How To Calculate Mileage Allowance Web 12 Aug 2022 nbsp 0183 32 Mobility premium for long distance commuters As of 2021 long distance commuters with a daily commute of 21 kilometers or more can apply for the new mobility premium Mobilit 228 tspr 228 mie In order to apply your taxable income must not exceed the basic tax free allowance Grundfreibetrag of 9 744 euros as of 2021

Web 26 Sept 2023 nbsp 0183 32 Best practices for mileage allowance calculation Use reliable mileage tracking tools Employers and employees should use reliable mileage tracking tools or apps to Compliance with tax regulations Stay compliant with tax regulations and adhere to the standard mileage rates Regular Web 27 Apr 2023 nbsp 0183 32 Mileage allowance The simplest way to settle your travel expenses is with the commuting allowance This can be claimed for expenses for the journey between home and the first place of business as well as family trips home regardless of what means of transport you use

How To Calculate Mileage Allowance

How To Calculate Mileage Allowance

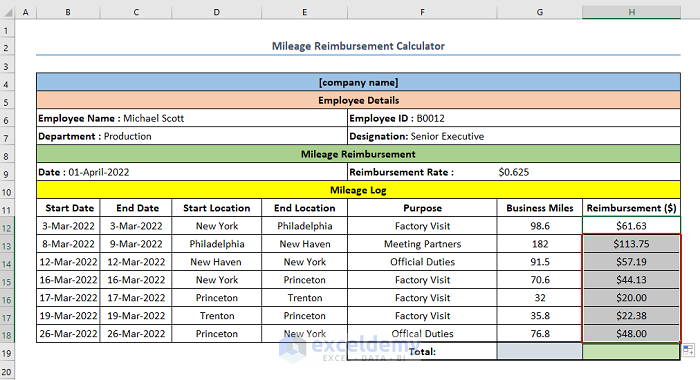

https://www.exceldemy.com/wp-content/uploads/2022/06/how-to-calculate-mileage-reimbursement-in-excel-4.png

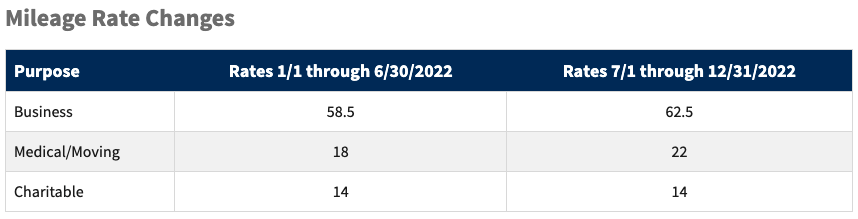

IRS Increases Standard Mileage Rates Starting July 1 2022 Stinson

https://jdsupra-html-images.s3-us-west-1.amazonaws.com/2cc30a4d-edf6-4797-b367-9df3694291f8-Picture6.png

Claim Car Expenses From The ATO In 5 Simple Steps 2023 ATO Claims

https://storage.googleapis.com/driversnote-marketing-pages/AU infographic - how to deduct mileage-landscape.png

Web To calculate the approved amount multiply your employee s business travel miles for the year by the rate per mile for their vehicle Use HMRC s MAPs working sheet if you need help Web 30 Dez 2020 nbsp 0183 32 For 2021 the IRS suggests deducting 0 56 per mile for business use 0 14 for charity use and 0 16 for certain medical uses and moving for 2020 it s 0 575 0 14 and 0 17 respectively

Web Calculation of mileage allowance relief The same calculation is used to determine both MAR and the chargeable amount of mileage allowance payments see EIM31235 The same statutory Web From tax year 2011 to 2012 onwards First 10 000 business miles in the tax year Each business mile over 10 000 in the tax year Cars and vans 45p 25p Motor cycles 24p 24p

Download How To Calculate Mileage Allowance

More picture related to How To Calculate Mileage Allowance

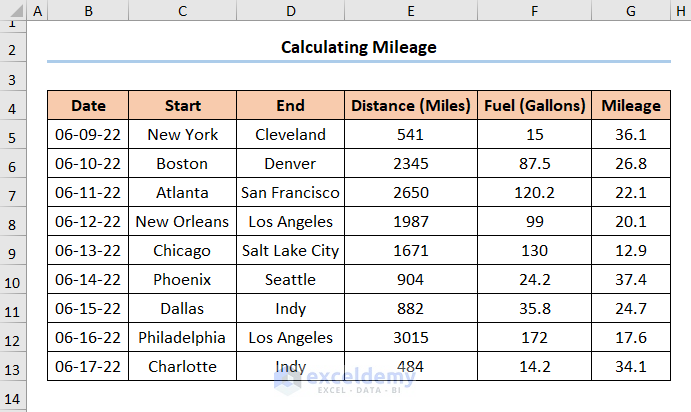

How To Calculate Mileage In Excel Step by Step Guide

https://www.exceldemy.com/wp-content/uploads/2022/06/How-to-Calculate-Mileage-in-Excel-3.png

How To Calculate Revenue For A Startup

https://www.kanakkupillai.com/learn/wp-content/uploads/2022/10/How-to-Calculate-Revenue-for-a-Startup.png

Business Mileage Deduction How To Calculate For Taxes

https://www.patriotsoftware.com/wp-content/uploads/2019/04/mileage_reimbursement-03.png

Web 25 Sept 2023 nbsp 0183 32 20p 20p For the first 10 000 miles per tax year cars and vans are eligible for 45p per mile From there travel is at a rate of 25p per mile For motorcycles and bikes the rates are the same for all travel it s always 24p for motorcycles and 20p for bikes If it s still unclear or if you have a hard time calculating how much you Web 30 Dez 2019 nbsp 0183 32 The maximum that can be paid tax free is calculated as the number of business miles for which a passenger is carried multiplied by a rate expressed in pence per mile The rate is in Appendix 3

Web 12 Juli 2022 nbsp 0183 32 A quick explanation Mileage allowance relief is a tax deduction employees can claim if they ve incurred business mileage They can only claim it if their employers haven t reimbursed the full amount Employers can offer Mileage Allowance Payments MAPs to employees who use their own vehicles for business purposes HMRC sets Web As a car allowance is given to the employee to buy their own personal vehicle they can claim a mileage allowance on top when using this car for work purposes A car allowance can help to cover fuel costs in general but claiming a mileage allowance on top is good for business What does car allowance cover

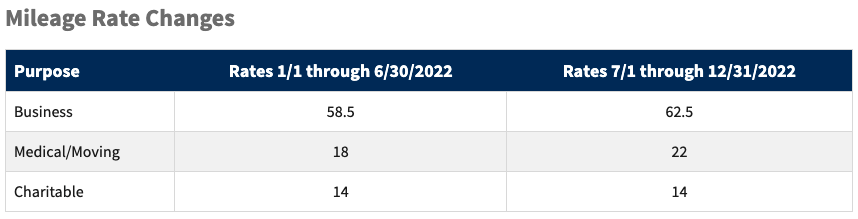

Mileage Rate Changes 2022 CPA Nerds

https://www.cpanerds.com/app/uploads/2022/06/Mileage-Rate-Changes.png

Gas Mileage Calculator 2023 AyreneHailey

https://www.ssacpa.com/wp-content/uploads/2021/12/aaaa-graphic-12-21.jpg

https://germantaxes.de/tax-tips/travel-expenses-tax-declaration

Web 12 Aug 2022 nbsp 0183 32 Mobility premium for long distance commuters As of 2021 long distance commuters with a daily commute of 21 kilometers or more can apply for the new mobility premium Mobilit 228 tspr 228 mie In order to apply your taxable income must not exceed the basic tax free allowance Grundfreibetrag of 9 744 euros as of 2021

https://yokoy.io/blog/mileage-allowance

Web 26 Sept 2023 nbsp 0183 32 Best practices for mileage allowance calculation Use reliable mileage tracking tools Employers and employees should use reliable mileage tracking tools or apps to Compliance with tax regulations Stay compliant with tax regulations and adhere to the standard mileage rates Regular

How To Calculate Mileage For Tax Deduction TlwaStoria

Mileage Rate Changes 2022 CPA Nerds

Best Mileage Log Template Updated For 2022 Free Template 2022

How To Calculate The Price to Sales Ratio InfoComm

How To Calculate Gas Mileage MPG The Right Way

Hmrc Mileage Allowance Management And Leadership

Hmrc Mileage Allowance Management And Leadership

Business Miles Reimbursement 2024 Rate Arlyne Jillene

How To Calculate The Lifetime Value Of A Customer

How To Calculate Weighted Average In Excel Pivot Table SpreadCheaters

How To Calculate Mileage Allowance - Web To calculate the approved amount multiply your employee s business travel miles for the year by the rate per mile for their vehicle Use HMRC s MAPs working sheet if you need help