Hra Rebate In Income Tax Rules House Rent Allowance HRA is a key part of a salaried individual s compensation package This article explains HRA its tax exemption and calculation Individuals can avail HRA exemption under Section 10 13A of the Income Tax Act Self employed individuals can use Section 80GG for tax deductions on rented accommodation

HRA tax exemption rules The HRA tax exemption reduces the total salary before calculating taxable income helping employees save on taxes It s important to note that if an employee lives in their own house or does not pay any rent the HRA received from the employer is fully taxable For most employees House Rent Allowance HRA is a part of their salary structure Although it is a part of your salary HRA unlike basic salary is not fully taxable Subject to certain conditions a part of HRA is exempted under Section 10 13A of the Income tax Act 1961

Hra Rebate In Income Tax Rules

Hra Rebate In Income Tax Rules

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhjaMWWuh9Yw1oHqfkfrIaYbLGaB376RebKDTPXR4-jMTYYQRhPBXomiwY9EVzEmXIgQ2oXuDWoror_llXVa0a4CVcBPyG3JecnKbrFpU1YAcL3BqdldNxiSh81eUspfAXJiNGbHbVcluzwXjoIUmqkZimUhTYHrQKq1Zu6xuaat2LRf6h-UCOGnP3s/w640-h596/87a.jpg

How To Get Full Rebate On HRA In Income Tax

https://4.bp.blogspot.com/-MstZZqwHN2I/WJs7rd_yvRI/AAAAAAAADPI/D_ZiTxYk4Vsn0NSbSomUZGbQCM6JL6AjwCLcB/w1200-h630-p-k-no-nu/hra-exemptoin.JPG

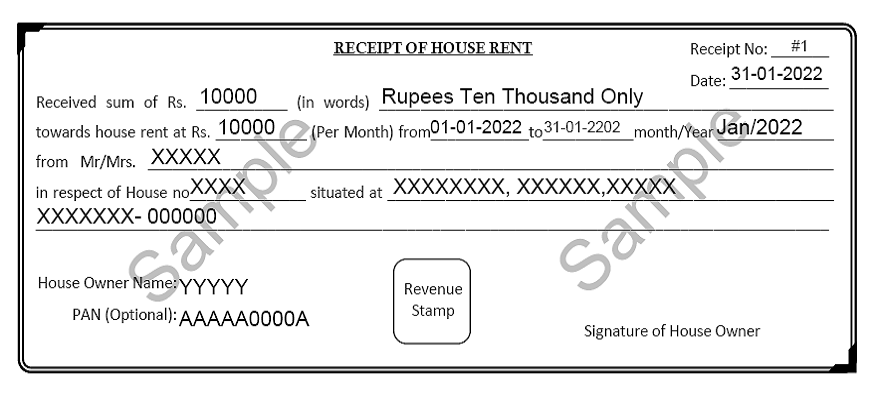

Rent Receipt Generator Online Download Rent Receipt For HRA

https://localitydetails.com/images/rental-receipt-fromat-2.png

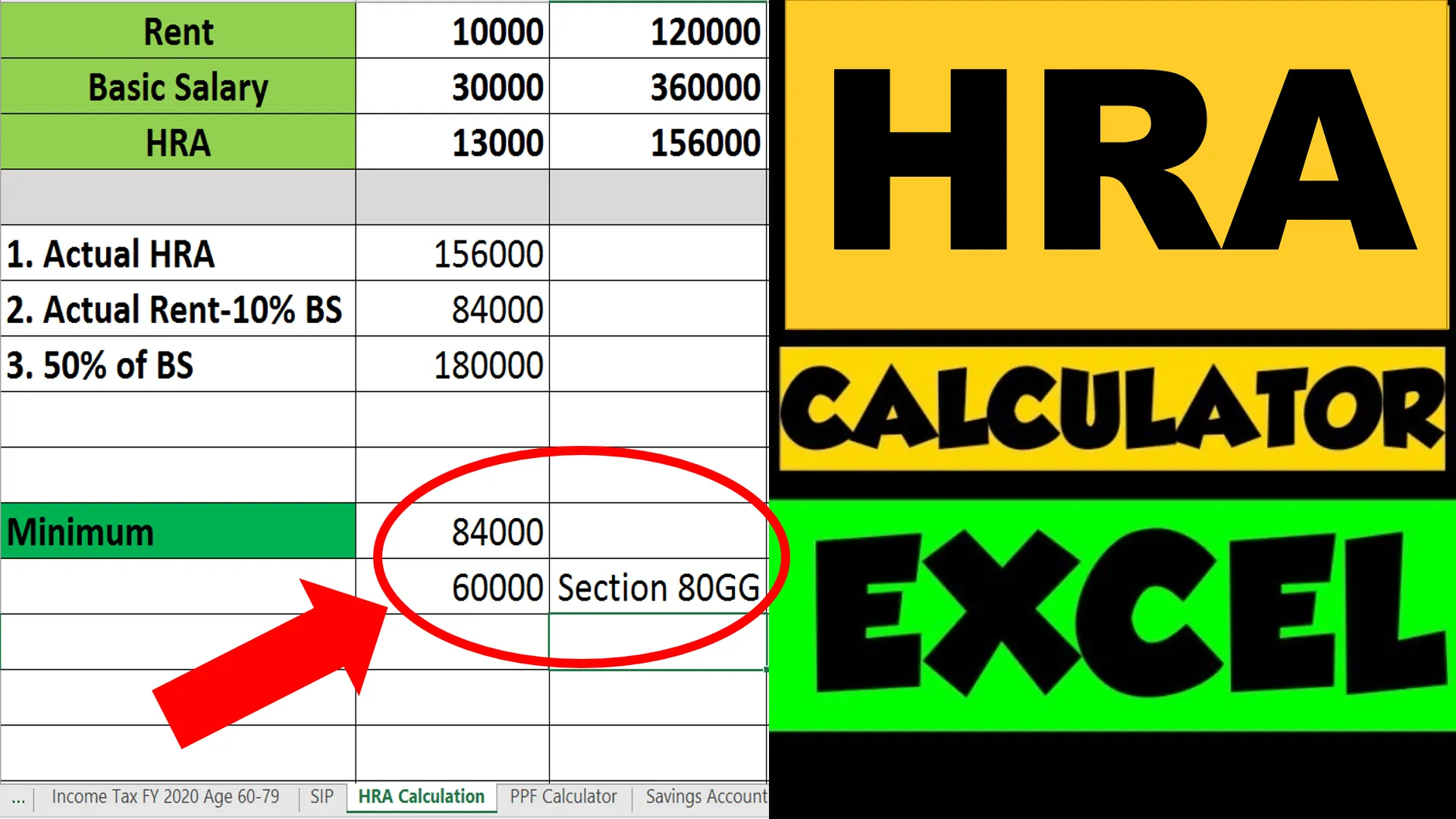

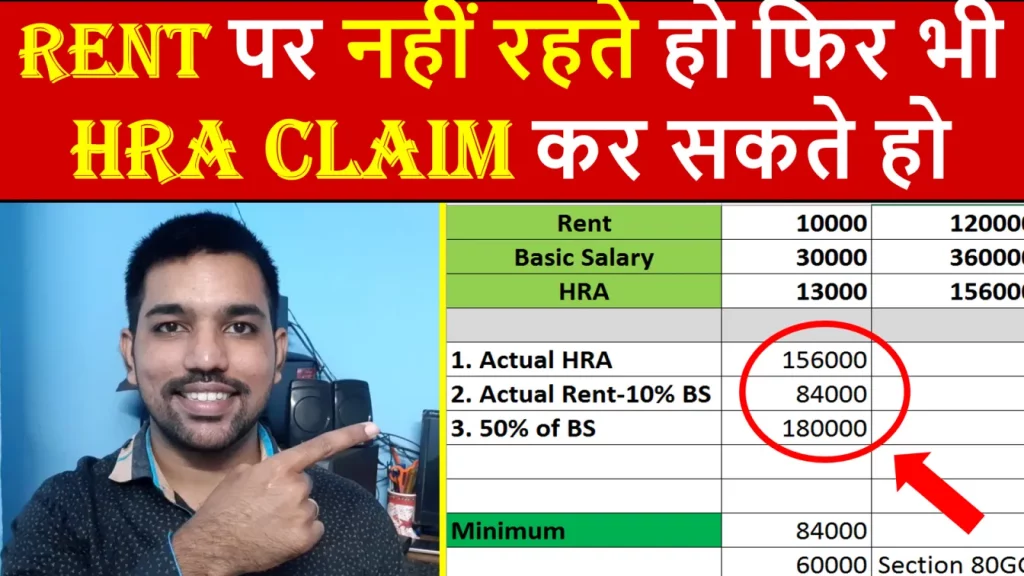

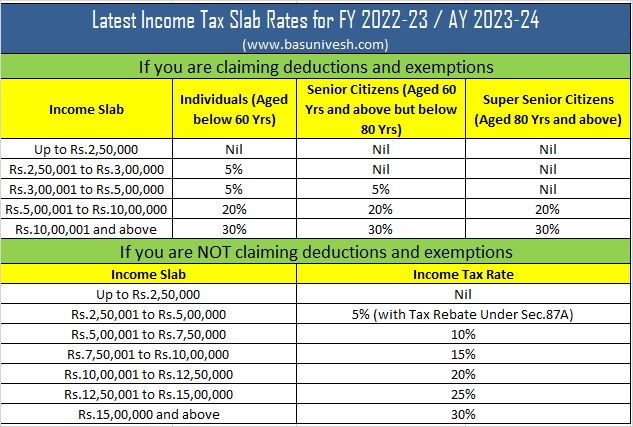

Under the old tax regime House Rent Allowance HRA is exempted under section 10 13A for salaried individuals However this exemption is not available in the new tax regime Section 80GG of the Income Tax Act in India allows individuals who pay rent but don t receive House Rent Allowance HRA to claim deductions for that rent on their taxes This benefit applies to both salaried individuals and self employed persons

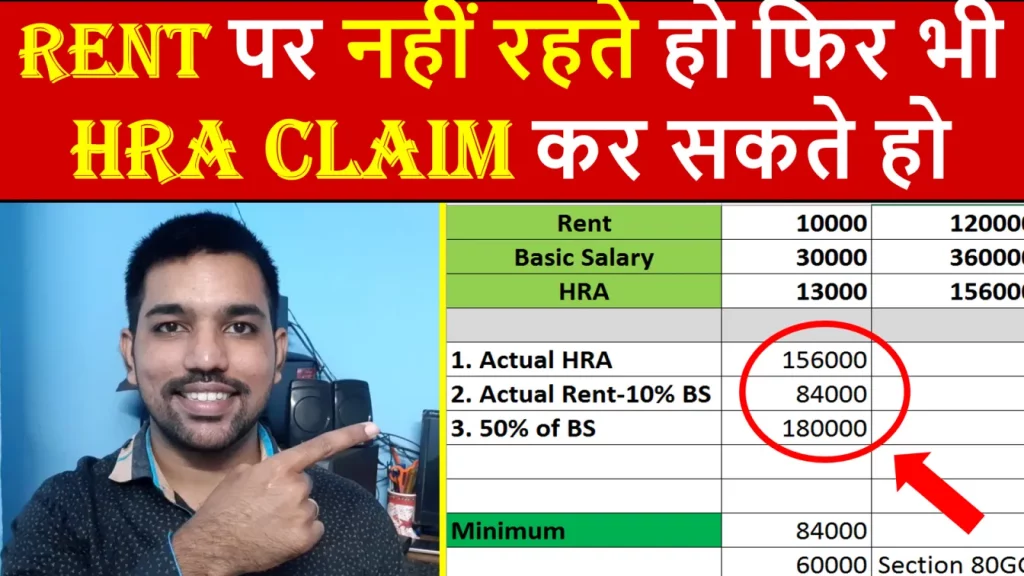

Know the HRA Exemption Rules how to calculate HRA on your salary Check out the eligibility criteria understand how HRA helps you to utilise Section 80C Our HRA exemption calculator will help you calculate what portion of the HRA you receive from your employer is exempt from tax and how much is taxable If you don t live in a rented accommodation but still get house rent allowance the allowance will be fully taxable

Download Hra Rebate In Income Tax Rules

More picture related to Hra Rebate In Income Tax Rules

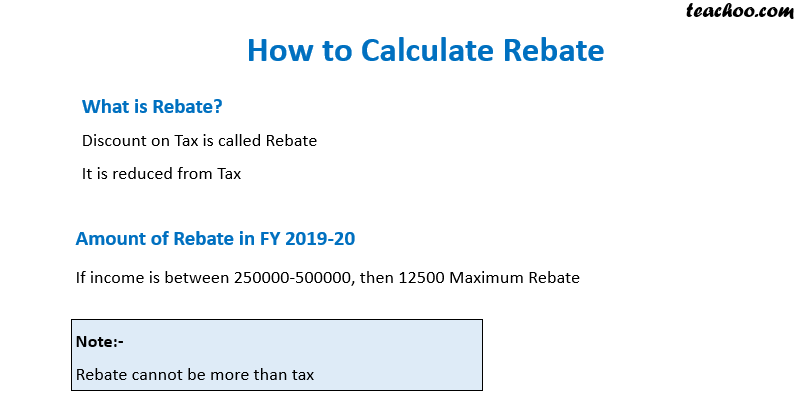

How To Calulate Rebate FY 2019 20 AY 2020 21 Chapter 4 Income Tax

https://d77da31580fbc8944c00-52b01ccbcfe56047120eec75d9cb2cbd.ssl.cf6.rackcdn.com/4f3e8d40-1fcf-4c08-b717-2df0bca83a73/rebate-1.png

HRA Exemption Calculator In Excel House Rent Allowance Calculation

https://fincalc-blog.in/wp-content/uploads/2021/09/hra-exemption-calculator-house-rent-allowance-to-save-income-tax-salaried-employees-video.webp

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/585/571/585571881/large.png

HRA is paid as a part of the salary to meet accommodation expenses Learn how to save tax by claiming HRA exemption and their rules HRA is an allowance and is subject to income tax An employee can claim exemption on his House Rent Allowance HRA under the Income Tax Act if he stays in a rented house and is in receipt of HRA from his employer In order to claim the deduction an employee must actually pay rent for the house which he occupies

Even if you have forgotten to submit rental receipts you can claim an HRA rebate while filing your income tax returns All you have to do is manually calculate the HRA tax exemption using the formula mentioned above and then report this as an expense under Section 10 13A in ITR1 Step 1 Enter your basic salary and HRA you get as per your salary slip Step 2 Enter the actual rent paid and specify whether you live in a metro city or not from the drop down The HRA calculation for income tax makes it easy for the employees to save tax

HRA Exemption Calculator For Salaried Employees FinCalC Blog

https://fincalc-blog.in/wp-content/uploads/2021/12/how-to-calculate-hra-to-save-income-tax-1024x576.webp

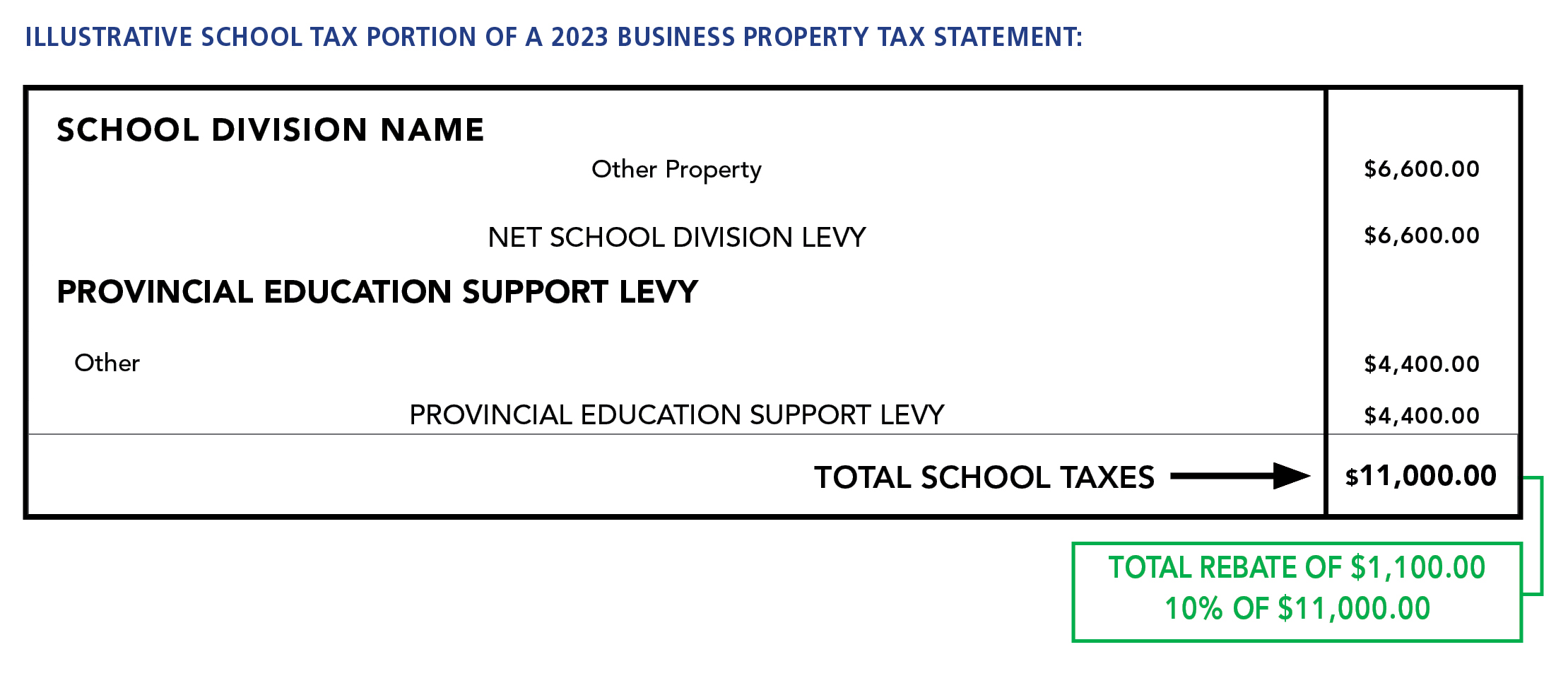

Province Of Manitoba School Tax Rebate

https://www.gov.mb.ca/asset_library/en/schooltaxrebate/white-slip-school-taxes-2023.jpg

https://cleartax.in/s/hra-house-rent-allowance

House Rent Allowance HRA is a key part of a salaried individual s compensation package This article explains HRA its tax exemption and calculation Individuals can avail HRA exemption under Section 10 13A of the Income Tax Act Self employed individuals can use Section 80GG for tax deductions on rented accommodation

https://economictimes.indiatimes.com/wealth/tax/...

HRA tax exemption rules The HRA tax exemption reduces the total salary before calculating taxable income helping employees save on taxes It s important to note that if an employee lives in their own house or does not pay any rent the HRA received from the employer is fully taxable

House Rent Allowance What Is HRA HRA Exemptions Deductions Tax2win

HRA Exemption Calculator For Salaried Employees FinCalC Blog

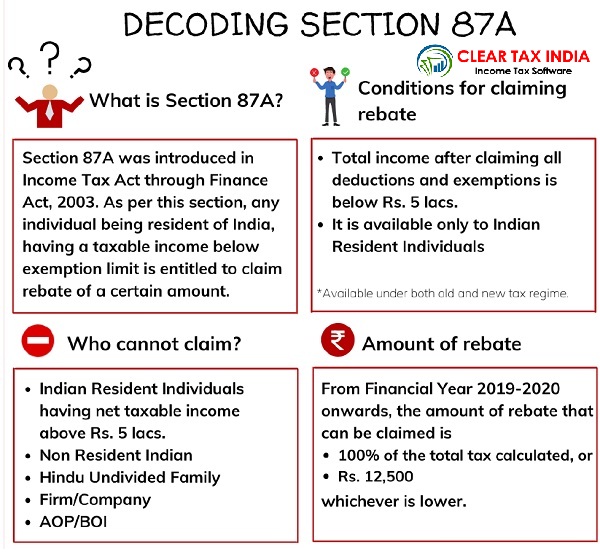

Income Tax Rebate Under Section 87A

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

House Rent Allowance

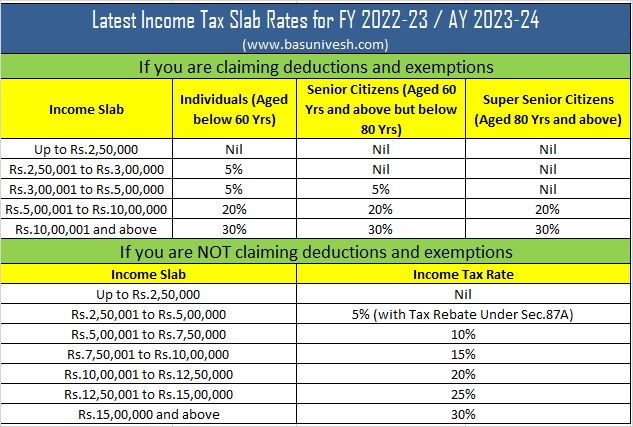

Budget 2022 Different Types Of Taxable Incomes Income Tax Slab Rates

Budget 2022 Different Types Of Taxable Incomes Income Tax Slab Rates

HRA Calculation Taxability Hindi Video House Rent Allowance Tax

Who Should File A Revised ITR Is There A Penalty

Rent Receipt Format A Complete Guideline

Hra Rebate In Income Tax Rules - Section 80GG of the Income Tax Act in India allows individuals who pay rent but don t receive House Rent Allowance HRA to claim deductions for that rent on their taxes This benefit applies to both salaried individuals and self employed persons