Total Income Tax Deducted Canada The Payroll Deductions Online Calculator PDOC calculates Canada Pension Plan CPP Employment Insurance EI and tax deductions based on the information you provide

Estimate your income taxes with our free Canada income tax calculator See your tax bracket marginal and average tax rates payroll tax deductions tax refunds and taxes Canada income tax calculator 2023 Get a quick free estimate of your 2023 income tax refund or taxes owed using our income tax calculator Plus explore Canadian and

Total Income Tax Deducted Canada

Total Income Tax Deducted Canada

https://talkingcents.ca/wp-content/uploads/2022/07/taxes.png

Income Tax DEDUCTED From Salary What You Can Do To SAVE INCOME TAX

https://i.ytimg.com/vi/Ko-mtUlt4NE/maxresdefault.jpg

Mandatory Government Deductions From Salary SSS Philhealth Pag Ibig

https://i.ytimg.com/vi/lBO3PaW69Mc/maxresdefault.jpg

The Basic Canadian Income Tax Calculator will display taxes payable for every province and territory for 6 years as well as the marginal tax rate for each source of income for To get an estimate of your total net income and income tax use an online tax calculator How to pay income tax online With income sources such as employment income

Free simple online income tax calculator for any province and territory in Canada 2023 Use it to estimate how much provincial and federal taxes you need to pay By law an employer must deduct the following amounts from your employment earnings Income tax Employee contributions to Employment Insurance EI Employee

Download Total Income Tax Deducted Canada

More picture related to Total Income Tax Deducted Canada

Pin On Income Tax Blogs

https://i.pinimg.com/originals/7f/63/ec/7f63ec88885e63841ab2aa85433df846.jpg

How To Calculate Income Tax On Salary With Payslip Example Income Tax

https://i.ytimg.com/vi/USW68EaURfg/maxresdefault.jpg

APTF VIZAG Income Tax Advance Tax Deducted From Employees Every Month

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEgKn5hNNTRWcRHTNc00CAAY8q1jGtVwryq4dmsl2k2s0OzNJ06ROcp1qBVuSWtMETXm0CmR4lB0rptAwKVqMMc5lJzsszBv0linZdseSBmc0Cw_E4zNzWlYWhE5UbkQgZ0ZrRCDSQIJf4E6GfLZrRDEQWue-UxEZs3TTc7Ei3b7ULoTCdCjTIIUdXNeXg/s1226/IMG-20220910-WA0012.jpg

To calculate Net Income Before Adjustments line 23400 on the tax return deduct the following items from Total Income for Tax Purposes registered pension plan deduction Free income tax calculator to estimate quickly your 2023 and 2024 income taxes for all Canadian provinces Find out your tax brackets and how much Federal and

Tax deductions are a way to reduce your taxable income and consequently your tax bill You must meet eligibility criteria to claim a tax deduction Your tax rate will vary by how much income you declare at the end of the year on your T1 General Income Tax Return and where you live in Canada Importantly your provincial

TDS Refund Tax Deducted At Source One Time Password Income Tax Return

https://i.pinimg.com/originals/23/d3/1a/23d31ae316ff8f1ccef7e23b341742b6.png

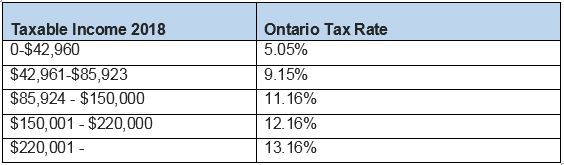

2023 Income Tax Rates Ontario Printable Forms Free Online

https://workingholidayincanada.com/wp-content/uploads/2018/09/ontario2.jpg

https://www.canada.ca/en/revenue-agency/services/e...

The Payroll Deductions Online Calculator PDOC calculates Canada Pension Plan CPP Employment Insurance EI and tax deductions based on the information you provide

https://www.wealthsimple.com/en-ca/tool/tax-calculator

Estimate your income taxes with our free Canada income tax calculator See your tax bracket marginal and average tax rates payroll tax deductions tax refunds and taxes

Tax Deducted At Source March Month Tax Deductions Income Tax Simple

TDS Refund Tax Deducted At Source One Time Password Income Tax Return

Newest TDS Charges FY 2021 22 Chart My Finance Network

Your Ultimate Guide To TDS Tax Deduction At Source Samco

All About Tax Deducted At Source Under Income Tax YouTube

T FV 3048 Invalid Sum Of Total Income Tax Deducted At Source

T FV 3048 Invalid Sum Of Total Income Tax Deducted At Source

Standard Deduction For Salary Ay 2021 22 Standard Deduction 2021

Is Tax Required To Be Deducted At Source U s 194A For Bill Discounting

Income Tax And TDS Forms Form 15CA And Form 15CB

Total Income Tax Deducted Canada - The Basic Canadian Income Tax Calculator will display taxes payable for every province and territory for 6 years as well as the marginal tax rate for each source of income for