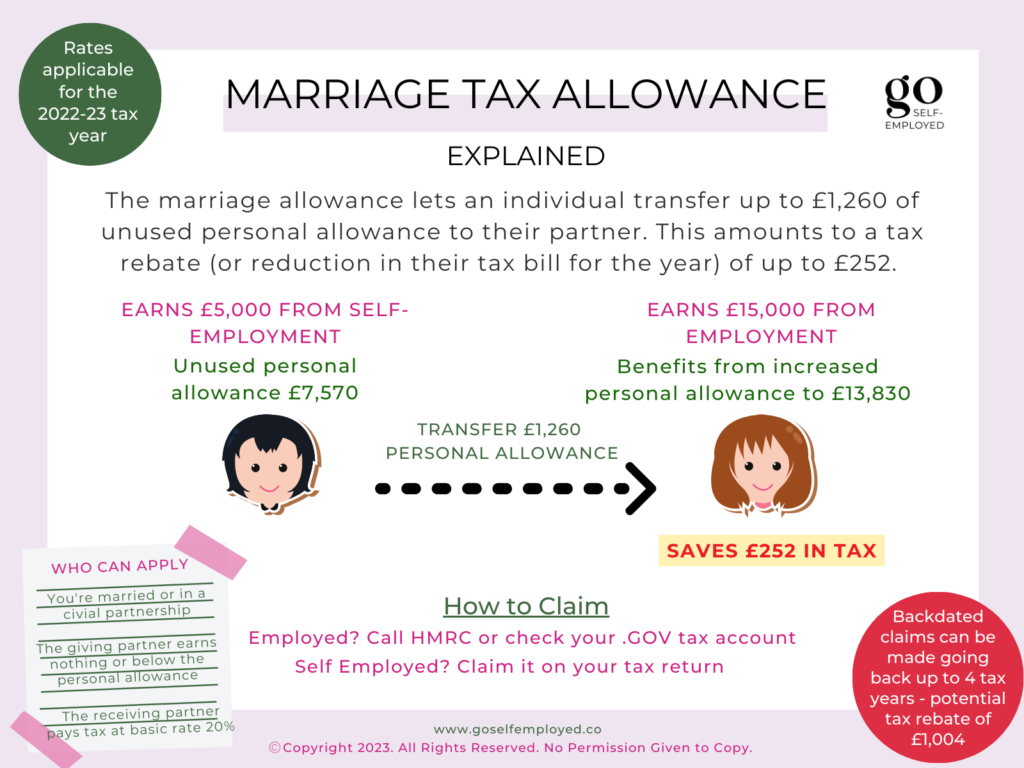

How To Claim Marriage Tax Allowance For Previous Years If you re married or in a civil partnership and under 89 years old you may be entitled to a 1 260 tax break called the marriage tax

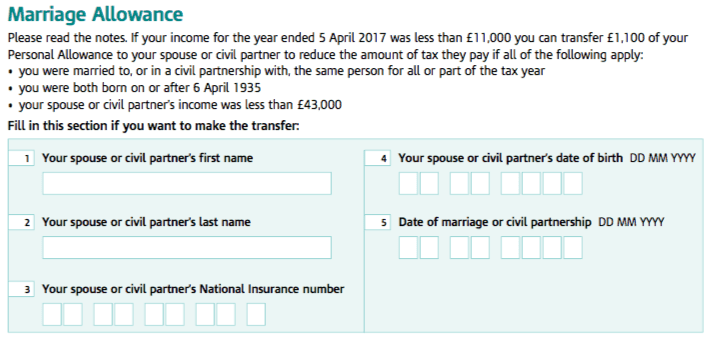

How to apply You can apply for Marriage Allowance online It s free to apply If both of you have no income other than your wages then the person who earns the least should Can I claim marriage allowance for previous years If you have only just heard of the tax break don t worry Eligible couples can backdate their claim to include

How To Claim Marriage Tax Allowance For Previous Years

How To Claim Marriage Tax Allowance For Previous Years

https://i.ibb.co/xHTHtXn/Marriage-Tax-Claims.png

Marriage Tax Allowance Claims What Do You Need To Know Gowing Law

https://i.ibb.co/Tmffpxh/marriage.png

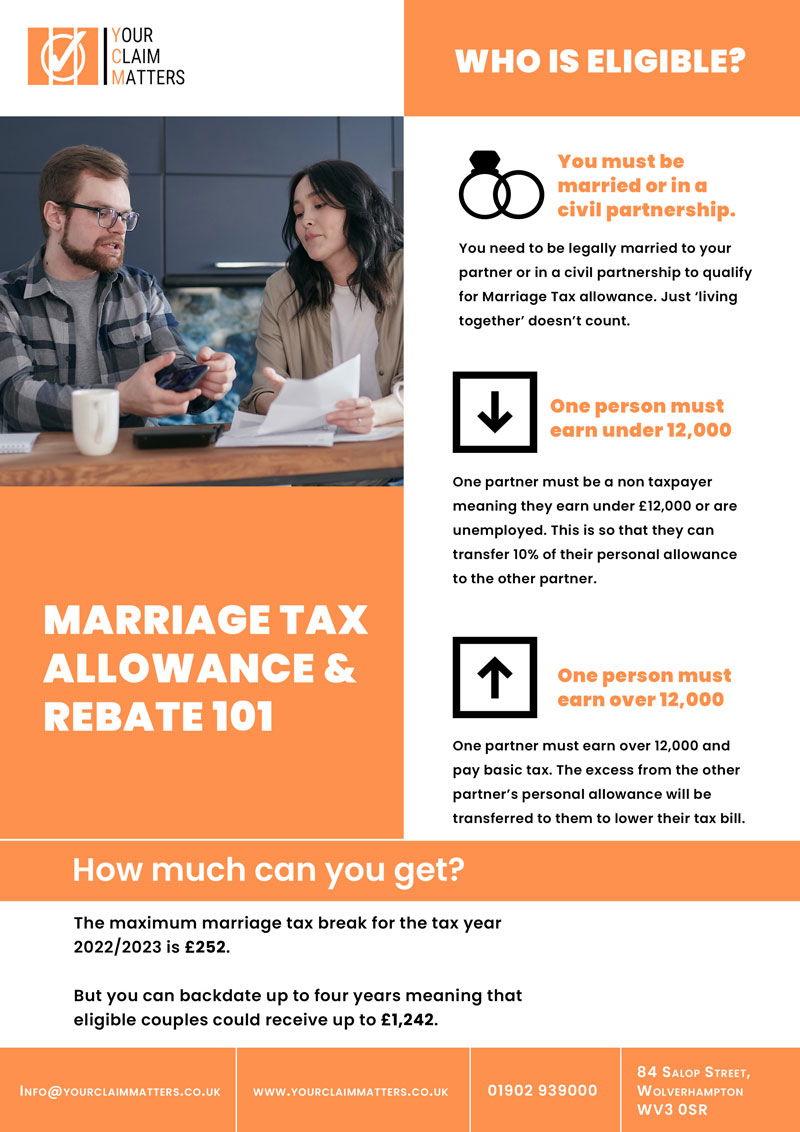

The 101 Marriage Tax Allowance Rebate And Claim Guide

https://www.yourclaimmatters.co.uk/wp-content/uploads/2022/12/marriage-tax-allowance.jpg

Find out whether you re eligible to claim marriage allowance the tax break which could allow married couples to earn an extra 252 in 2024 25 plus other tax breaks available for married couples and civil You can backdate your claim to include any tax year since 5 April 2019 that you were eligible for Marriage Allowance If your partner has since died you can still claim To use this service you ll need your National Insurance

If you cannot claim online you can telephone HMRC on 0300 200 3300 to make the claim or download form MATCF to make the claim Previous Next The The marriage allowance is a tax free perk which over 2 million couples don t claim We explain how you can claim your 252 tax rebate The marriage allowance for 2023 24 is 252 Better still you can claim

Download How To Claim Marriage Tax Allowance For Previous Years

More picture related to How To Claim Marriage Tax Allowance For Previous Years

Marriage Tax Allowance Explained Goselfemployed co

https://goselfemployed.co/wp-content/uploads/2018/07/Marriage-Tax-Allowance-1024x768.png

Marriage Tax Allowance Explained

https://wpimg.latestdeals.co.uk/guide/wp-content/uploads/2021/04/23144825/image-27-1024x576.png

Marriage Tax Allowance Explained Goselfemployed co

https://goselfemployed.co/wp-content/uploads/2018/07/marriage-allowance-self-employed.png

You can claim Married Couple s Allowance in your Self Assessment tax return If you don t complete a Self Assessment tax return contact HMRC Opens in a new window Couples can apply any time backdate their claims for any of the 4 previous tax years and receive a payment of up to 1 220 at a time when they need it most

If back claiming for previous years you will receive a payout either via bank transfer or cheque If one partner died during or after the year 2018 the surviving partner may The marriage tax allowance allows you to transfer a portion of your personal tax allowance to your civil partner or spouse The personal tax allowance for those

The Marriage Allowance Tax Break Explained Be Clever With Your Cash

https://i1.wp.com/becleverwithyourcash.com/wp-content/uploads/2020/05/Marriage_allowance_tax_break_explained.jpg?fit=1200%2C628&ssl=1

Marriage Tax Allowance How To Combine Your Tax free Allowance YouTube

https://i.ytimg.com/vi/cnAZlPCJlmQ/maxresdefault.jpg

https://www.moneysavingexpert.com/fa…

If you re married or in a civil partnership and under 89 years old you may be entitled to a 1 260 tax break called the marriage tax

https://www.gov.uk/marriage-allowance/how-to-apply

How to apply You can apply for Marriage Allowance online It s free to apply If both of you have no income other than your wages then the person who earns the least should

Tax Allowance For Couples Marriage Tax Allowance And Inheritance

The Marriage Allowance Tax Break Explained Be Clever With Your Cash

Marriage Tax Allowance Explained

Marriage Allowances You Can Claim

Marriage Tax Allowance Claim How To Claim Marriage Allowance

Claim Your Marriage Allowance

Claim Your Marriage Allowance

Make A Marriage Tax Claim This Christmas Gowing Law

Let s Get Legal Weekly Expert Law Advice Part 1 Gowing Law

Marriage Tax Allowance Claim Back 1 188 YouTube

How To Claim Marriage Tax Allowance For Previous Years - Claiming Marriage Allowance for previous years You can backdate your claim by four years alongside the current year The amount per year changes though