Income Tax Return Exemption Returns and Forms Applicable for Salaried Individuals for AY 2024 25 Disclaimer The content on this page is only to give an overview and general guidance and is not exhaustive For complete details and guidelines please refer Income Tax Act Rules and Notifications 1 ITR 1 SAHAJ Applicable for Individual

Tax exempt status allows a taxpayer to file a return with the IRS that exempts them from paying taxes on any net income or profit A taxpayer can offset capital gains and avoid taxes on Section 80 Deductions A complete guide on Income Tax deduction under section 80C 80CCC 80CCD 80D Find out the deduction under section 80c for FY 2023 24 AY 2024 25

Income Tax Return Exemption

Income Tax Return Exemption

https://taxmasala.in/wp-content/uploads/2016/12/image.jpg

Exemption From The Obligation To Submit An Income Tax Return

https://www.fides-corp.com/wp-content/uploads/income-tax-return.jpg

Process Flow Of Applying For Tax Exemptions Of Corporations And

https://1.bp.blogspot.com/-prJpam_lFnI/XMdpYfbdIII/AAAAAAAABM4/sCP3PZywJyUQi6p7PqKutMirNe426OKGACLcBGAs/s1600/tax-exemption.jpg

Efiling Income Tax Returns ITR is made easy with Clear platform Just upload your form 16 claim your deductions and get your acknowledgment number online You can efile income tax return on your income from salary house property capital gains business profession and income from other sources Key Takeaways Exempt income is not subject to taxation Some income may be exempt at the state level but taxed at the federal level Income from some types of investments like municipal

Exempt income is income that you don t pay tax on that is it s tax free You may still need to include this income in your tax return for use in other tax calculations Examples of exempt income can include some government pensions and payments including the invalidity pension Latest income tax slabs for FY 2024 25 Here are the latest income tax slabs that will be effective for the current financial year after Budget 2024 The budget was presented in July instead of February due to the Lok Sabha Elections 2024 held in April May and June as opposed to the usual February presentation

Download Income Tax Return Exemption

More picture related to Income Tax Return Exemption

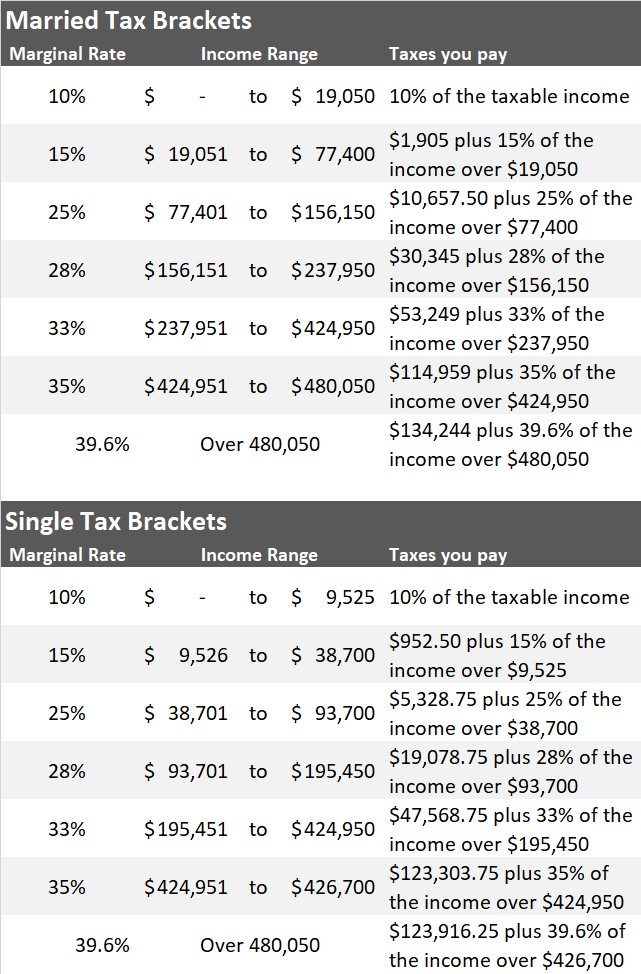

Irs Tax Chart 2018

https://images.squarespace-cdn.com/content/v1/572ff08b044262a7f8c2405e/1508861962592-KIG66TODG5ZZR0TLPSSC/2018+Tax+Brackets.jpg

Tax Exempt Tax Bind Consulting

https://taxbind.net/application/uploads/2018/09/tax-exempt.jpg

Income Tax

https://www.segunbagicha.com/wp-content/uploads/2023/09/00-Tax-Certificate-sample-1523x2048.jpg

If Congress does nothing by the end of 2025 the child tax credit will revert back to 1 000 per child ages 16 years and under It would be refundable and phased in starting at 3 000 of earned The personal exemption from state income tax increases from 2 250 for each person on a Kansas income tax return to 18 320 for married taxpayers filing joint and 9 160 for all other taxpayers New for 2024 an additional 2 320 exemption is allowed for each dependent listed on the Kansas income tax return Standard deduction

Section 194P of the Income Tax Act 1961 provides conditions for exempting Senior Citizens from filing income tax returns aged 75 years and above Conditions for exemption are Senior Citizen should be of age 75 years or above Senior Citizen should be Resident in the previous year Your organisation may have to lodge an income tax return or notify of a non lodgment advice your organisation may have the benefit of special rules for working out its taxable income and have special rates of tax there is transitional support if you need more time to meet lodgment obligations

Sample Letter Tax Exemption Complete With Ease AirSlate SignNow

https://www.signnow.com/preview/497/332/497332566/large.png

Tax File Number Declaration Form Pdf Withholding Tax Payments Vrogue

https://i2.wp.com/universalnetworkcable.com/wp-content/uploads/2019/03/income-tax-filing-form-number.jpg

https://www.incometax.gov.in/iec/foportal/help/individual/return-applicable-1

Returns and Forms Applicable for Salaried Individuals for AY 2024 25 Disclaimer The content on this page is only to give an overview and general guidance and is not exhaustive For complete details and guidelines please refer Income Tax Act Rules and Notifications 1 ITR 1 SAHAJ Applicable for Individual

https://www.investopedia.com/terms/t/tax_exempt.asp

Tax exempt status allows a taxpayer to file a return with the IRS that exempts them from paying taxes on any net income or profit A taxpayer can offset capital gains and avoid taxes on

2017 PAFPI Certificate of TAX Exemption Certificate Of

Sample Letter Tax Exemption Complete With Ease AirSlate SignNow

FREE 10 Sample Tax Exemption Forms In PDF ExemptForm

Income Tax Act Malaysia Samuel Gutierrez

Withholding Tax Return

How To Claim Tax Exemptions Here s Your 101 Guide app app

How To Claim Tax Exemptions Here s Your 101 Guide app app

Request Letter For Tax Certificate For Income Tax SemiOffice Com

IRS Tax Exemption Letter Peninsulas EMS Council

Latest ITR Forms Archives Certicom

Income Tax Return Exemption - Tax exempt means some or all income isn t subject to tax at the federal state or local level Here s how it works and who qualifies