Home Loan Tax Benefit Under Section 80eea Discover Section 80EEA of the Income Tax Act which provides deductions for interest paid on a home loan Explore the eligibility criteria maximum deduction limits and conditions for claiming this tax

These deductions against the tax could be claimed under four sections of the income tax act namely Section 80C Section 24 Section 80EE and Section 80EEA In this article we will discuss at Yes tax benefits on a home loan taken for the renovation of a property can be claimed under Section 24 of the Income Tax Act 1961 up to a maximum limit of Rs

Home Loan Tax Benefit Under Section 80eea

Home Loan Tax Benefit Under Section 80eea

https://i.ytimg.com/vi/I1CVMfWWIAU/maxresdefault.jpg

AVAIL HOME LOAN TAX BENEFIT BEFORE APRIL 2022 CLAIM THE SECTION 80EEA

https://i.ytimg.com/vi/yeFFg33fjjo/maxresdefault.jpg

Impact Of SECTION 80EEA 80EEB 194N AND 194M Under Tax Audit AY 20

http://camukulgarg.com/blog/uploads/images/image_750x_5e88532fd655e.jpg

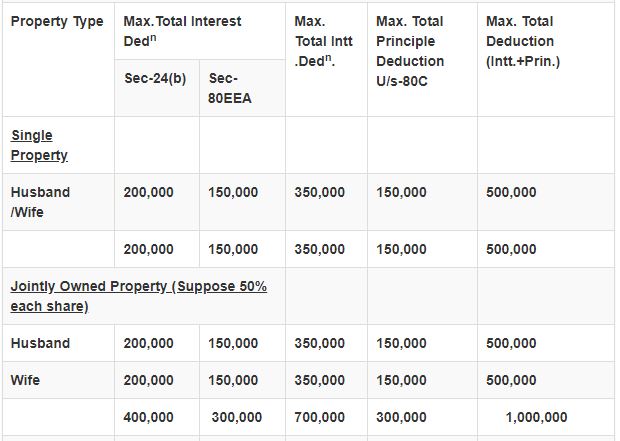

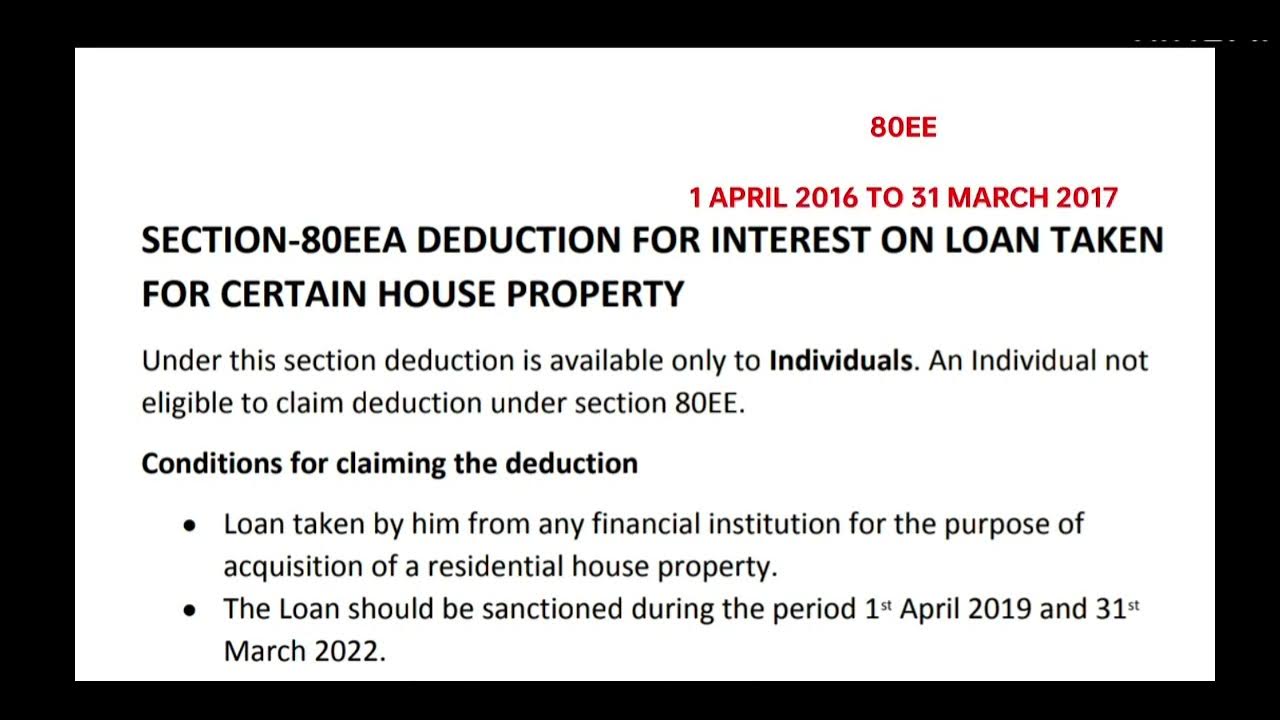

First time home buyers can claim deduction of up to Rs 50 000 under Section 80EE in a financial year against payment of home loan interest 80EE deductions can be claimed till the home loan is fully The section 80EEA of income tax act 1961 as amended for A Y 2023 24 hereinafter referred as 80EEA provides incentive to first time home buyers by giving income tax benefit Under this section

Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution As per this section you can claim a Section 80EEA provides extended tax deductions of up to Rs 1 50 000 for first time homebuyers in India An individual is permitted to claim this particular benefit over and

Download Home Loan Tax Benefit Under Section 80eea

More picture related to Home Loan Tax Benefit Under Section 80eea

Home Loan Tax Benefit Under Sec 80C Sec 24 Sec 80 EE Sec 80EEA Of

https://www.fisdom.com/wp-content/uploads/2021/08/103.png

Section 80EEA Deduction For Interest Paid On Home Loan For Affordable

https://finvestfox.com/wp-content/uploads/2021/07/Section-80EEA-1.jpg

Section 80EEA Claim Deduction For The Interest Paid On Housing Loan

https://life.futuregenerali.in/media/suwdjtal/tax-saving-on-interest-paid-on-house-loan.jpg

Under this taxpayers can avail income tax benefits of Interest on home loans taken for first time home buyer maximum of up to INR 50 000 The exemption can be availed until they repay their loan Section 80EEA of the Income Tax Act allows first time home buyers to claim a tax deduction of up to 1 5 Lakh for the interest payments made towards their home

Section 80EE lets first time house owners claim an additional Rs 50 000 on the payable interest of a Home Loan taken from any financial institution This Section allows you to One of such is Section 80EEA under which homebuyers can avail an additional tax deduction of up to Rs 1 5 lakh on their loan component when they are buying affordable

Home Loan Tax Benefit saving In 2019 20 In Hindi tax Benefit saving On

https://i.ytimg.com/vi/TqmeyW7QUDY/maxresdefault.jpg

Everything You Need To Know About Home Loan Tax Breaks

https://cdn.navimumbaihouses.com/blog/wp-content/uploads/2021/05/Everything-you-need-to-know-about-home-loan-tax-breaks.-2.jpg

https://tax2win.in/guide/section-80eea-…

Discover Section 80EEA of the Income Tax Act which provides deductions for interest paid on a home loan Explore the eligibility criteria maximum deduction limits and conditions for claiming this tax

https://housing.com/news/home-loans-…

These deductions against the tax could be claimed under four sections of the income tax act namely Section 80C Section 24 Section 80EE and Section 80EEA In this article we will discuss at

Difference Between Section 80ee And 80eea For Home Loan

Home Loan Tax Benefit saving In 2019 20 In Hindi tax Benefit saving On

Section 80EEA Additional Deduction Of Interest Payment On Housing Loan

Home Construction Loan How To Claim Tax Benefits Loan Trivia

How Housing Loan Tax Benefit

Home Loan Tax Benefits As Per Union Budget 2020

Home Loan Tax Benefits As Per Union Budget 2020

Deduction Under Chapter 6A Of Income Tax Act Loan Deduction Under

Tax Benefits Of Home Loan Section 24 Section 80C Section 80EEA

SECTION 80EEA ADDITIONAL BENEFIT ON HOME LOAN RBGCONSULTANTS

Home Loan Tax Benefit Under Section 80eea - Section 80EEA provides extended tax deductions of up to Rs 1 50 000 for first time homebuyers in India An individual is permitted to claim this particular benefit over and