India Tax Return Filing Deadline Taxpayers must file their income tax return by the due date to avoid interest and penalties FY 2023 24 AY 2024 25 filing deadline is July 31 2024 with a belated filing option until December 31 2024 Understanding FY AY and consequences of missing deadlines is crucial Late fees and interest charges apply for belated returns

Income tax return filing for FY 2023 24 for individuals and entities not liable for tax audit and who have not entered into any international or specified domestic transaction August 2024 Due date The Income Tax Return filing last date for FY 2023 24 AY 2024 25 is 31st July 2024 Also the ITR last date for a late return for the same FY is 31st December 2024

India Tax Return Filing Deadline

India Tax Return Filing Deadline

https://www.cio.com/wp-content/uploads/2021/12/indian-income-tax-return-100894119-orig-2.jpeg?quality=50&strip=all&w=1024

Tax Deadlines For Q1 Of 2022 Holbrook Manter

https://www.holbrookmanter.com/wp-content/uploads/2021/10/tax-deadline--scaled.jpg

ITR Filing 2022 Filed Income Tax Return Before Deadline And Still

https://i1.wp.com/static.india.com/wp-content/uploads/2022/07/income-tax-return.jpg

Due date of filing ITR Individuals assessee whose accounts are not required to be audited individuals HUFs Association of Persons Body of Individuals etc Last date to file ITR for financial year 2023 24 AY 2024 25 without late fees is July 31 2024 Home Central Board of Direct Taxes Government of India

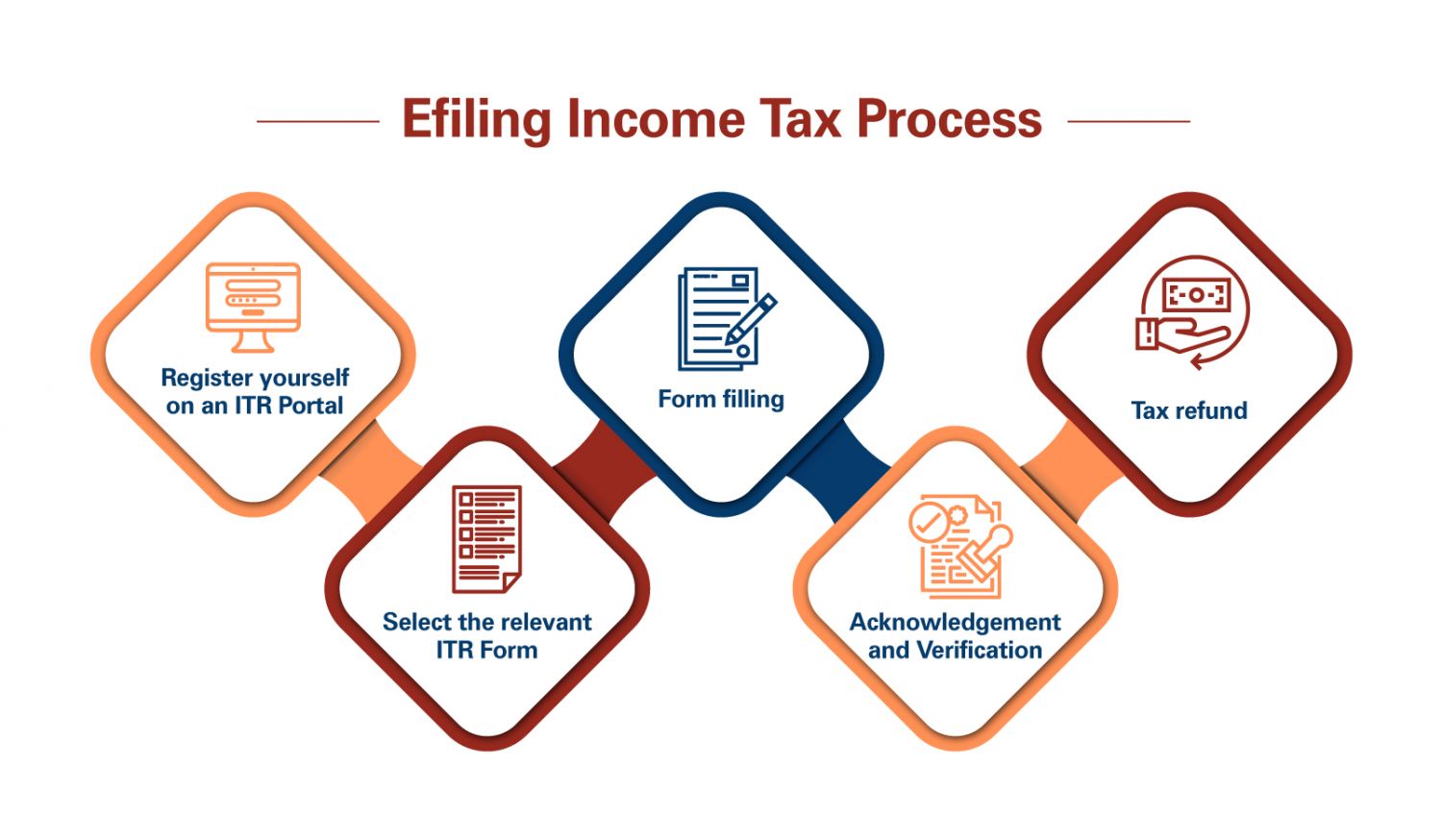

ITR due dates for FY 2023 24 AY 2024 25 The table below outlines the deadlines for filing ITR in 2024 Note The requirement to pay advance tax arises solely when an individual s overall ITR Filing for FY 2023 24 AY 2024 25 e Filing of Income Tax Returns online made easy with ClearTax to get maximum tax refund Income Tax login upload Form 16 view download Form 26AS review your TDS deductions track refund status for Income Tax Filing in India

Download India Tax Return Filing Deadline

More picture related to India Tax Return Filing Deadline

Plastic Taxes Cheap Offer Save 63 Jlcatj gob mx

https://e00-marca.uecdn.es/assets/multimedia/imagenes/2022/04/18/16502788138655.jpg

4 Days Left Penalty And Loss Of Benefits If You Miss Tax Return

https://c.ndtvimg.com/2022-07/vroniddo_image_625x300_27_July_22.jpg

Can You File Your Taxes With Your Last Pay Stub This Is What To Know

https://estilo-tendances.com/wp-content/uploads/2020/02/df7477343e18ae41cf296e4b62f1d931.jpeg

The due date to file Income Tax Returns ITR for the financial year 2021 22 is July 31 Many taxpayers faced several issues in recent weeks and demands have been made to extend the ITR due date However the government is unlikely to do so Here s what happens if you fail to file the ITR before July 31 The last date for filing income tax returns ITR is July 31 i e Sunday The income tax department has made it clear that the deadline will not be extended and has asked the tax

The deadline for filing Income Tax Returns ITRs for the assessment year 2023 24 ends today i e July 31st The Income Tax Department has urged taxpayers across the country to complete their ITR filing before July 31 Keep PAN Aadhaar bank statements Form 16 ready Follow steps login file return choose assessment year Verify ITR within 30 days to complete process The deadline for filing the income tax return for the financial year 2023 24 is nearing and taxpayers should start the process to avoid last minute hassle

Tax Return Filing Lawplustax

https://lawplustax.com/wp-content/uploads/2022/09/lawplustax-1-1.png

Los Angeles 2024 Tax Deadline Buffy Wrennie

https://checkersaga.com/wp-content/uploads/2024/01/hero_-_2024_self-employed_tax_deadlines-1024x576.png

https://cleartax.in/s/due-date-tax-filing

Taxpayers must file their income tax return by the due date to avoid interest and penalties FY 2023 24 AY 2024 25 filing deadline is July 31 2024 with a belated filing option until December 31 2024 Understanding FY AY and consequences of missing deadlines is crucial Late fees and interest charges apply for belated returns

https://cleartax.in/s/income-tax-calendar

Income tax return filing for FY 2023 24 for individuals and entities not liable for tax audit and who have not entered into any international or specified domestic transaction August 2024 Due date

Tax Return Deadline ATO Issues New Warning

Tax Return Filing Lawplustax

INCOME TAX RETURN FILING IN INDIA REGULATIONS FOR NRIs Planning For

Latest ITR Forms Archives Certicom

Income Tax Return Filing Free Online Portal V s Income Tax Consultant

Tax Day 2021 When s The Last Day To File Taxes El Paso TX

Tax Day 2021 When s The Last Day To File Taxes El Paso TX

Online Income Tax Return India

P Tax Return Filing At Rs 1499 month In Kolkata ID 23891703688

Income Tax Return Filing Fy 2021 22 Ay 2022 23 Gambaran

India Tax Return Filing Deadline - ITR due dates for FY 2023 24 AY 2024 25 The table below outlines the deadlines for filing ITR in 2024 Note The requirement to pay advance tax arises solely when an individual s overall