Exemption Of Income Tax This is a list of income exempted from tax in Nigeria The income of a person from a source of livelihood whereby the person earns is lesser than the National Minimum Wage Income earned by holders of bonds and short term securities of Federal State and Local Government bonds and supra nationals

Learn about the types of income that are exempt from withholding tax in Nigeria such as interest dividends pensions and foreign income Find out the conditions and exceptions for each exemption category and how to apply them Tax exemption is the removal of a liability to make a compulsory payment that would otherwise be imposed by a ruling power upon persons property income or transactions Tax exempt status may provide complete relief from taxes reduced rates or tax on only a

Exemption Of Income Tax

Exemption Of Income Tax

https://www.signnow.com/preview/497/332/497332572/large.png

Income Tax Calculation Example 2 For Salary Employees 2023 24

https://govtempdiary.com/wp-content/uploads/2022/12/example-2.jpg

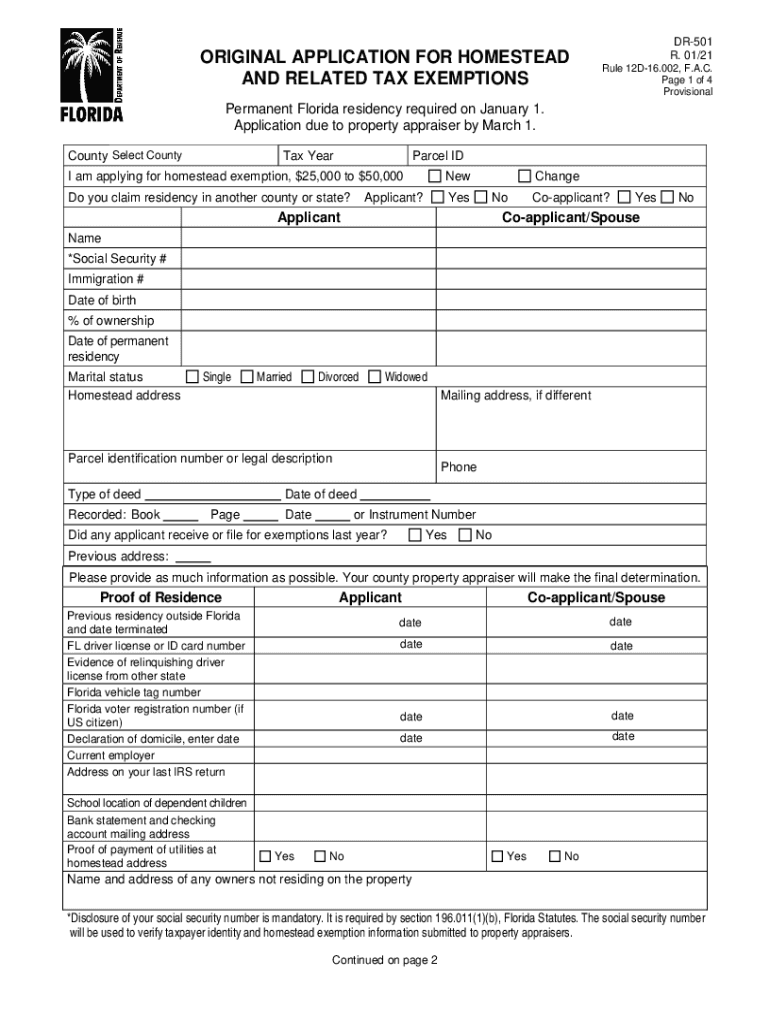

Homestead Exemption Florida Deadline 2021 2023 Form Fill Out And Sign

https://www.signnow.com/preview/547/892/547892759/large.png

In the table below we examine the exempt income and allowable deductibles in computing the Personal Income Tax PIT liability of a taxable person in Nigeria The Federal Inland Revenue Service FIRS issued a circular to clarify the provisions of the Finance Act 2020 as they relate to personal income tax in Nigeria The circular covers topics such as non resident income deductions gross income tax

Learn about the concept types regulatory laws and bodies of taxation in Nigeria Find out the difference between tax evasion and avoidance and the incentives and exemptions available to tax payers Exemption from payment of Companies Income Tax Tertiary Education Tax TET Section 55 of the CIT Act as amended requires every company including a company granted exemption from incorporation to submit its income tax returns whether or not the company is liable to pay tax

Download Exemption Of Income Tax

More picture related to Exemption Of Income Tax

BIR FORM NO 2305 Certificate Of Update Of Exemption And Employers And

https://imgv2-1-f.scribdassets.com/img/document/272914545/original/1aca7d85e2/1627634615?v=1

Tax Exemption Letter Arancel Impuestos

https://imgv2-1-f.scribdassets.com/img/document/348416876/original/f16a4f99fe/1568331597?v=1

Government Tax Exempt Form Pdf Fill Online Printable Fillable

https://www.pdffiller.com/preview/15/184/15184121/large.png

In Nigeria just as it is applicable in other countries businesses operating in the free zone are exempted from payment of the mandatory companies income tax and other applicable taxes In addition businesses are equally granted duty free importation of raw materials waiver on all import and export duties and the ability to repatriate all With the expiration of the Orders and consequently the exemption incentives interests accruing to already issued debt instruments will now be subject to withholding tax WHT and CIT effective from 2022 Year of Assessment

[desc-10] [desc-11]

Tax Exempt Tax Bind Consulting

https://taxbind.net/application/uploads/2018/09/tax-exempt.jpg

Form Rev 1220 Pennsylvania Exemption Certificate Printable Pdf Download

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/form-rev-1220-pennsylvania-exemption-certificate-printable-pdf-download-1.png?w=950&ssl=1

https://nigerianfinder.com/list-of-income-exempted...

This is a list of income exempted from tax in Nigeria The income of a person from a source of livelihood whereby the person earns is lesser than the National Minimum Wage Income earned by holders of bonds and short term securities of Federal State and Local Government bonds and supra nationals

https://nigerianfinder.com/withholding-tax-exemption-list-in-nigeria

Learn about the types of income that are exempt from withholding tax in Nigeria such as interest dividends pensions and foreign income Find out the conditions and exceptions for each exemption category and how to apply them

Proposal To Remove Foreign Source Income Exemption Comes As A Surprise

Tax Exempt Tax Bind Consulting

Affidavit Of Tax Exemption

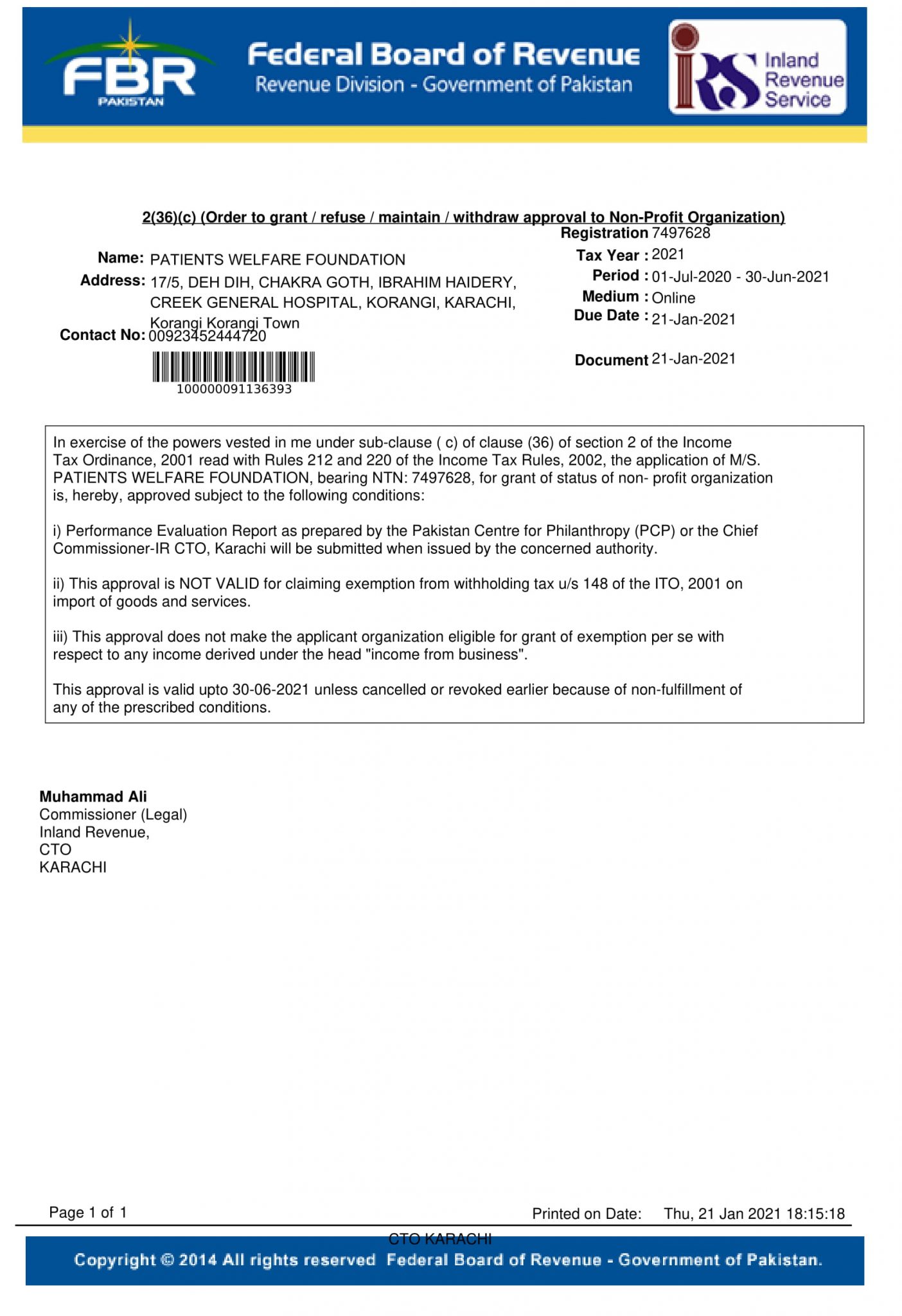

Tax Exemption Certificate PWF Pakistan

California Tax Exempt Form Fill Out Sign Online DocHub

IRS Tax Exemption Letter Peninsulas EMS Council

IRS Tax Exemption Letter Peninsulas EMS Council

Certificate Of Exemption From Withholding New York Free Download

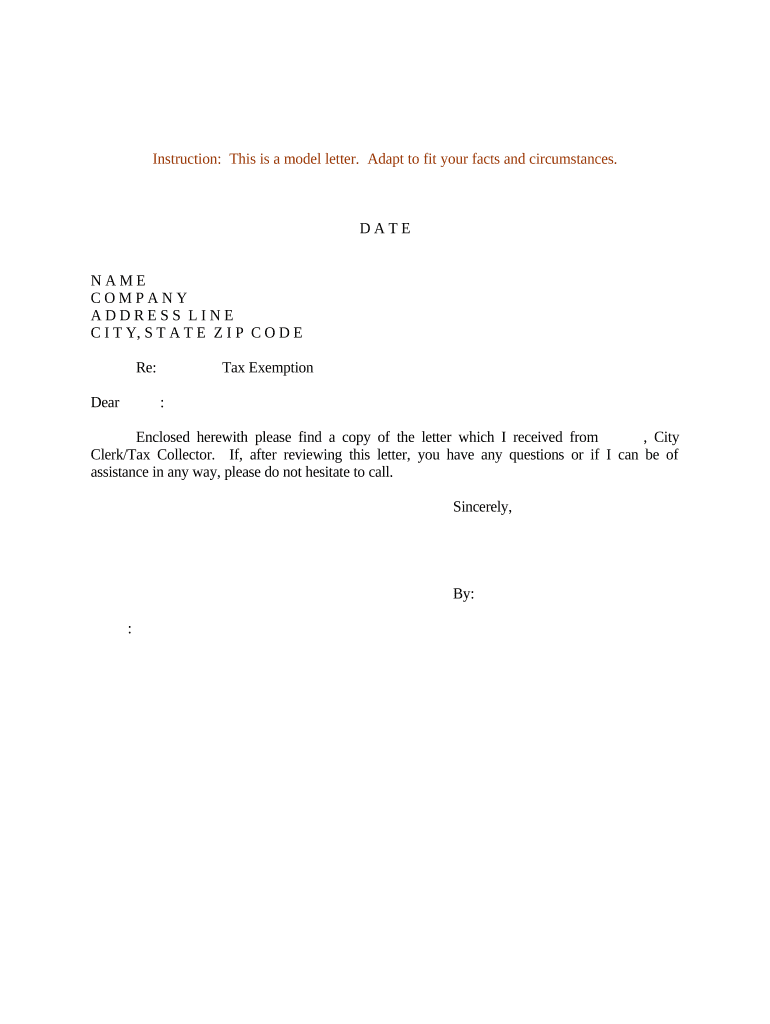

Sample Letter Tax Exemption Form Fill Out And Sign Printable PDF

Tax Exempt Form TAX

Exemption Of Income Tax - In the table below we examine the exempt income and allowable deductibles in computing the Personal Income Tax PIT liability of a taxable person in Nigeria