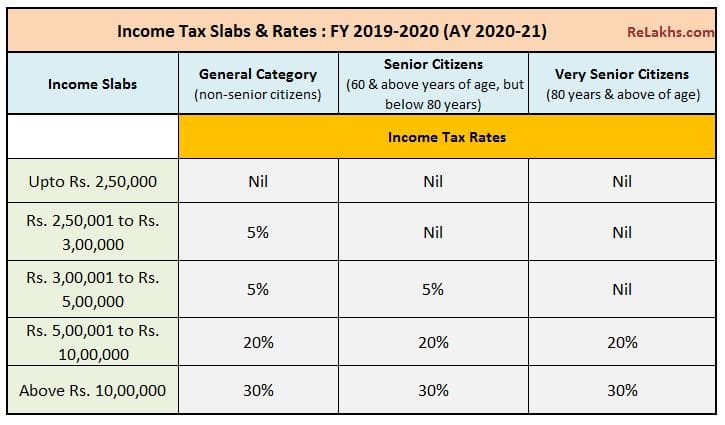

Income Tax Rebate For Pensioners In India Web Income Tax slabs for Super Senior citizens 80 years and above in age New Personal Income Tax Regime 115BAC INCOME SLAB RATE OF INCOME TAX Upto Rs 2 50 000 Nil Rs 2 50 001 to Rs 5 00 000 5 Rs 5 00 001 to Rs 7 50 000 Rs

Web A retired employee above 60 years of age who is in receipt of pension income from his former employer can claim a deduction upto Rs 50 000 against such salary income Am I exempt from payment of advance tax Every person whose estimated tax liability for the Web 1 f 233 vr 2023 nbsp 0183 32 The revised new tax regime has introduced a standard deduction of Rs 50 000 for pensioners as well including family

Income Tax Rebate For Pensioners In India

Income Tax Rebate For Pensioners In India

https://i1.wp.com/only30sec.com/wp-content/uploads/2020/12/Income-tax-Sections-of-deductions-and-rebates-for-Residents-and-Non-Residents.png?resize=750%2C480&is-pending-load=1#038;ssl=1

Latest Income Tax Slab Rates FY 2019 20 AY 2020 21 Budget 2019

https://www.relakhs.com/wp-content/uploads/2019/02/Latest-income-tax-slab-rates-FY-2018-19-AY-2019-20-Tax-rates-for-individuals-budget-2019-2020-pic.jpg

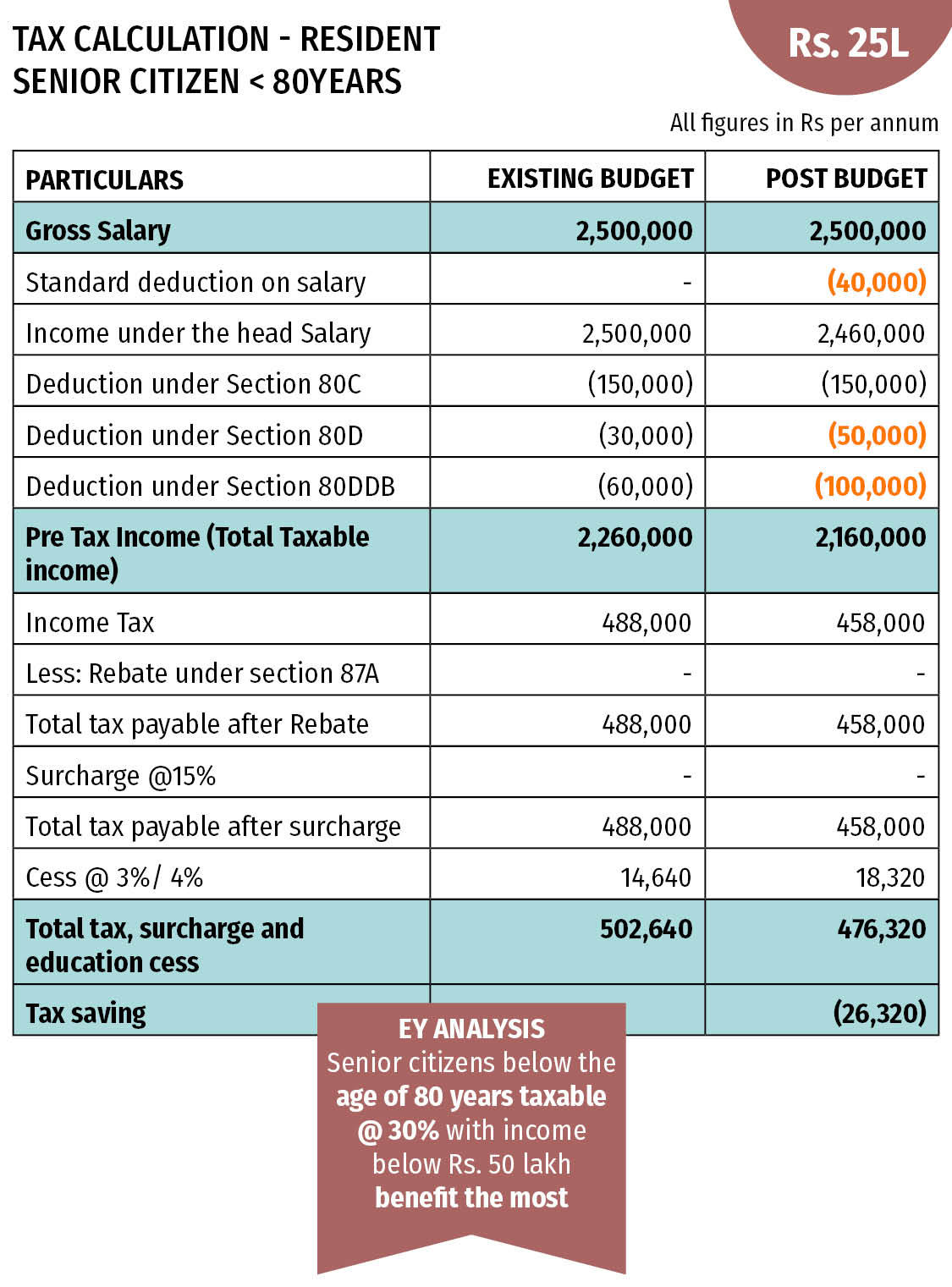

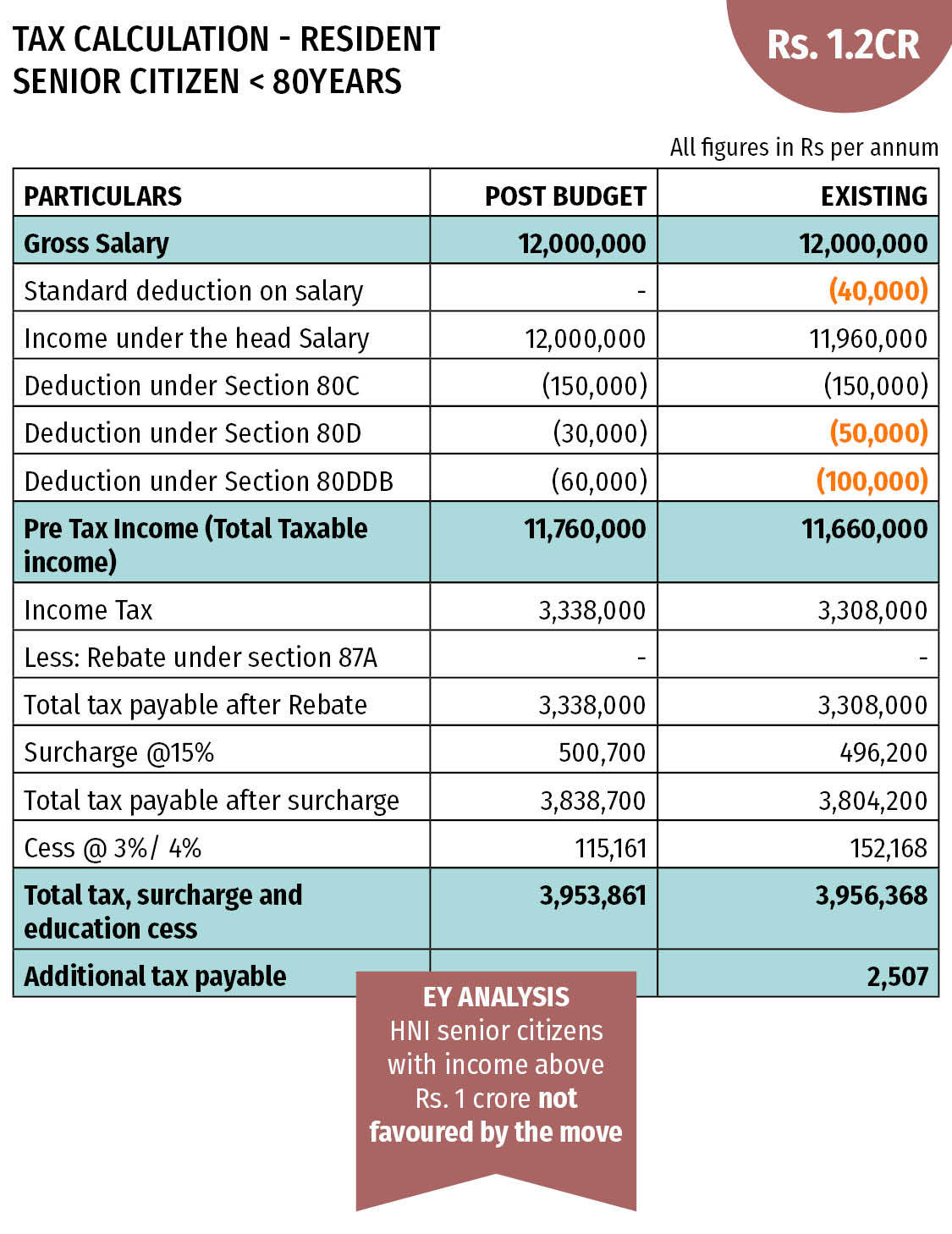

Tax Benefits For Senior Citizens Budget 2018 Proposes Tax Other

https://img.etimg.com/photo/msid-62914737/tax_calculation_80yr_senior_citizen_25l-1.jpg

Web As per old tax regime the income tax slab rates for super senior citizen for FY 2022 23 are as follows The above calculated tax for senior and super senior citizens shall be increased by Health and Education Cess 4 of the income tax Additionally surcharge is Web 9 f 233 vr 2023 nbsp 0183 32 Thus salaried individuals and pensioners can claim the standard deduction of Rs 50 000 only from their salary pension income Getty Images 3 6 For family pensioners For family pensioners a standard deduction of Rs 15 000 will be available

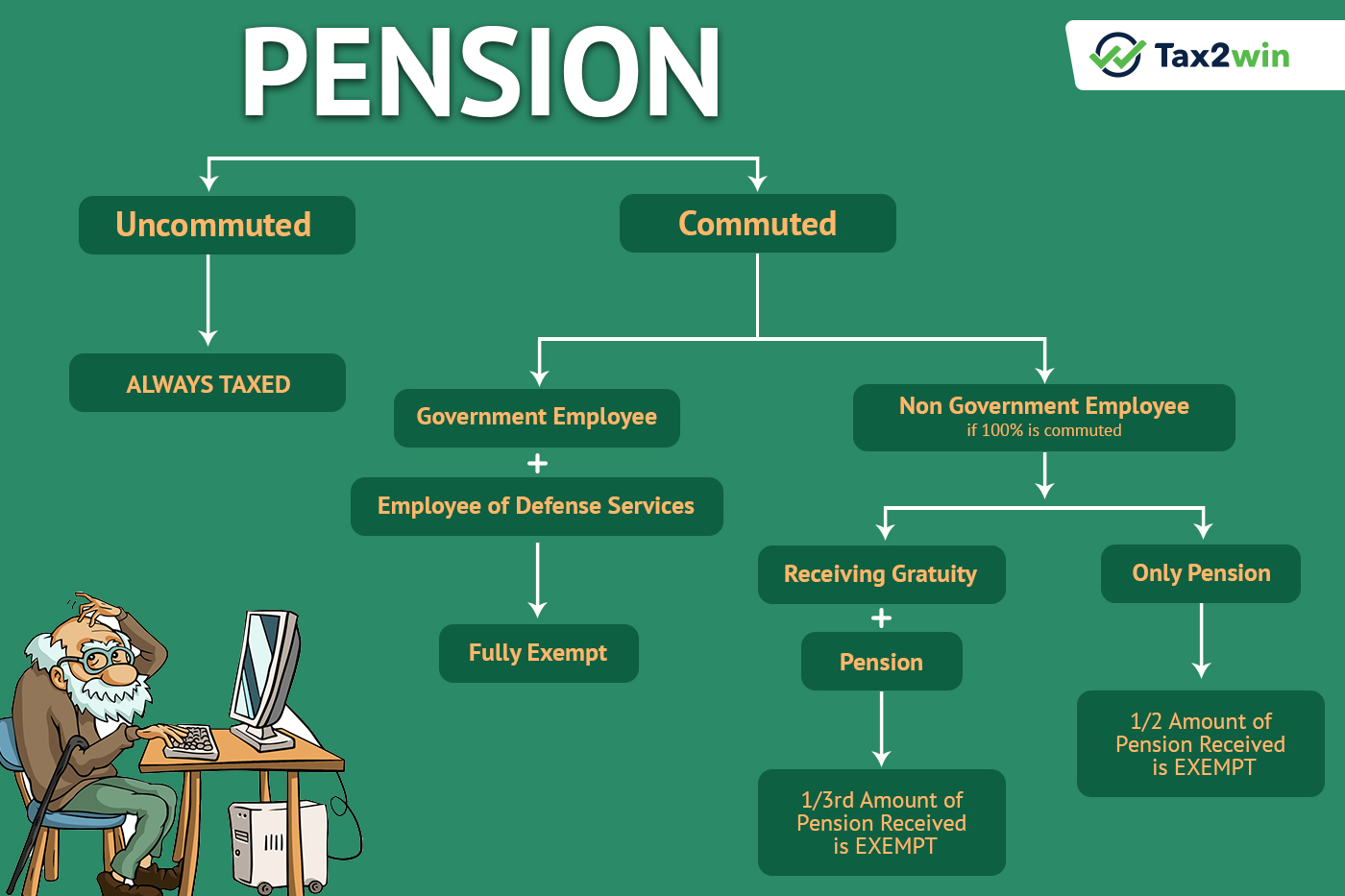

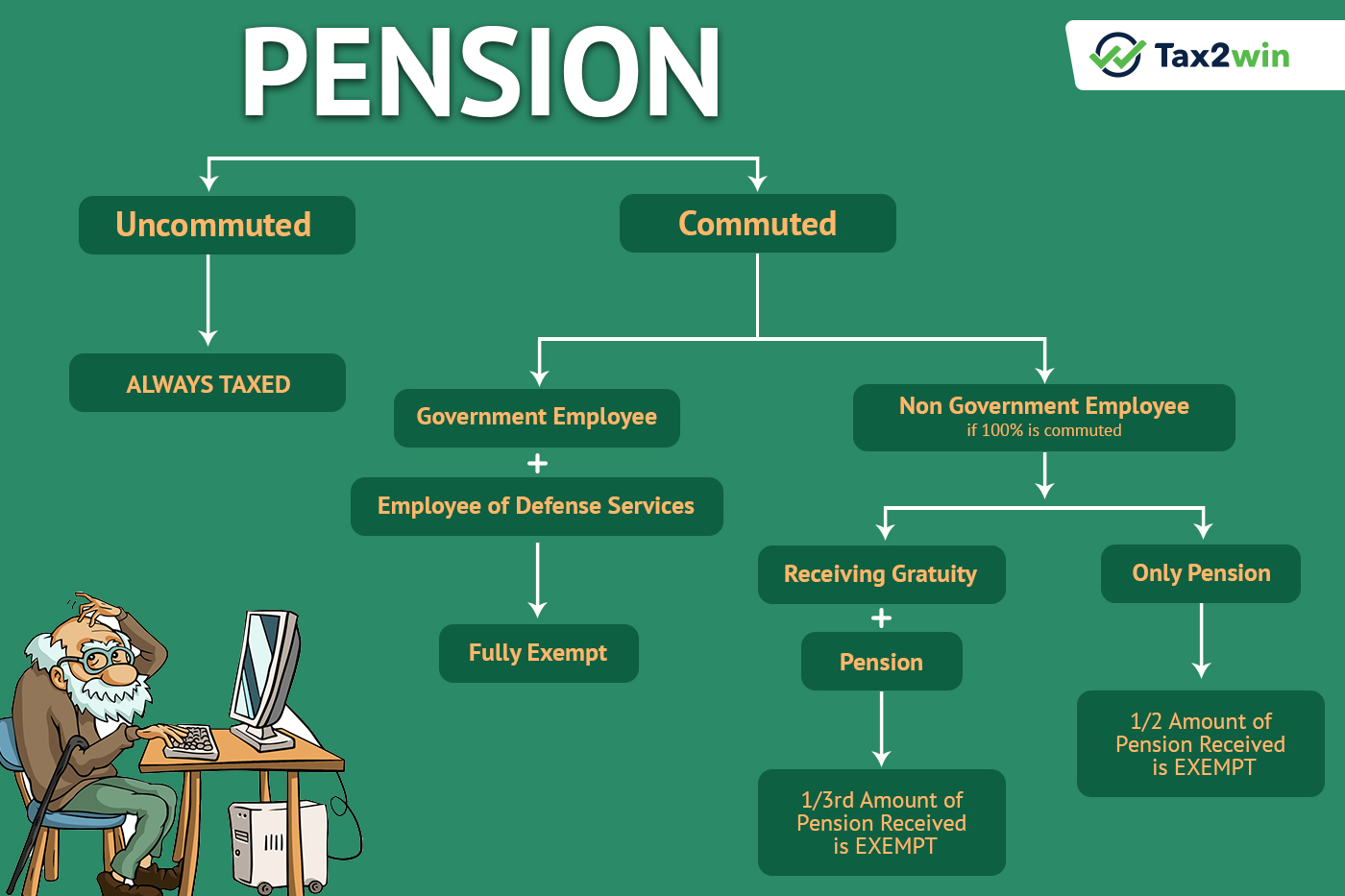

Web 14 juin 2023 nbsp 0183 32 Budget 2023 Update Standard Deduction on family pension under the new tax regime Rs 15 000 or 1 3rd of the pension amount whichever is lower Contents Are Pensions taxable Pension income should be disclosed under which head of income Web 23 janv 2023 nbsp 0183 32 Income tax regulations for pensioners New Tax Return Regulations for 2021 Eligibility for ITR Exemption What Category Of Income Should Pension Income Be Reported Under Form for Pensioners Income Tax ITR Filing Procedure for

Download Income Tax Rebate For Pensioners In India

More picture related to Income Tax Rebate For Pensioners In India

Income Tax Slab For FY 2022 23 New Income Tax Rates Slabs In India

https://www.canarahsbclife.com/content/dam/choice/blog-inner/images/income-tax-slab-and-rates-for-individuals-between-60-years-to-80-years1.jpg

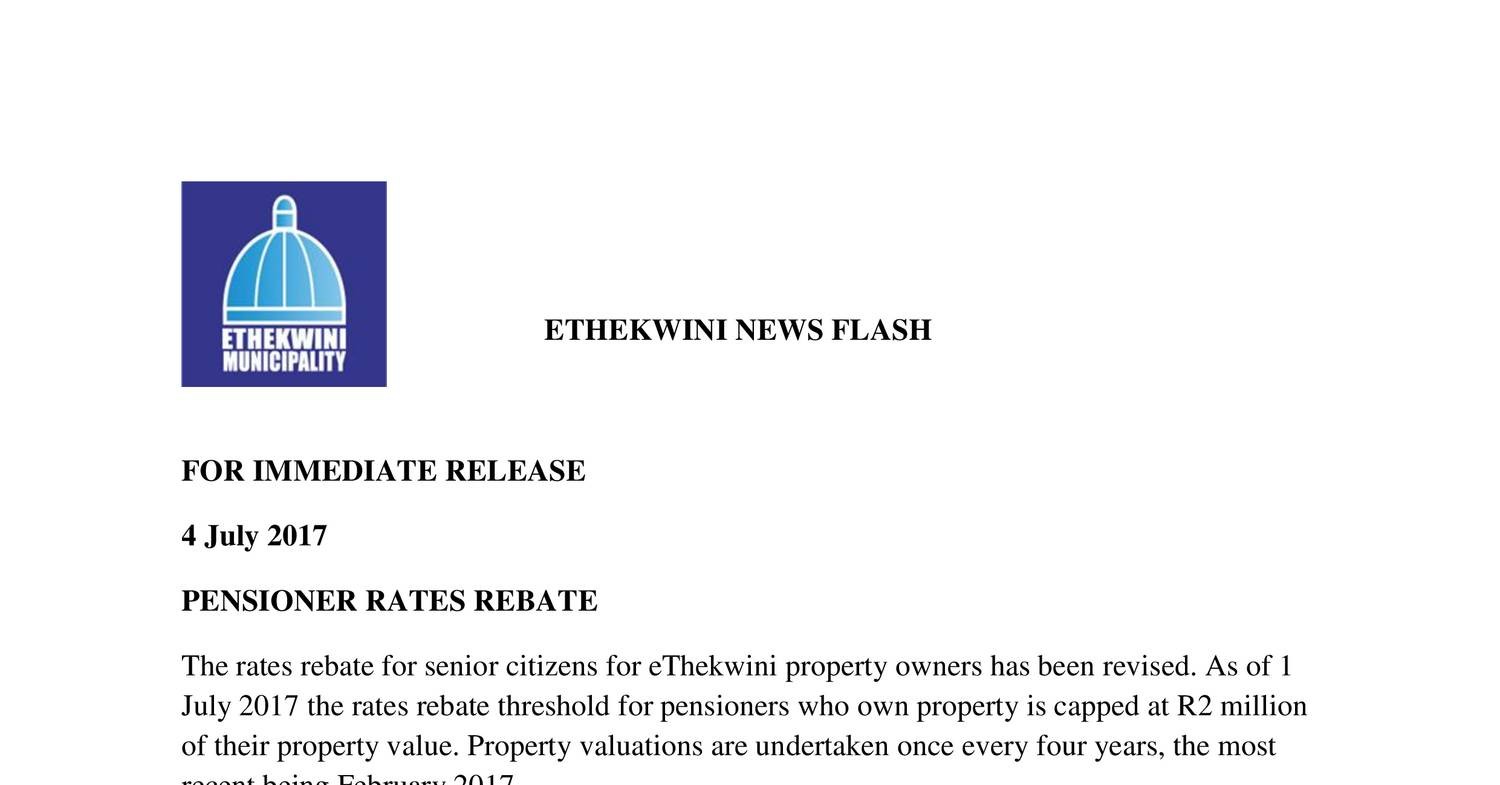

Ethekwini Pensioners Rates Rebate Form Application Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/08/Ethekwini-Pensioners-Rates-Rebate-Form-768x717.png

Tax Benefits For Senior Citizens Budget 2018 Proposes Tax Other

https://img.etimg.com/photo/msid-62914770/tax_calculation_80yr_senior_citizen_1-2cr-1.jpg

Web ITR 1 OR SAHAJ The ITR 1 form is also known as the Sahaj Form and is applicable to individuals who receive an income of up to Rs 50 lakh from the following modes Income from a salary Income from a pension Income from a house property Income from other Web 5 No advance tax While individuals below the age of 60 have to pay an advance tax if their tax liability is 10 000 or more in a financial year senior citizens are free from this burden unless they make income from business or profession 6 Allowance for the treatment of

Web Note Tax rebates under this particular section are not available to those who earn more than Rs 5 Lakhs a year Section 88 B Senior citizens can get more tax rebate under this section in case their age is above 65 years The maximum rebate is Rs 20 000 Section Web To file ITR for pensioners online follow the steps given below Step 1 Visit the Income Tax e filing official website and log in by typing in your credentials Step 2 Navigate to the e File tab and from the drop down menu select Income Tax Returns Step 3 Click on

Income Tax Slab For Ay 2020 21 And Financial Year 2019 20

https://4.bp.blogspot.com/-ygld82QNGGs/Xd_7fFpO9WI/AAAAAAAAJBU/w2H37lRhli4Tk4pgjN-Ra8So_O_t_RJ-wCK4BGAYYCw/s1600/slab_rate_%25281%2529-20190201043639.png

Rates Rebate Form For Pensioners Durban 2022 Application Printable

https://printablerebateform.net/wp-content/uploads/2022/08/Rates-Rebate-Form-For-Pensioners-Durban-2022.png

https://incometaxindia.gov.in/Booklets Pamphlets/Benefits-f…

Web Income Tax slabs for Super Senior citizens 80 years and above in age New Personal Income Tax Regime 115BAC INCOME SLAB RATE OF INCOME TAX Upto Rs 2 50 000 Nil Rs 2 50 001 to Rs 5 00 000 5 Rs 5 00 001 to Rs 7 50 000 Rs

https://incometaxindia.gov.in/Booklets Pamphlets/e-PDF__…

Web A retired employee above 60 years of age who is in receipt of pension income from his former employer can claim a deduction upto Rs 50 000 against such salary income Am I exempt from payment of advance tax Every person whose estimated tax liability for the

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

Income Tax Slab For Ay 2020 21 And Financial Year 2019 20

Budget 2019 Income Tax Rebate Hiked For Income Up To Rs 5 Lakh Here

Pensioners Rebate pdf DocDroid

Pensioners Tax Financial Year 2018 19 No Income Tax Below 5 Lakhs

Income Tax Return For Pension Earners No More A Tedious Task Tax2win Blog

Income Tax Return For Pension Earners No More A Tedious Task Tax2win Blog

Explore India PENSION CALCULATOR

2007 Tax Rebate Tax Deduction Rebates

Income Tax Calculator India In Excel FY 2021 22 AY 2022 23

Income Tax Rebate For Pensioners In India - Web As per old tax regime the income tax slab rates for super senior citizen for FY 2022 23 are as follows The above calculated tax for senior and super senior citizens shall be increased by Health and Education Cess 4 of the income tax Additionally surcharge is