How Much Tax Credit For Ev You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032

A 7 500 tax credit for electric vehicles has seen substantial changes in 2024 It should be easier to get because it s now available as an instant rebate at dealerships but fewer models The government is offering a hefty tax credit to buyers of electric vehicles but taking advantage of it is not straightforward Here s what you need to know

How Much Tax Credit For Ev

How Much Tax Credit For Ev

https://thegreencarguy.com/wp-content/uploads/2016/05/GCG-CashandCar-1024x1024.jpg

Lawmakers Try To Delay EV Tax Credit Requirements

https://i.kinja-img.com/gawker-media/image/upload/c_fill,f_auto,fl_progressive,g_center,h_675,pg_1,q_80,w_1200/14bb001fb0a96378884c82ce9957d8d4.png

The Federal Tax Credit For Electric Cars Is Set To Expire OsVehicle

https://cdn.osvehicle.com/can_i_claim_the_ev_tax_credit_every_year.png

We ll help you determine whether your purchase of an electric vehicle EV or fuel cell vehicle FCV qualifies for a tax credit based on whether you are Planning to buy a new clean vehicle Looking to claim a credit for a new clean vehicle you already bought A6 Beginning Jan 1 2023 eligible vehicles may qualify for a tax credit of up to 7 500 The amount of the credit depends on when the eligible new clean vehicle is placed in service and whether the vehicle meets certain requirements for a full or partial credit

Tax credits up to 7 500 are available for eligible new electric vehicles and up to 4 000 for eligible used electric vehicles You can claim the credit yourself or work with your dealership Make sure you meet the requirements below How EV Tax Credits Work and How to Claim Them Currently the tax credit for purchasing a qualifying new battery electric and plug in hybrid vehicles is either 3750 or 7500 Used EVs and

Download How Much Tax Credit For Ev

More picture related to How Much Tax Credit For Ev

EV Tax Credit Explained What You Need To Know YouTube

https://i.ytimg.com/vi/FqX0drE820I/maxresdefault.jpg

It s Now Or Maybe Never For A Federal EV Tax Credit Extension

https://i.kinja-img.com/gawker-media/image/upload/c_fill,f_auto,fl_progressive,g_center,h_675,pg_1,q_80,w_1200/6038557ca222cc7dc9561af381679559.jpg

How To Get EV Tax Credit Evs101

https://evs101.com/wp-content/uploads/2019/04/how_to_get_ev_tax_credit.jpg

Federal tax credit for EVs will remain at 7 500 The timeline to qualify is extended a decade from January 2023 to December 2032 Tax credit cap for automakers after they hit 200 000 EVs sold A federal EV tax credit is here thanks to the Inflation Reduction Act IRA massive tax and climate legislation promoting clean energy The credit of up to 7 500 for certain electric

You could call it a tax pre fund Starting in January you ll be able to get an electric vehicle tax credit of up to 7 500 without having to wait for the IRS to process your return Instead This EV tax credit calculator is a tool that helps estimate the amount of tax credit an electric car buyer can receive The 2023 EV tax credit is calculated based on a vehicle s manufacturing process

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

https://www.autopromag.com/usa/wp-content/uploads/2022/08/EV-Federal-Tax-Credits-5MgJUp.jpeg?is-pending-load=1

Everything You Need To Know About The IRS s New EV Tax Credit Guidance

https://electrek.co/wp-content/uploads/sites/3/2022/11/EV-tax-credit-flowchart.jpg?quality=82&strip=all&w=1024

https://www.irs.gov/credits-deductions/credits-for...

You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032

https://www.npr.org/2023/12/28/1219158071

A 7 500 tax credit for electric vehicles has seen substantial changes in 2024 It should be easier to get because it s now available as an instant rebate at dealerships but fewer models

Ev Tax Credit 2022 Cap Clement Wesley

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

How Does The EV Tax Credit Work Flipboard

Ev Credit Tax Todrivein

Tax Credit For EV Everything You Need To Know

How Does EV Tax Credit Work Hertz

How Does EV Tax Credit Work Hertz

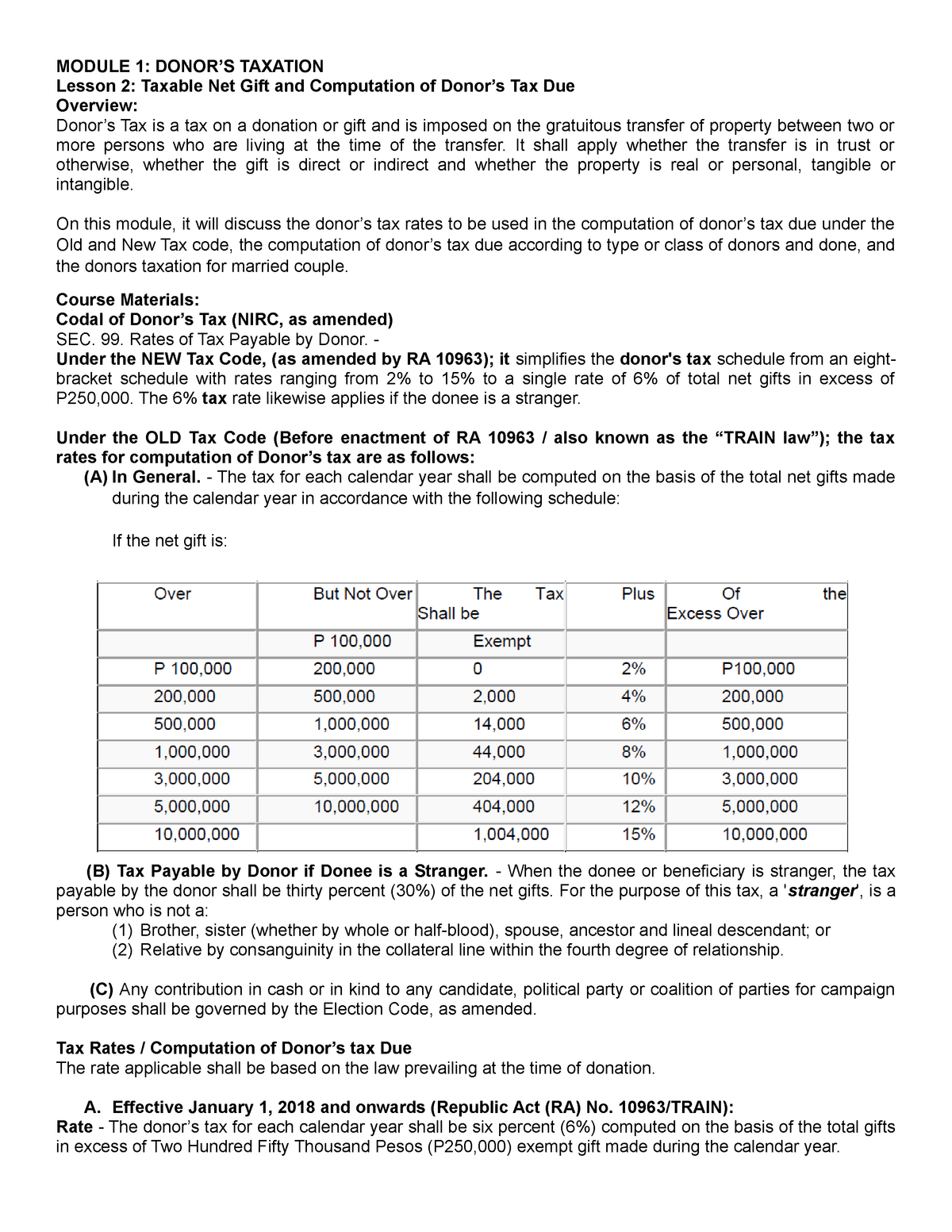

Module 1 Lesson 2 Taxable Net Gift And Computation Of Donor s Tax

How The EV Tax Credit Can Benefit You EV America

How To Qualify Almost Any EV For U S Tax Credit

How Much Tax Credit For Ev - The EV tax credit of 7 500 once applied to a narrow range of cars Those buying a pure EV stood to qualify in full from the credit whereas a buyer of a plug in hybrid or hydrogen fuel cell