Health Plan Income Tax Rebate The Premium Tax Credit is a refundable tax credit designed to help eligible individuals and families with low or moderate income afford health insurance purchased through the Health Insurance Marketplace also known as the Exchange The size of your Premium Tax Credit is based on a sliding scale

A tax credit you can use to lower your monthly insurance payment called your premium when you enroll in a plan through the Health Insurance Marketplace Your tax credit is based on the income estimate and household information you If you claim your rebate as a tax offset in your income tax return we will apply the adjusted rebate percentages to determine your correct private health insurance tax offset You don t need to contact your health

Health Plan Income Tax Rebate

Health Plan Income Tax Rebate

https://navi.com/blog/wp-content/uploads/2022/03/income-tax-rebate-1.jpg

Income Tax Rebate U s 87A For The Financial Year 2022 23

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhjaMWWuh9Yw1oHqfkfrIaYbLGaB376RebKDTPXR4-jMTYYQRhPBXomiwY9EVzEmXIgQ2oXuDWoror_llXVa0a4CVcBPyG3JecnKbrFpU1YAcL3BqdldNxiSh81eUspfAXJiNGbHbVcluzwXjoIUmqkZimUhTYHrQKq1Zu6xuaat2LRf6h-UCOGnP3s/w640-h596/87a.jpg

Rebate us 87A infographic Income Tax Rebate Under Section Flickr

https://live.staticflickr.com/7850/32304200437_b8b18b3f1c_b.jpg

Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return electronically for free through the IRS Free File Program If the PTC exceeds the advance payments you can claim the excess as a refundable credit on the 1040 If the PTC is less than the advances most people will need to repay all or part of the

You can get the health care tax credits in two ways Advance premium tax credit APTC You pay less for health insurance each month based on your estimated tax credit Federal tax refund You get your health insurance subsidy in a Find health care tax forms and information on the individual shared responsibility provision exemptions payments and the premium tax credit

Download Health Plan Income Tax Rebate

More picture related to Health Plan Income Tax Rebate

ICICIdirect On Twitter Income Tax Rebate Revised Interest Rates New

https://pbs.twimg.com/media/DykgM5RXQAAmbeJ.jpg:large

Rebate And Releif Of Tax Rebate 87a Of Income Tax Rebate And Relief

https://i.ytimg.com/vi/IrYTqu6Hohg/maxresdefault.jpg

One time Direct Payments From 50 To 700 Still Going Out How You Can

https://www.the-sun.com/wp-content/uploads/sites/6/2022/12/lb-xmas-cash-OP.jpg?strip=all&quality=100&w=1920&h=1080&crop=1

The Premium Tax Credit PTC makes health insurance more affordable by helping eligible individuals and their families pay premiums for coverage purchased through the Health Insurance Marketplace also referred to as the Marketplace or Exchange There are two ways to get the credit How to save on your monthly insurance bill with a premium tax credit When you apply for Marketplace coverage you ll find out if you qualify for the premium tax credit that lowers your premium the amount you pay each month for your insurance plan

Under Section 80D a resident individual can claim a tax deduction of up to 25 000 in a year for medical insurance premiums paid for self spouse and children and an additional 25 000 for What is Section 80D Every individual or HUF can claim a deduction for medical insurance premiums paid in the financial year under Section 80D This deduction is also available for top up health plans and critical illness plans The best part is that it is over and above the Rs 1 5 lakh limit deductions claimed under Section 80C

SEE This Is How Much You ll Be Paying In Taxes From 1 March 2022

https://turntable.kagiso.io/images/IMG-1427_1.original.jpg

ICICIdirect On Twitter Income Tax Rebate Revised Interest Rates New

https://pbs.twimg.com/media/DykgM5IXcAYqDoq.jpg:large

https://www.irs.gov/affordable-care-act/...

The Premium Tax Credit is a refundable tax credit designed to help eligible individuals and families with low or moderate income afford health insurance purchased through the Health Insurance Marketplace also known as the Exchange The size of your Premium Tax Credit is based on a sliding scale

https://www.healthcare.gov/taxes

A tax credit you can use to lower your monthly insurance payment called your premium when you enroll in a plan through the Health Insurance Marketplace Your tax credit is based on the income estimate and household information you

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template

SEE This Is How Much You ll Be Paying In Taxes From 1 March 2022

Everything You Should Claim As Income Tax Relief Malaysia 2022 Ya 2021

Window To Enjoy Tax Reliefs Closing CN Advisory

Income Tax Rebate Statement Template Free Word Excel Templates

5 3

5 3

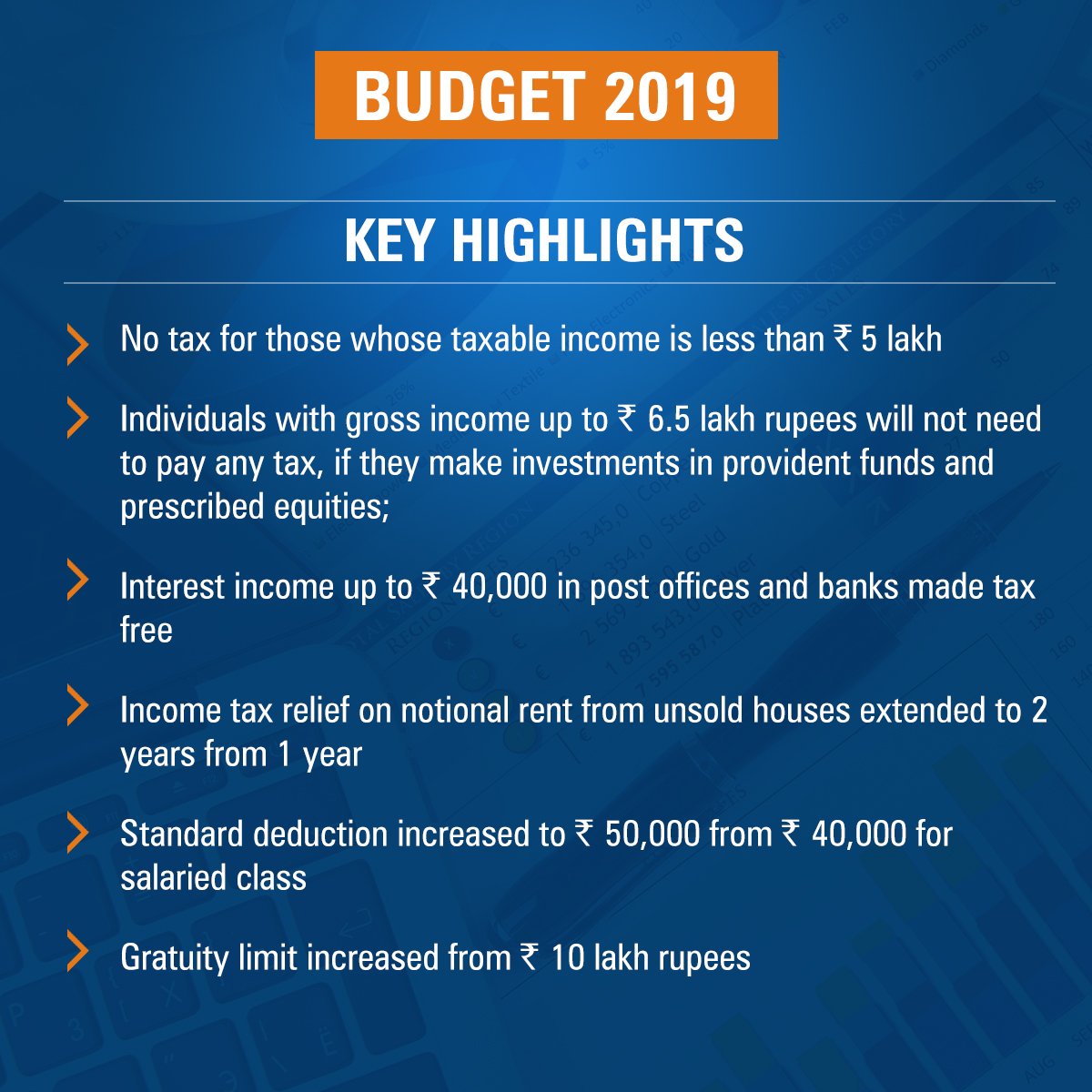

Budget 2023 No Income Tax Up To 7 Lakh Revised Tax Slabs For New

Income Tax Rebate Under Section 87A Eligibility To Claim Rebate

Union Budget 2023 Income Tax Rebate 10 Biggest Statements By Finance

Health Plan Income Tax Rebate - A tax credit you can use to lower your monthly insurance payment called your premium when you enroll in a plan through the Health Insurance Marketplace Your tax credit is based on the income estimate and household information you