Income Tax Rebate On Electric Cars Web 9 juil 2019 nbsp 0183 32 What is Section 80EEB Section 80EEB of the Income Tax Act allows you to claim tax savings of up to Rs 1 5 lakh on interest paid on a loan made specifically to

Web 22 ao 251 t 2022 nbsp 0183 32 Only singles with incomes up to 150 000 a year and couples who file taxes jointly who earn up to 300 000 will qualify This Web 17 mars 2022 nbsp 0183 32 Pour 234 tre 233 ligible au bonus 233 cologique 2022 pour l achat d une voiture 233 lectrique neuve il faut remplir plusieurs conditions VOITURE 201 LECTRIQUE NEUVE

Income Tax Rebate On Electric Cars

Income Tax Rebate On Electric Cars

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2023/05/ca-electric-car-rebate-income-limit-electricrebate-13.png?resize=840%2C436&ssl=1

Electric Car Available Rebates 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/06/electric-vehicle-rebates-now-available-in-maine-nrcm-1.jpg

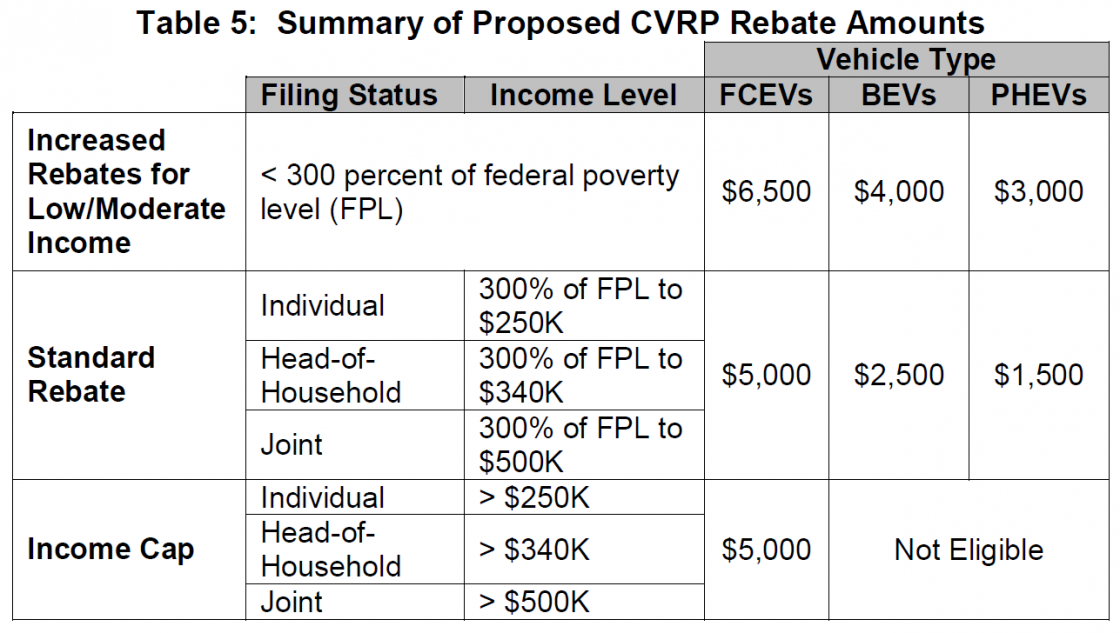

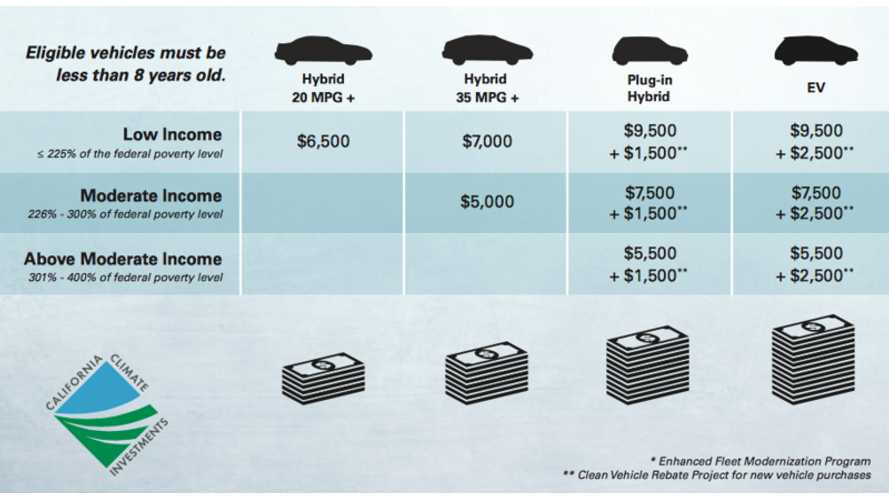

Ca Electric Car Rebate Income Limit ElectricRebate

https://www.electricrebate.net/wp-content/uploads/2022/08/key-states-rethink-electric-car-subsidies-bestride-1.png

Web 31 mars 2023 nbsp 0183 32 A tax credit of up to 7 500 to buy an electric car is about to undergo a major change again The Inflation Reduction Act a major climate law passed last Web 5 sept 2023 nbsp 0183 32 People who buy new electric vehicles may be eligible for a tax credit as high as 7 500 and used electric car owners may qualify for up to 4 000 in tax breaks as of

Web 17 ao 251 t 2022 nbsp 0183 32 That number will gradually grow to 100 in 2029 Under the new credit system the MSRP of a pickup or SUV must not be over 80 000 and other vehicles like Web You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation

Download Income Tax Rebate On Electric Cars

More picture related to Income Tax Rebate On Electric Cars

Tax Rebate Lease Electric Car 2022 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/08/does-a-leased-electric-car-qualify-for-tax-credit-car-retro-2.jpg

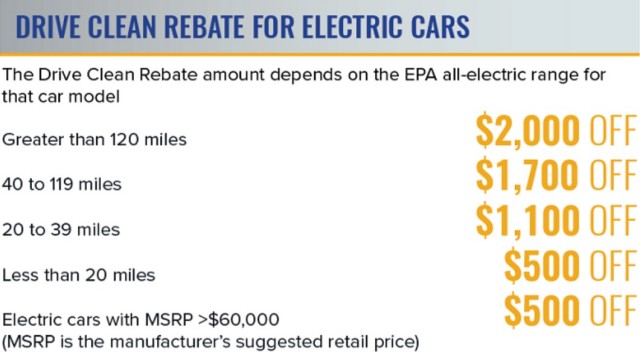

NY 2 000 Electric car Rebate Falls To 500 If It s Over 60K Sorry Tesla

https://images.hgmsites.net/med/new-york-state-drive-clean-electric-car-rebate-program-amounts-march-2017_100596542_m.jpg

Delaware Electric Car Tax Rebate Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/03/Delaware-Tax-Rebate-2023-768x679.png

Web The Inflation Reduction Act broke the credit into two halves You can claim 3 750 if at least half of the value of your vehicle s battery components are manufactured or assembled in Web If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section

Web 7 mai 2022 nbsp 0183 32 Federal income tax credit up to 7 500 Currently 7 500 is the maximum amount available to buyers of new fully electric or plug in hybrid cars leasing only Web 10 ao 251 t 2022 nbsp 0183 32 Under the Inflation Reduction Act which received Senate approval on Sunday and is expected to clear the House this week a tax credit worth up to 7 500

Tax Rebate On Electric Vehicle ElectricRebate

https://www.electricrebate.net/wp-content/uploads/2022/09/electric-vehicle-rebates-dakota-electric-association-6.gif

Tax Rebate On Electric Cars 2022 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/06/electric-car-tax-credits-and-rebates-charged-future-11.jpeg

https://cleartax.in/s/section-80eeb-deduction-purchase-electric-vehicle

Web 9 juil 2019 nbsp 0183 32 What is Section 80EEB Section 80EEB of the Income Tax Act allows you to claim tax savings of up to Rs 1 5 lakh on interest paid on a loan made specifically to

https://www.npr.org/2022/08/22/1118052620

Web 22 ao 251 t 2022 nbsp 0183 32 Only singles with incomes up to 150 000 a year and couples who file taxes jointly who earn up to 300 000 will qualify This

Electric Car Rebates Canada 2021

Tax Rebate On Electric Vehicle ElectricRebate

What Is The Tax Rebate For Electric Cars 2023 Carrebate

Does California Offer Electric Car Rebates

Ev Car Tax Rebate Calculator 2022 Carrebate

California Electric Car Rebate EV Tax Credit Incentives Eligibility

California Electric Car Rebate EV Tax Credit Incentives Eligibility

Ca Electric Car Rebate Income Limit ElectricRebate

Federal Rebate Hybrid Car 2023 Carrebate

Residential Electric Vehicle Incentive Program Volkswagen Pasadena

Income Tax Rebate On Electric Cars - Web You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation