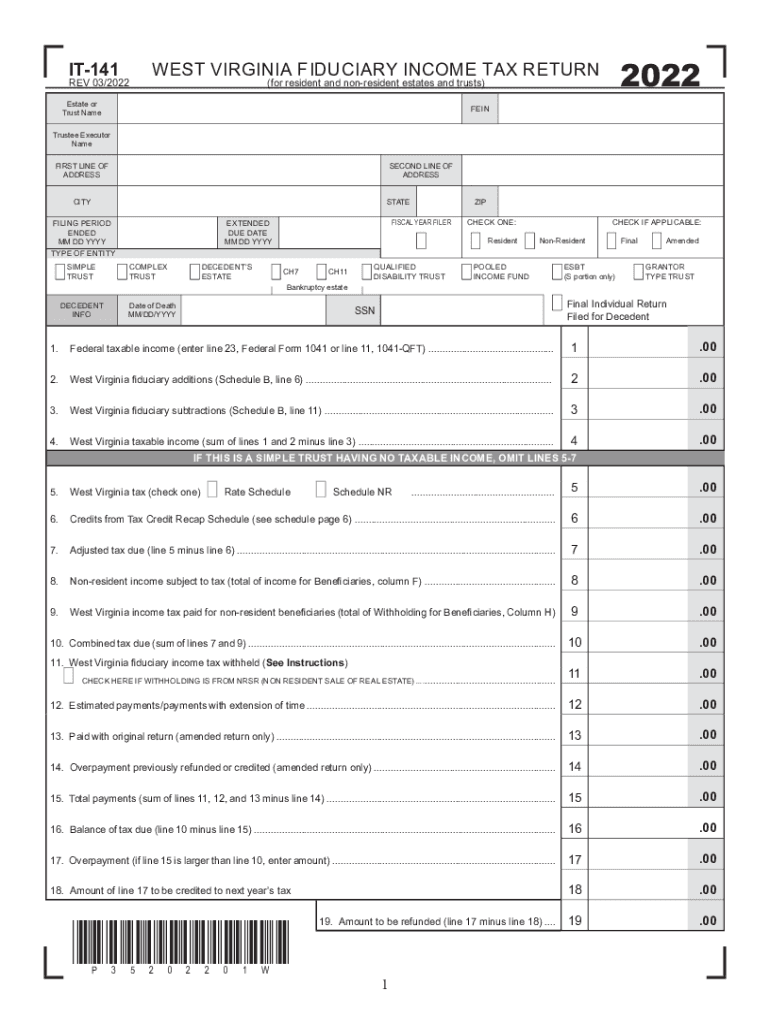

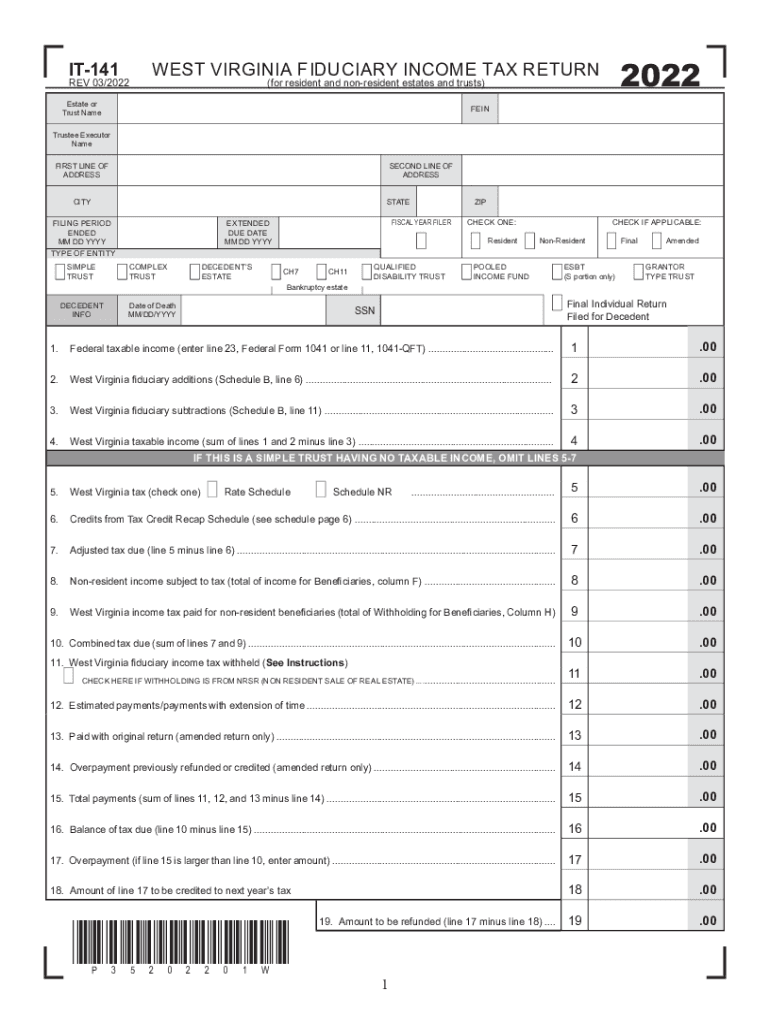

Fuel Tax Credit Calculator June 2023 Fuel tax credit rates You need to use the rate that applies on the date you acquired the fuel Use the fuel tax credit calculator to easily work out the amount to

Use the fuel tax credit calculator to easily work out the amount to report on your business activity statement BAS Note 1 From 1 November 2019 this rate The fuel tax credit is a calculation of No of eligible litres x cents per litre rate The cents per litre rate is generally the rate applicable on the date of purchase however there are a number of

Fuel Tax Credit Calculator June 2023

Fuel Tax Credit Calculator June 2023

https://www.sentrika.com.au/media/website_pages/blog/fuel-tax-credit-changes/AdobeStock_294574354_2370x1580a.jpeg

Accountancy Group Fuel Tax Credit Changes Accountancy Group

https://www.accountancygroup.com.au/wp-content/uploads/fuel-tax.jpg

Fuel Tax Credit Latest Rates Salisbury Accountants

https://www.salisburys.net.au/wp-content/uploads/2022/02/Blog-Banners-15-1030x515.jpg

ATO Fuel Tax Credit Calculator This tool from Banlaw will perform a fuel tax credit calculation for you based on the current fuel tax credit rates from the ATO If your business uses fuel you may be able to claim credits for the fuel tax included in the price of the fuel Find out if you re eligible for fuel tax credits and how to

Get a tax credit of up to 7 500 for new vehicles purchased before 2023 The amount varies based on battery capacity and manufacturer phase out The Inflation Reduction Act of 2022 retroactively extended several fuel tax credits

Download Fuel Tax Credit Calculator June 2023

More picture related to Fuel Tax Credit Calculator June 2023

Fuel Tax Credit Calculator Banlaw

https://www.banlaw.com/wp-content/uploads/2022/04/[email protected]

Fuel Tax Credit Changes

https://static.wixstatic.com/media/f17a4e_650e20db39394a77bb5b5d7d33a6b151~mv2.jpeg/v1/fill/w_1000,h_667,al_c,q_85,usm_0.66_1.00_0.01/f17a4e_650e20db39394a77bb5b5d7d33a6b151~mv2.jpeg

Fuel Tax Credit Changes HTA

https://www.hta.com.au/wp-content/uploads/2022/05/Fuel-tax-credit-changes-1.png

All electric plug in hybrid and fuel cell electric vehicles purchased new in 2023 or after may be eligible for a federal income tax credit of up to 7 500 If your business is registered for fuel tax credits you can use the fuel tax credit calculator to check the fuel tax credits for the fuel acquired for use in your

To claim your fuel tax credits accurately use the rate applicable on the date you acquired the fuel For convenience utilize the ATO s fuel tax credit calculator You can use the fuel tax credits calculation worksheet to help you calculate your fuel tax credits and claim them on your business activity statement BAS You

Income Tax Virginia 2022 2024 Form Fill Out And Sign Printable PDF

https://www.signnow.com/preview/626/980/626980480/large.png

Fuel Tax Credit Changes Active Accounting Group

https://www.activeaccountinggroup.com.au/assets/Uploads/_resampled/ScaleWidthWzEyMDBd/ScaleHeightWzYzMF0/Blog-11.jpg

https://www.ato.gov.au/businesses-and...

Fuel tax credit rates You need to use the rate that applies on the date you acquired the fuel Use the fuel tax credit calculator to easily work out the amount to

https://www.ato.gov.au/businesses-and...

Use the fuel tax credit calculator to easily work out the amount to report on your business activity statement BAS Note 1 From 1 November 2019 this rate

Changes To Fuel Tax Credit Rates Kinsella

Income Tax Virginia 2022 2024 Form Fill Out And Sign Printable PDF

Fuel Tax Credit Calculator CairenAbsalat

Fuel Tax Credit Rate Changes

Termination Distributions JULY Services

Fuel Tax Credit Changes The Garis Group

Fuel Tax Credit Changes The Garis Group

Fuel Tax Credit Calculator AccountKit Support Center

Fuel Tax Credit Changes Acumon Accountants And Business Advisors

How To Claim Fuel Tax Credits And Reduce Your Business Expenses In 2023

Fuel Tax Credit Calculator June 2023 - Fuel Tax Credits Fuel tax credit rates changed on 1 February 2023 The new rates will apply until 30 June 2023 The rates for liquid fuels such as diesel or