Federal Tax Credit Heat Pump Requirements Verkko 30 jouluk 2022 nbsp 0183 32 Heat pumps are either ducted or non ducted mini splits Eligibility depends on whether you live in the north or south Ducted South All heat pumps that have earned the ENERGY STAR label North Heat pumps designated as ENERGY STAR Cold Climate that have an EER2 gt 10 Ductless mini splits South ENERGY

Verkko 2025 must meet the criteria established by the IECC standard in effect on January 1 2023 to qualify for the Energy Efficient Home Improvement Credit in 2025 Electric or natural gas heat pumps electric or natural gas heat pump water heaters central air Verkko 29 jouluk 2023 nbsp 0183 32 The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit

Federal Tax Credit Heat Pump Requirements

Federal Tax Credit Heat Pump Requirements

https://raviniaplumbing.com/wp-content/uploads/2023/08/Are-There-Federal-Tax-Credits-Available-for-Heat-Pumps_-1-scaled.jpg

Tax Credits Offered For Heat Pump Installation YouTube

https://i.ytimg.com/vi/j5EODeZMn-0/maxresdefault.jpg

Air Source Heat Pump Tax Credit 2023 Comfort Control

https://comfortcontrolspecialists.com/wp-content/uploads/2023/06/CCS-Air-Source-Heat-Pumps-Tax-Credit-750x420.jpg

Verkko Instructions for Form 5695 2022 Residential Energy Credits Section references are to the Internal Revenue Code unless otherwise noted 2022 General Instructions Future Developments For the latest information about developments related to Form 5695 and its instructions such as legislation enacted after they were published go to Verkko Geothermal heat pumps must meet Energy Star requirements in effect at the time of purchase Battery storage technology must have a capacity of at least 3 kilowatt hours How to Claim the Credit File Form 5695 Residential Energy Credits with your tax return to claim the credit

Verkko IR 2023 97 May 4 2023 WASHINGTON The Internal Revenue Service reminds taxpayers that making certain energy efficient updates to their homes could qualify them for home energy tax credits The credit amounts and types of qualifying expenses were expanded by the Inflation Reduction Act of 2022 Verkko 22 jouluk 2022 nbsp 0183 32 A1 The following energy efficiency requirements must be met to qualify for the Energy Efficient Home Improvement Credit Exterior doors must meet applicable Energy Star requirements Windows and skylights must meet Energy Star most efficient certification requirements

Download Federal Tax Credit Heat Pump Requirements

More picture related to Federal Tax Credit Heat Pump Requirements

Federal Tax Credits Carrier Residential

https://images.carriercms.com/image/upload/w_auto,c_lfill,q_auto,f_auto/v1660667885/carrier/residential-hvac/products/split-system-tax-credit-25c.png

Heat Pumps Rebates 2019 Coastal Energy PumpRebate

https://i0.wp.com/www.pumprebate.com/wp-content/uploads/2022/09/heat-pumps-rebates-2019-coastal-energy-118.png

Air Source Heat Pump Electrical Requirements Source Heat Pump

https://sourceheatpump.com/wp-content/uploads/air-source-heat-pump-59.jpg

Verkko 27 huhtik 2021 nbsp 0183 32 Qualifying properties are solar electric property solar water heaters geothermal heat pumps small wind turbines fuel cell property and starting December 31 2020 qualified biomass fuel property expenditures paid or incurred in taxable years beginning after that date Verkko 30 jouluk 2022 nbsp 0183 32 In addition to the energy efficiency credits homeowners can also take advantage of the modified and extended Residential Clean Energy credit which provides a 30 percent income tax credit for clean energy equipment such as rooftop solar wind energy geothermal heat pumps and battery storage through 2032 stepping down to

Verkko The 25c tax credit allows taxpayers to claim certain home energy upgrades like heat pumps to reduce their tax burden In 2023 the maximum federal tax credit for installing a heat pump increased to 30 of your project Verkko 15 elok 2022 nbsp 0183 32 If you opt to install a heat pump you ll be eligible for a federal tax credit for models that achieve the Consortium for Energy Efficiency s CEE highest tier for efficiency

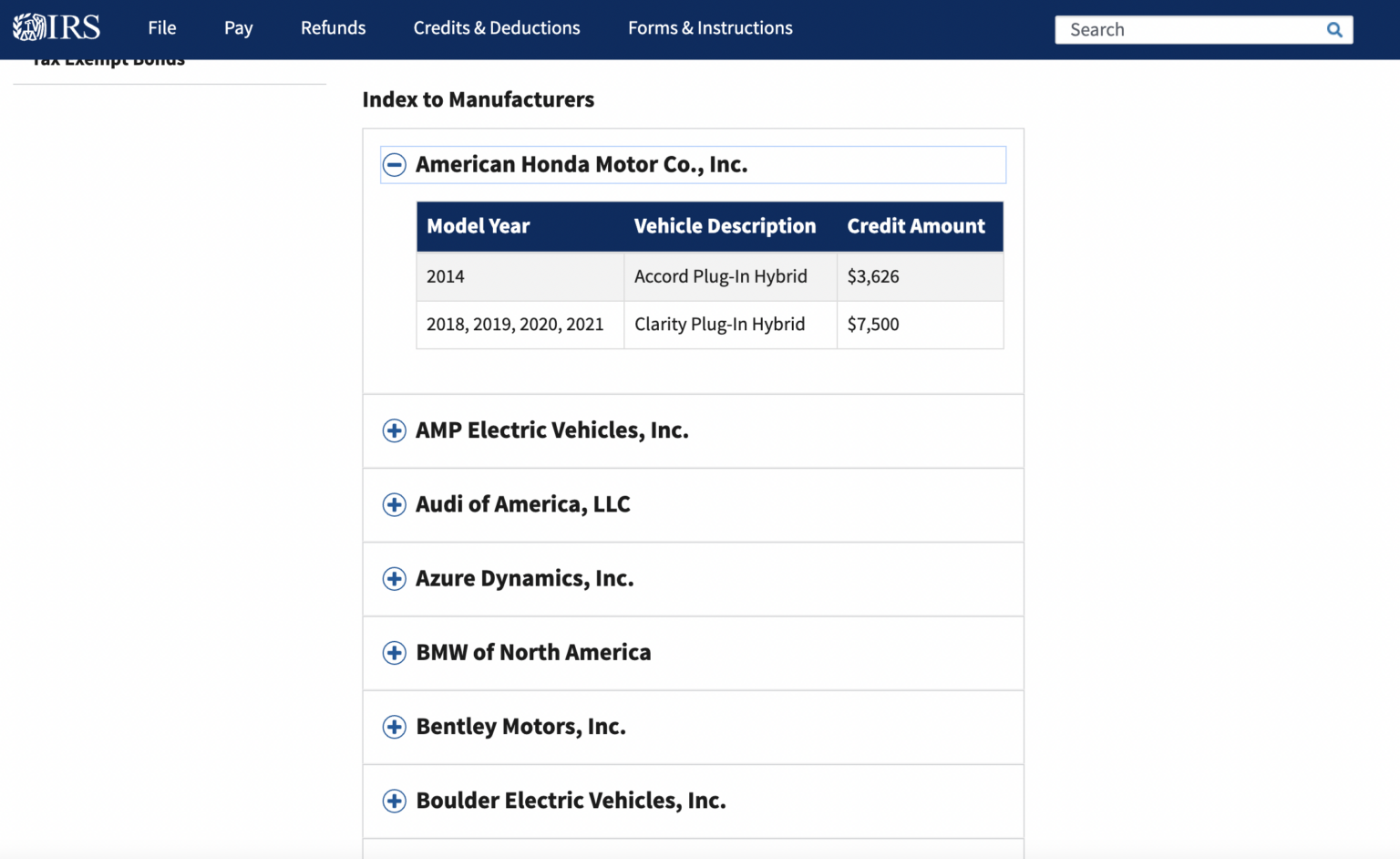

EV Tax Credit Gets Tougher US Treasury Issues New Guidelines For Clean

https://i.ytimg.com/vi/zeISZIR84G0/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4Ac4FgAKACooCDAgAEAEYVyBlKCUwDw==&rs=AOn4CLCplZ4vrSZkM2hZb1Z0se98_wyTFg

Air Source Heat Pump Space Requirements With Real Example Source

https://sourceheatpump.com/wp-content/uploads/air-source-heat-pump-5.jpg

https://www.energystar.gov/about/federal_tax_credits/air_source_heat_…

Verkko 30 jouluk 2022 nbsp 0183 32 Heat pumps are either ducted or non ducted mini splits Eligibility depends on whether you live in the north or south Ducted South All heat pumps that have earned the ENERGY STAR label North Heat pumps designated as ENERGY STAR Cold Climate that have an EER2 gt 10 Ductless mini splits South ENERGY

https://www.irs.gov/pub/taxpros/fs-2022-40.pdf

Verkko 2025 must meet the criteria established by the IECC standard in effect on January 1 2023 to qualify for the Energy Efficient Home Improvement Credit in 2025 Electric or natural gas heat pumps electric or natural gas heat pump water heaters central air

What You Need To Know About The Federal Tax Credit For Heat Pumps In 2023

EV Tax Credit Gets Tougher US Treasury Issues New Guidelines For Clean

Heat Pump Tax Credit 2023 All You Need To Know Clover Contracting

EVs That Are Eligible For A Federal Tax Credit In 2024

Federal Tax Credits For Air Conditioners Heat Pumps 2023

The Inflation Reduction Act pumps Up Heat Pumps Hvac

The Inflation Reduction Act pumps Up Heat Pumps Hvac

Inflation Reduction Act Expands 45L Tax Credit For Energy Efficient

The Federal Tax Credit For Electric Cars How To Save 7 500

Want To Lease An EV There s A Tax Credit Loophole For That

Federal Tax Credit Heat Pump Requirements - Verkko 22 jouluk 2022 nbsp 0183 32 A1 The following energy efficiency requirements must be met to qualify for the Energy Efficient Home Improvement Credit Exterior doors must meet applicable Energy Star requirements Windows and skylights must meet Energy Star most efficient certification requirements