Home Loan Tax Benefit Under Section These deductions against the tax could be claimed under four sections of the income tax act namely Section 80C Section 24 Section 80EE and Section 80EEA In this article we will discuss at

Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution As per this A top up home loan is eligible for tax benefits under Section 80C if used for the purchase or construction of a residential property and Section 24 b if used for the

Home Loan Tax Benefit Under Section

Home Loan Tax Benefit Under Section

https://static.tnn.in/photo/msid-92839544,imgsize-176236,updatedat-1657675255072,width-200,height-200,resizemode-75/92839544.jpg

Home Loan Tax Benefit In Tamil

https://i.ytimg.com/vi/3Ofa_Xcb0Qk/maxresdefault.jpg

Tax Benefits On Housing Loan Thdailymagazine

https://thdailymagazine.com/wp-content/uploads/2021/11/Tax-Benefits-on-Housing-Loan.jpg

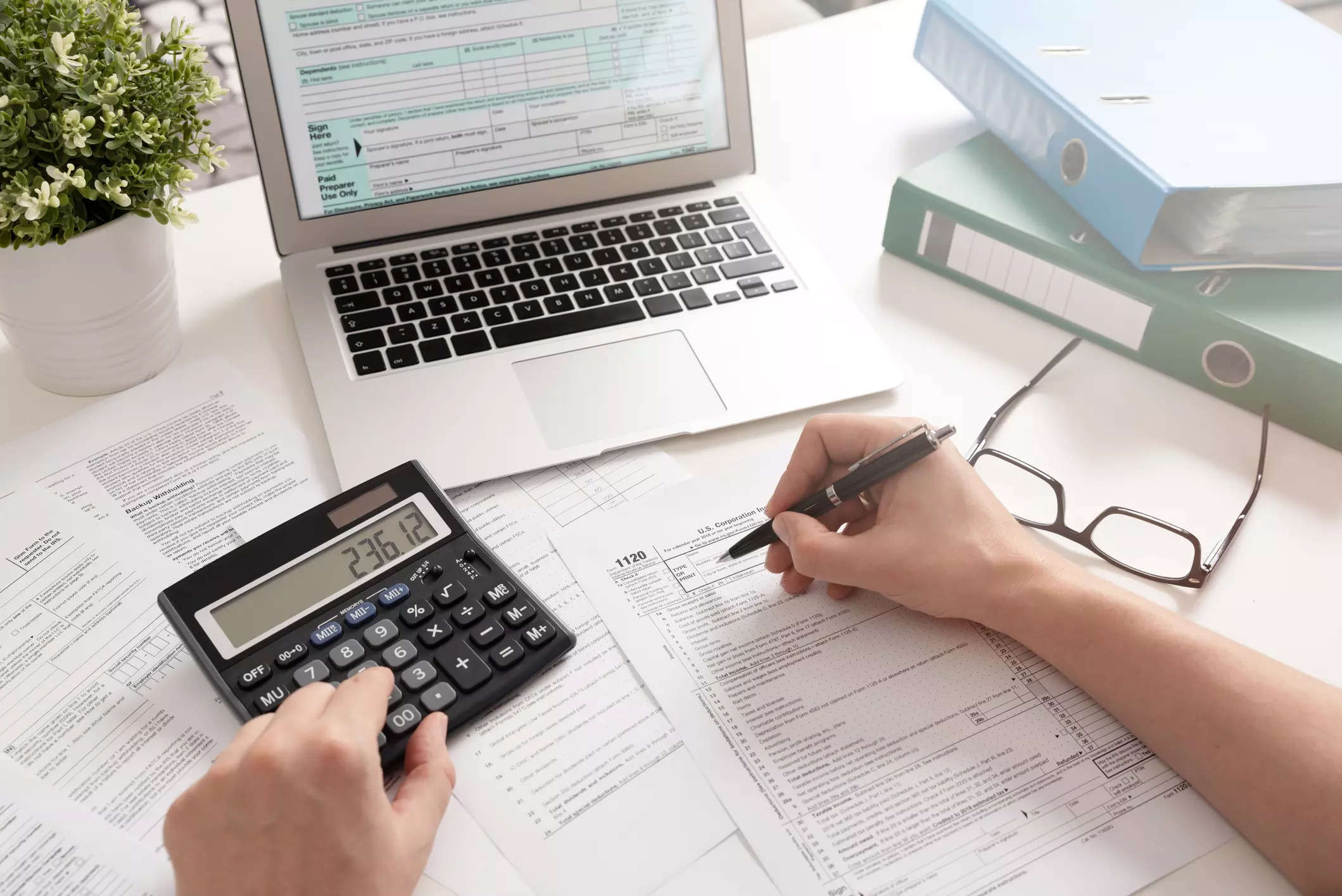

What is the maximum tax benefit on home loan The maximum tax deduction for a housing loan as per different sections in Income Tax Acts is listed below Up to Rs 2 lakh under Section 24 b for self occupied Under Section 24 b you can claim a deduction from your gross income on the interest amount paid on your Home Loan For a self occupied home you can claim the

To qualify for tax benefits on a home loan you need to submit your loan statement proof of interest and principal payments to either your employer or the Income Tax Department Tax advantages can be claimed under As per Section 24 of the Income Tax Act you can get attractive tax benefits on your home loan interest To avail these benefits ensure timely payments maintain proper documentation and consider factors like

Download Home Loan Tax Benefit Under Section

More picture related to Home Loan Tax Benefit Under Section

Maximizing Home Loan Tax Benefits In India 2023

https://www.kanakkupillai.com/learn/wp-content/uploads/2023/08/Home-Loan-Tax-Benefits-.jpg

Home Loan Tax Benefit 8 Ways To Avail Tax Benefits On Home Loans

https://life.futuregenerali.in/media/ldbnmvyr/home-loan-tax-benefit.jpg

Home Loan Tax Benefit saving In 2019 20 In Hindi tax Benefit saving On

https://i.ytimg.com/vi/TqmeyW7QUDY/maxresdefault.jpg

Check out the Home Loan tax benefits under Sections 24 b 80EE and 80C to save tax on your Home Loan Learn how much tax exemption you can claim on a housing loan Discover the tax advantages of home loans under the Income Tax Act 1961 Explore Sections 24B 80C 80EE and 80EEA which offer deductions for interest on loan borrowed principal repayment and

What are the Tax deductions for a Home Loan under section 80C With the help of section 80C you can claim benefits on The principal amount and The Looking to save income tax on a home loan Learn how to secure tax benefits on home loans discover deductions under Section 24 80C and more

Pin On Home Loan Tax Benefits

https://i.pinimg.com/originals/be/e4/a6/bee4a6e3150a18a57f21502a4c5b430e.png

Home Loan Tax Benefit 2021 22 YouTube

https://i.ytimg.com/vi/KhZyjx_gcqo/maxresdefault.jpg

https://housing.com/news/home-loans-…

These deductions against the tax could be claimed under four sections of the income tax act namely Section 80C Section 24 Section 80EE and Section 80EEA In this article we will discuss at

https://cleartax.in/s/section-80ee-income-tax...

Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution As per this

Avail Joint Home Loan To Get These Amazing Benefits Homes Loans Blog

Pin On Home Loan Tax Benefits

Home Loan Tax Benefit

How To Avail Max Home Loan Tax Benefit In India In 2022 Crazyhoja

Home Loan Tax Benefit U s 80c In Hindi Benefits

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

Home Construction Loan How To Claim Tax Benefits Loan Trivia

Tax Benefits On Under Construction Properties Home Loan Tax Benefits

Home Loan Tax Benefit

Home Loan Tax Benefit Under Section - Tax benefits on home loan interest payment include deductions under Section 24 for self occupied and let out properties and an additional benefit of up to Rs