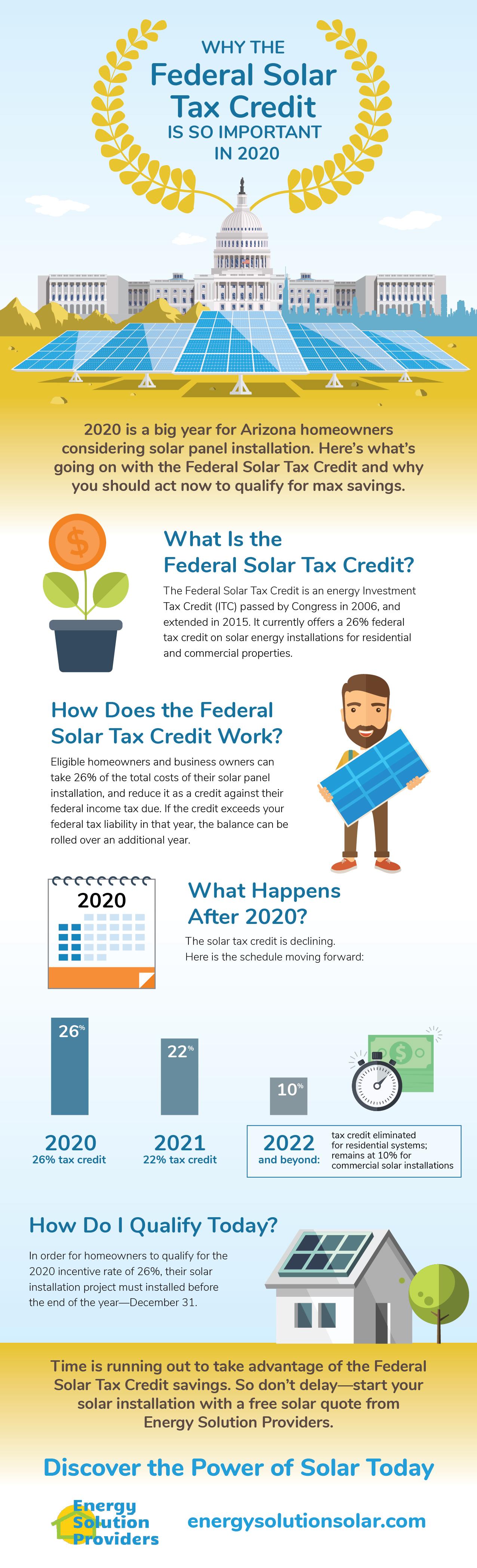

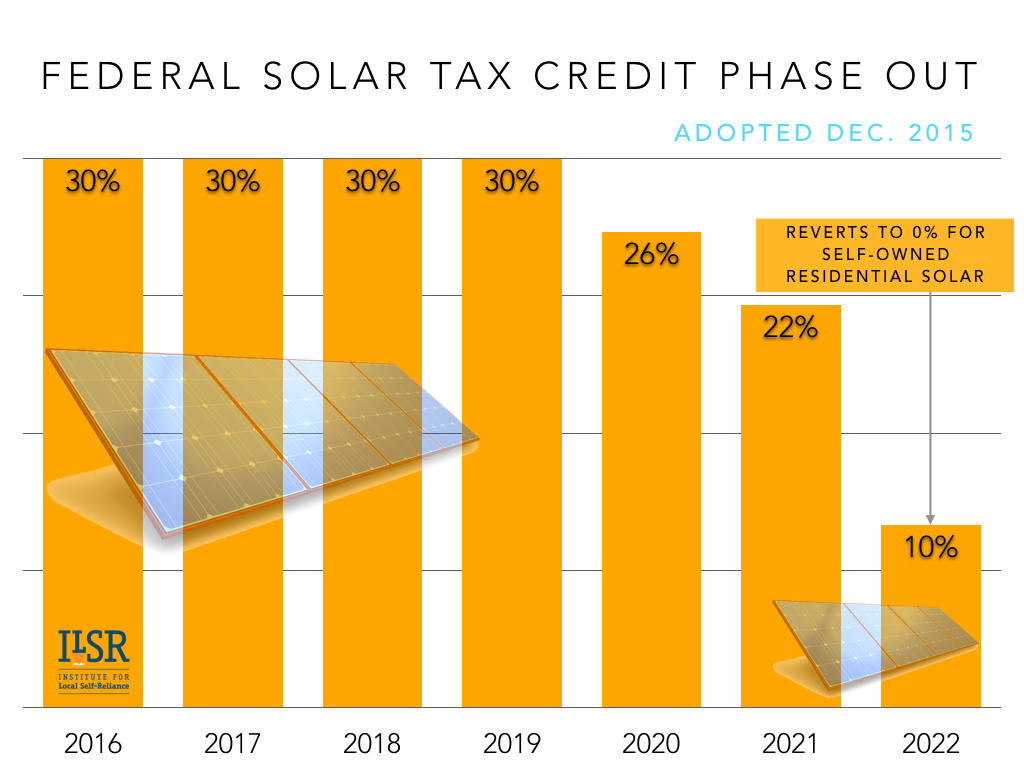

Federal Solar Tax Credit Income Limit Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems

The solar panel tax credit allows filers to take a tax credit equal to up to 30 of eligible costs There is no income limit to qualify and you can claim the credit each year you re The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system 2 Other

Federal Solar Tax Credit Income Limit

Federal Solar Tax Credit Income Limit

https://www.livesmartconstruction.com/wp-content/uploads/2020/05/solar-tax-credit.jpg

The Federal Solar Tax Credit Energy Solution Providers Arizona

https://energysolutionsolar.com/sites/default/files/styles/panopoly_image_original/public/federalsolartax2020-03_1.jpg?itok=EB_bqkCL

How Does The Federal Solar Tax Credit Work PB Roofing Co

https://pbroofingco.com/wp-content/uploads/2021/06/federal-solar-tax-credit.png

There is no lifetime limit for either credit the limits for the credits are determined on a yearly basis For example beginning in 2023 a taxpayer can claim the Claiming a 1 000 federal tax credit reduces your federal income taxes due by 1 000 1 What is the federal solar tax credit The federal residential solar energy credit is a tax

WASHINGTON The Internal Revenue Service today updated frequently asked questions in Fact Sheet 2024 15 PDF to address the federal income tax treatment of amounts paid for the purchase of Is there an income limit for the federal solar tax credit There is no income limit but the amount you can receive from the tax credit is limited to how much you would pay in taxes for

Download Federal Solar Tax Credit Income Limit

More picture related to Federal Solar Tax Credit Income Limit

Federal Solar Tax Credit A Quick Rundown Next Energy Solution

https://nextenergysolution.com/wp-content/uploads/82527958_l-scaled.jpg

Federal Solar Tax Credits For Businesses Department Of Energy

https://www.energy.gov/sites/default/files/2022-10/Summary-ITC-and-PTC-Values-Table.png

Solar Tax Credit Guide And Calculator

https://www.solar-estimate.org/build/images/pages/solar-tax-credit/residential-bar-e0482b8d.png

The federal solar tax credit is a dollar for dollar income tax credit equal to 30 of solar installation costs Homeowners earn an average solar tax credit of 6 000 The 30 solar tax credit is available until 2032 before What is the income limit for the federal solar tax credit There is no income limit for the federal solar tax credit However you need a large enough taxable income to claim the full

The solar tax credit which is among several federal Residential Clean Energy Credits available through 2032 allows homeowners to subtract 30 percent of the cost of installing solar The federal residential solar tax credit is the most valuable incentive you can claim this year because it saves you thousands of dollars in the form of a 30 tax credit

The Solar Tax Credit Also Know As The ITC Is A Dollar For Dollar

https://i.pinimg.com/originals/58/28/2c/58282c905274c1827d1d8b95646b152a.jpg

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse

https://www.ecohousesolar.com/wp-content/uploads/2022/09/Ecohouse-Tax-Credit-Graphic-06-2048x1136.png

https://www.energy.gov/eere/solar/hom…

Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems

https://www.nerdwallet.com/.../taxes/s…

The solar panel tax credit allows filers to take a tax credit equal to up to 30 of eligible costs There is no income limit to qualify and you can claim the credit each year you re

Federal Investment Solar Tax Credit Guide Learn How To Claim The

The Solar Tax Credit Also Know As The ITC Is A Dollar For Dollar

The Federal Solar Tax Credit What You Need To Know 2022

Plan Your Solar Transition With A 30 Solar Tax Credit KC Green Energy

Federal Solar Tax Credit Take 30 Off Your Solar Cost Page 2 Of 3

Federal Solar Tax Credit Guide Atlantic Key Energy

Federal Solar Tax Credit Guide Atlantic Key Energy

The Federal Solar Tax Credit Extension Can We Win If We Lose

Congress Gets Renewable Tax Credit Extension Right Institute For

Federal Solar Tax Credit For Residential Solar Energy

Federal Solar Tax Credit Income Limit - Calculating the amount of your federal solar tax credit is very simple Take the total cost your system and multiply it by 0 30 For example if you spent 25 000 all