Income Tax Deducted Canada Your taxable income is your income after various deductions credits and exemptions have been applied There are also various tax credits deductions and benefits available

Use our Canada Salary Calculator to find out your take home pay and how much tax federal tax provincial tax CPP QPP EI premiums QPIP you owe Estimate your income taxes with our free Canada income tax calculator See your tax bracket marginal and average tax rates payroll tax deductions tax refunds and taxes

Income Tax Deducted Canada

Income Tax Deducted Canada

https://www.rkbaccounting.ca/wp-content/uploads/2020/12/Personal-Income-tax.jpg

2020 2023 Form Canada T1213 Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/535/276/535276248/large.png

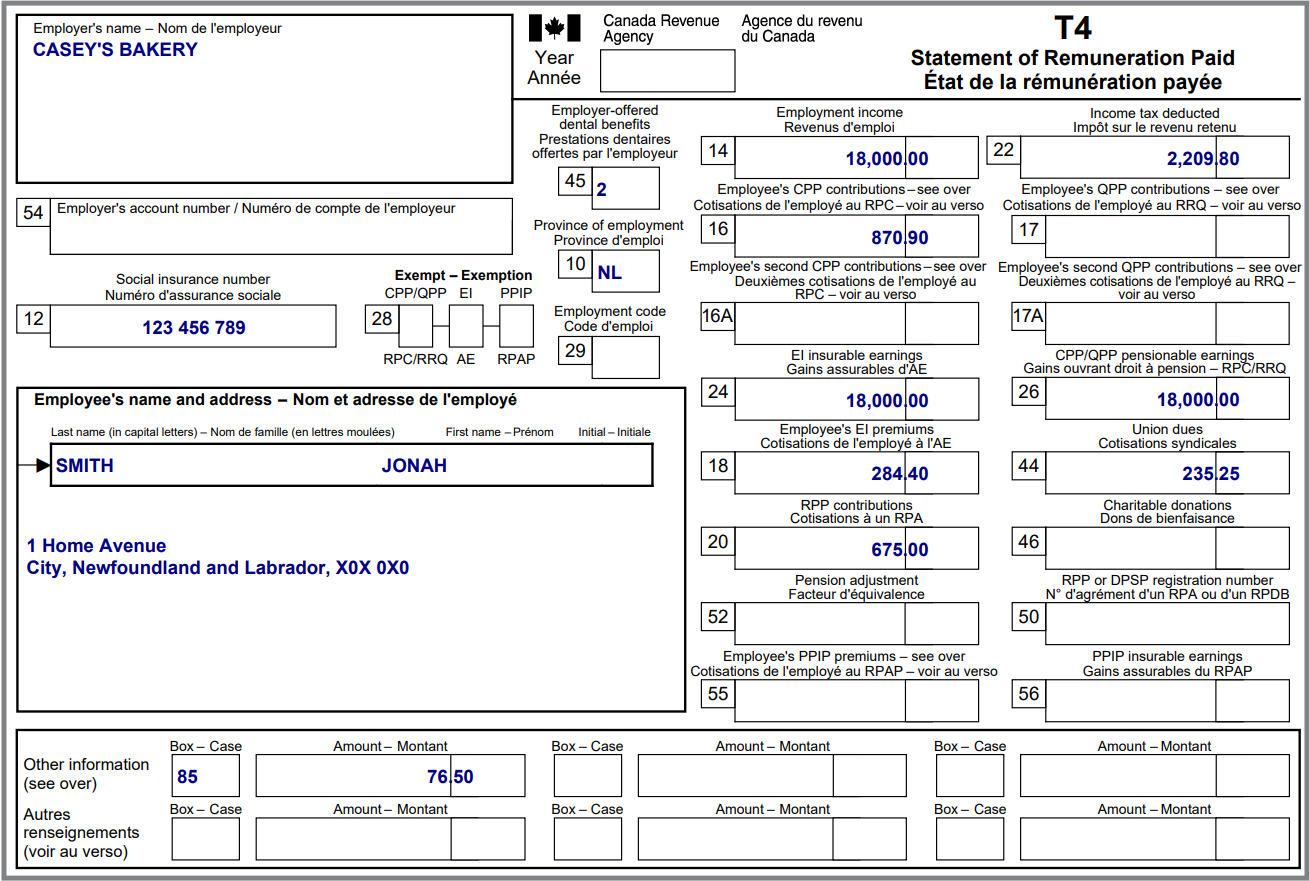

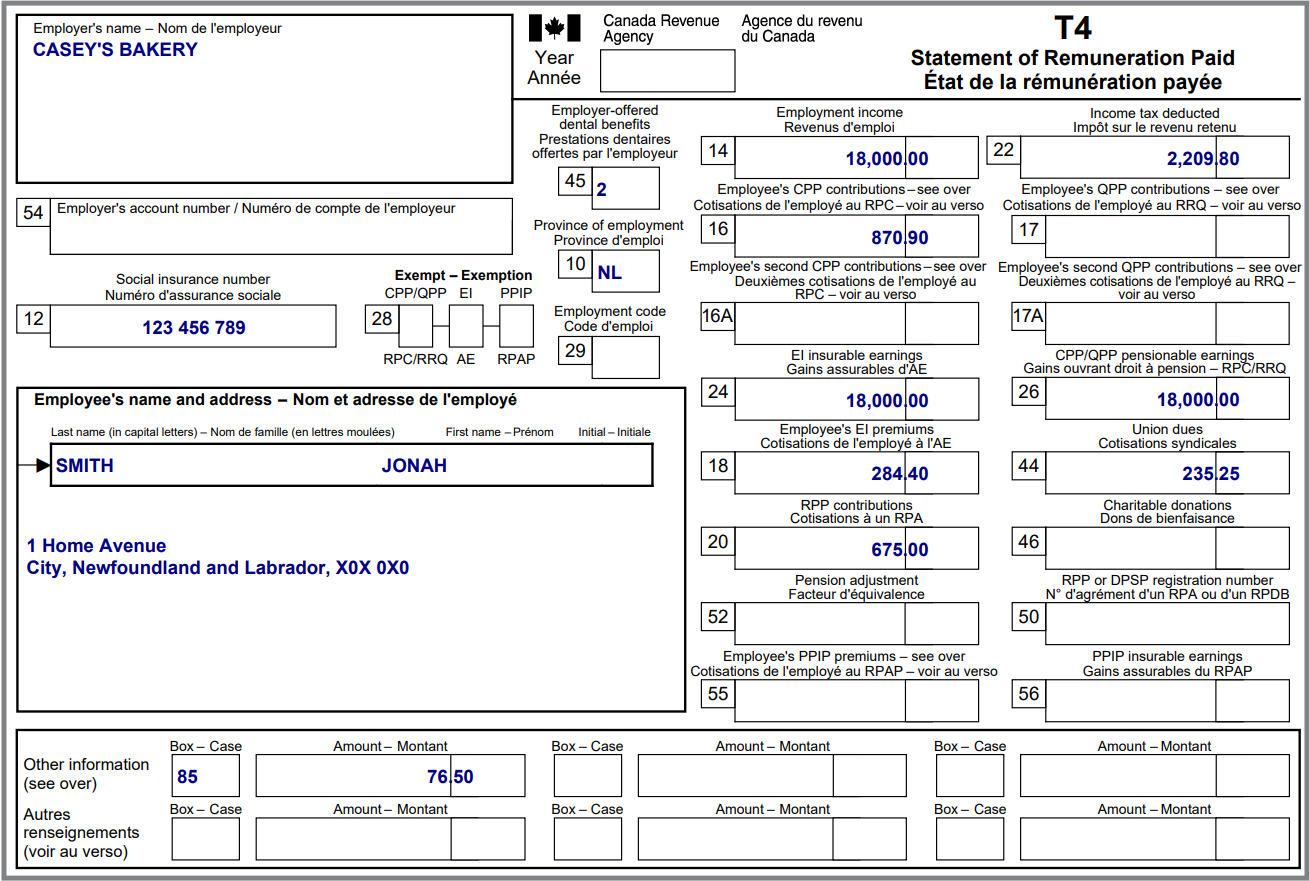

What Is A T4 Slip Canada ca

https://www.canada.ca/content/canadasite/en/revenue-agency/services/tax/individuals/educational-programs/learning-about-taxes/learning-material/module-4-completing-a-simple-tax-return/your-t4-information-slip/_jcr_content/par/img_0_0/image.img.jpg/1549471504001.jpg

Make a payment to the CRA Personal income tax rates File income tax get the income tax and benefit package and check the status of your tax refund Business or By law an employer must deduct the following amounts from your employment earnings Income tax Employee contributions to Employment Insurance EI Employee

With income sources such as employment income income tax is deducted from your income and remitted to the CRA throughout the year With other sources such as self For both employed and self employed individuals the deductible contribution to an RRSP is generally 18 of the total employment self employment and rental

Download Income Tax Deducted Canada

More picture related to Income Tax Deducted Canada

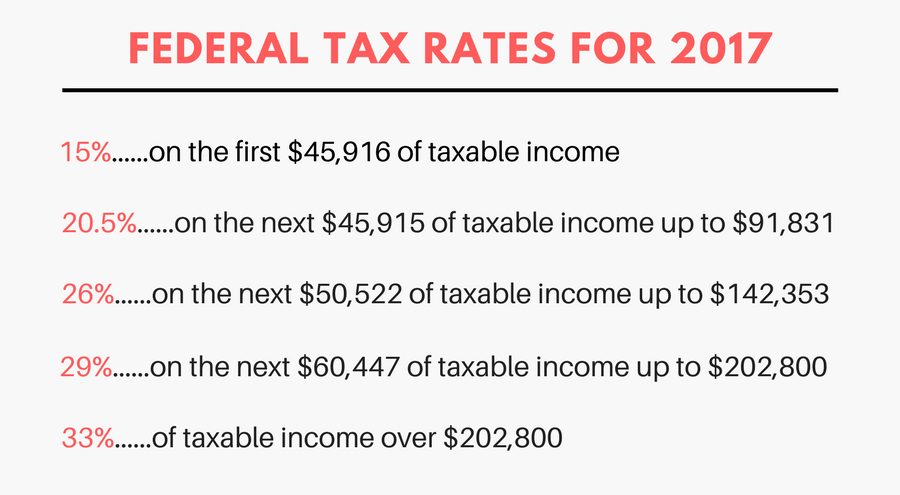

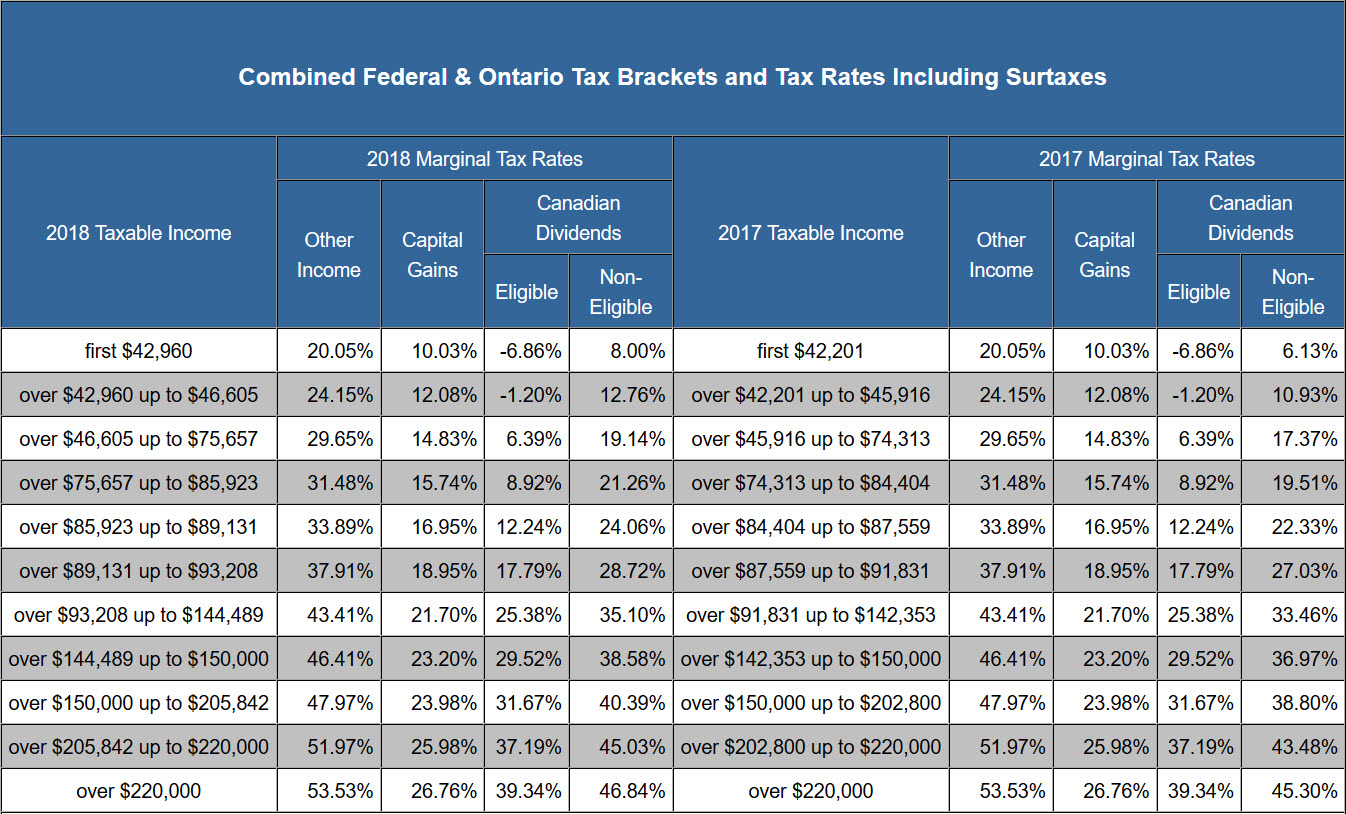

The Basics Of Tax In Canada WorkingHolidayinCanada

https://workingholidayincanada.com/wp-content/uploads/2020/02/Federal-rates-min.jpg

Income Tax Rates For The Self Employed 2020 2021 TurboTax Canada Tips

https://turbotax.intuit.ca/tips/images/self-employed-taxes-canada.jpg

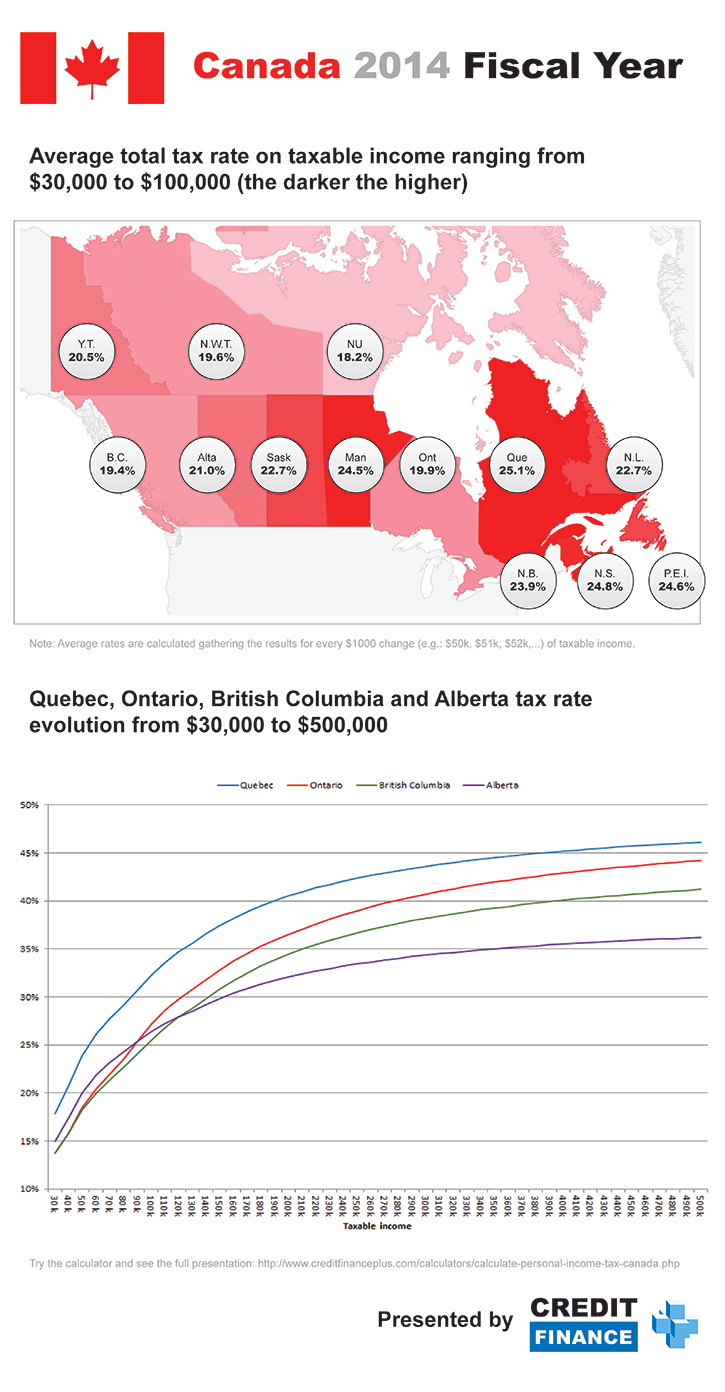

Infographic Canada 2014 Fiscal Year Comparing Personal Income Tax

http://www.creditfinanceplus.com/infographics/images/canada-income-taxes-2014.png

The Canada Revenue Agency allows you to deduct amounts from the tax that you owe based on your taxable income These calculations are carried out in Get a quick free estimate of your 2023 income tax refund or taxes owed using our income tax calculator Plus explore Canadian and provincial income tax FAQ and resources

Individuals resident in Canada are subject to Canadian income tax on worldwide income Relief from double taxation is provided through Canada s When it comes to taxes there s no one size fits all scenario That s why t here are over 400 deductions and credits that the CRA outlines We ve rounded up the

Starting To Work Learn About Your Taxes Canada ca

https://www.canada.ca/content/dam/cra-arc/serv-info/tax/individuals/edu-prgms/mdls-xrcss/jonah-t4-en.png

What s The Difference Between A Tax Credit And A Tax Deduction In

https://loanscanada.ca/wp-content/uploads/2017/07/Federal-tax-rates-for-2017.png

https://www.canada.ca/en/revenue-agency/services...

Your taxable income is your income after various deductions credits and exemptions have been applied There are also various tax credits deductions and benefits available

https://salaryaftertax.com/ca

Use our Canada Salary Calculator to find out your take home pay and how much tax federal tax provincial tax CPP QPP EI premiums QPIP you owe

Income Tax Deducted In Canada Accountants In Calgary

Starting To Work Learn About Your Taxes Canada ca

Your T4 Information Slip Canada ca

Minimum Tax Bracket Canada Are You Ready Greater Fool Authored

The Handy Income Tax Deductions Checklist To Help You Maximize Your

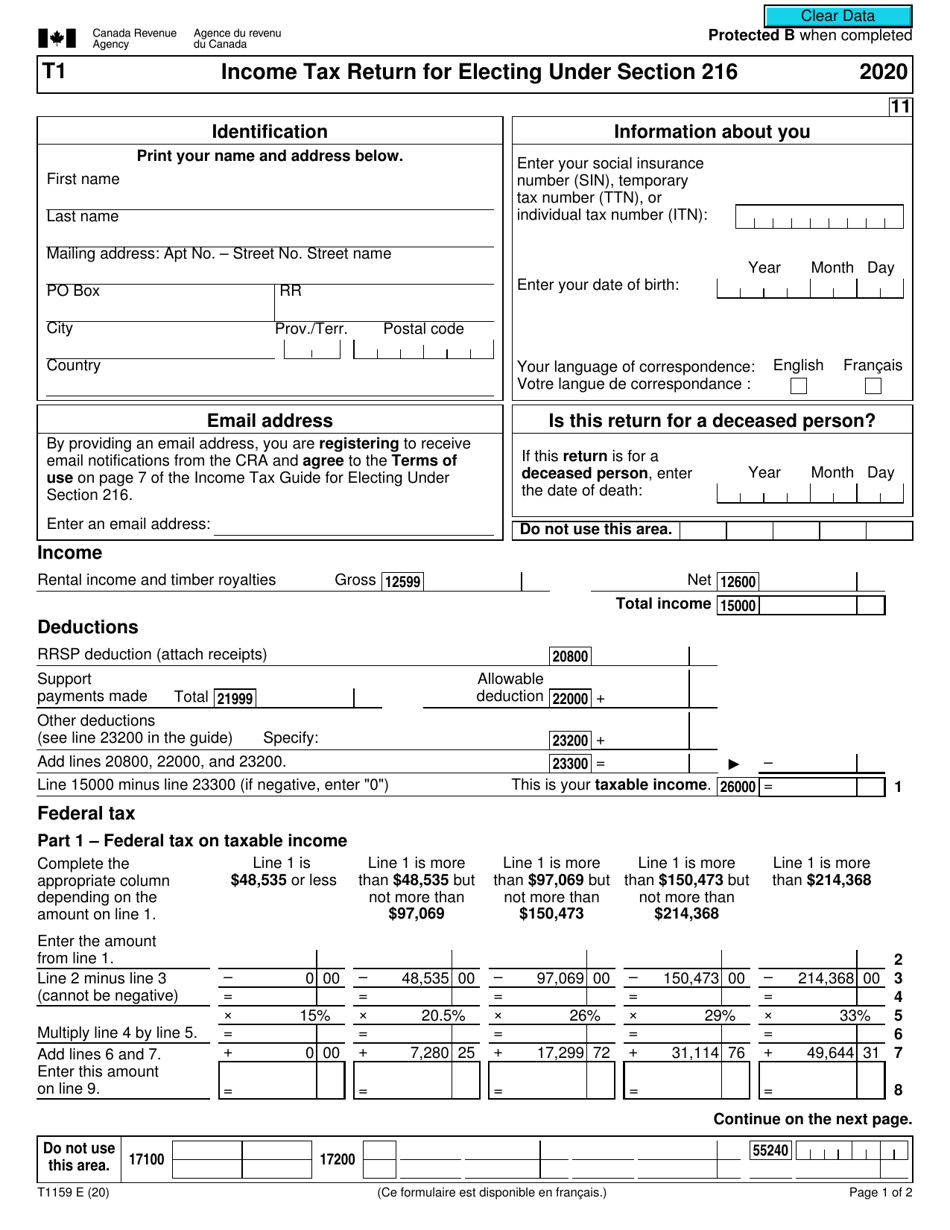

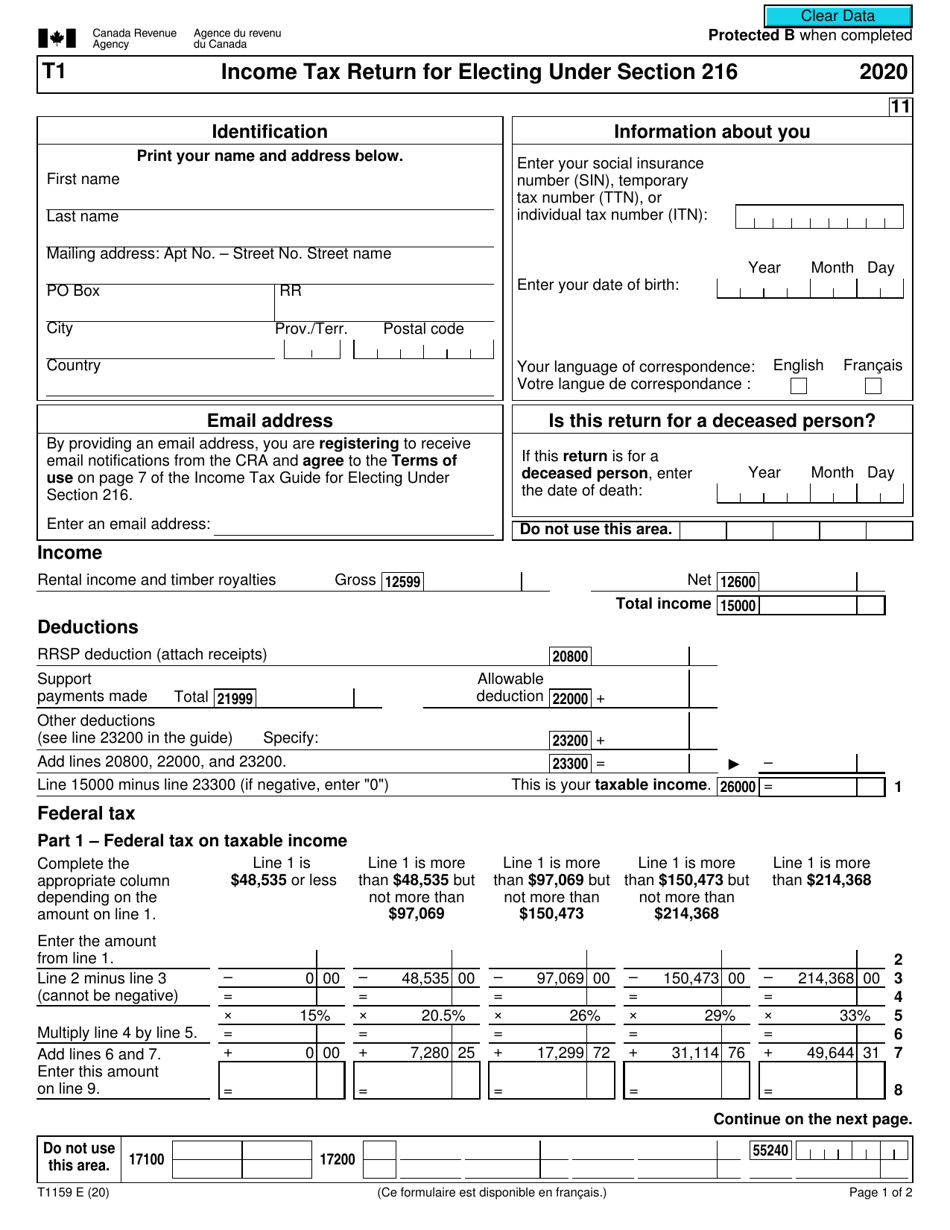

Form T1159 Download Fillable PDF Or Fill Online Income Tax Return For

Form T1159 Download Fillable PDF Or Fill Online Income Tax Return For

Canadian Provincial Taxes Canada Province Tax Rates GST PST HST

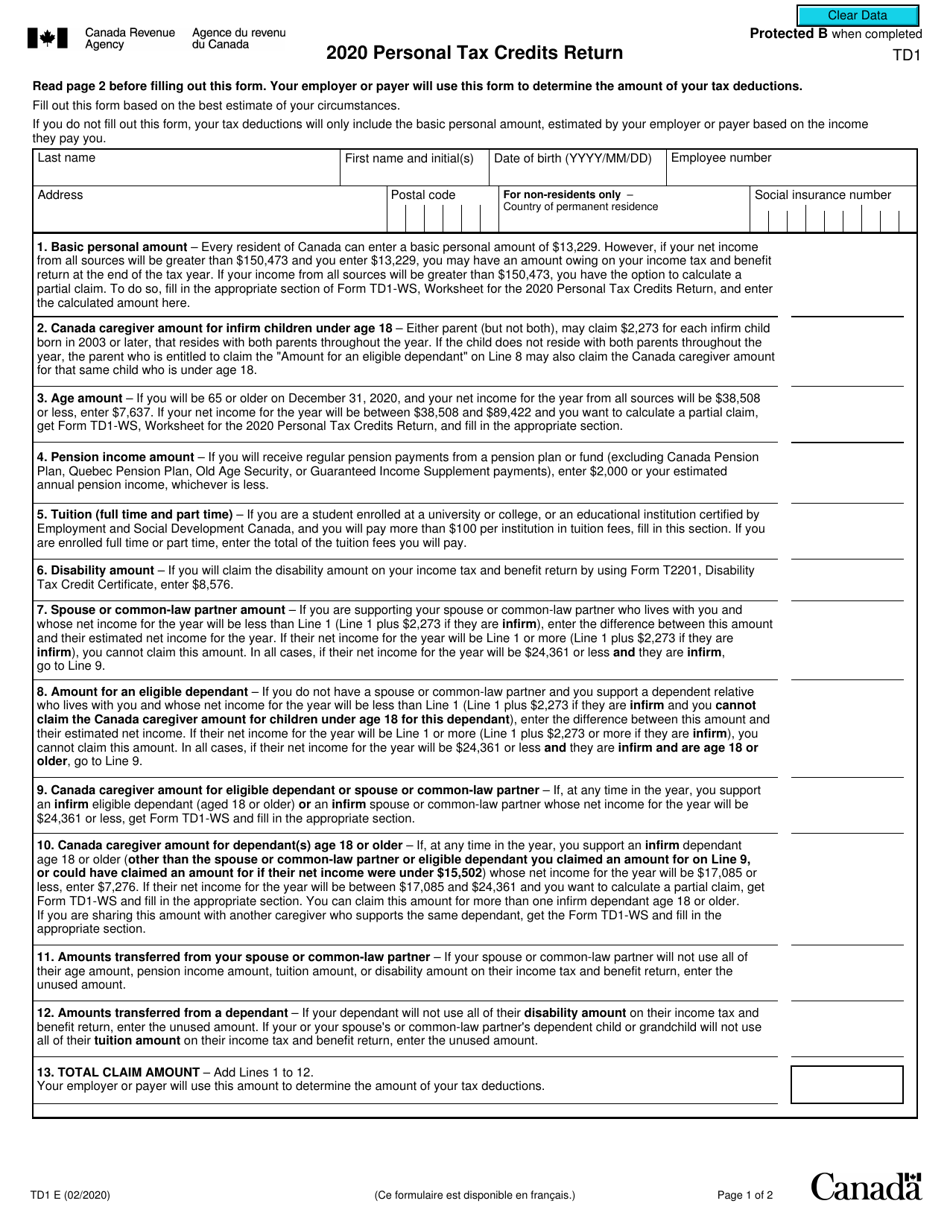

Form TD1 2020 Fill Out Sign Online And Download Fillable PDF

2021 Provincial Tax Rates Frontier Centre For Public Policy

Income Tax Deducted Canada - With income sources such as employment income income tax is deducted from your income and remitted to the CRA throughout the year With other sources such as self