Hmrc Company Tax Return Phone Number Contact details webchat and helplines for enquiries with HMRC on tax Self Assessment Child Benefit or tax credits including Welsh language services

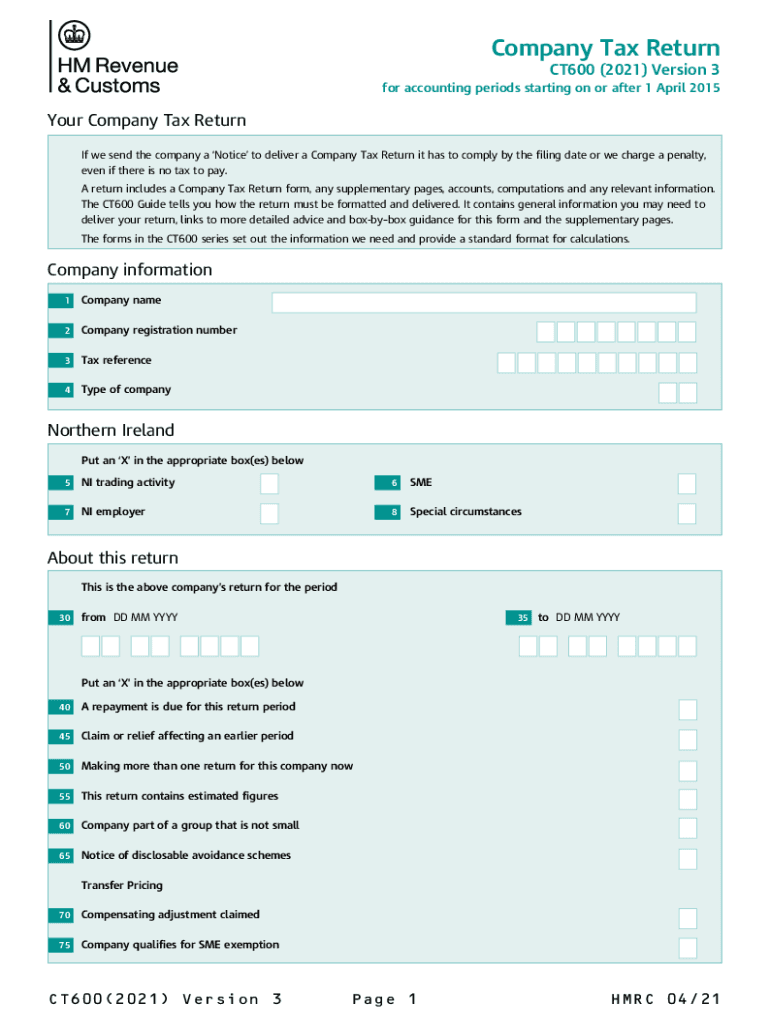

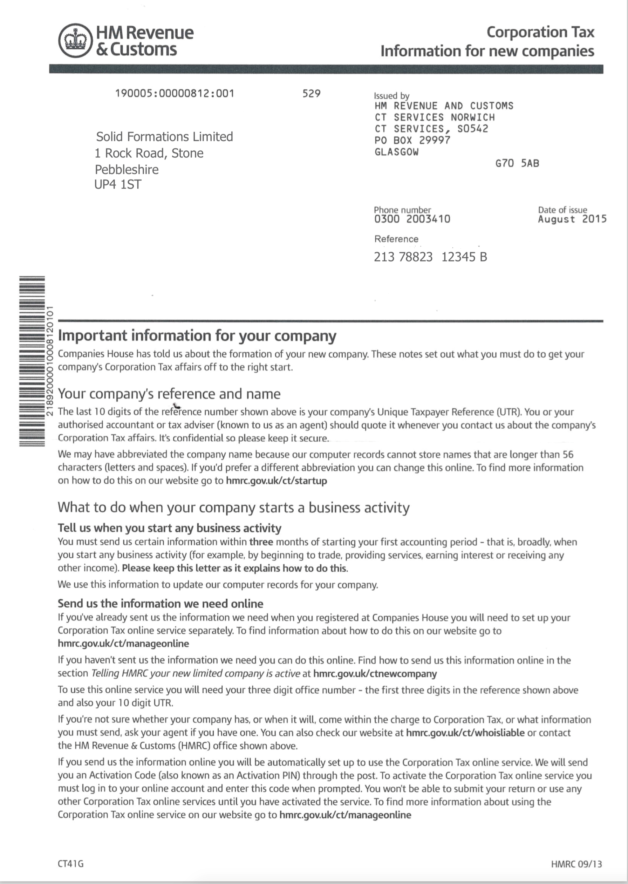

Use this service to file your company or association s Company Tax Return CT600 for Corporation Tax with HM Revenue and Customs HMRC accounts with Companies About this guide This guide will help you prepare your Company Tax Return It tells you how to complete the Company Tax Return form CT600 and what other information you

Hmrc Company Tax Return Phone Number

Hmrc Company Tax Return Phone Number

https://customerservicecontactnumber.uk/wp-content/uploads/2016/08/HMRC.jpg

Hmrc Customs Contact Number

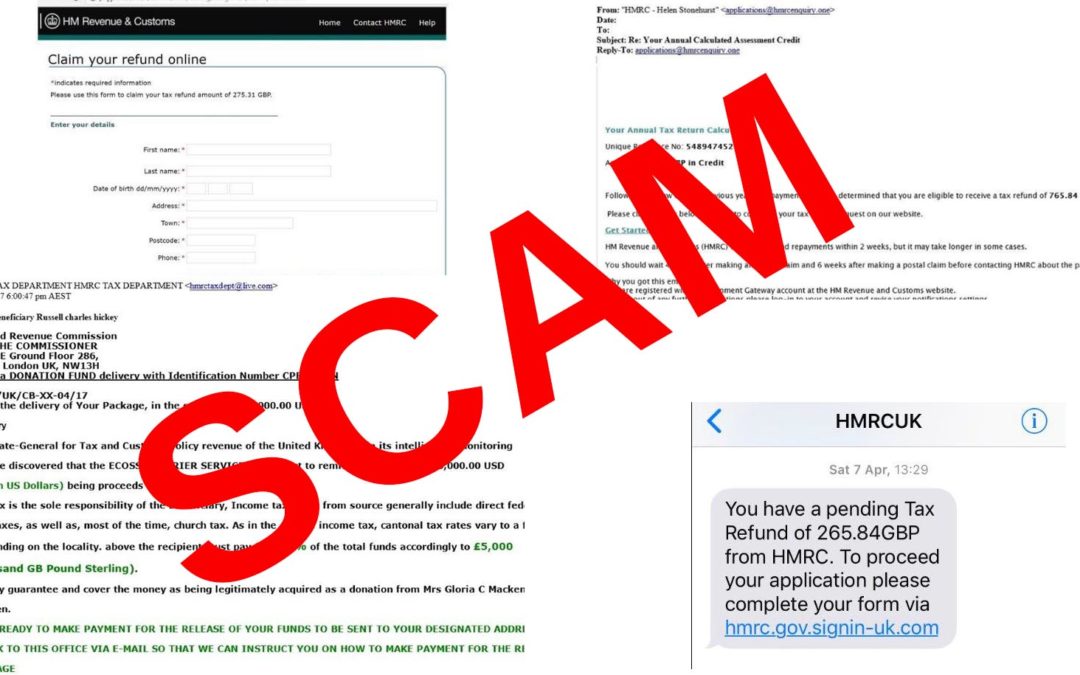

https://gmpdrivercare.com/wp-content/uploads/2018/12/hmrc-scam-1080x675.jpg

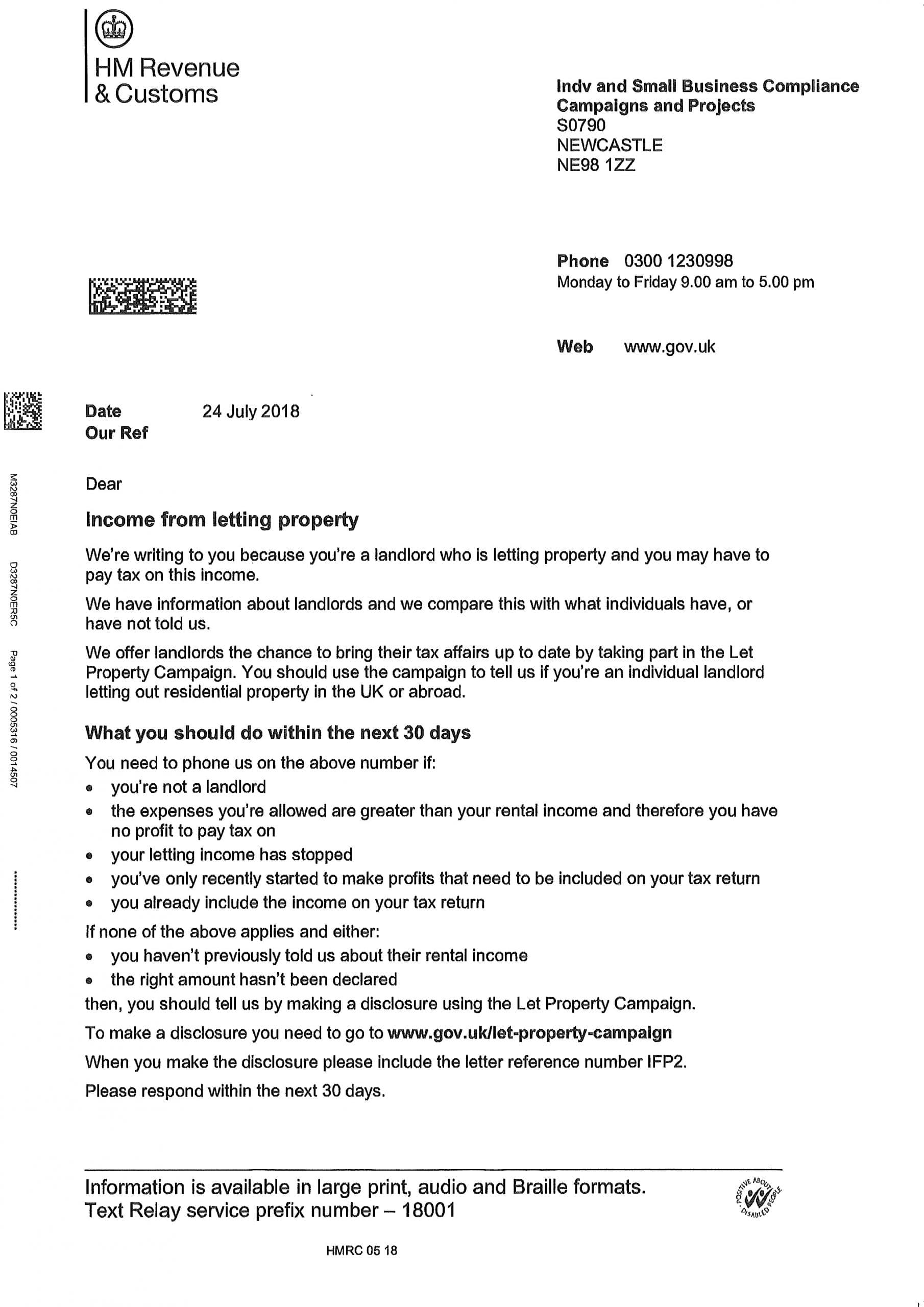

Reporting Letting Income Letter From HMRC MCL

https://b6m6e4y6.rocketcdn.me/wp-content/uploads/2021/02/Letter-from-Hmrc-for-Income-from-letting-property-scaled.jpg

Guidance Contacting HM Revenue and Customs Offices by phone or in writing Updated 1 January 2014 Download CSV 473 KB This CSV cannot be viewed online You can Employer helpline 0300 200 3200 Income Tax helpline 0300 200 3300 National Insurance helpline 0300 200 3500 HMRC online services helpdesk 0300 200

If you need more help please phone your HM Revenue and Customs HMRC office on the number shown on the front of the Non resident Company or Other Entity Tax Return or Posted Wed 21 Aug 2024 08 22 18 GMT by HMRC Admin 21 Response Hi katiepressick I suggest you contact CT Services H M Revenue Customs BX9 1AX or call the CT

Download Hmrc Company Tax Return Phone Number

More picture related to Hmrc Company Tax Return Phone Number

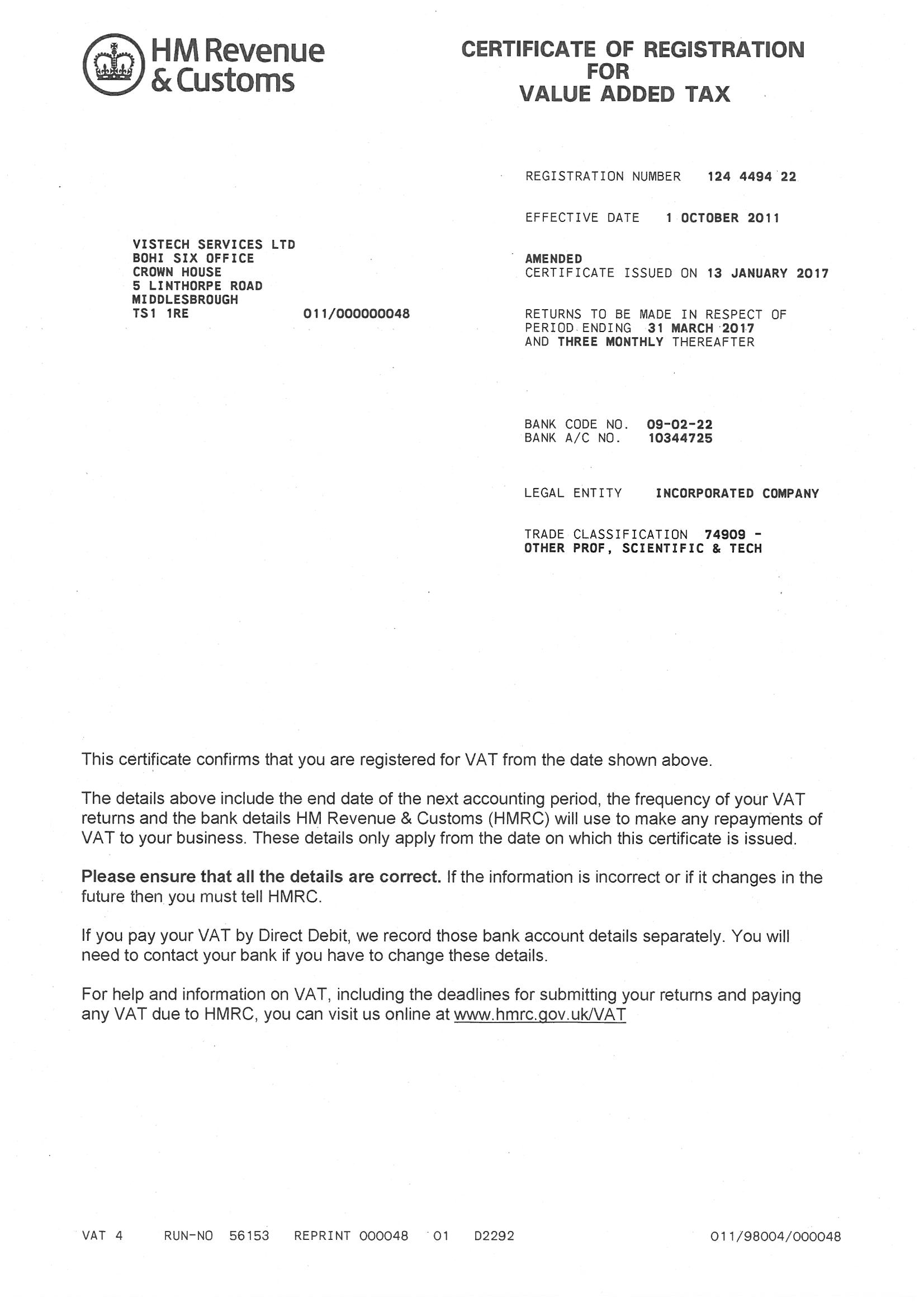

Registering For Vat

https://vistechservices.co.uk/wp-content/uploads/2021/03/2017-HMRC-VAT-Certificate-of-Registration.jpg

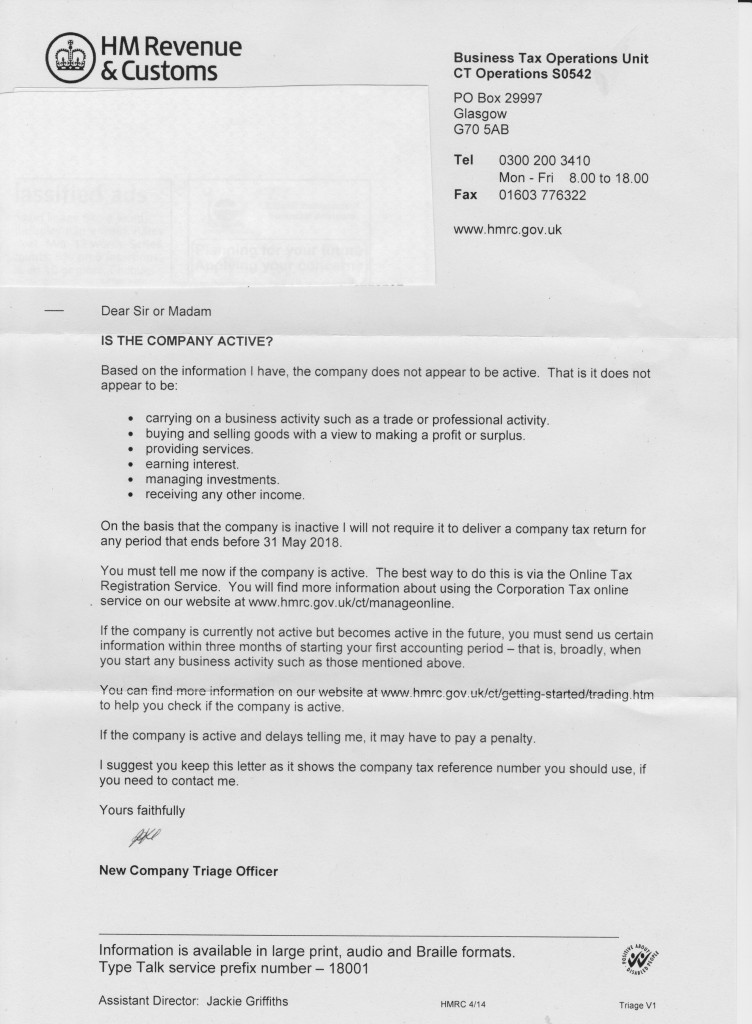

HMRC Really Do Not Want To Collect Corporation Tax

https://www.taxresearch.org.uk/Blog/wp-content/uploads/2014/05/HMRCCT-752x1024.jpeg

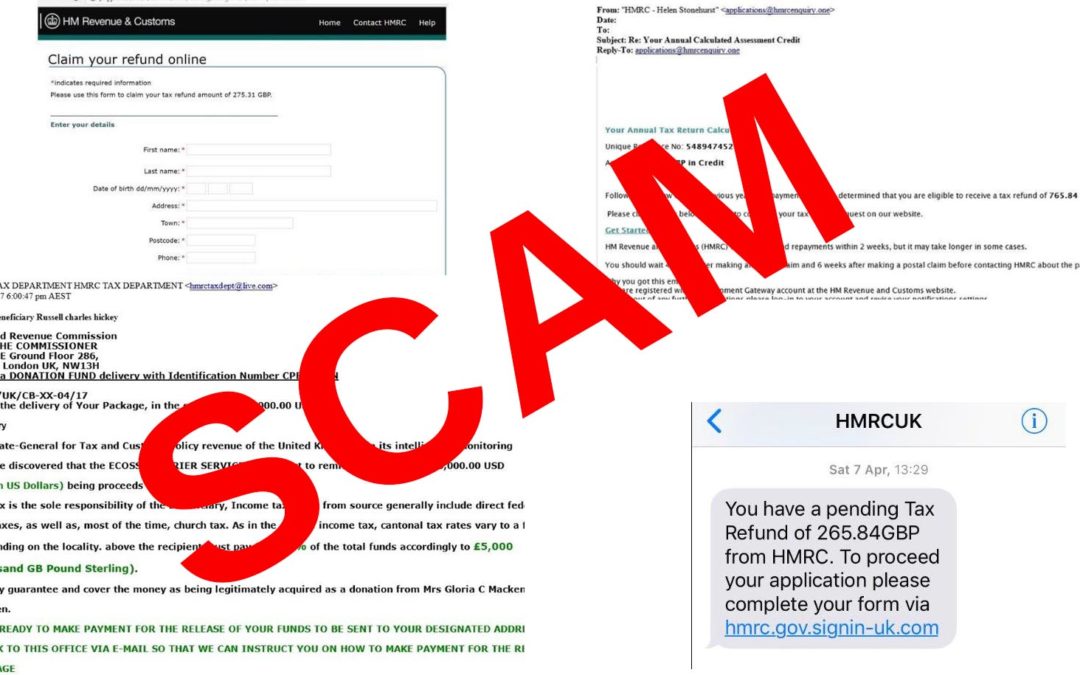

HMRC Security Notice Requests HMRC Fraud Investigation Service

https://businessadviceservices.co.uk/wp-content/uploads/2017/12/requirement-to-give-security-for-PAYE-redact.jpg

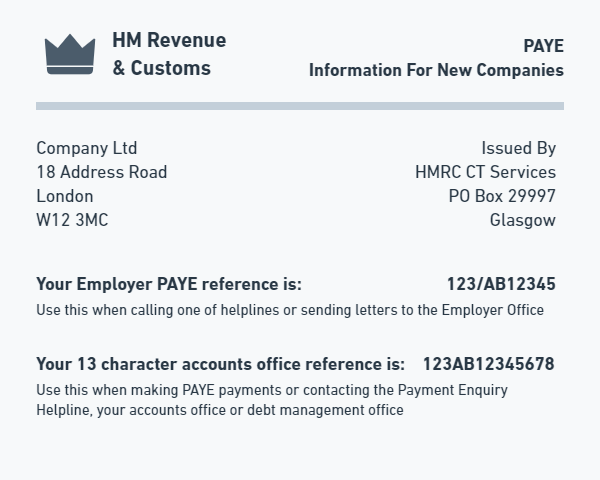

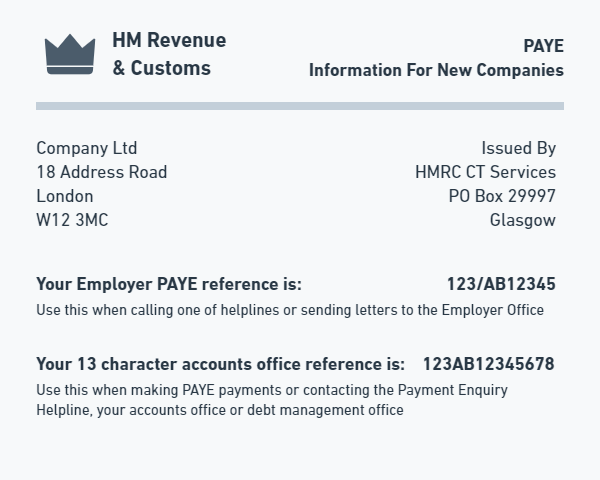

Contact HMRC for help with questions about PAYE and Income Tax including coding notices and Marriage Allowance and for advice on savings including ISAs and claiming HMRC Corporation Tax Helpline General Enquiries HMRC offers a specialised helpline for general inquiries regarding Corporation Tax When contacting them it is important to provide your 10 digit Unique Tax

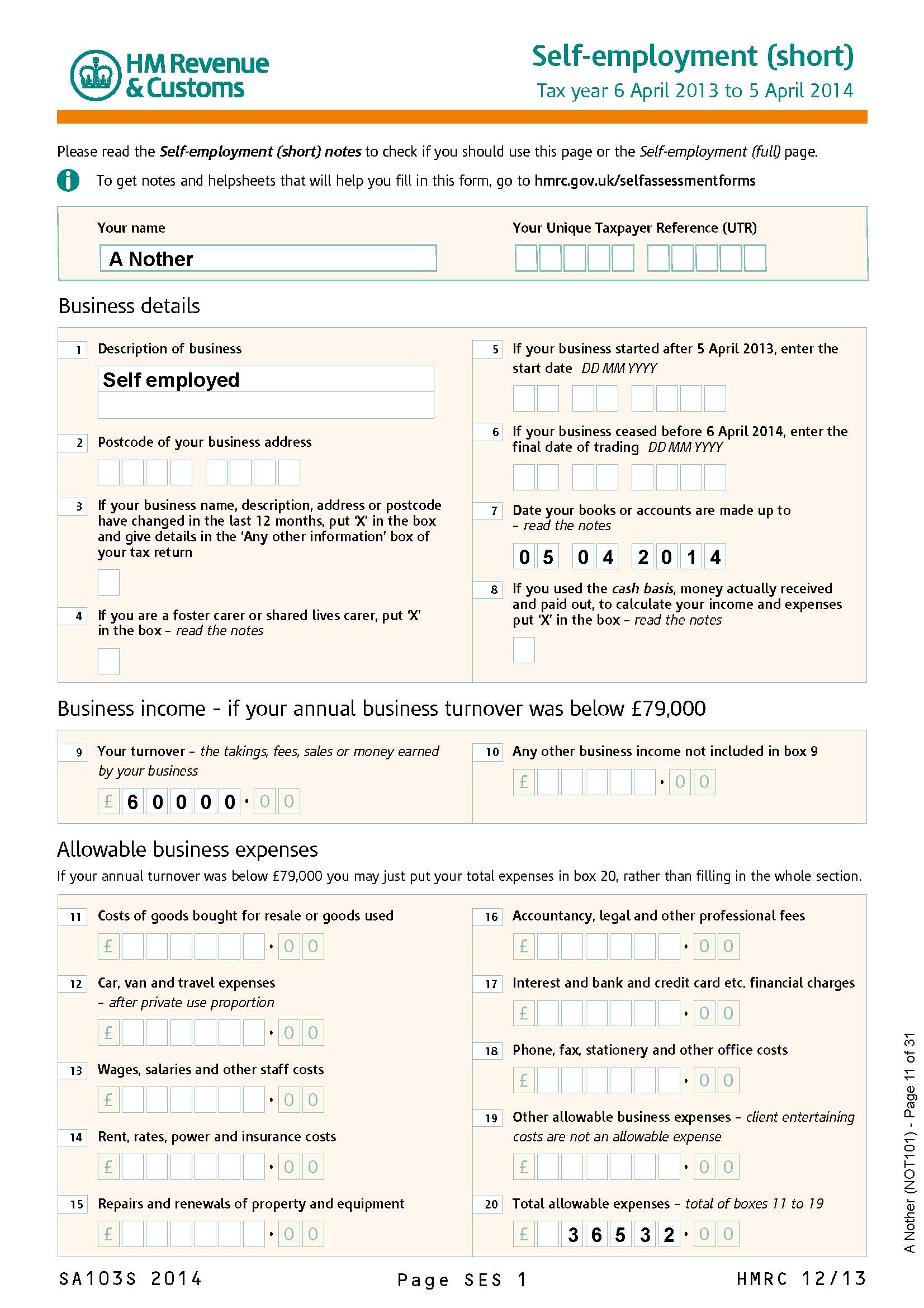

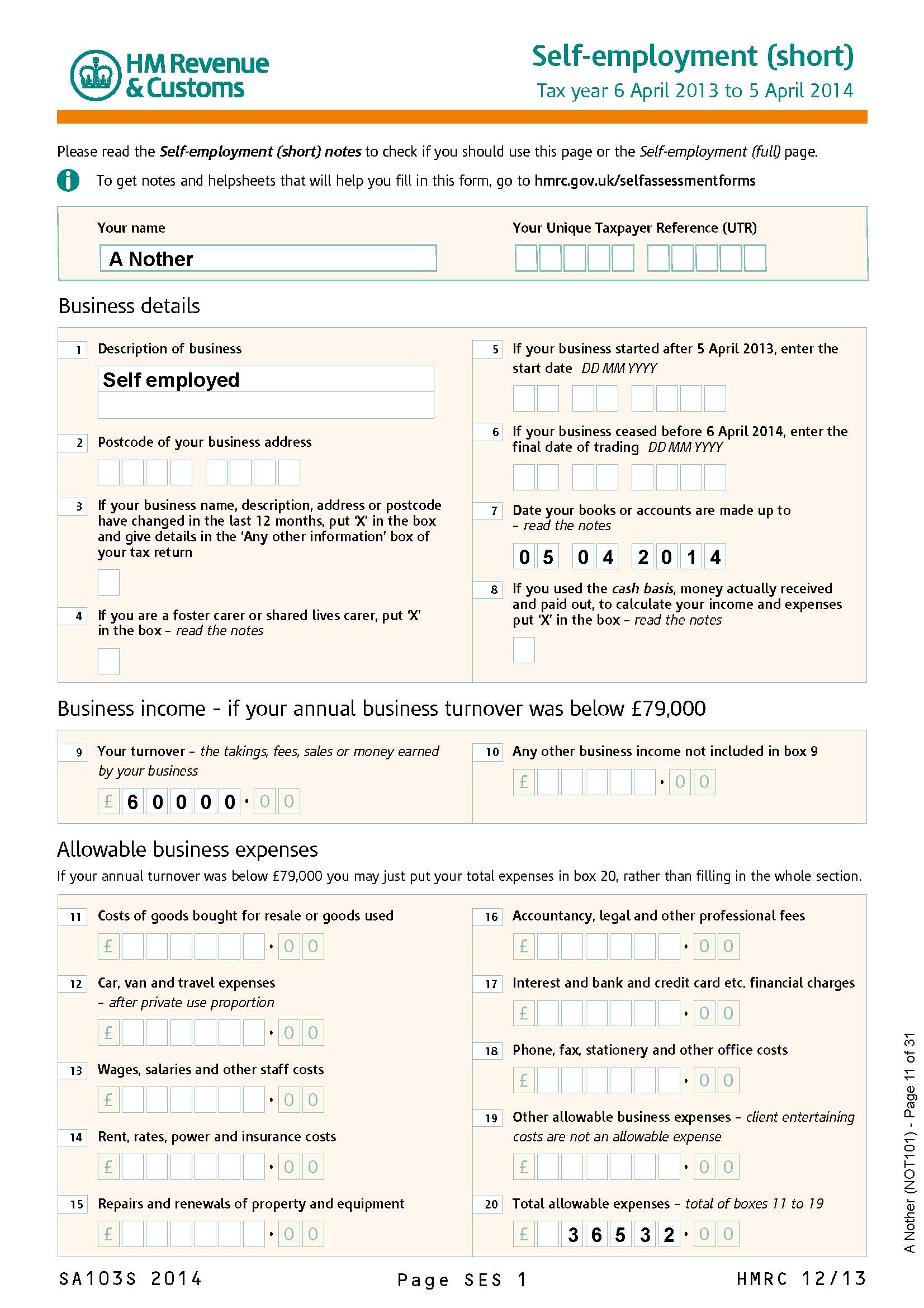

A company tax return also called CT600 form is filed by companies to report their spending corporation tax figures and profits to HMRC A company must file a CT600 form every year and the due date Monday to Saturday 8am to 8pm Closed on Sundays and bank holidays Phone To speak with an HMRC Self Assessment adviser call 0300 200 3310 44 161

Getting Started With HMRC For Limited Companies

https://www.numble.co.uk/content/images/2020/08/GOV-min-wage---HMRC---PAYE-Letter.png

Ct600 Example Complete With Ease AirSlate SignNow

https://www.signnow.com/preview/560/820/560820246/large.png

https://www.gov.uk › contact-hmrc

Contact details webchat and helplines for enquiries with HMRC on tax Self Assessment Child Benefit or tax credits including Welsh language services

https://www.gov.uk › file-your-company-accounts-and-tax-return

Use this service to file your company or association s Company Tax Return CT600 for Corporation Tax with HM Revenue and Customs HMRC accounts with Companies

HMRC Nudge Letter To Offshore Corporates Disposing UK Property

Getting Started With HMRC For Limited Companies

Hmrc Tax Return Letters With Logos And Cash Stock Photo Royalty Free

Hmrc Tax Return

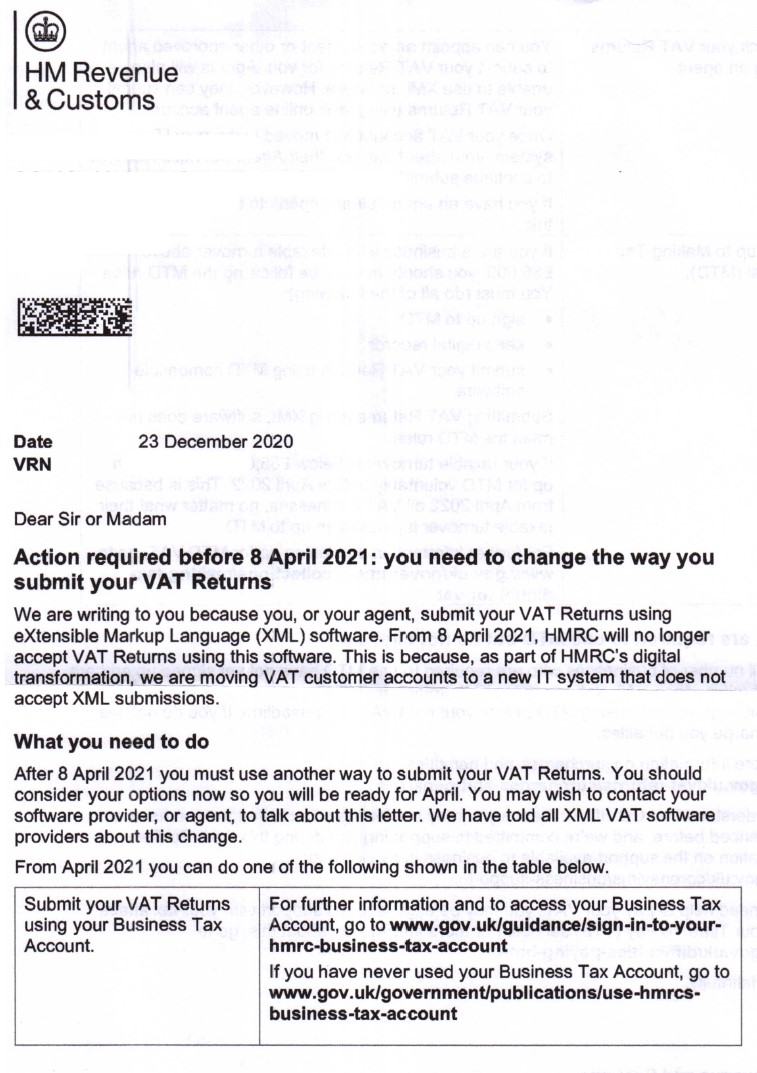

HMRC Letter Action Required Before 8 April 2021 Alterledger

Company Tax Return Hmrc Company Tax Return Guide

Company Tax Return Hmrc Company Tax Return Guide

HMRC Company Tax Returns Everything You Need To Know

Hmrc Ssp Form Printable Printable Forms Free Online

HMRC 2021 Paper Tax Return Form

Hmrc Company Tax Return Phone Number - Posted Wed 21 Aug 2024 08 22 18 GMT by HMRC Admin 21 Response Hi katiepressick I suggest you contact CT Services H M Revenue Customs BX9 1AX or call the CT