Income Tax Deduction For Charitable Donations The charitable contributions deduction reduces taxable income by allowing individual taxpayers and businesses to deduct contributions of cash and property to qualified charitable

Charitable contributions or donations can help taxpayers to lower their taxable income via a tax deduction To claim a tax deductible donation you must itemize on your taxes Charitable contributions to qualified organizations may be deductible if you itemize deductions on Schedule A Form 1040 Itemized Deductions PDF To see if the organization you have contributed to qualifies as a charitable organization for income tax deductions use Tax Exempt Organization Search

Income Tax Deduction For Charitable Donations

Income Tax Deduction For Charitable Donations

http://bargainbabe.com/wp-content/uploads/2014/02/taxable_donations.jpg

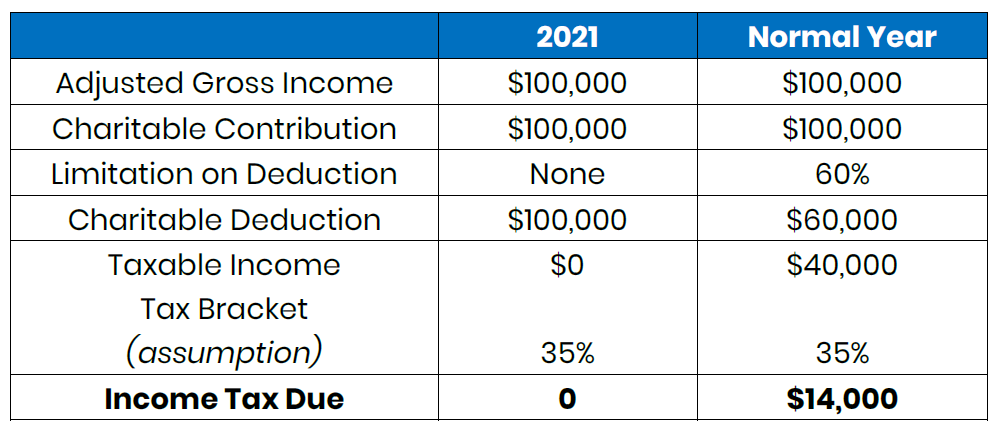

2021 Giving Tax Incentives Judi s House

https://judishouse.org/wp-content/uploads/2021/11/Charitable-Giving-Incentives-2021-Table.png

How To Legally Claim A Tax Deduction For Charitable Giving From Your

http://www.wealthsafe.com.au/wp-content/uploads/2015/02/charity-hand.jpg

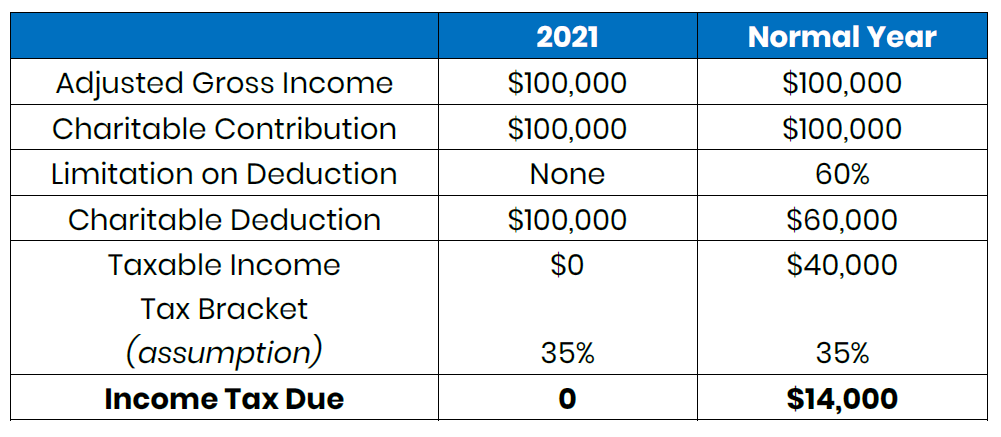

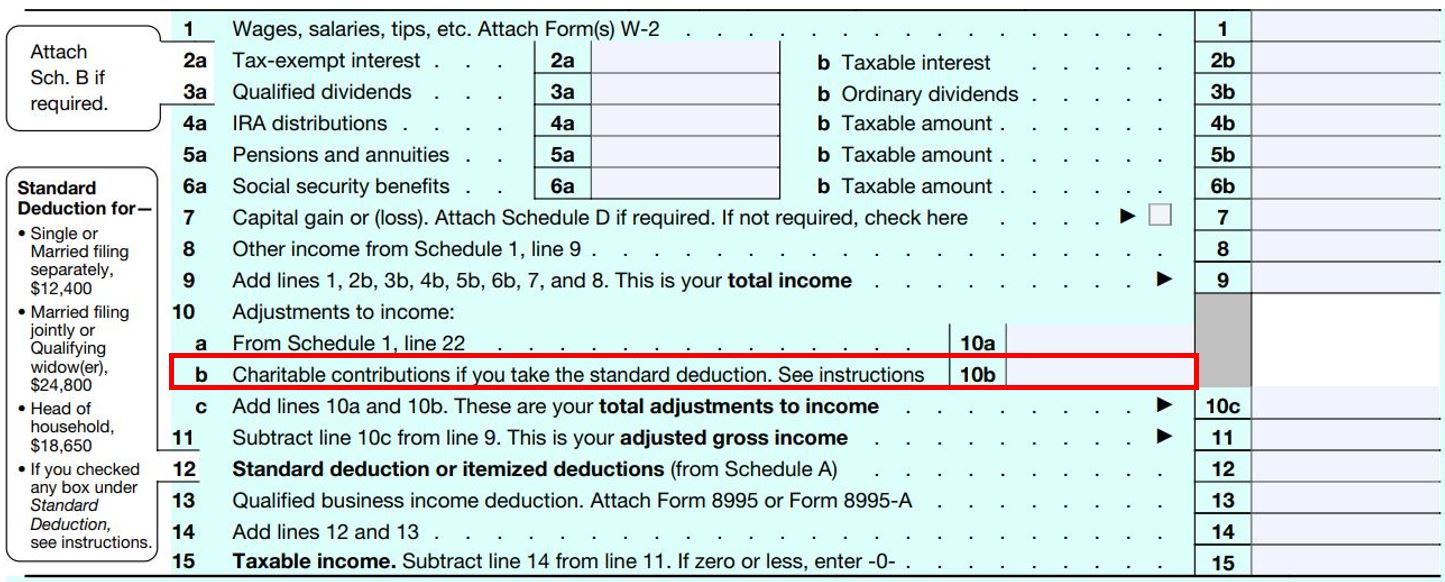

Charitable contributions must be claimed as itemized deductions on Schedule A of IRS Form 1040 The 60 AGI ceiling on charitable cash contributions to qualified charities applies for tax Introduction This publication explains how individuals claim a deduction for charitable contributions It discusses the types of organizations to which you can make deductible charitable contributions and the types of contributions you can deduct

Taxpayers can deduct charitable contributions by itemizing their deductions using Schedule A Form 1040 For non cash contributions greater than 500 the IRS requires Form 8283 to be When you donate money or property to a qualified nonprofit organization you can deduct the value of your donation up to IRS limits from your taxable income when filing your income tax return as long as you itemize deductions The IRS provides guidelines on which organizations qualify for tax deductible contributions

Download Income Tax Deduction For Charitable Donations

More picture related to Income Tax Deduction For Charitable Donations

Section 80G Deduction For Donation To Charitable Organizations

https://assets.learn.quicko.com/wp-content/uploads/2020/04/17135805/flow-chart.png

/tax-deduction-for-charitable-donations-57a5e46a3df78cf459cd2099.jpg)

Charitable Giving Take Advantage Of The Tax Deduction

https://fthmb.tqn.com/WTZF3eXFhZ0fX5VLuL9VwzDfneY=/1500x1000/filters:fill(auto,1)/tax-deduction-for-charitable-donations-57a5e46a3df78cf459cd2099.jpg

13 Tips For Making Your Charitable Donation Tax Deductible Giving Compass

https://cdn.givingcompass.org/wp-content/uploads/2017/12/19160022/tax-deduction.jpg

In that case you d claim charitable donations on Schedule A Form 1040 As a general rule you can deduct donations totaling up to 60 of your adjusted gross income AGI If donating to a charity is part of your tax plan here are a couple of tips so you can maximize your tax deductible donation before year end Featured Partner Offers Federal Filing Fee

[desc-10] [desc-11]

Charitable Tax Deductions By State Tax Foundation

https://files.taxfoundation.org/20181217150305/charitable-18.png

Printable Itemized Deductions Worksheet

https://i0.wp.com/briefencounters.ca/wp-content/uploads/2018/11/clothing-donation-tax-deduction-worksheet-together-with-clothing-deduction-worksheet-fresh-calculating-sales-tax-worksheet-of-clothing-donation-tax-deduction-worksheet.jpg

https://www. investopedia.com /terms/c/charitable...

The charitable contributions deduction reduces taxable income by allowing individual taxpayers and businesses to deduct contributions of cash and property to qualified charitable

https://www. nerdwallet.com /article/taxes/tax...

Charitable contributions or donations can help taxpayers to lower their taxable income via a tax deduction To claim a tax deductible donation you must itemize on your taxes

A 2020 Charitable Giving Strategy You Don t Want To Miss

Charitable Tax Deductions By State Tax Foundation

Donation List For Taxes Charitable Donations Tracker Tax Deductions Tax

Donation Spreadsheet In Charitable Donation Worksheet Spreadsheet

Charitable Deduction Rules For Trusts Estates And Lifetime Transfers

Charitable Contributions And How To Handle The Tax Deductions

Charitable Contributions And How To Handle The Tax Deductions

Charity Donation List Destock Track Charitable Giving Tax Deductions

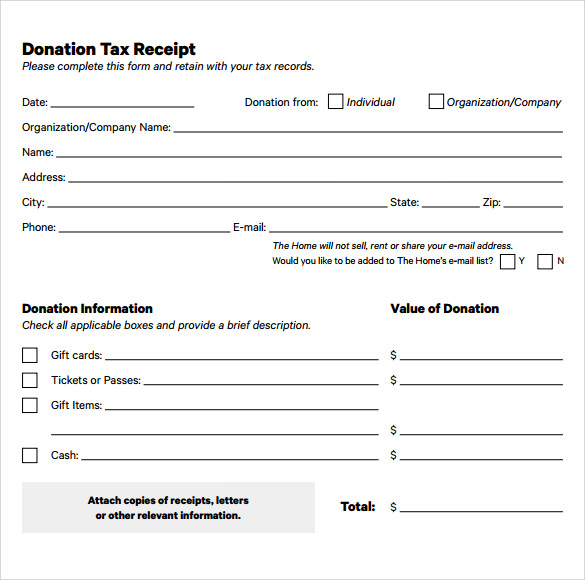

7 Donation Receipt Templates And Their Uses NeuFutur Magazine

How Many People Donate To Charity

Income Tax Deduction For Charitable Donations - When you donate money or property to a qualified nonprofit organization you can deduct the value of your donation up to IRS limits from your taxable income when filing your income tax return as long as you itemize deductions The IRS provides guidelines on which organizations qualify for tax deductible contributions