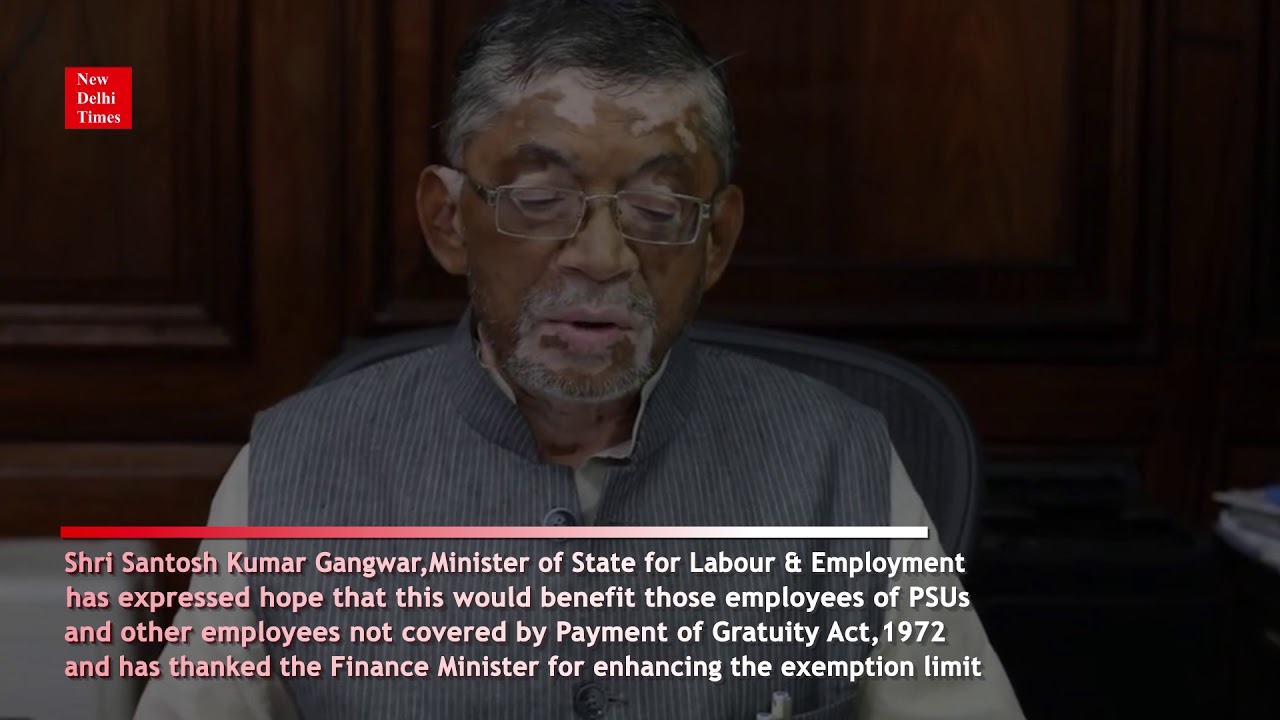

Income Tax Exemption For Handicapped Dependent Section 80U of Income Tax Act provides tax benefits to those with disabilities in India A resident with at least 40 disability can claim Rs 75 000 deduction

AS A PARENT OF A CHILD WITH A DISABILITY you may qualify for some of the following tax exemptions deductions and credits More detailed information may be found in the Section 80DDB permits a tax deduction for expenses related to the treatment of certain diseases for oneself one s spouse dependent children dependent parents

Income Tax Exemption For Handicapped Dependent

Income Tax Exemption For Handicapped Dependent

https://i.ytimg.com/vi/8JxQiLmrGvc/maxresdefault.jpg

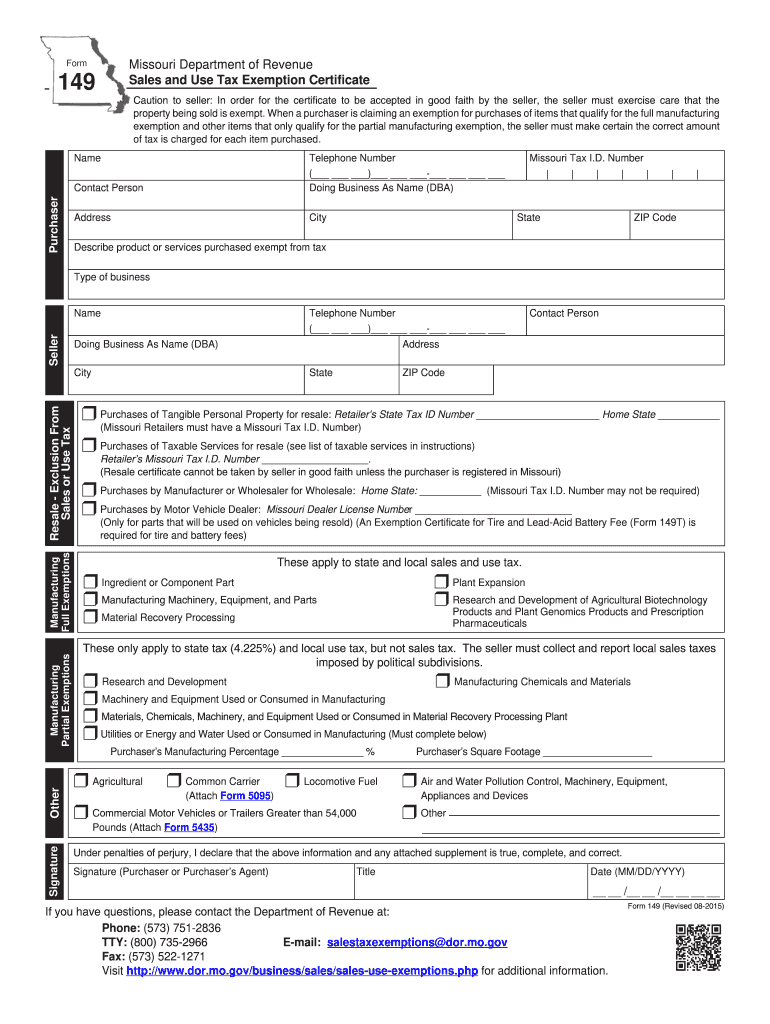

Sample Letter Tax Exemption Form Fill Out And Sign Printable PDF

https://www.signnow.com/preview/497/332/497332566/large.png

Income Tax Exemption For Physically Handicapped A Complete Guideline

https://www.inatecservices.com/wp-content/uploads/2023/03/Income-Tax-Exemption.jpg

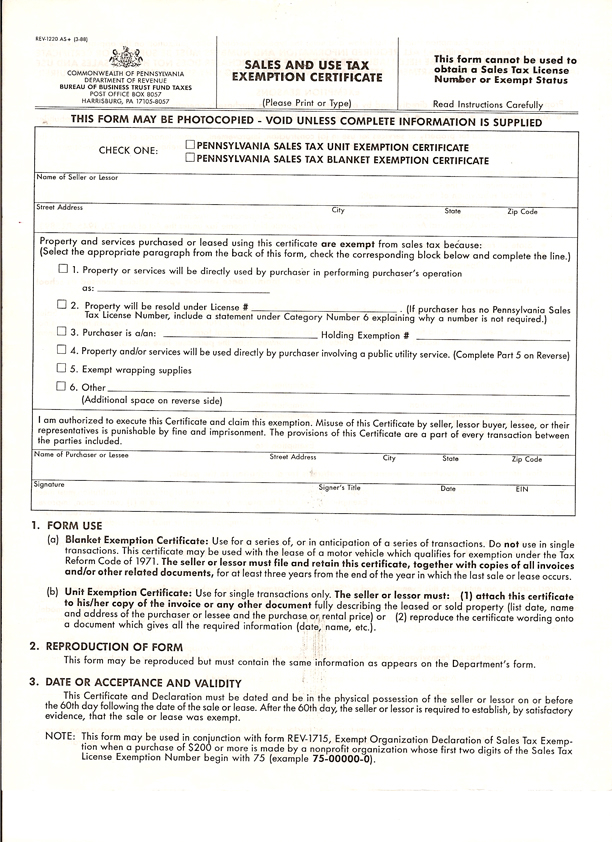

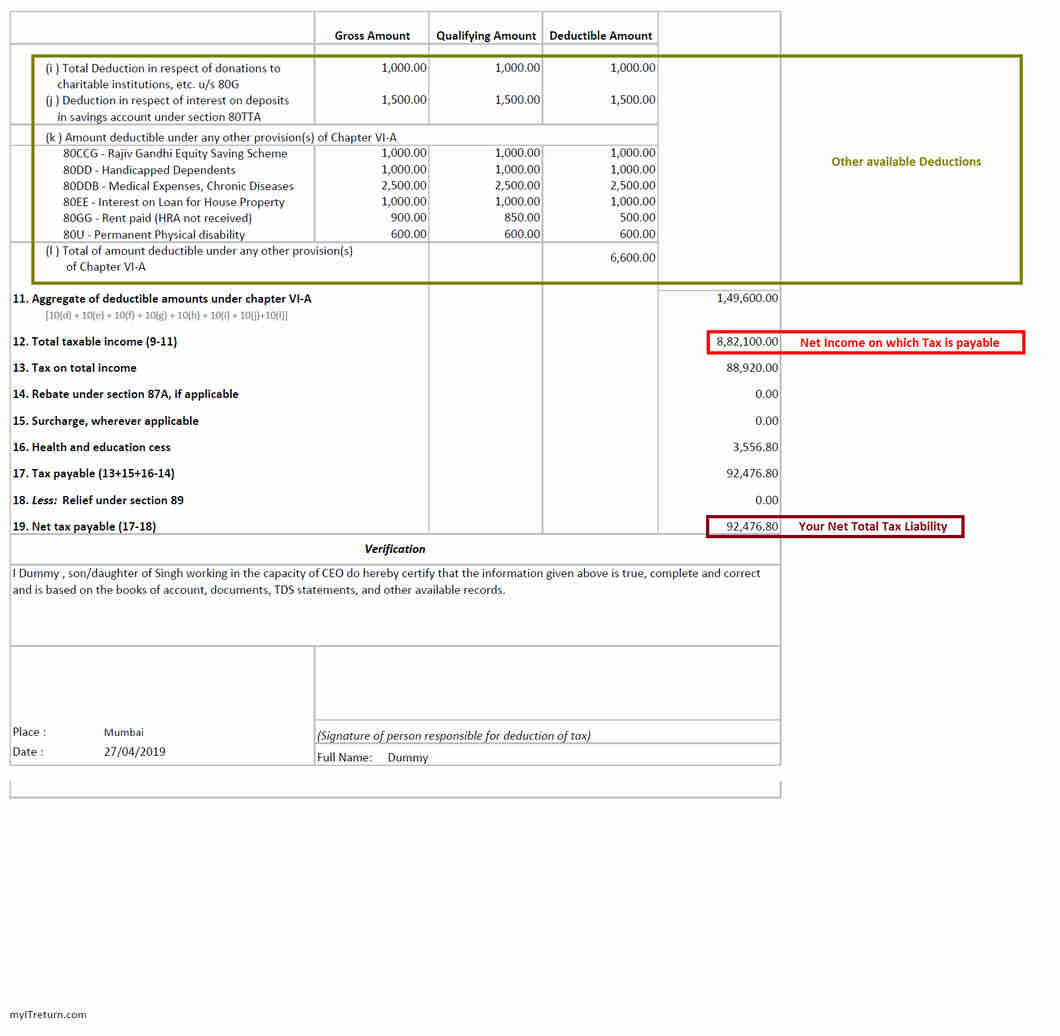

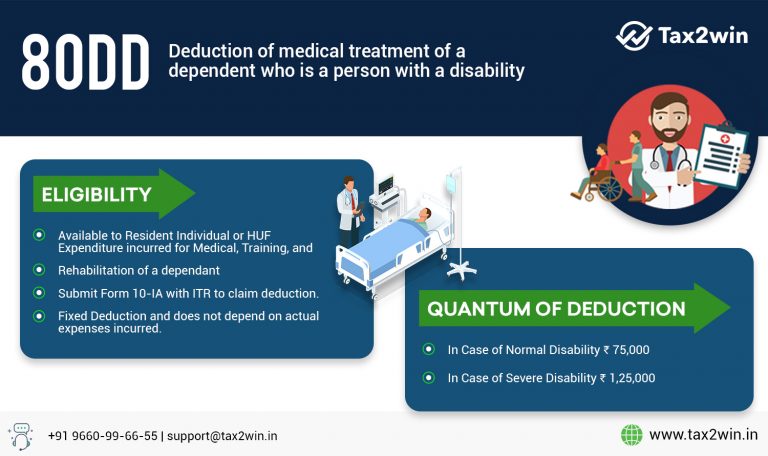

Section 80DD Here we explains everything about Section 80DD of income tax act including eligibility criteria deductions available and how to claim them Section 80DD is the deduction for the medical All Indian residents can claim tax deductions under Section 80DD of the Income Tax Act 1961 on the medical treatment of their dependent and disabled family member To

Section 80DD allows a deduction of up to Rs 75 000 a year and if the disability is severe up to Rs 1 25 000 a year Severe disability means a person with 80 per cent or more of the Deduction under Section 80U is provided in case the individual is himself disabled and Deduction under Section 80DD is provided in case any of the dependent family

Download Income Tax Exemption For Handicapped Dependent

More picture related to Income Tax Exemption For Handicapped Dependent

Pa Exemption Certificate Fill Out And Sign Printable PDF Template

https://www.exemptform.com/wp-content/uploads/2022/08/pennsylvania-tax-exempt-1.jpg

State Lodging Tax Exempt Forms ExemptForm

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/ny-hotel-tax-exempt-fill-online-printable-fillable-blank-pdffiller-8.png

Claim Deduction Under Section 80DD Learn By Quicko

https://learn.quicko.com/wp-content/uploads/2023/01/10IA-1.png

A person who has been certified as disabled may be eligible for tax benefits under Section 80U of the Income Tax Act A family member who pays for a disabled dependent s medical care may claim a tax deduction under Section 80DD allows for tax deductions for anyone who pays for a disabled dependent Learn its meaning eligibility benefits limitations etc Section 80DD Deduction of the

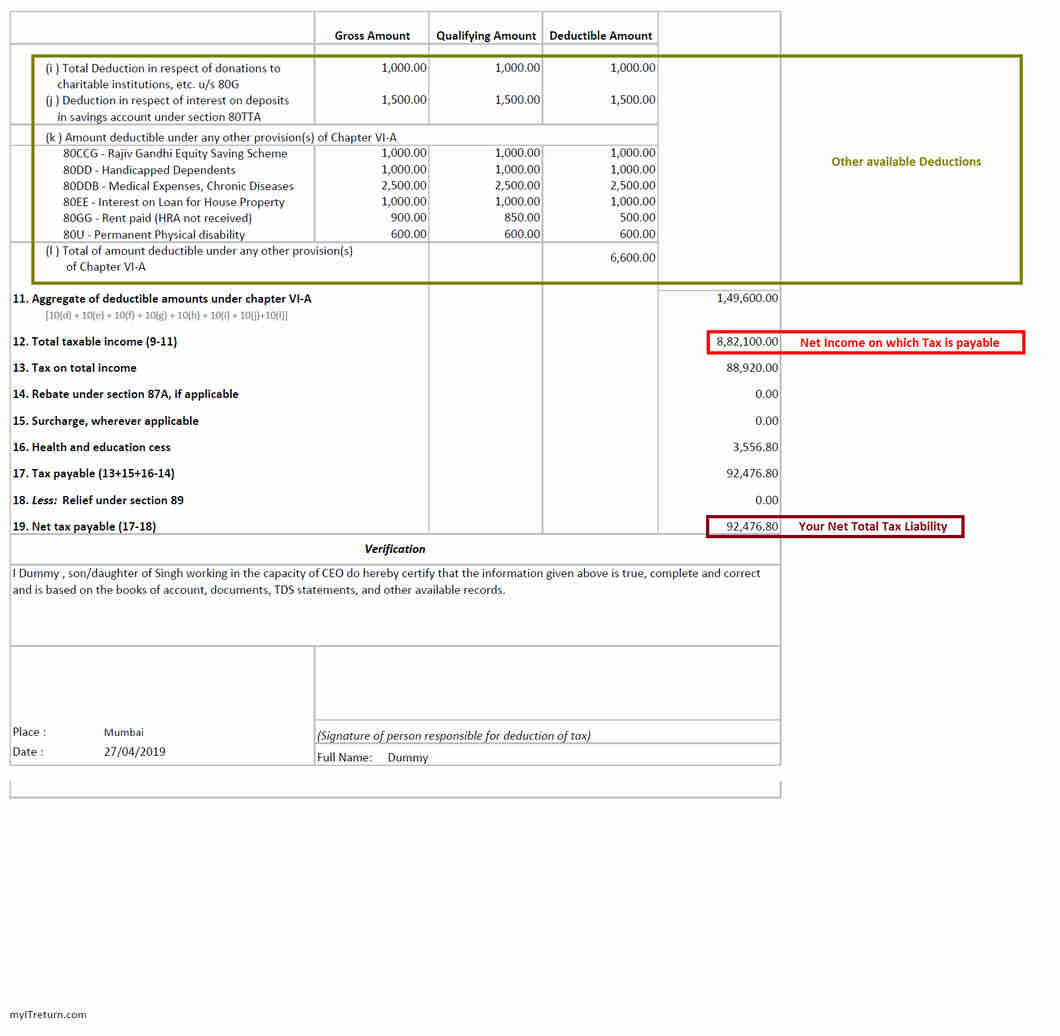

The Income tax Act 1961 allows deductions from your gross total income before the levy of tax if medical expenditure has been incurred on the treatment of a differently abled Deducting your child as a dependent If your child is a minor and you provide at least half of his support you can claim him as a dependent which will give you a significant income

Income Tax Form 16 What Is Form 16 Eligibility Benefits And Exemptions

https://www.godigit.com/content/dam/godigit/directportal/en/contenthm/tax-form-16-2.jpg

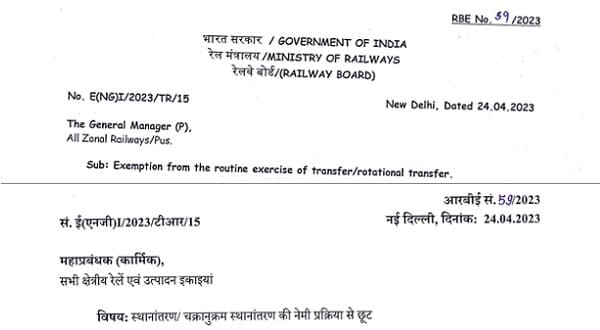

Exemption From The Routine Train Of Switch rotational Switch Railway

https://www.staffnews.in/wp-content/uploads/2023/04/transfer-rotational-transfer-rbe-no-59-2023-eng-hindi.jpg

https://cleartax.in/s/section-80u-deduction

Section 80U of Income Tax Act provides tax benefits to those with disabilities in India A resident with at least 40 disability can claim Rs 75 000 deduction

https://www.irs.gov/pub/irs-pdf/p3966.pdf

AS A PARENT OF A CHILD WITH A DISABILITY you may qualify for some of the following tax exemptions deductions and credits More detailed information may be found in the

Section 80 Deduction Deduction U s 80DD 80DDB 80U Tax2win Blog

Income Tax Form 16 What Is Form 16 Eligibility Benefits And Exemptions

501 c 3 Tax Exempt Form Definition Finance Strategists

Income Tax Calculation Example 2 For Salary Employees 2023 24

Income Tax Exemption For Physically Handicapped Dependent PNB MetLife

Private Sector Employees Can Now Claim Tax Exemption For Leave Travel

Private Sector Employees Can Now Claim Tax Exemption For Leave Travel

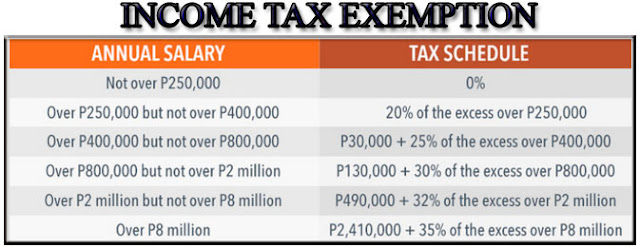

The Take home Pay Is Bigger As Senate Approved Higher Personal Income

Mo Tax Exemption Form Fill Out And Sign Printable PDF Template SignNow

Section 80U Tax Deductions For Disabled Individuals Tax2win

Income Tax Exemption For Handicapped Dependent - Section 80DD of the income tax act is allowed for Resident Individuals or HUFs for a person who is differently abled and is wholly dependent on the individual or HUF These