How Does The Solar Energy Tax Credit Work How does the solar tax credit work The solar tax credit is a non refundable credit worth 30 of the gross system cost of your solar project That means

The federal solar tax credit commonly referred to as the investment tax credit or ITC allows you to claim 30 of the cost of your solar energy system as a The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid for by the

How Does The Solar Energy Tax Credit Work

How Does The Solar Energy Tax Credit Work

https://a1asolar.com/wp-content/uploads/2021/09/Solar_Tax_Credit_Work-1536x1024.jpg

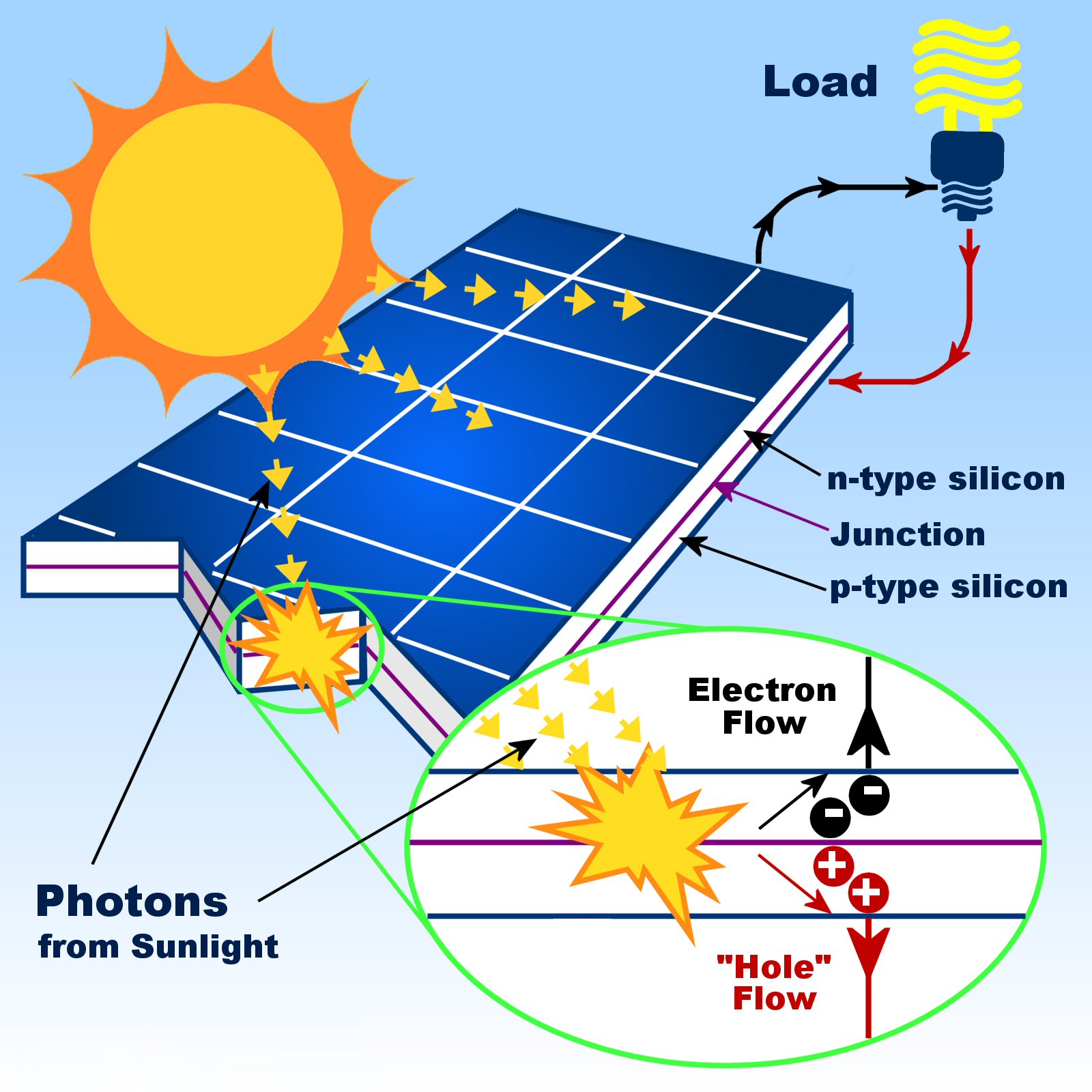

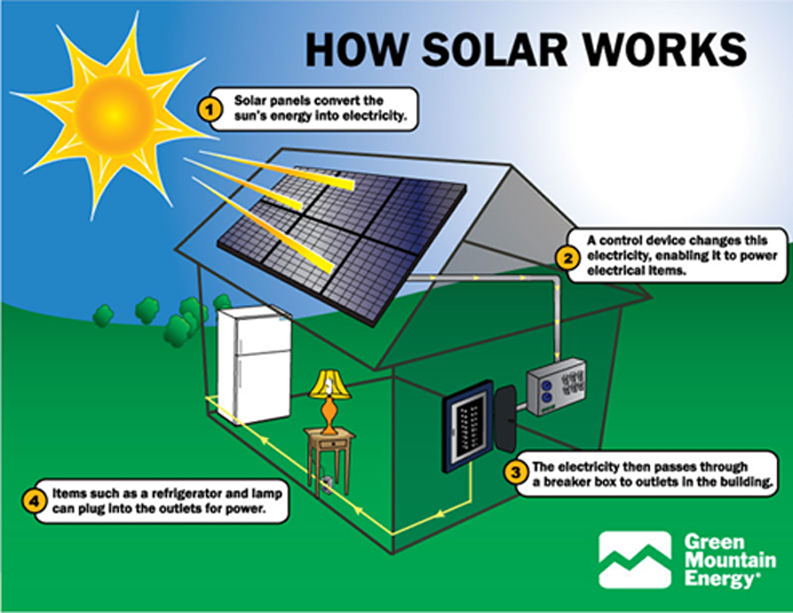

Solar Overview Ruaha Energy

https://ruahaenergy.com/wp-content/uploads/2016/06/energy-solar2.jpg

Home Energy Improvements Lead To Real Savings Infographic Solar

https://i.pinimg.com/originals/d9/ad/96/d9ad96393cb13907229e3e2b1609bcc1.jpg

The solar tax credit which is among several federal Residential Clean Energy Credits available through 2032 allows homeowners to subtract 30 percent of Worksheet Line 1 Enter the total taxes you owe you found this out earlier and entered it into line 18 on your 1040 form Example 10 000 Worksheet Line 2

The Residential Clean Energy Credit equals 30 of the costs of new qualified clean energy property for your home installed anytime from 2022 through 2032 Energy improvements to your home such as solar or wind generation biomass stoves fuel cells and new windows may qualify you for credits expanded in

Download How Does The Solar Energy Tax Credit Work

More picture related to How Does The Solar Energy Tax Credit Work

Commercial Solar Tax Credit Guide 2023

https://propertymanagerinsider.com/wp-content/uploads/2022/12/Commercial-Solar-Tax-Credit-Guide-2023.png

Working Of Solar System How Solar Energy System Works How Solar

https://photonenergytech.com/image/FZ7YNWOI45HKZDL.LARGE.jpg

How Does The Federal Solar Tax Credit Work Freedom Solar

https://freedomsolarpower.com/wp-content/uploads/2021/03/Solar-Panels-On-House.jpg

The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system 2 Other One of the many things this act accomplishes is the expansion of the Federal Tax Credit for Solar Photovoltaics also known as the Investment Tax Credit ITC This credit can be claimed on

In an effort to encourage Americans to use solar power the US government offers tax credits for solar systems The Inflation To calculate your federal solar tax credit simply multiply your total solar installation cost by the ITC s current rate in this case 0 3 For example if you spent

Solar Energy Tax Credit Andrews Tax Accounting

https://andrewstaxaccounting.com/wp-content/uploads/2022/02/solar-panels-install-rsz.jpg

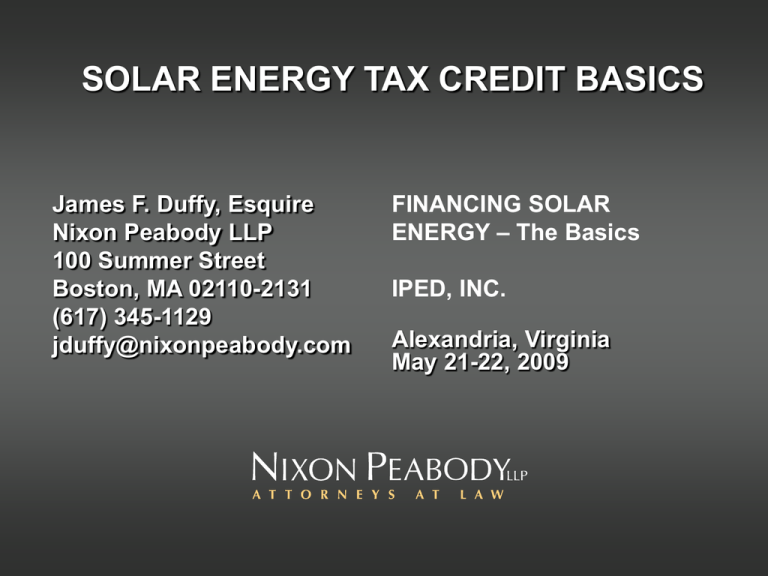

Solar Energy Tax Credit Basics

https://s2.studylib.net/store/data/009906505_1-1c8209be4201d8616781301da40ba34d-768x994.png

https://www.solar.com/learn/how-does-federal-solar-tax-credit-work

How does the solar tax credit work The solar tax credit is a non refundable credit worth 30 of the gross system cost of your solar project That means

https://www.energysage.com/solar/solar-tax-credit-explained

The federal solar tax credit commonly referred to as the investment tax credit or ITC allows you to claim 30 of the cost of your solar energy system as a

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

Solar Energy Tax Credit Andrews Tax Accounting

Solar Energy Tax Credit For Businesses Faster ROI

Solar Energy Tax Credit Explained Basit Siddiqi CPA

How Does The Federal Solar Tax Credit Work YouTube

Federal Solar Energy Tax Credit Sapling

Federal Solar Energy Tax Credit Sapling

Federal Solar Tax Credit What It Is How To Claim It For 2024

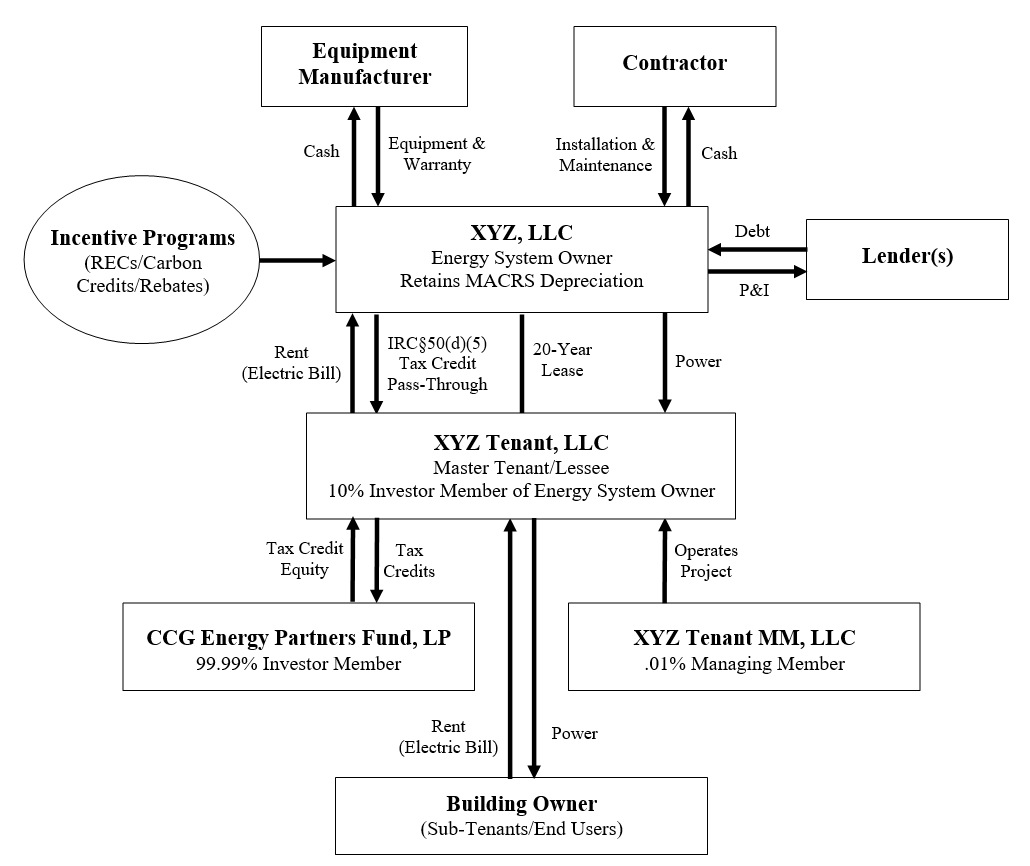

Solar Energy Transactional Structures CityScape Capital Group The

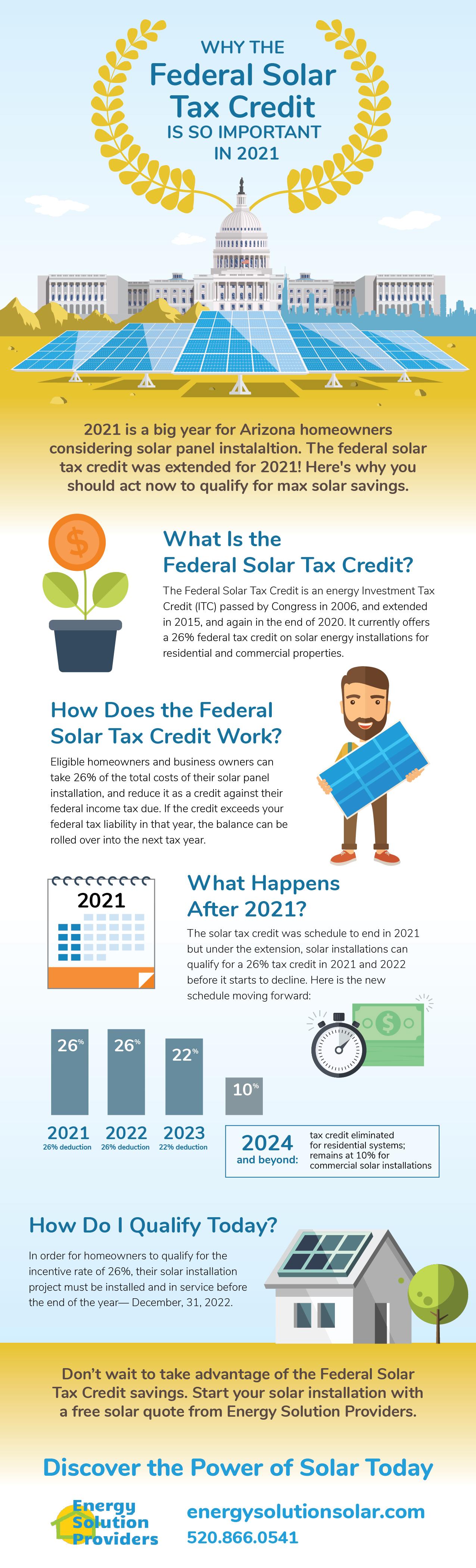

The Federal Solar Tax Credit Energy Solution Providers Arizona

How Does The Solar Energy Tax Credit Work - How solar tax credits work The tax credit is a reduction in an individual s or business s tax liability based on the cost of the solar property It s a nonrefundable tax