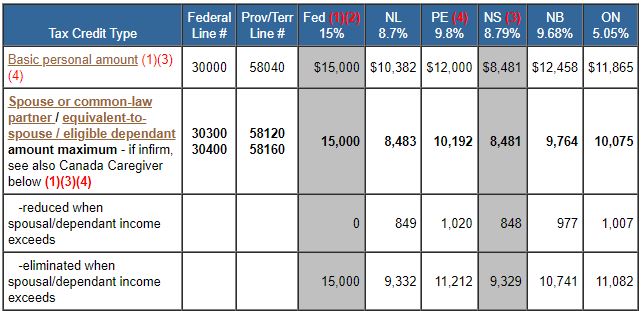

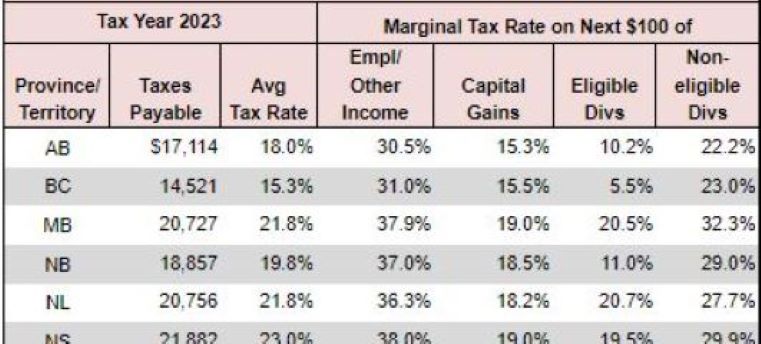

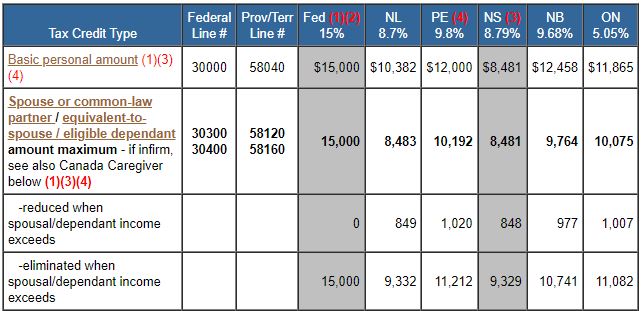

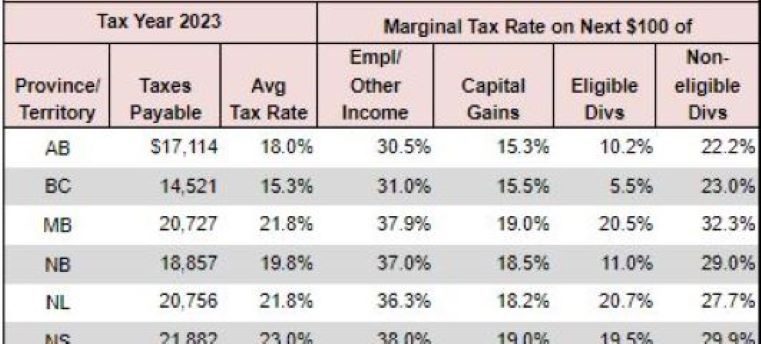

Federal Tax Credit Amount 2023 Every taxpayer gets a tax credit for the basic personal amount so any person can earn taxable income of 15 000 in 2023 without paying any federal tax and can earn anywhere from 8 481 to 21 003 depending on the province or territory in which they live without paying any provincial or territorial tax

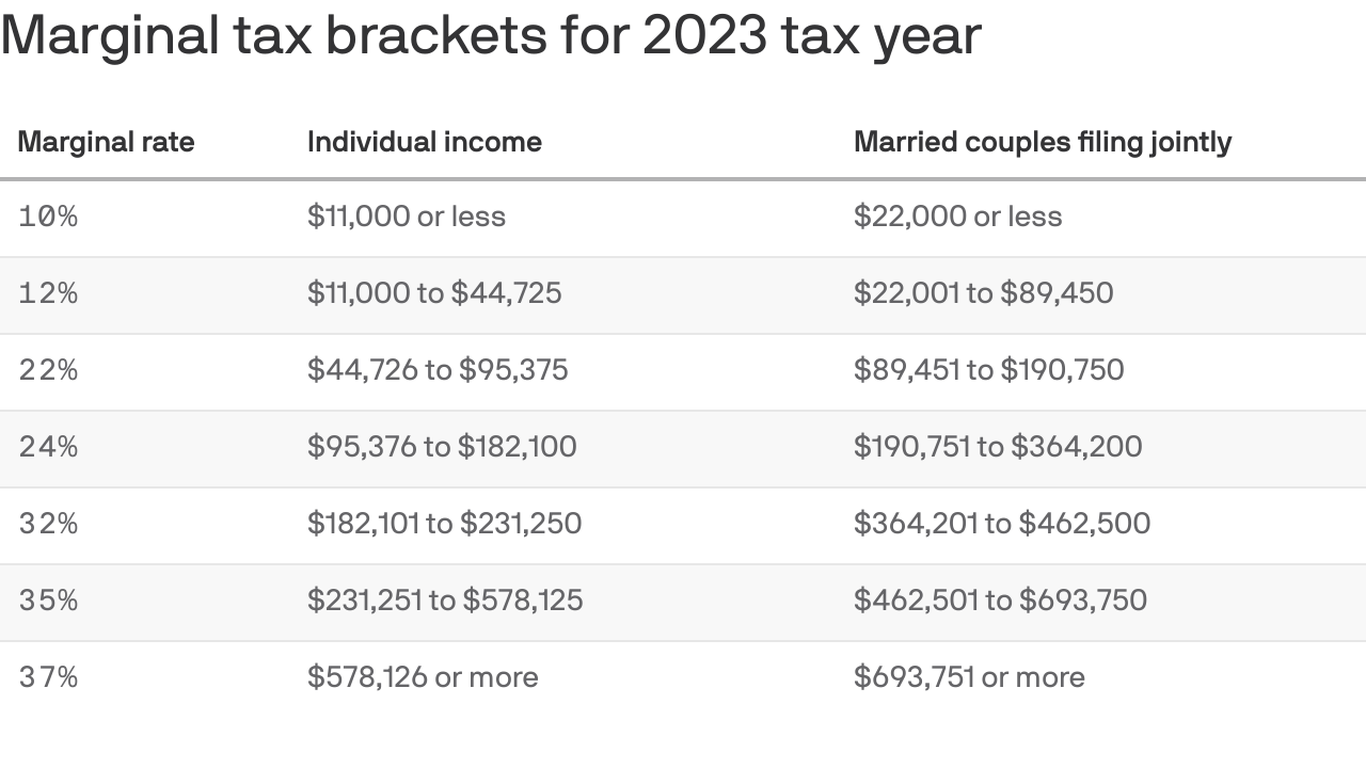

2023 tax rates for a single taxpayer For a single taxpayer the rates are Here s how that works for a single person earning 58 000 per year 2023 tax rates for other filers Find the current tax rates for other filing statuses Use tab to go to the next focusable element Married filing jointly or qualifying surviving spouse You may qualify for a clean vehicle tax credit up to 7 500 if you buy a new qualified plug in electric vehicle or fuel cell electric vehicle If you place in service a new plug in electric vehicle EV or fuel cell vehicle FCV in 2023 or after you may qualify for a

Federal Tax Credit Amount 2023

Federal Tax Credit Amount 2023

https://www.taxtips.ca/nrcredits/2023-personal-tax-credits.jpg

TaxTips ca 2023 Earlier Basic Tax Calculator Compare 2 Scenarios

https://www.taxtips.ca/calculators/enhanced-basic/2023-basic-tax-calculator-rates.jpg

Weekly Tax Table Federal Withholding Tables 2021

https://federal-withholding-tables.net/wp-content/uploads/2021/07/weekly-tax-table-2016-17-hqb-accountants-auditors-advisors.jpg

FS 2023 09 April 2023 A tax credit is a dollar for dollar amount taxpayers claim on their tax return to reduce the income tax they owe Eligible taxpayers can use them to reduce their tax bill and potentially increase their refund Advertiser disclosure 2023 2024 Tax Credits Guide Definition Who Qualifies Tax credits can come in handy when tax filing season rolls around Here are a few common ones for people

With the end of the year on the horizon now is the time to think about the coming tax year Here are some of the projected tax brackets deductions and credits for 2023 Plug in electric vehicles and fuel cell vehicles placed in service in 2023 or later may be eligible for a federal income tax credit of up to 7 500

Download Federal Tax Credit Amount 2023

More picture related to Federal Tax Credit Amount 2023

Federal Tax Credit Use It Or Lose It

https://blog.allenergysolar.com/hs-fs/hubfs/AES-taxcredit-1.jpg?width=2100&name=AES-taxcredit-1.jpg

Oct 19 Irs Here Are The New Income Tax Brackets For 2023 Free Nude

https://image.cnbcfm.com/api/v1/image/107136825-1666125851699-6clBX-marginal-tax-brackets-for-tax-year-2023-single-individuals_1.png?v=1666125859

Your First Look At 2023 Tax Brackets Deductions And Credits 3

https://db0ip7zd23b50.cloudfront.net/dims4/default/aedfbe6/2147483647/resize/633x10000>/quality/90/?url=http:%2F%2Fbloomberg-bna-brightspot.s3.amazonaws.com%2Fae%2F00%2F2ce5bb3d4ec493a63ec4724e6e05%2Fd64957248d6c49ebb92ef34db2768c4e

A tax credit refers to the specific amount taken away from what a person owes For example if you receive a tax credit of 2 000 on a 4 500 tax bill it would be reduced to 2 500 On the other Advertiser disclosure Earned Income Tax Credit What It Is How to Qualify In general the less you earn the larger the credit Families with children often qualify for the largest

What Are the Federal Tax Brackets for 2023 for filing in 2024 What Are the Federal Tax Brackets for 2024 for filing in 2025 Click to expand Key Takeaways Tax rate schedules can help you estimate the amount of tax that you will owe when you prepare your taxes Standard Deduction for 2023 27 700 Married filing jointly and surviving spouses 20 800 Head of Household 13 850 Unmarried individuals 13 850 Married filing separately The Standard Deduction is an amount every taxpayer is allowed to take as a deduction from their income to reduce their taxable income

New 2023 IRS Income Tax Brackets And Phaseouts

https://imageio.forbes.com/specials-images/imageserve/637d001647ac19edd4588245/0x0.jpg?format=jpg&width=1200

Federal Tax Credit Calculation

https://media-exp1.licdn.com/dms/image/C4E12AQG5Q0qM6sabVQ/article-cover_image-shrink_720_1280/0/1627170582682?e=2147483647&v=beta&t=c68LlSF5_z0QfUc4QA18VjSk4YxcSaHzB4e4tRsjpiw

https://www.taxtips.ca/nrcredits/tax-credits-2023-base.htm

Every taxpayer gets a tax credit for the basic personal amount so any person can earn taxable income of 15 000 in 2023 without paying any federal tax and can earn anywhere from 8 481 to 21 003 depending on the province or territory in which they live without paying any provincial or territorial tax

https://www.irs.gov/filing/federal-income-tax-rates-and-brackets

2023 tax rates for a single taxpayer For a single taxpayer the rates are Here s how that works for a single person earning 58 000 per year 2023 tax rates for other filers Find the current tax rates for other filing statuses Use tab to go to the next focusable element Married filing jointly or qualifying surviving spouse

Act Fast The Solar Tax Credit Will Soon Expire

New 2023 IRS Income Tax Brackets And Phaseouts

How Does The Federal Solar Tax Credit Work CRJ Contractors

Irs Tax Brackets 2023 Chart Printable Forms Free Online

The Earned Income Tax Credit EITC Refund Schedule For 2022 2023

2022 Tax Brackets Lashell Ahern

2022 Tax Brackets Lashell Ahern

2023 Tax Brackets The Best Income To Live A Great Life

2023 IRS Inflation Adjustments Tax Brackets Standard Deduction EITC

Earned Income Tax Credit Claims Are Less Likely After IRS Audits

Federal Tax Credit Amount 2023 - Advertiser disclosure 2023 2024 Tax Credits Guide Definition Who Qualifies Tax credits can come in handy when tax filing season rolls around Here are a few common ones for people