Income Tax Rebate For First Time Home Buyer Web 4 ao 251 t 2023 nbsp 0183 32 A first time homebuyer tax credit offers a direct reduction of the amount of income tax you owe The U S federal government offered a tax credit program to first

Web 8 sept 2022 nbsp 0183 32 Taxpayers must file Form 1040 U S Individual Income Tax Return or Form 1040 SR U S Income Tax Return for Seniors and itemize their deductions to deduct Web 27 janv 2023 nbsp 0183 32 First time home buyers who acquire a qualifying home can claim a non refundable tax credit of up to 750 The value of the HBTC is calculated by multiplying

Income Tax Rebate For First Time Home Buyer

Income Tax Rebate For First Time Home Buyer

https://canadian-data.com/wp-content/uploads/2023/04/First-Time-Home-Buyer.jpg

Tax Credits Rebates For First Time Home Buyers In Toronto First

https://i.pinimg.com/originals/73/83/a3/7383a34119ed5366c234bae48ff59560.jpg

BC Government Announces Assistance For First Time Home Buyers Kelowna

http://briggsonhomes.com/wp-content/uploads/2016/12/2017-First-Time-Home-Buyers-New-Campaign-1.png

Web 15 mars 2021 nbsp 0183 32 If you re buying a home for the first time claiming the First Time Home Buyers Tax Credit can land you a total tax rebate of Web 28 nov 2022 nbsp 0183 32 The First Time Homebuyer Act of 2021 enables federal tax credits worth up to 15 000 It applies to any home purchased after January 1 2021 with no end date or

Web 23 janv 2022 nbsp 0183 32 Under the overall tax deduction ceiling of 1 5 lakh of Section 80C a borrower can avail deduction on the repayment of principal on a home loan Istock Web There are three main incentive programs for first time home buyers Land transfer tax rebates which rebate some or all of your land transfer tax Government of Canada First

Download Income Tax Rebate For First Time Home Buyer

More picture related to Income Tax Rebate For First Time Home Buyer

Upto INR 5 Lakh Income Tax Rebate For 1st time Homebuyers Check How

https://blog.saginfotech.com/wp-content/uploads/2022/01/5-lakh-income-tax-rebate-1st-time-homebuyers.jpg

Tax Benefits Of First Time Home Buyers BenefitsTalk

https://www.benefitstalk.net/wp-content/uploads/first-time-home-buyer-program-and-grants-first-time-home-buyers-tax.jpeg

Micastle ca Yang Yang Broker Of Record First Time Home Buyer

http://micastle.ca/wp-content/uploads/2015/03/First-Time-HomeBuyer.jpg

Web Information for individuals about home buyers amount First Time Home Buyers Tax Credit which reduces your federal tax Note Line 31270 was line 369 before tax year Web You do not have to be a first time home buyer if you are eligible for the disability tax credit or you acquired the home for the benefit of a related person who is eligible for the

Web 27 janv 2023 nbsp 0183 32 SOLVED by TurboTax 44 Updated January 27 2023 As a first time home buyer or builder you may be eligible to claim certain tax credits or apply for Web 23 mai 2023 nbsp 0183 32 The Home Buyers Plan allows first time home buyers to withdraw up to 35 000 from their Registered Retirement Savings Plan RRSP tax free You must

First Time Home Buyer Things To Know Brock Realty Inc 2022

https://brockrealtyinc.com/wp-content/uploads/2019/06/2MED-Brock-Realty-InfoGraphic-First-Time-Buyers.png

First time Homebuyer Guide The Countdown To Closing

http://www.mortgageprosus.com/wp-client_data/20837/1050/uploads/2017/06/First-Time-Home-Buyer-Infographic-Email.png

https://www.bankrate.com/mortgages/first-time-homebuyer-tax-credit

Web 4 ao 251 t 2023 nbsp 0183 32 A first time homebuyer tax credit offers a direct reduction of the amount of income tax you owe The U S federal government offered a tax credit program to first

https://www.irs.gov/newsroom/know-whats-deductible-after-buying-that...

Web 8 sept 2022 nbsp 0183 32 Taxpayers must file Form 1040 U S Individual Income Tax Return or Form 1040 SR U S Income Tax Return for Seniors and itemize their deductions to deduct

How To Buy Your First House First Time Home Buyers Stuff To Buy Steps

First Time Home Buyer Things To Know Brock Realty Inc 2022

First Time Home Buyer Virtual Workshops City Of Garden Grove

First Time Home Buyers Tax Credit Benefits Kalfa Law Firm

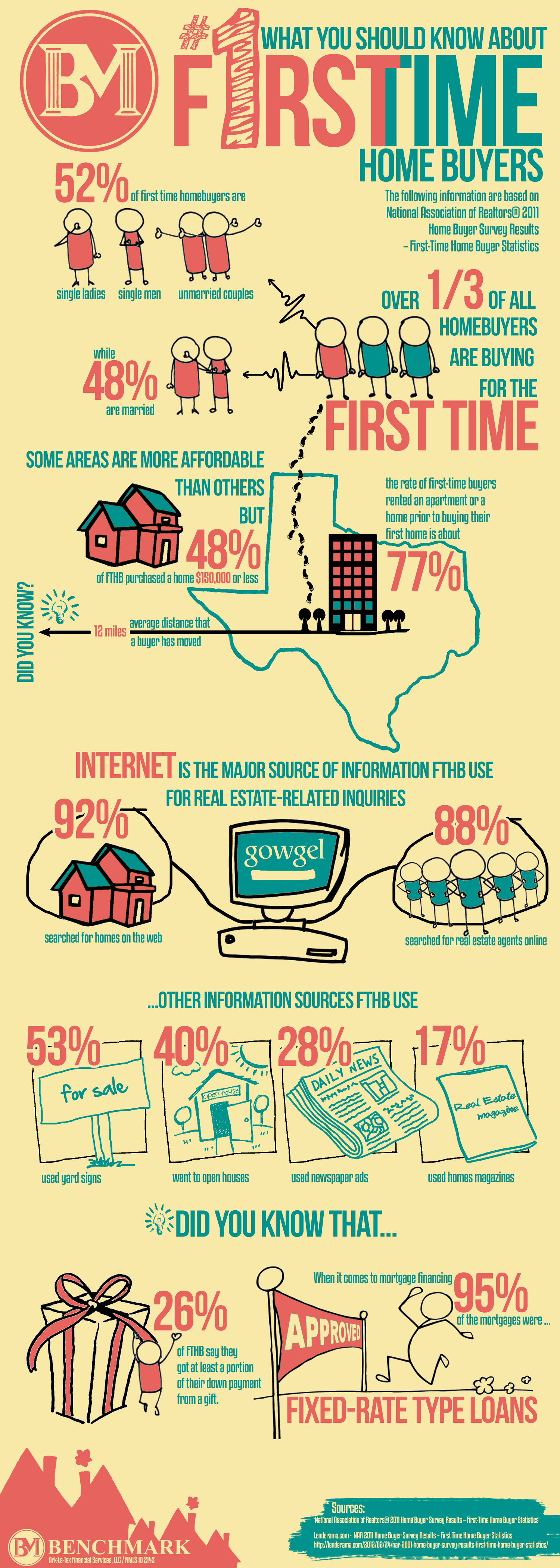

The Average First Time Home Buyer INFOGRAPHIC Logan West

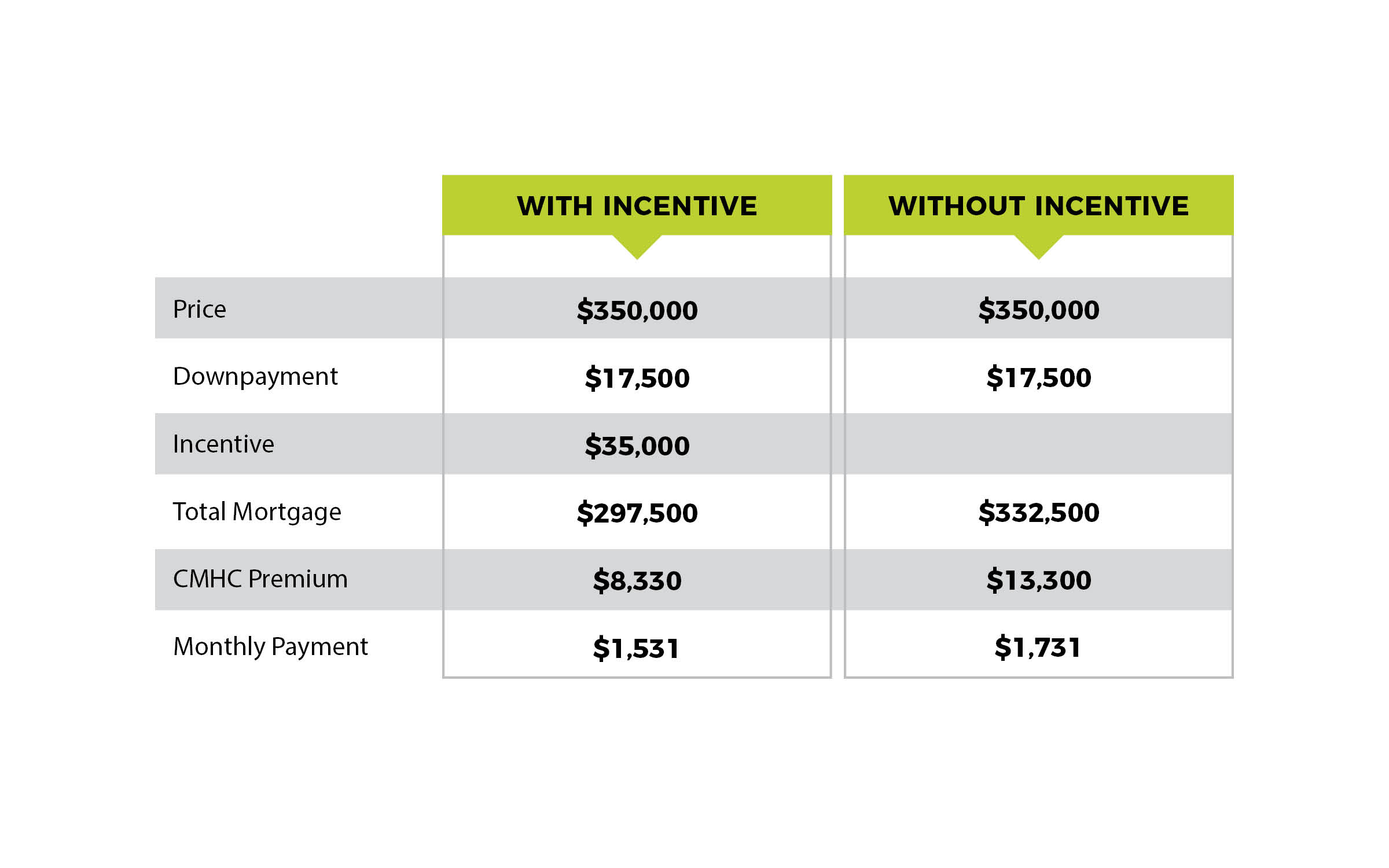

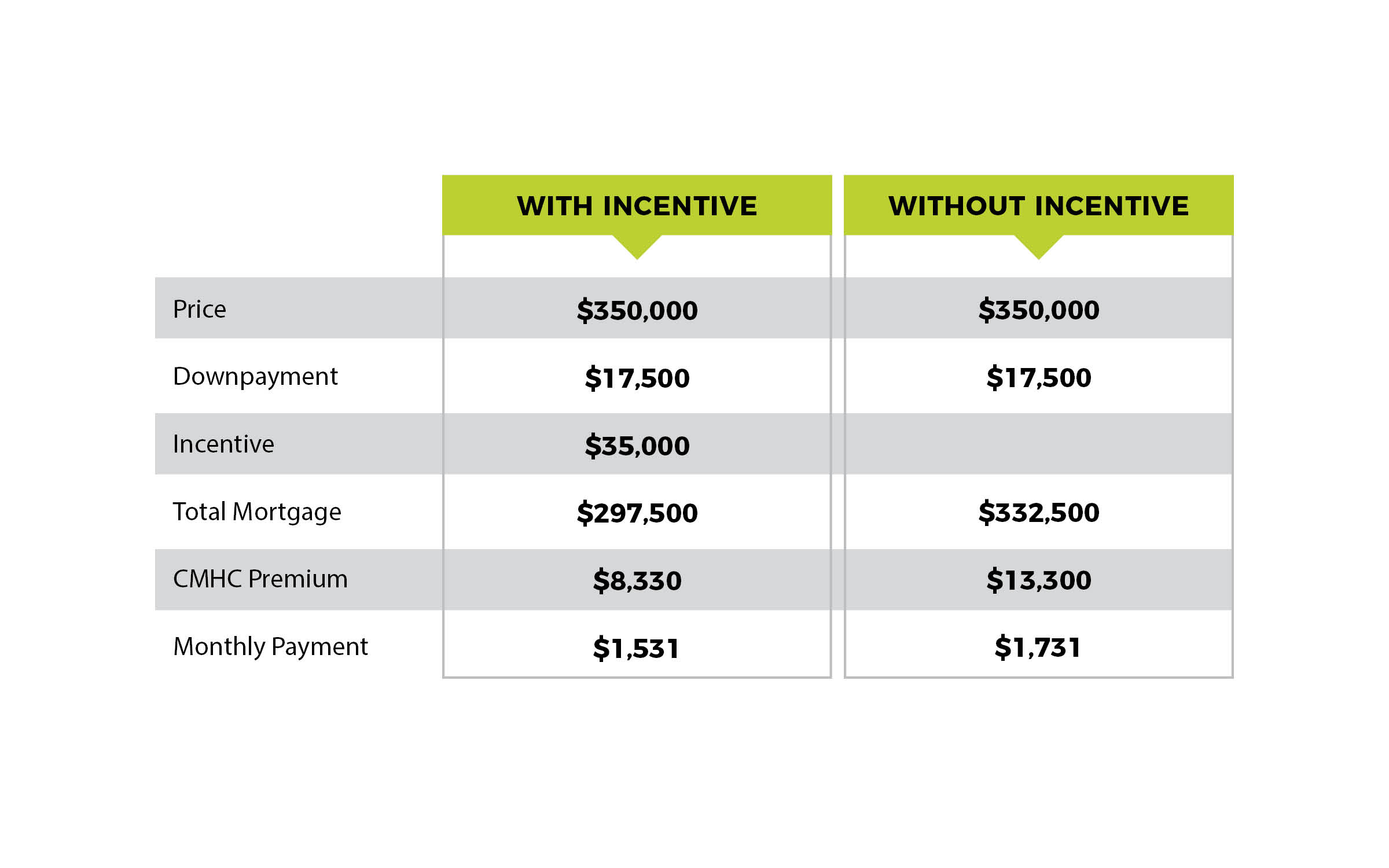

First Time Home Buyer s Incentive Sarasota Homes

First Time Home Buyer s Incentive Sarasota Homes

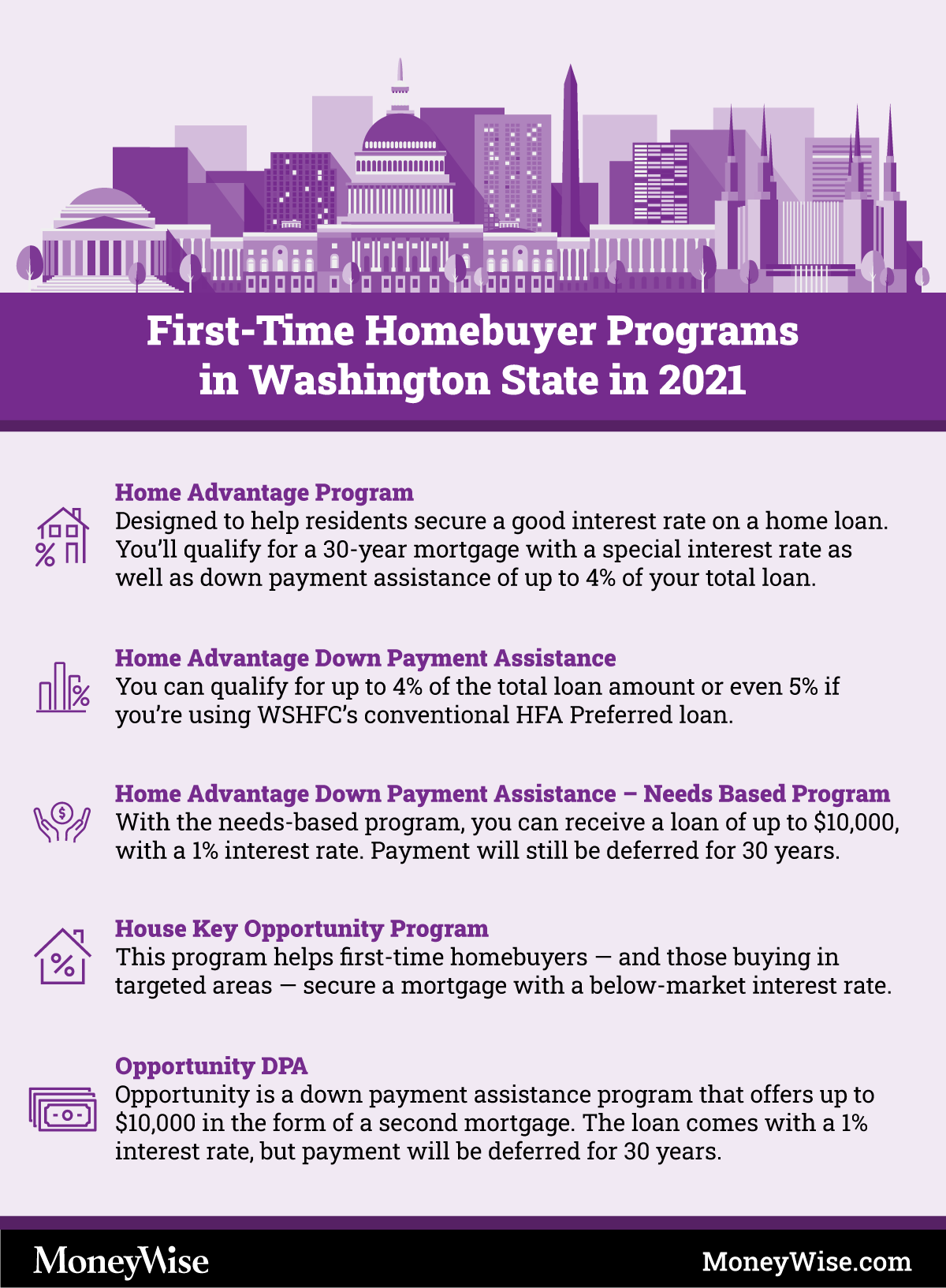

Programs For First Time Home Buyers In Washington State 2021

First time Home Buyer Iowa Tax Credit 2020 Labeerweek

Our Very First Home 2015 Homeownership ca Buying First Home First

Income Tax Rebate For First Time Home Buyer - Web 23 janv 2022 nbsp 0183 32 Under the overall tax deduction ceiling of 1 5 lakh of Section 80C a borrower can avail deduction on the repayment of principal on a home loan Istock