How Much Is Fringe Benefits Tax Fringe benefits tax FBT is a tax paid by employers on certain benefits provided to their employees or to their employees family or other associates FBT is

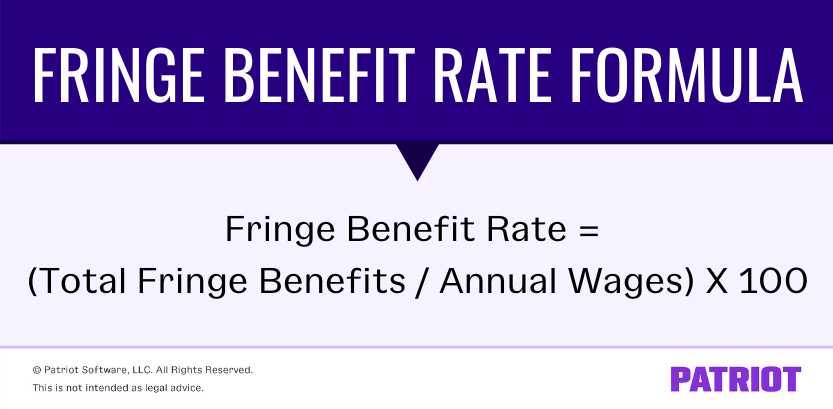

How Much Are Fringe Benefits Taxed Fringe benefits may be taxed at the employee s income tax rate or the employer may elect to withhold a flat supplemental Fringe benefit rates are specific percentages of the benefits received in relation to the employee s salary or wages Understanding these calculations will provide

How Much Is Fringe Benefits Tax

How Much Is Fringe Benefits Tax

https://www.employmentinnovations.com/wp-content/uploads/2022/03/Fringe-Benefits-Tax-What-Employers-Need-to-Know_Feature-Image.jpg

How Does Fringe Benefits Tax Work Pherrus

https://www.pherrus.com.au/wp-content/uploads/2023/05/Blog_2__01_cover_How-Does-Fringe-Benefits-Tax-Work.jpg

Fringe Benefits Tax Time Connolly Associates

https://connollysbs.com.au/wp-content/uploads/2023/03/fringe-benefits-tax-time.jpg

Fringe benefits tax FBT rates and thresholds for employers for the 2020 21 to 2024 25 FBT years Last updated 22 May 2024 Print or Download On this By default fringe benefits are taxable unless they are specifically exempted Recipients of taxable fringe benefits include the fair market value in their

Most fringe benefits are taxable at fair market value but some benefits such as health and life insurance are nontaxable As an employer you can choose to How to calculate Fringe Benefits Tax Here we take a look at what you need to do in order to calculate report and pay fringe benefits tax in Australia Fringe

Download How Much Is Fringe Benefits Tax

More picture related to How Much Is Fringe Benefits Tax

What Are Fringe Benefits And How The Tax On Fringe Benefits Computed

http://1.bp.blogspot.com/-dBBjjTOmgsE/VYsry9RQpkI/AAAAAAAAAeE/is4Jx8fzWew/s1600/benefits.jpg

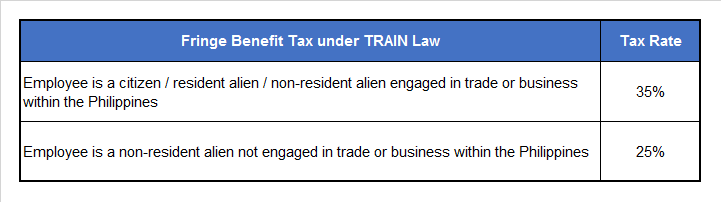

What Is The Tax Rate For Fringe Benefits

http://reliabooks.ph/wp-content/uploads/2019/01/Fringe-Benefit-Tax-under-TRAIN-Law.png

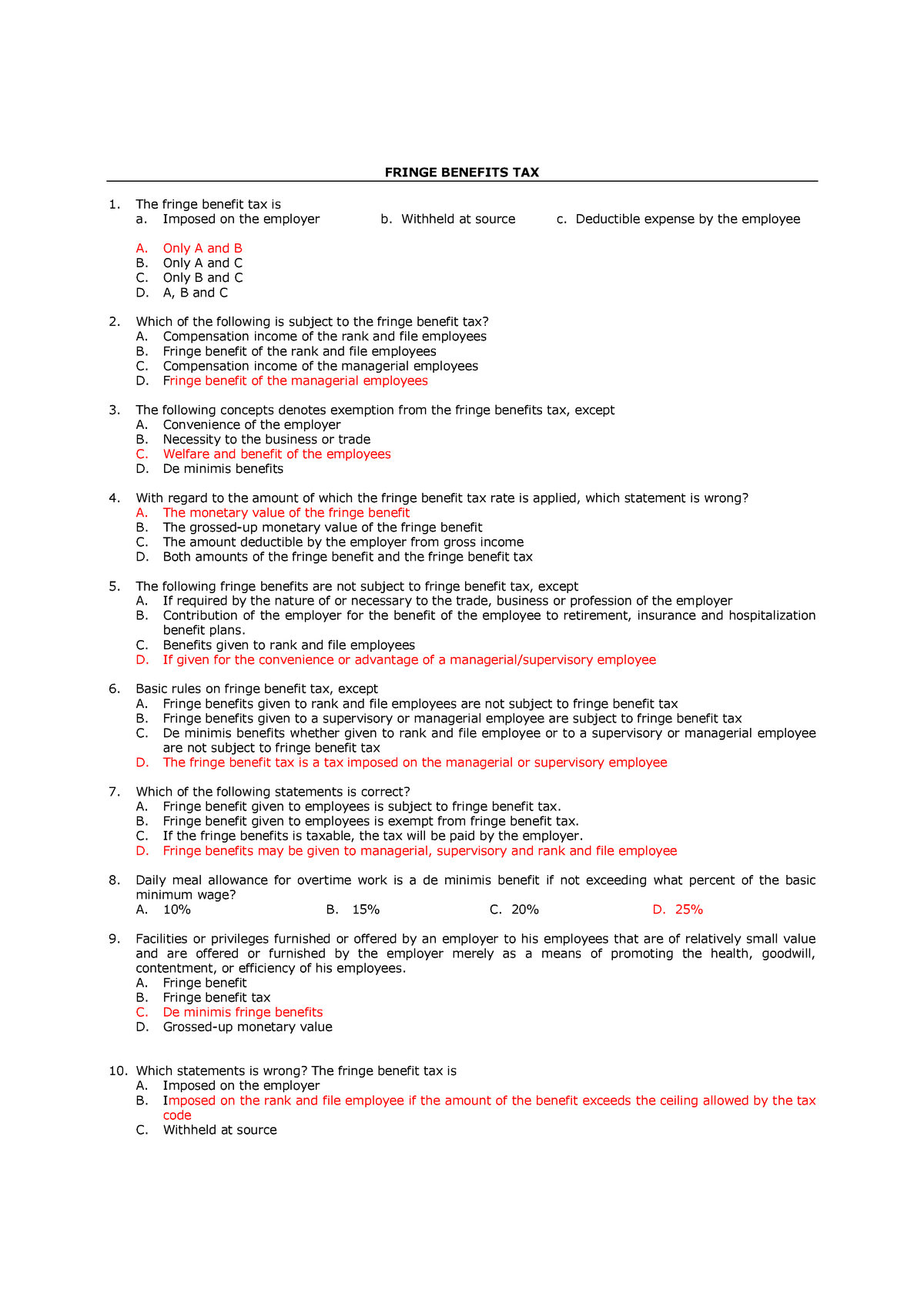

87 06 Fringe Benefits Tax FRINGE BENEFITS TAX The Fringe Benefit Tax

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/b54bfcdaec3f181e1d18c8e1b363f86f/thumb_1200_1697.png

Generally fringe benefits with significant value are considered taxable to the employee and subject to federal withholding Social Security and Medicare taxes A fringe benefit rate is the percent of an employee s wages relative to the fringe benefits they receive Calculate a fringe benefit rate by dividing the cost of an

Accident and health benefits commuting benefits dependent care assistance educational assistance employee discounts health savings accounts What is fringe benefits tax FBT Your employer is liable for any applicable FBT on fringe benefits they provide to you and or your family FBT is separate from income tax It s

Fringe Benefits Tax FBT Mason Lloyd

https://masonlloyd.com.au/wp-content/uploads/2023/06/fringe-benefits-tax-fbt-to-pay-with-personal-income-tax-on-fringe-benefits-they-receive-vector.jpg

Fringe Benefits Tax Meaning Pherrus

https://www.pherrus.com.au/wp-content/uploads/2023/05/Blog_3__01_cover_Fringe-Benefits-Tax-Meaning--768x768.jpg

https://www.ato.gov.au/businesses-and...

Fringe benefits tax FBT is a tax paid by employers on certain benefits provided to their employees or to their employees family or other associates FBT is

https://www.investopedia.com/ask/answers/011915/...

How Much Are Fringe Benefits Taxed Fringe benefits may be taxed at the employee s income tax rate or the employer may elect to withhold a flat supplemental

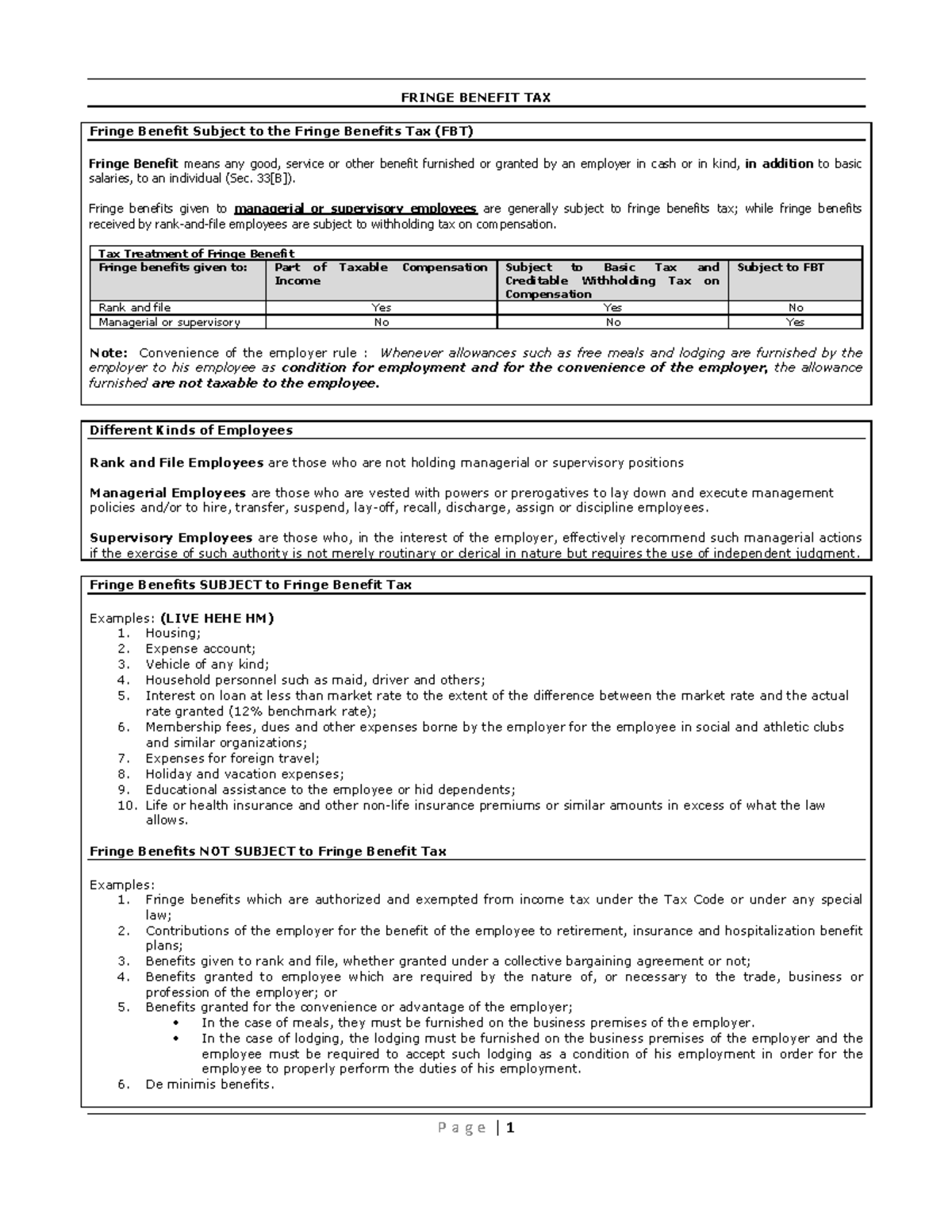

5 Fringe Benefit Tax PSBA FRINGE BENEFIT TAX Fringe Benefit Subject

Fringe Benefits Tax FBT Mason Lloyd

Fringe Benefits Tax Update

How To Calculate Fringe Benefit Tax

Fringe Benefits Tax Tips Professional Personal Business

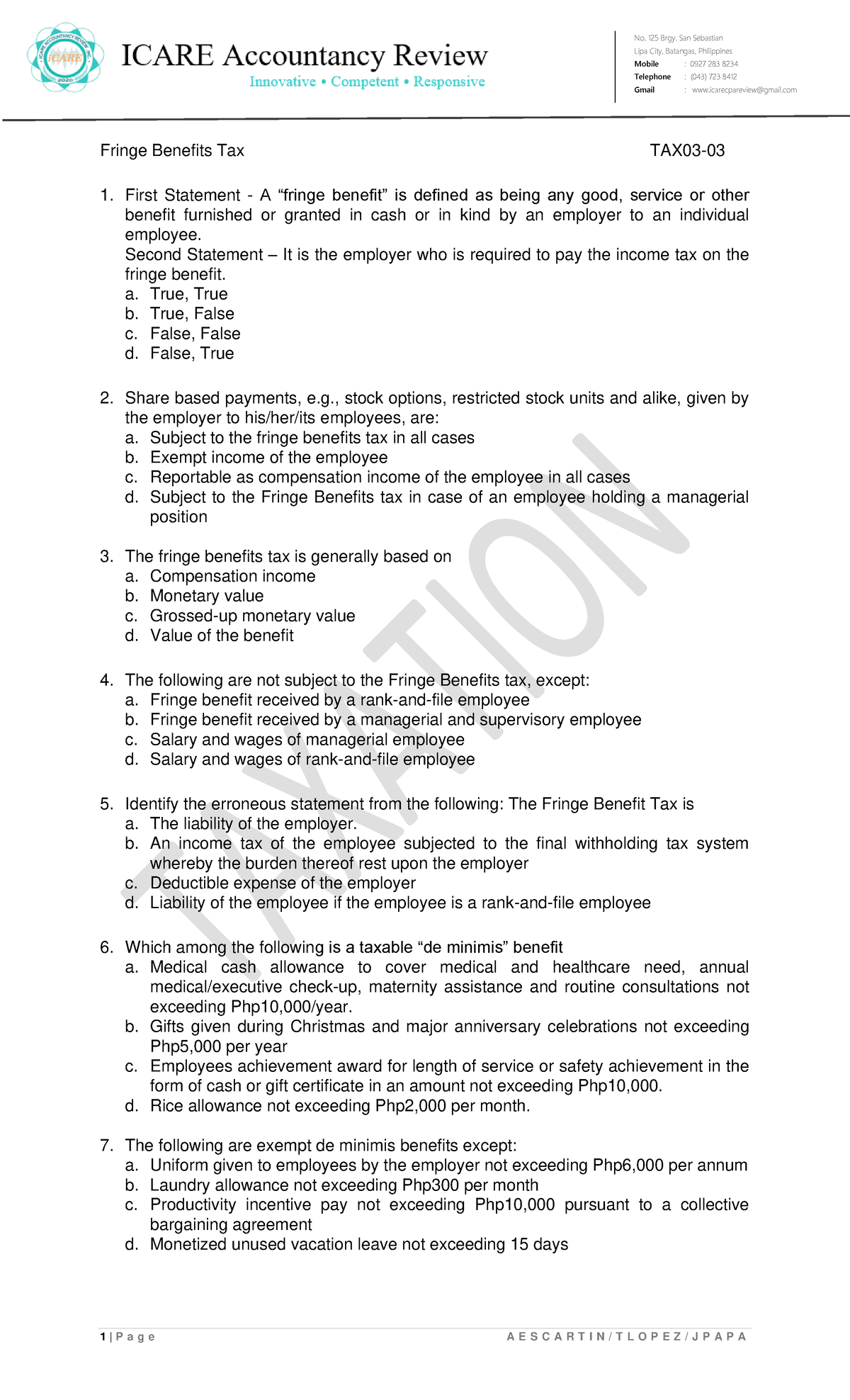

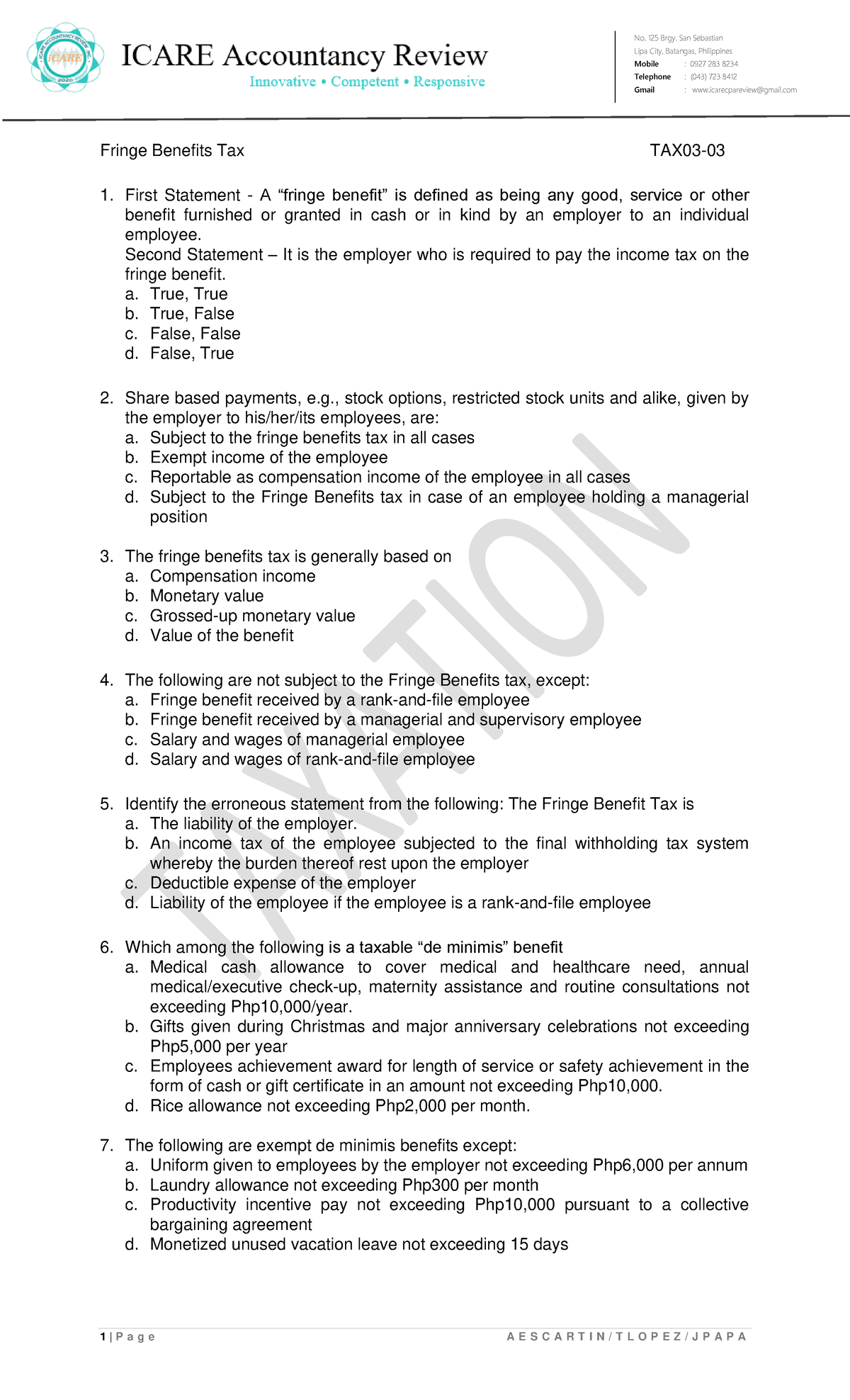

Tax 03 03 Fringe Benefits Tax Encrypted 1 P A G E A E S C A R T I N

Tax 03 03 Fringe Benefits Tax Encrypted 1 P A G E A E S C A R T I N

TAX 8606 Fringe Benefits Tax MCQ PRACTICE MATERIAL BS Accountancy

Question 4 Q4 FRINGE BENEFITS TAX WEEK 11 Essential Features Of

Lecture 4 FBT LAW3ITL Fringe Benefits Taxation Fringe Benefits Tax

How Much Is Fringe Benefits Tax - Fringe benefits tax FBT rates and thresholds for employers for the 2020 21 to 2024 25 FBT years Last updated 22 May 2024 Print or Download On this