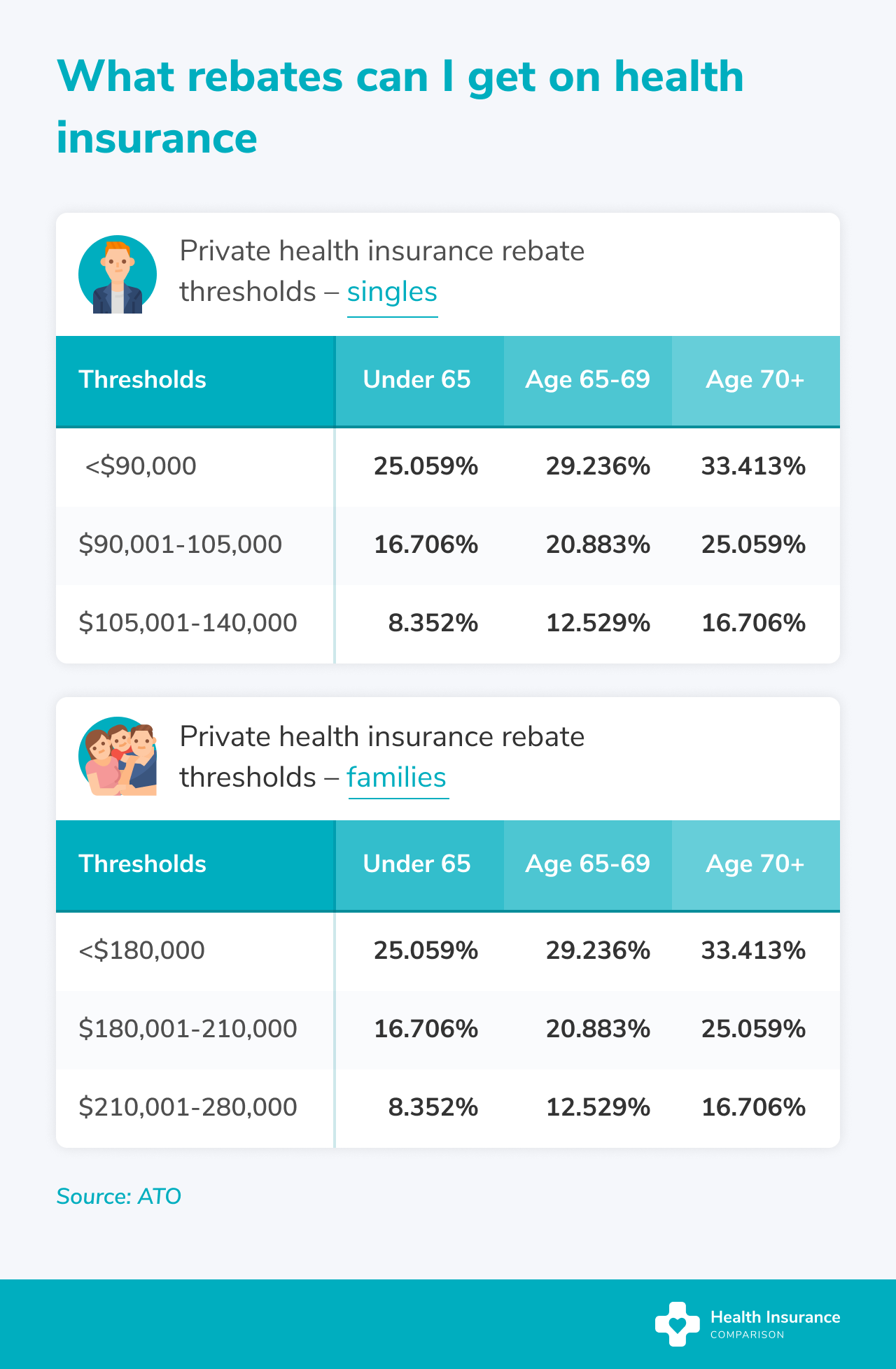

Health Insurance Income Tax Rebate Web How to claim the private health insurance rebate how to claim for your spouse and if you have prepaid your premium Find out the private health insurance rebate income

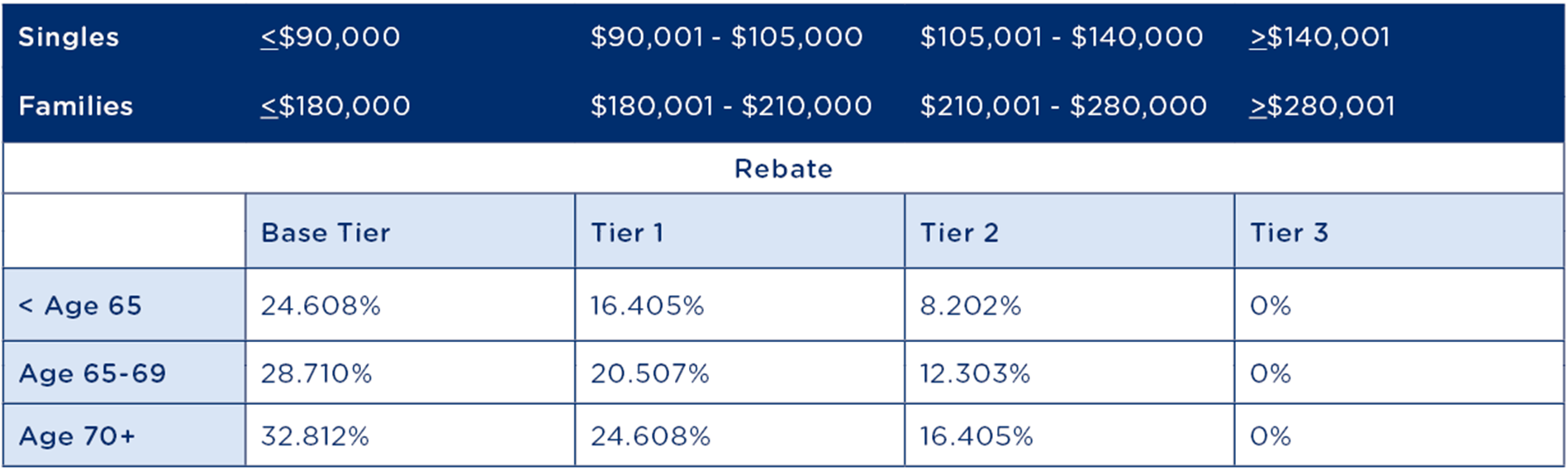

Web When you apply for coverage in the Health Insurance Marketplace 174 you estimate your expected income for the year If you qualify for a premium tax credit based on your Web 30 juin 2023 nbsp 0183 32 receive 16 405 of premium reduction from his health insurer for premiums paid in the respective months claim the rebate as a refundable tax offset in his tax return

Health Insurance Income Tax Rebate

Health Insurance Income Tax Rebate

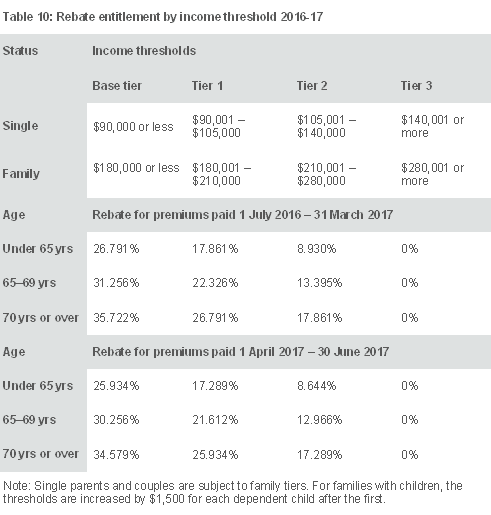

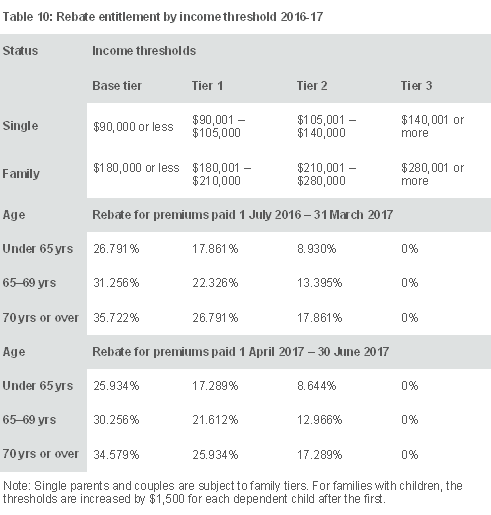

https://www.blgba.com.au/hs-fs/hubfs/Imported_Blog_Media/Table-10.png?width=609&height=639&name=Table-10.png

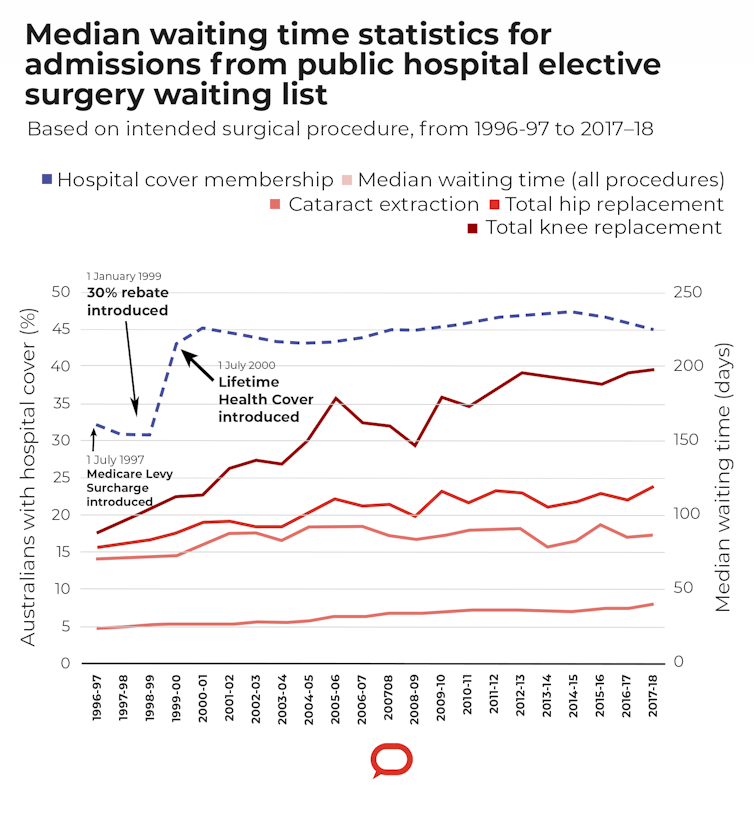

What Should Happen To The Private Health Insurance Rebate This Election

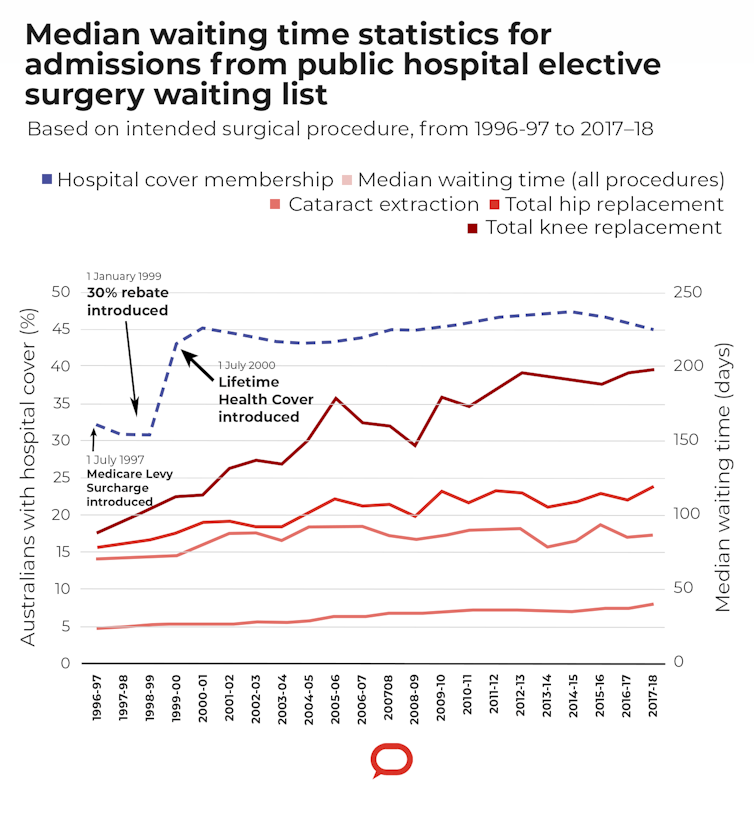

https://images.theconversation.com/files/458508/original/file-20220419-24-8c9jju.png?ixlib=rb-1.1.0&q=45&auto=format&w=754&fit=clip

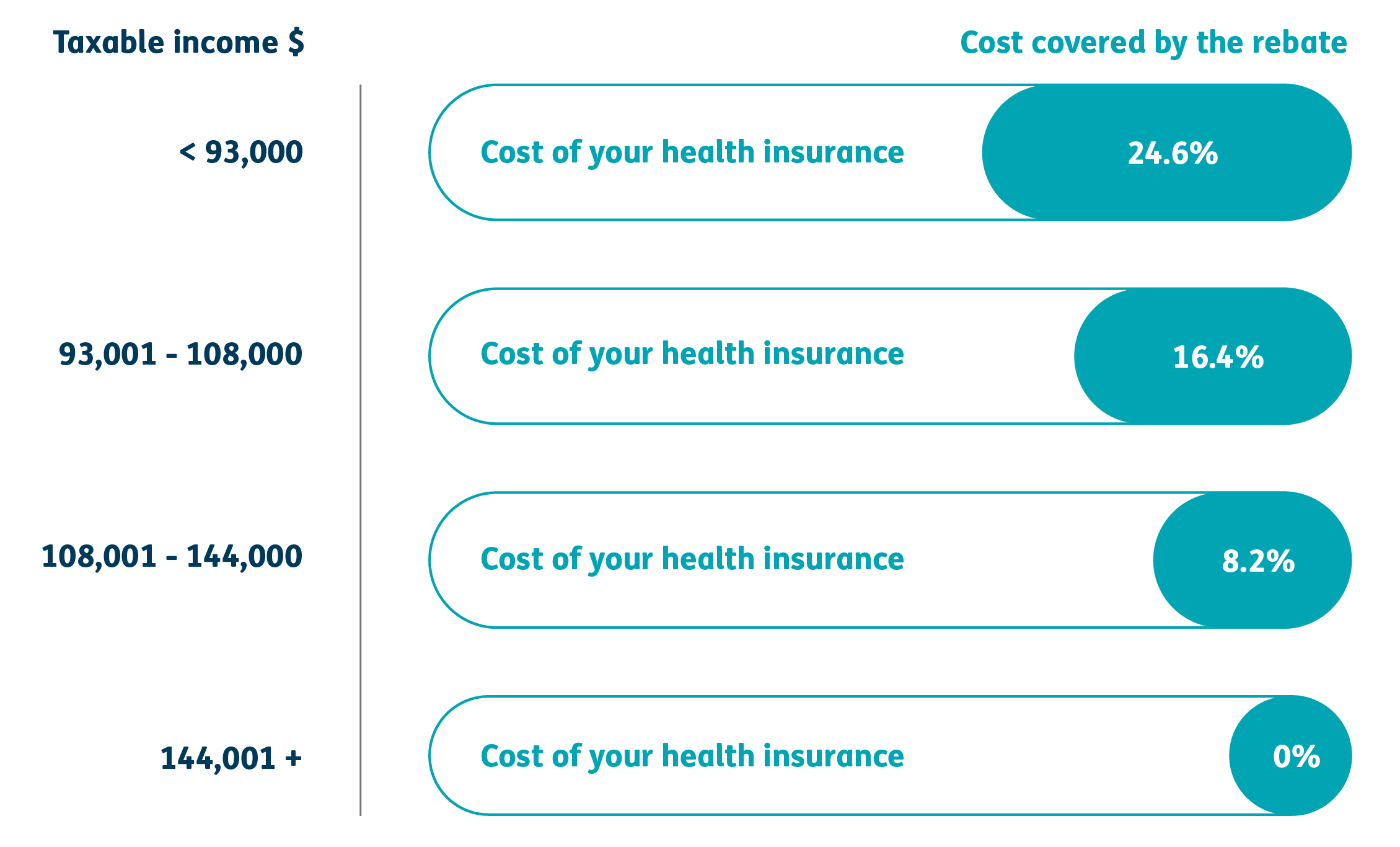

New To Private Health Insurance HBF Health Insurance

https://www.hbf.com.au/-/media/images/hbf/health-insurance/extras/singles-under-65.png?la=en&hash=46D4FB6E7BDC69C8763810EDA3F938B622C37A8C

Web To be eligible for the private health insurance rebate your income for surcharge purposes must be less than the Tier 3 income threshold Tier 3 is the highest income threshold for Web 19 avr 2022 nbsp 0183 32 The private health insurance rebate costs Australian taxpayers nearly A 7 billion per year and has cost over 100 billion since its introduction

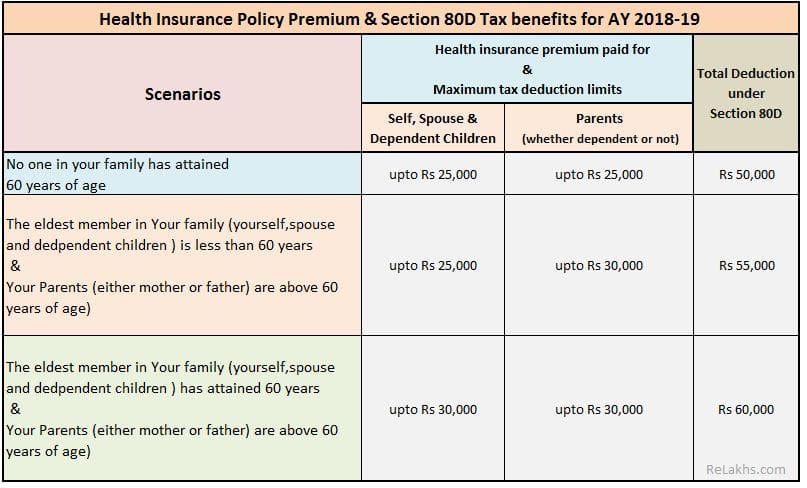

Web 12 ao 251 t 2022 nbsp 0183 32 Depending on how you get your health care coverage you may soon get a rebate from your insurer An estimated 8 2 million policyholders are expected to receive Web Section 80D of the Income Tax Act 1961 offers tax deductions of up to Rs 25 000 on health insurance premiums paid in a financial year The tax deduction limit increases to

Download Health Insurance Income Tax Rebate

More picture related to Health Insurance Income Tax Rebate

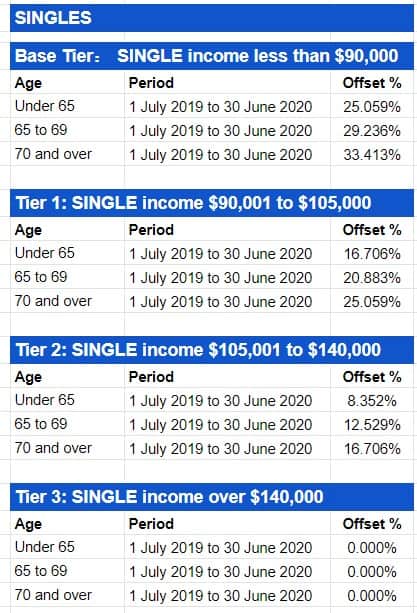

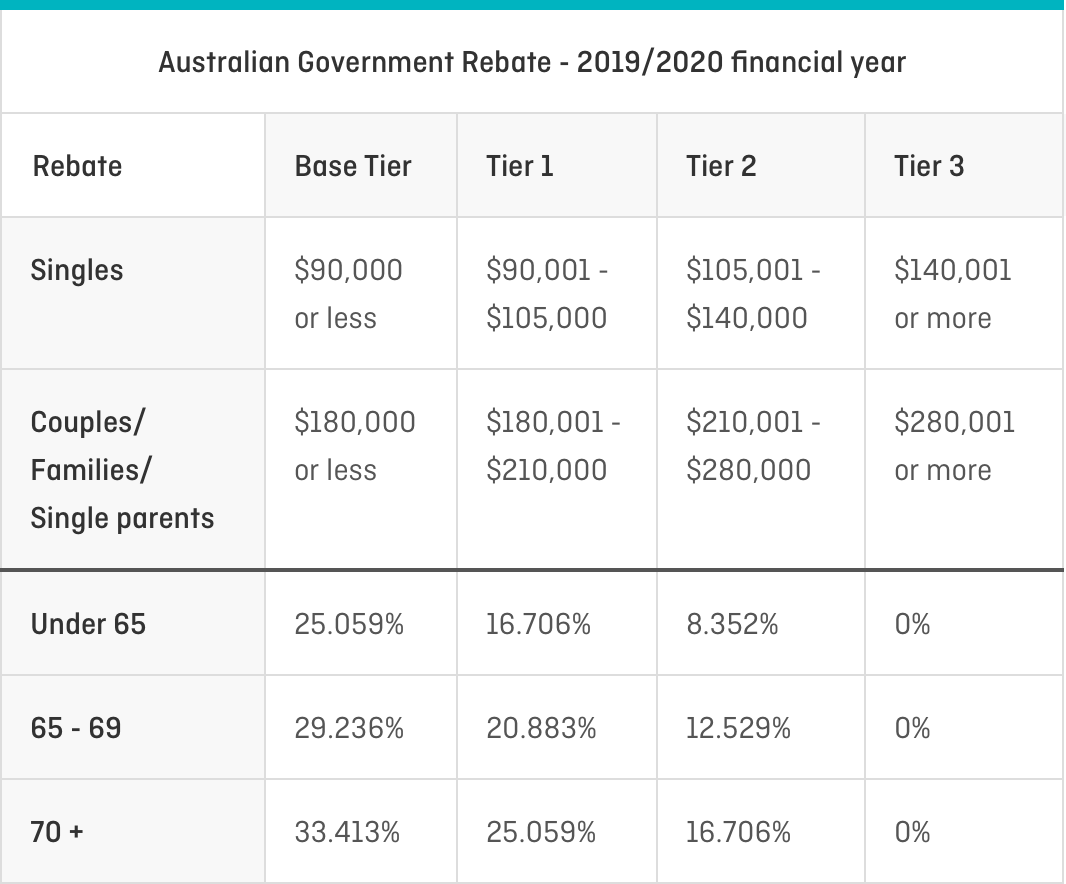

Private Health Insurance Tax Offset Atotaxrates info

http://atotaxrates.info/wp-content/uploads/2020/05/Private-Health-Insurance-Rebate-Percentages-SINGLES-2019-20.jpg

Private Health Insurance Rebate Navy Health

https://navyhealth.com.au/wp-content/uploads/2019/12/NAV20358-MLS-Rebate-Table-April-2020-Rates_DE1.4-1.jpg

Private Health Insurance Quote Qantas Insurance

https://insurance.qantas.com/dist/static/table-agr-6a9b38.png

Web To encourage people to purchase health insurance policies the government introduced tax benefits under Section 80D What is Section 80D Every individual or HUF can Web 3 ao 251 t 2023 nbsp 0183 32 Home Health Insurance Income Tax Rebate August 3 2023by tamble If you are looking for Health Insurance Income Tax Rebate you ve come to the right place

Web Income Tax Rebate in Health Insurance Policies Section 80D of the Income Tax Act 1961 essentially offers a tax deduction on an individual s taxable income if they have Web 5 oct 2022 nbsp 0183 32 The Good Brigade Getty Images The premium tax credit is a refundable credit that helps lower the cost of your monthly health insurance premium You must meet the

Tax Benefit Of Buying Health Insurance In India For NRI Section 80D

https://1.bp.blogspot.com/-e7M8q_wmnrg/V24ELtVM3WI/AAAAAAAAGaI/tPaf_vkBm-gAVt0-4k8bDqVODrYOTlkawCLcB/s1600/Tax%2BBenefit%2Bof%2BBuying%2BHealth%2BInsurance%2Bin%2BIndia%2BNRI.png

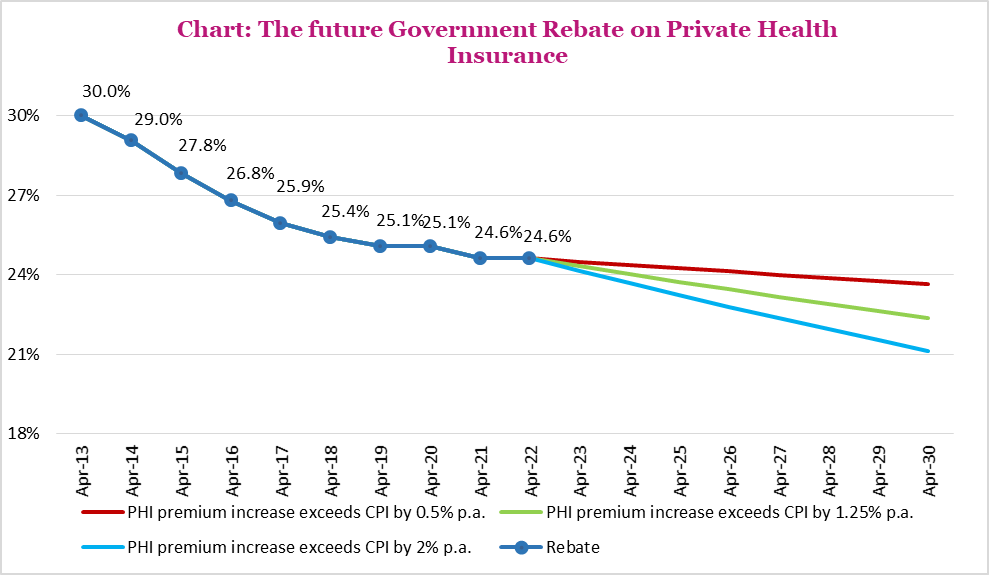

Not For Profits Call For Pledge To Restore 30 Per Cent Private Health

https://membershealth.com.au/wp-content/uploads/2022/05/Chart-The-future-Government-Rebate-on-Private-Health-Insurance.png

https://www.ato.gov.au/.../Private-health-insurance-rebate

Web How to claim the private health insurance rebate how to claim for your spouse and if you have prepaid your premium Find out the private health insurance rebate income

https://www.healthcare.gov/taxes

Web When you apply for coverage in the Health Insurance Marketplace 174 you estimate your expected income for the year If you qualify for a premium tax credit based on your

What Is The Annual Private Health Insurance Rate Rise

Tax Benefit Of Buying Health Insurance In India For NRI Section 80D

How Does Health Insurance For Single Parents Work

Latest Income Tax Exemptions FY 2017 18 AY 2018 19 Tax Deductions

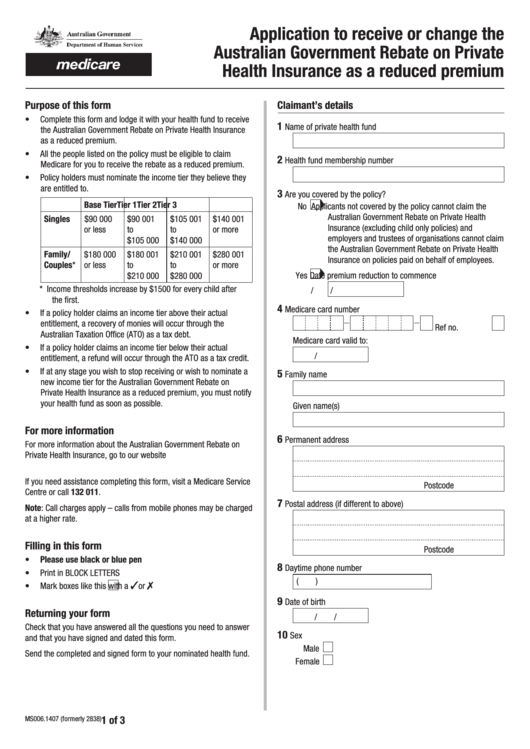

Fillable Application To Receive Or Change The Australian Government

I m Getting A Health Insurance Rebate Chris Schiffner s Corner Of

I m Getting A Health Insurance Rebate Chris Schiffner s Corner Of

Private Health Insurance Rebate Navy Health

What Is Australian Government Rebate On Private Health Insurance

Why Is Medicare

Health Insurance Income Tax Rebate - Web 19 avr 2022 nbsp 0183 32 The private health insurance rebate costs Australian taxpayers nearly A 7 billion per year and has cost over 100 billion since its introduction