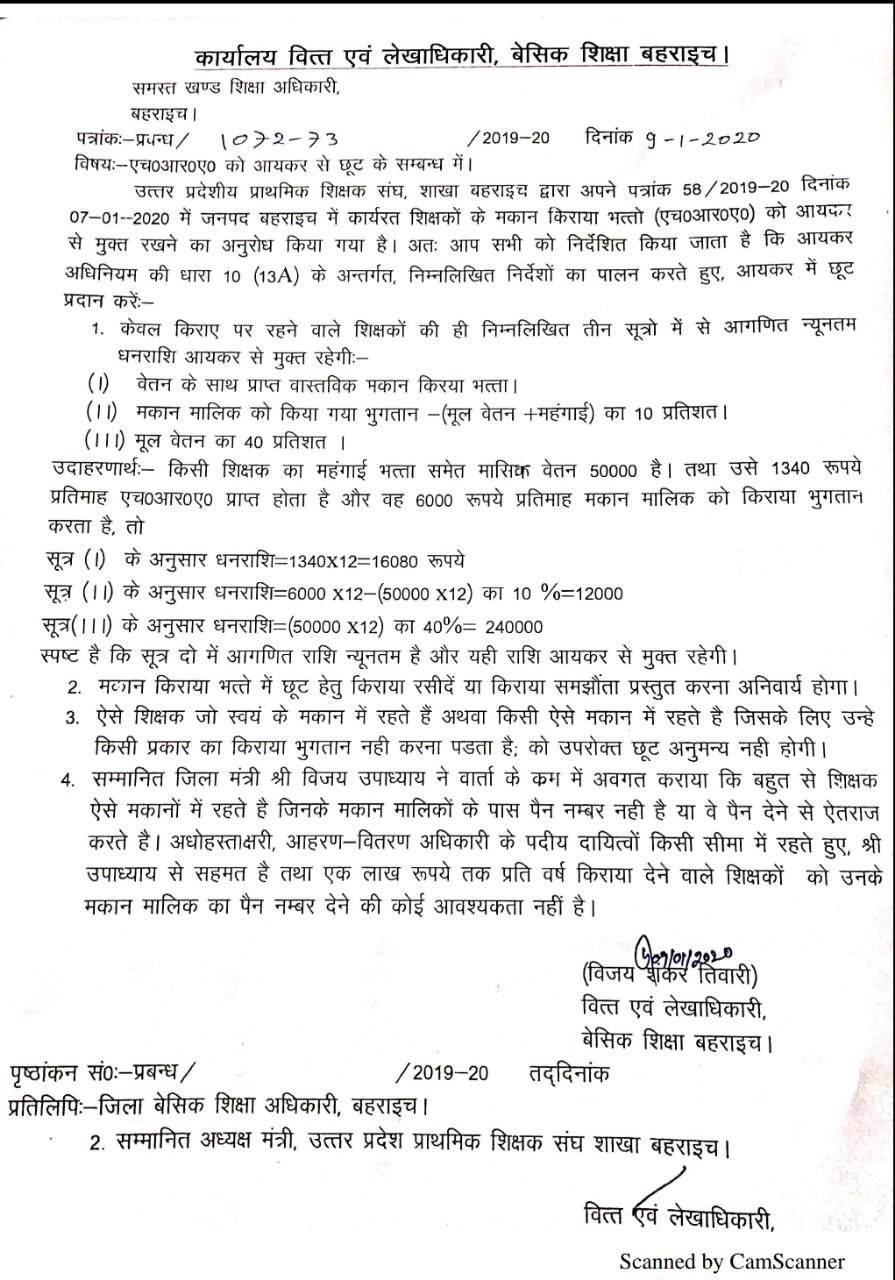

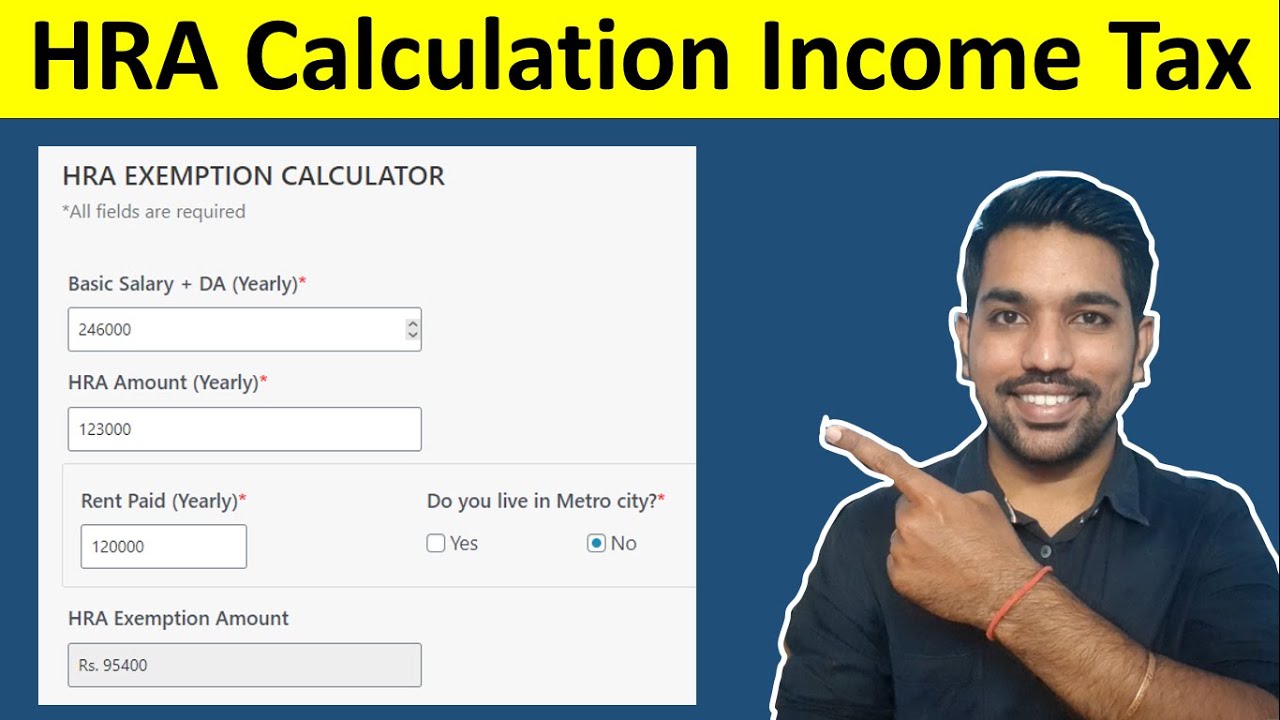

Hra Rebate In Income Tax Web 22 sept 2022 nbsp 0183 32 Tax Benefits of HRA HRA deduction under Section 10 13A of the ITA has the following benefits The biggest advantage of the HRA rebate is that it reduces your

Web 5 mai 2020 nbsp 0183 32 1 CONDITIONS FOR CLAIMING HRA EXEMPTION Salaried Individual only can claim HRA Self employed cannot claim HRA However Self Employed can also claim deduction of Rent paid under Web Calculate You can claim HRA while tax filing even if you have not submitted rent receipts to your HR clearTax will help you claim this while e filing If you don t receive HRA you can

Hra Rebate In Income Tax

Hra Rebate In Income Tax

https://4.bp.blogspot.com/-jcXR46JGbOw/WhOAD1L3J8I/AAAAAAAAF4A/ISuIxQnFWx4USLckHZYtmPvfE-NtuKIlwCLcBGAs/s1600/Form%2B16%2BPart%2BB.jpg

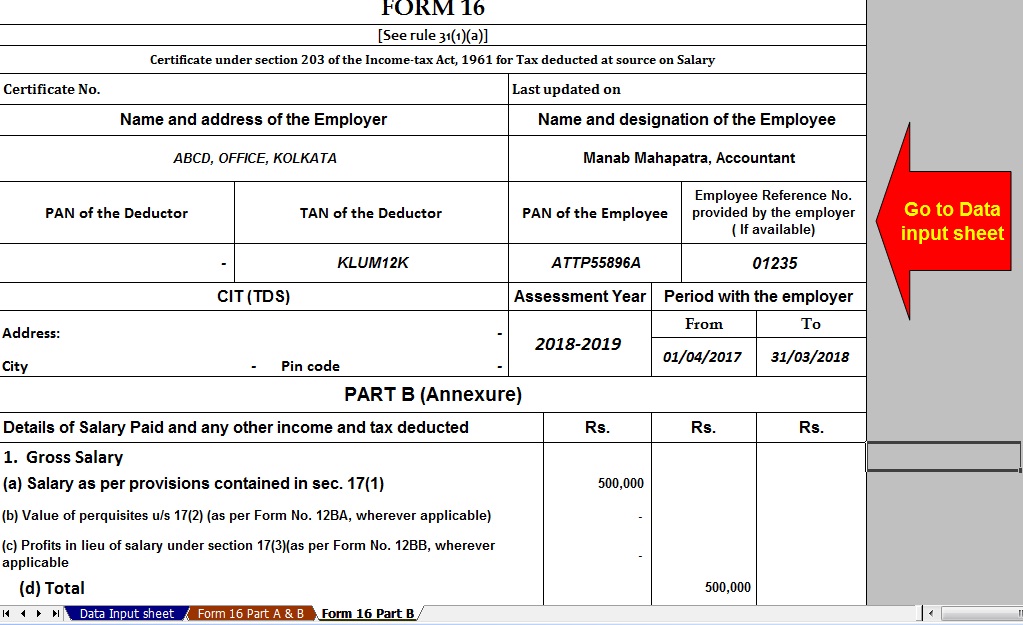

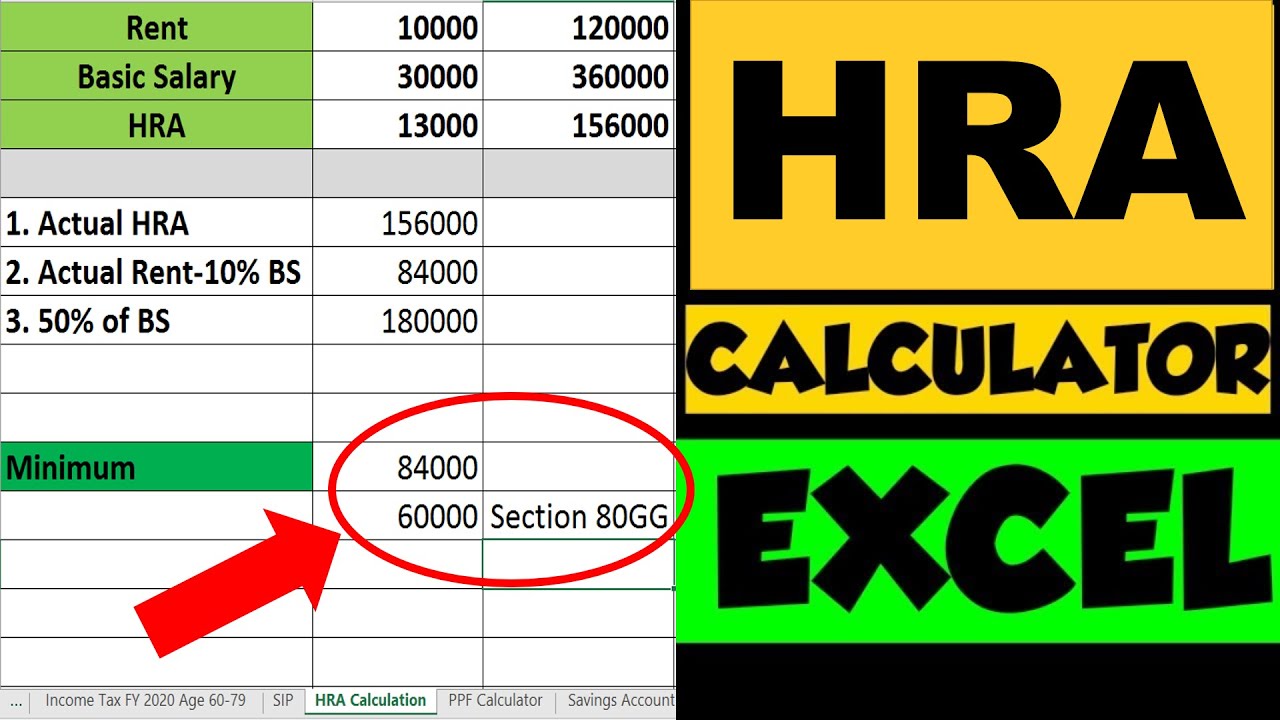

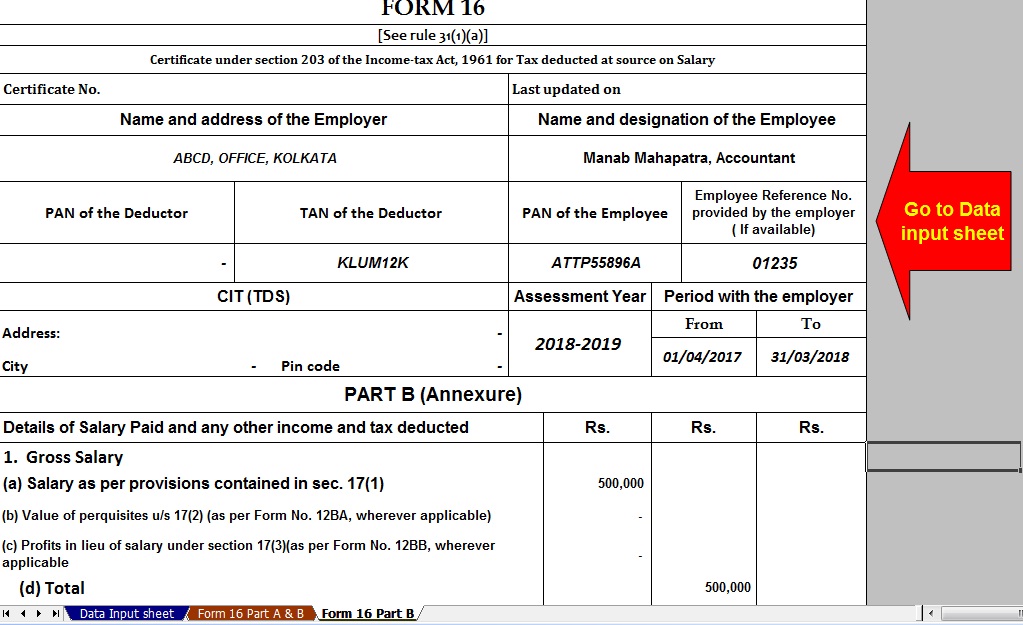

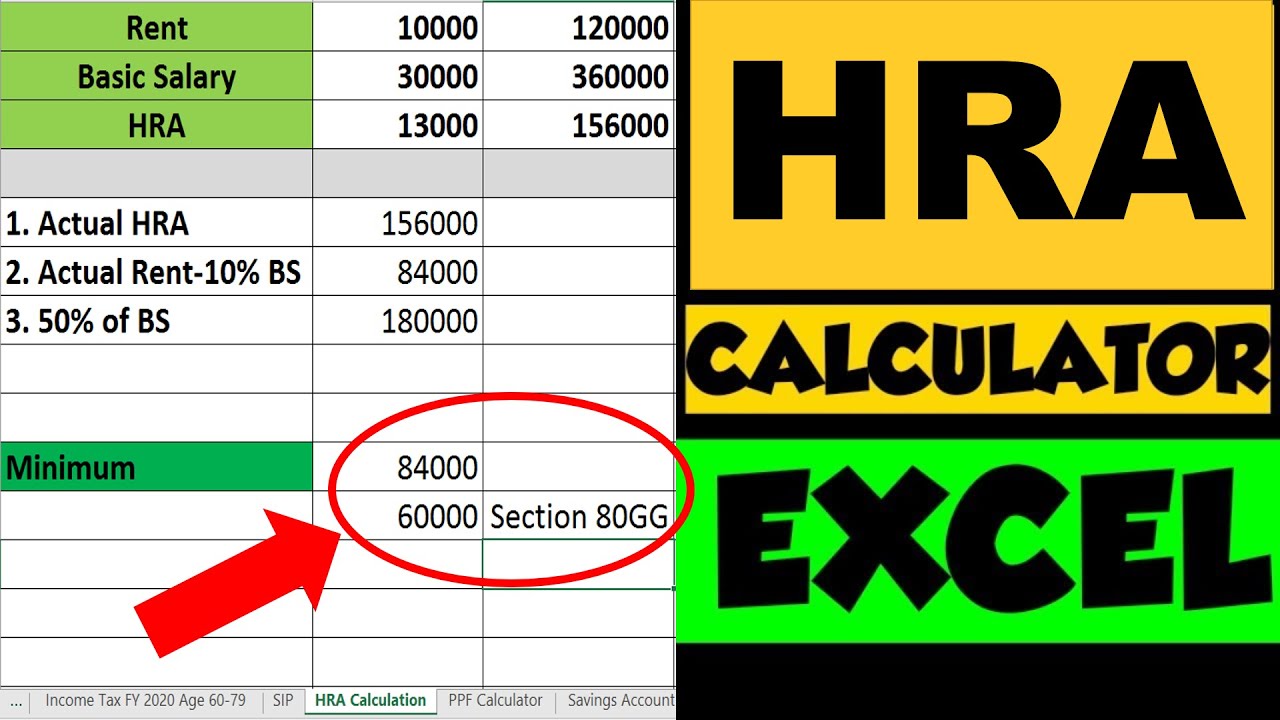

HRA Exemption Excel Calculator For Salaried Employees House Rent

https://i.ytimg.com/vi/8nnBiRzYQzI/maxresdefault.jpg

House Rent Allowance HRA Receipt Format For Income Tax TEACHER HARYANA

http://1.bp.blogspot.com/-ewd4gmFZDiM/Vr60xpZ2a2I/AAAAAAAARCw/IgWwp8ctHws/s1600/IMG-20160213-WA0009-788169.jpg

Web Although it is a part of your salary HRA unlike basic salary is not fully taxable Subject to certain conditions a part of HRA is exempted under Section 10 13A of the Income tax Web 26 janv 2022 nbsp 0183 32 The income tax rules allow deduction of the salary component received as HRA from the taxable salary income However HRA is fully taxable for an employee not living in a rented house

Web HOUSE RENT ALLOWANCE Basic salary DA forming part of salary Commission as of turnover achieved by the employee HRA Received Rent Paid Tick if residing in metro Web The old tax regime allows an individual to save income tax via various deductions and tax exemptions such as sections 80C 80D 80CCD 1b 80TTA HRA and LTA Standard deduction under the old tax

Download Hra Rebate In Income Tax

More picture related to Hra Rebate In Income Tax

Income Tax HRA

https://cdn.zeebiz.com/hindi/sites/default/files/inline-images/HRA.jpg

How To Rebate In HRA In Income Tax 2022

https://blogger.googleusercontent.com/img/a/AVvXsEgXrgE31VjACIISfpSa17566pKHsUahqfZcuE_qmK0iX4jVYf9ovQSqiHrQdUT3fgPaS7c8e6f2IY-4l5UBzNH8oohEmIgyGgaSbobfCrm-vF95bGebe8RYdnj1DJUWNsR8JrN2JscJwBoe13dhI2txEHKYoyWG7omsGX7bDHFNJNpwuDZ_ejiUWnZL=s16000

How To Get Full Rebate On HRA In Income Tax

https://4.bp.blogspot.com/-MstZZqwHN2I/WJs7rd_yvRI/AAAAAAAADPI/D_ZiTxYk4Vsn0NSbSomUZGbQCM6JL6AjwCLcB/w1200-h630-p-k-no-nu/hra-exemptoin.JPG

Web 21 juil 2023 nbsp 0183 32 A part of HRA can be claimed as a tax deduction according to Section 10 13A of the Income Tax Act if the following eligibility criteria are met You should be a Web 10 juil 2022 nbsp 0183 32 Watch the video to learn how to calculate your House Rent Allowance HRA tax exemption in a minute Download the all new Business Standard app https bit

Web HRA exemption in income tax for self employed and other employees If you live in rented accommodation and you are A self employed individual or Salaried individual but your Web The Income Tax Act Section 10 13A provides for HRA exemption of tax The deduction will be the lowest among the following The House Rent Allowances that the employer

How To Get MORE Out Of Your HRA Rediff Getahead

http://im.rediff.com/getahead/2011/jun/21table3.gif

Complete Guide On Rent Slips Receipts And Claim HRA Tax House Rent

https://tax2win.in/assets-new/img/guides/rent-receipt/9.jpg

https://www.etmoney.com/learn/saving-schemes/house-rent-allowance

Web 22 sept 2022 nbsp 0183 32 Tax Benefits of HRA HRA deduction under Section 10 13A of the ITA has the following benefits The biggest advantage of the HRA rebate is that it reduces your

https://taxguru.in/income-tax/house-rent-all…

Web 5 mai 2020 nbsp 0183 32 1 CONDITIONS FOR CLAIMING HRA EXEMPTION Salaried Individual only can claim HRA Self employed cannot claim HRA However Self Employed can also claim deduction of Rent paid under

How To Calculate HRA House Rent Allowance Exemption U s 10 13A As

How To Get MORE Out Of Your HRA Rediff Getahead

House Rent Allowance HRA Tax Exemption HRA Calculation Rules

HRA Calculation In Income Tax House Rent Allowance Calculator

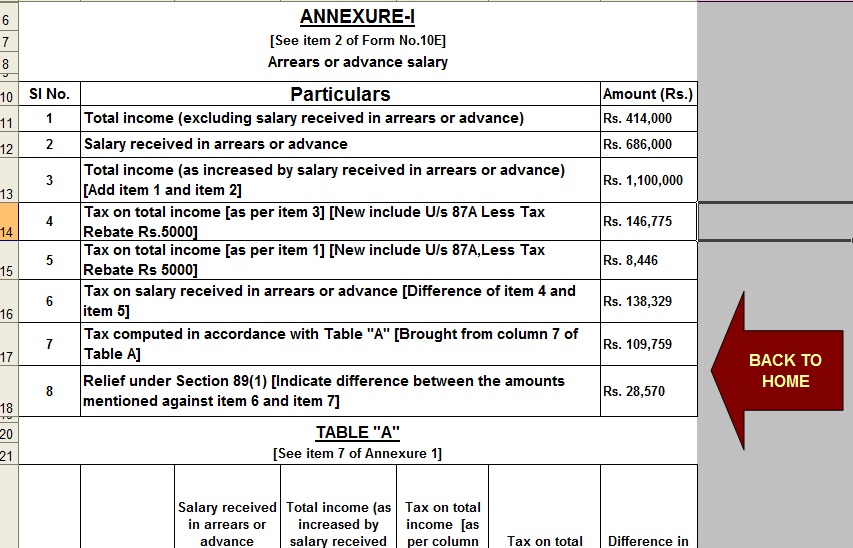

Download Automated Tax Computed Sheet HRA Calculation Arrears

Danpirellodesign Income Tax Rebate On Home Loan And Hra

Danpirellodesign Income Tax Rebate On Home Loan And Hra

Documents Required To Claim HRA CommonFloor Groups Invoice Template

Income Tax Department Puts House Rental Allowance HRA Exemption Rules

HRA Calculation Everything You Need To Know

Hra Rebate In Income Tax - Web 26 janv 2022 nbsp 0183 32 The income tax rules allow deduction of the salary component received as HRA from the taxable salary income However HRA is fully taxable for an employee not living in a rented house