide

https://www.irs.gov/credits-deductions/frequently...

Through December 31 2022 the energy efficient home improvement credit is a 500 lifetime credit As amended by the IRA the energy efficient home improvement

How Much Does Spray Foam Insulation Cost Uses Types Cost House Grail

Home Insulation Tips For Better Energy Conservation Greener Ideal

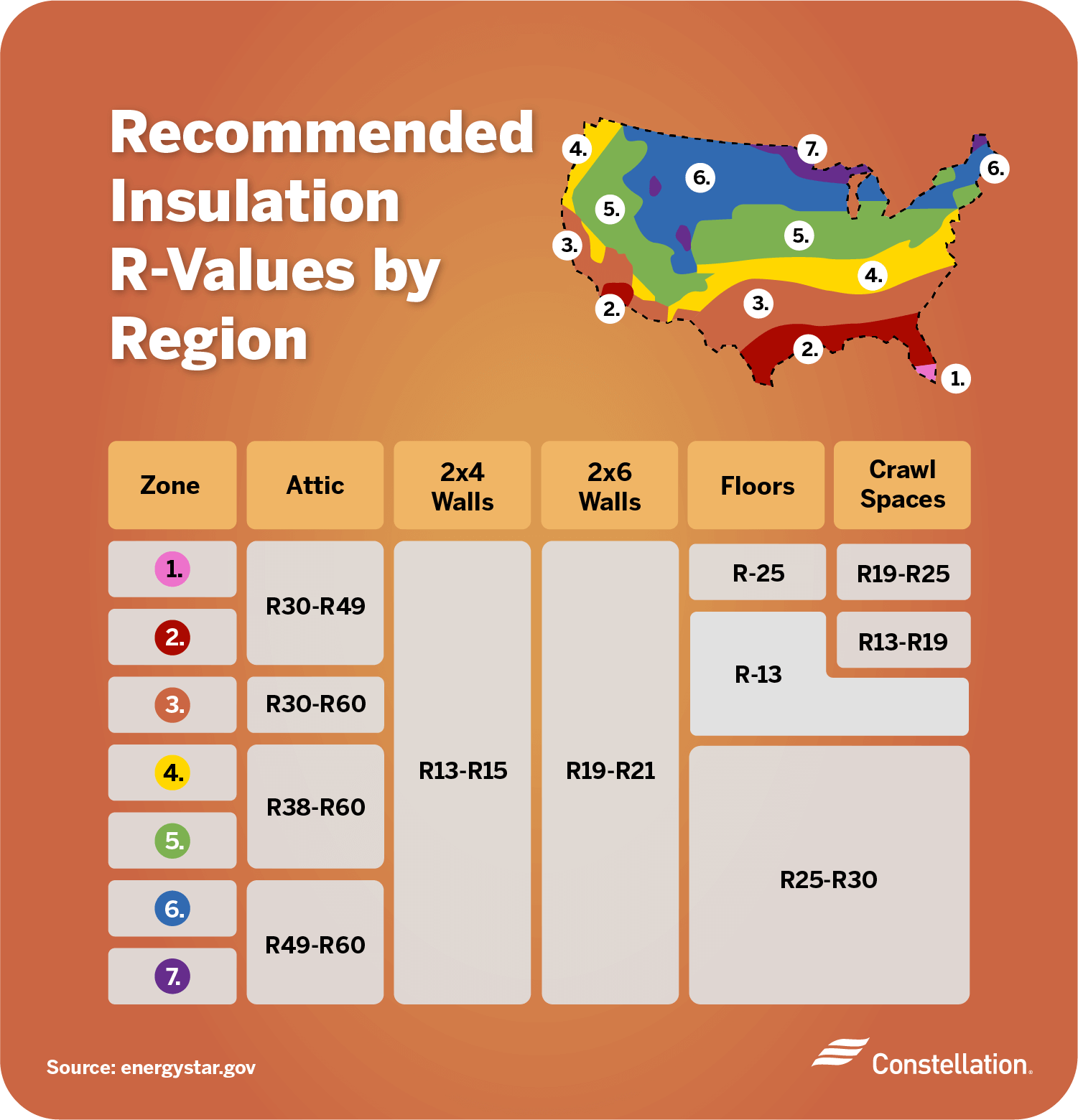

Types Of Insulation For Your Home Constellation

Best Solid Wall Insulation In 2022 Climate Insulation

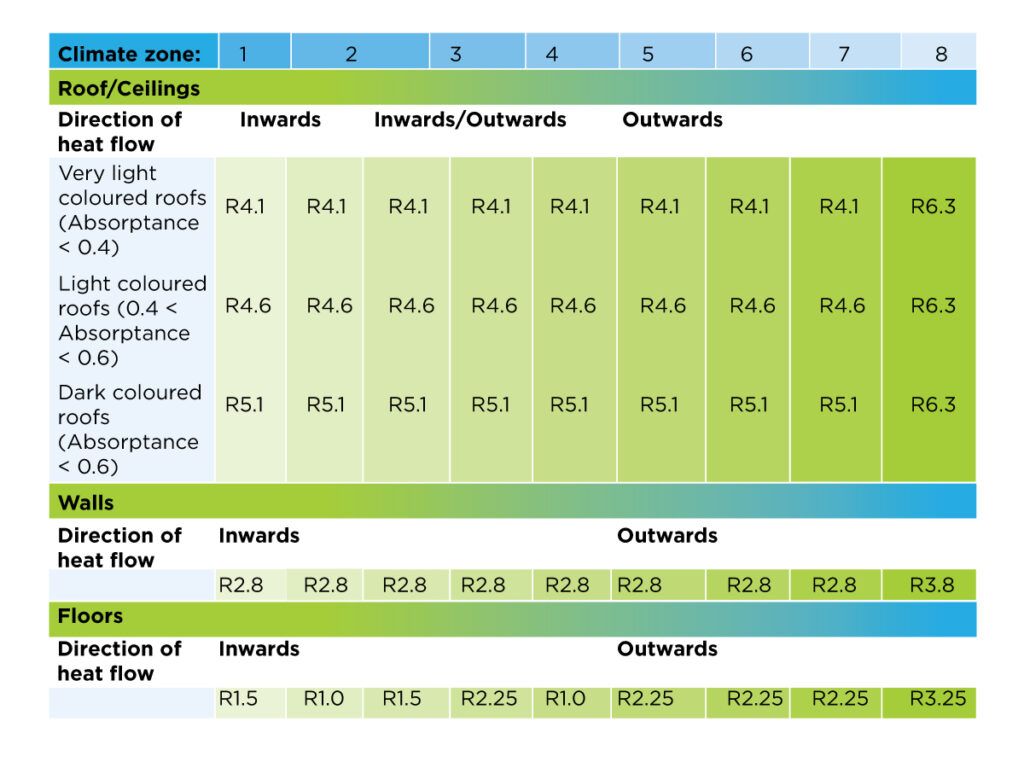

Minimum Insulation R Values For Australian Homes ECO Home Insulation

Energy Saving Insulation Systems Steel Building Insulation

Energy Saving Insulation Systems Steel Building Insulation

How To Fit Insulation 2023 To The Latest Building Regulations Part L

What Insulation Qualifies For Energy Tax Credit Storables

Complete Guide To Insulation Guide 2024 Icydk

Energy Credit For Insulation 2022 - The federal tax credits for energy efficiency were extended as part of the Inflation Reduction Act IRA of 2022 So if you made any qualifying home improvements to