Is A Retirement Annuity Tax Deductible Annuities are tax deferred retirement investments you won t owe taxes until you withdraw money or receive payments Principal and or earnings may be taxed depending on the type of

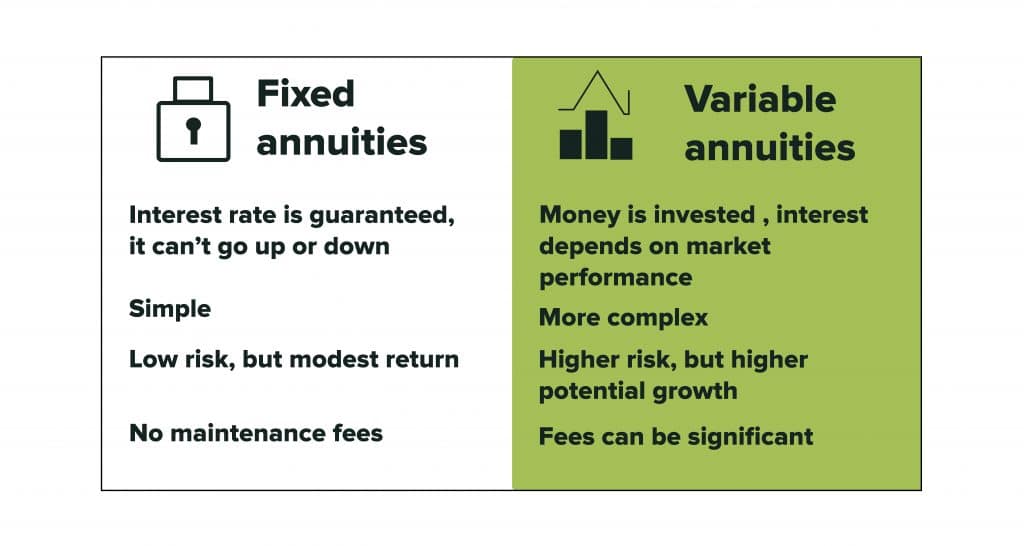

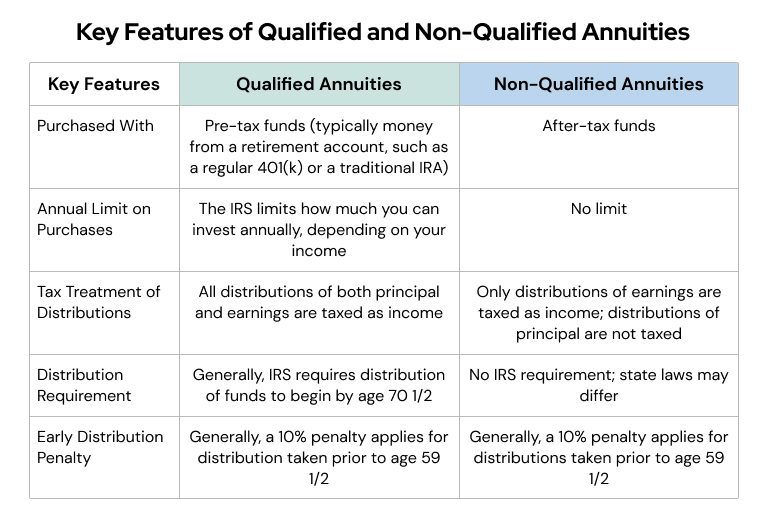

Qualified annuities are funded with pre tax dollars typically through an employer sponsored retirement plan like a 401 k or an IRA Contributions to these annuities are tax deferred meaning taxes are paid when withdrawals are made Non qualified annuities on the other hand are funded with after tax dollars The major difference between the two investment structures is that your contributions towards a retirement annuity are tax deductible up to 27 5 of taxable income whereas your contributions

Is A Retirement Annuity Tax Deductible

Is A Retirement Annuity Tax Deductible

https://www.retireguide.com/wp-content/uploads/qualified-vs-non-qualified-annuities-1-768x0-c-default.jpg

61 How To Manage A Retirement Annuity Pay Out FWC

https://static1.s123-cdn-static-a.com/uploads/4088141/800_623b146305387.jpg

Why A Retirement Annuity Is Better Than A 401 K Due

https://cdn.due.com/blog/wp-content/uploads/2021/06/Fixed-Annuities-vs-Variable-Annuities-1024x546.jpg

If your annuity is part of an existing qualified retirement plan such as an IRA or 401 k you may be eligible to receive a tax deduction for the contribution However this deduction is subject to the rules governing IRA and 401 k contributions including income limits Retirement savings products often boast tax perks that make them attractive to certain types of individuals This guide highlights how annuities are taxed

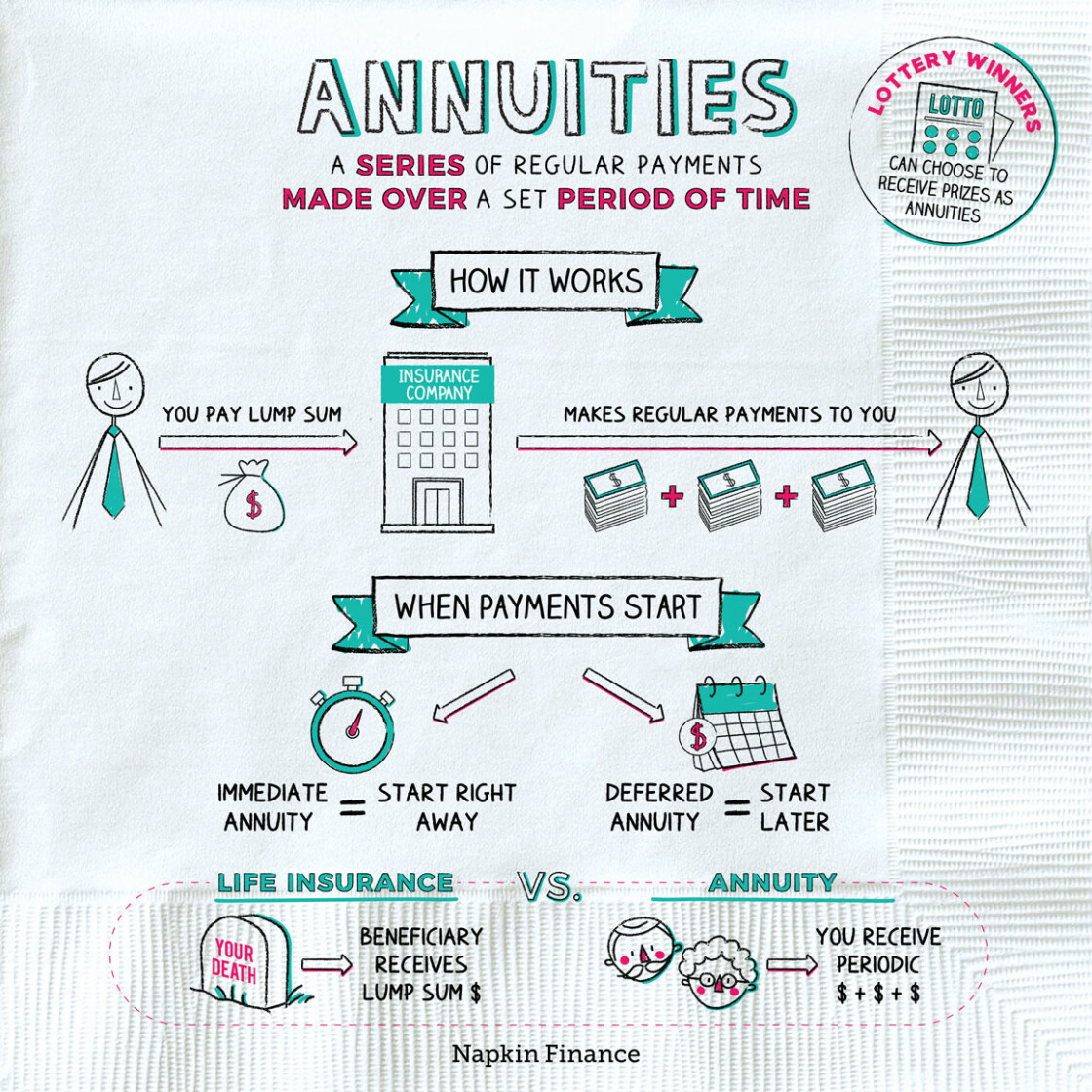

Your investment earnings grow tax deferred Contributions to nonqualified annuities aren t deductible but you don t pay taxes on the earnings until you withdraw the money Annuities can be taxable based on the type of annuity you have and when you withdraw funds which can have different potential implications for your retirement savings and income To make the most of an annuity it s important to consider their general tax rules

Download Is A Retirement Annuity Tax Deductible

More picture related to Is A Retirement Annuity Tax Deductible

What Is A Retirement Annuity The Full Guide Annuity Gator

https://www.annuitygator.com/wp-content/uploads/2020/05/what-is-a-retirement-annuity.jpg

:max_bytes(150000):strip_icc()/Term-a-annuity-d4d5906faea940828244ef128f416cc5.jpg)

Guide To Annuities What They Are Types And How They Work

https://www.investopedia.com/thmb/iHsETwmMIFyRlbl_bkMgUcAl3l8=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/Term-a-annuity-d4d5906faea940828244ef128f416cc5.jpg

9 How Do I Write A Letter Of Retirement Early 36guide ikusei

https://i2.wp.com/www.wikihow.com/images/6/68/Write-a-Retirement-Letter-Step-14.jpg

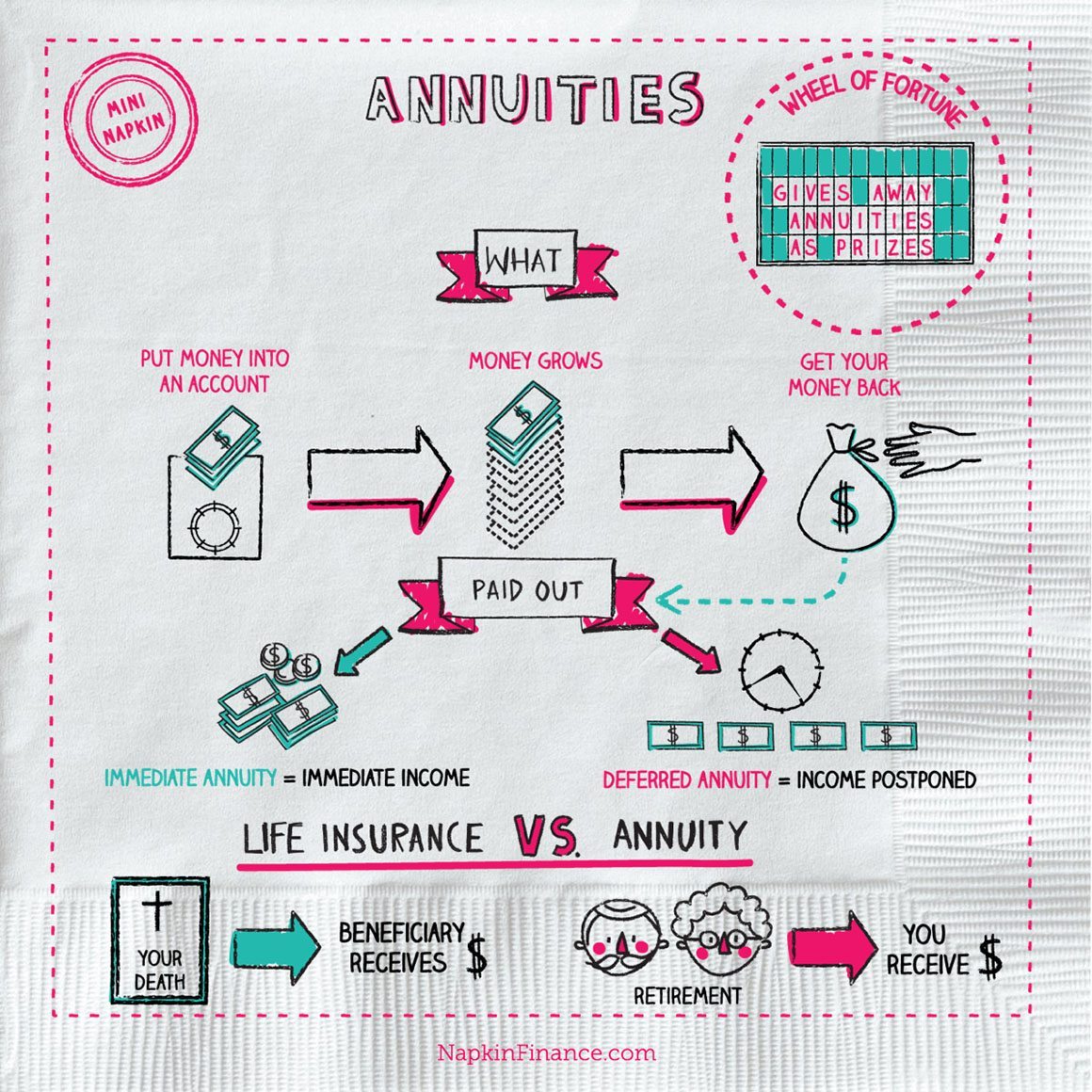

When you put money into an IRA your contributions which you may use to purchase the annuity are tax deductible provided you meet the income qualifications Any growth inside the IRA is tax deferred which means you ll pay Annuities are tax deferred investment options that carry a guaranteed income Here is how they work and the pros and cons

For a qualified annuity within a retirement plan like an IRA or 401k contributions may be tax deductible up to annual contribution limits The exact amount depends on the type of plan income and tax year Individual annuities outside these plans are not typically tax deductible Contributions made to a qualified annuity are deductible within IRS limits for retirement plans

Can I Convert A Qualified Annuity To A Roth Ira Choosing Your Gold IRA

https://www.annuity.org/wp-content/uploads/key-features-of-qualifies-and-non-qualified-annuities.jpg

Tax Deductions The New Rules INFOGRAPHIC Alloy Silverstein

https://alloysilverstein.com/wp-content/uploads/2019/03/Tax-Reform-Deductible-vs-Non-Deductible-Infographic-2019.png

https://www.investopedia.com

Annuities are tax deferred retirement investments you won t owe taxes until you withdraw money or receive payments Principal and or earnings may be taxed depending on the type of

https://www.annuity.org › annuities › taxation

Qualified annuities are funded with pre tax dollars typically through an employer sponsored retirement plan like a 401 k or an IRA Contributions to these annuities are tax deferred meaning taxes are paid when withdrawals are made Non qualified annuities on the other hand are funded with after tax dollars

Retirement Annuity Tax Benefit 1st Step In Saving Tax Today

Can I Convert A Qualified Annuity To A Roth Ira Choosing Your Gold IRA

What Are Annuities Napkin Finance

What Is Annuity Define Annuity Retirement Annuity Annuities

Inherited Non Qualified Annuity Stretch Calculator Choosing Your Gold IRA

PAY SARS LESS PAY YOURSELF MORE Contatto North

PAY SARS LESS PAY YOURSELF MORE Contatto North

Retirement Planning Neat Dollar

What Retirement Contributions Are Tax Deductible Retire Gen Z

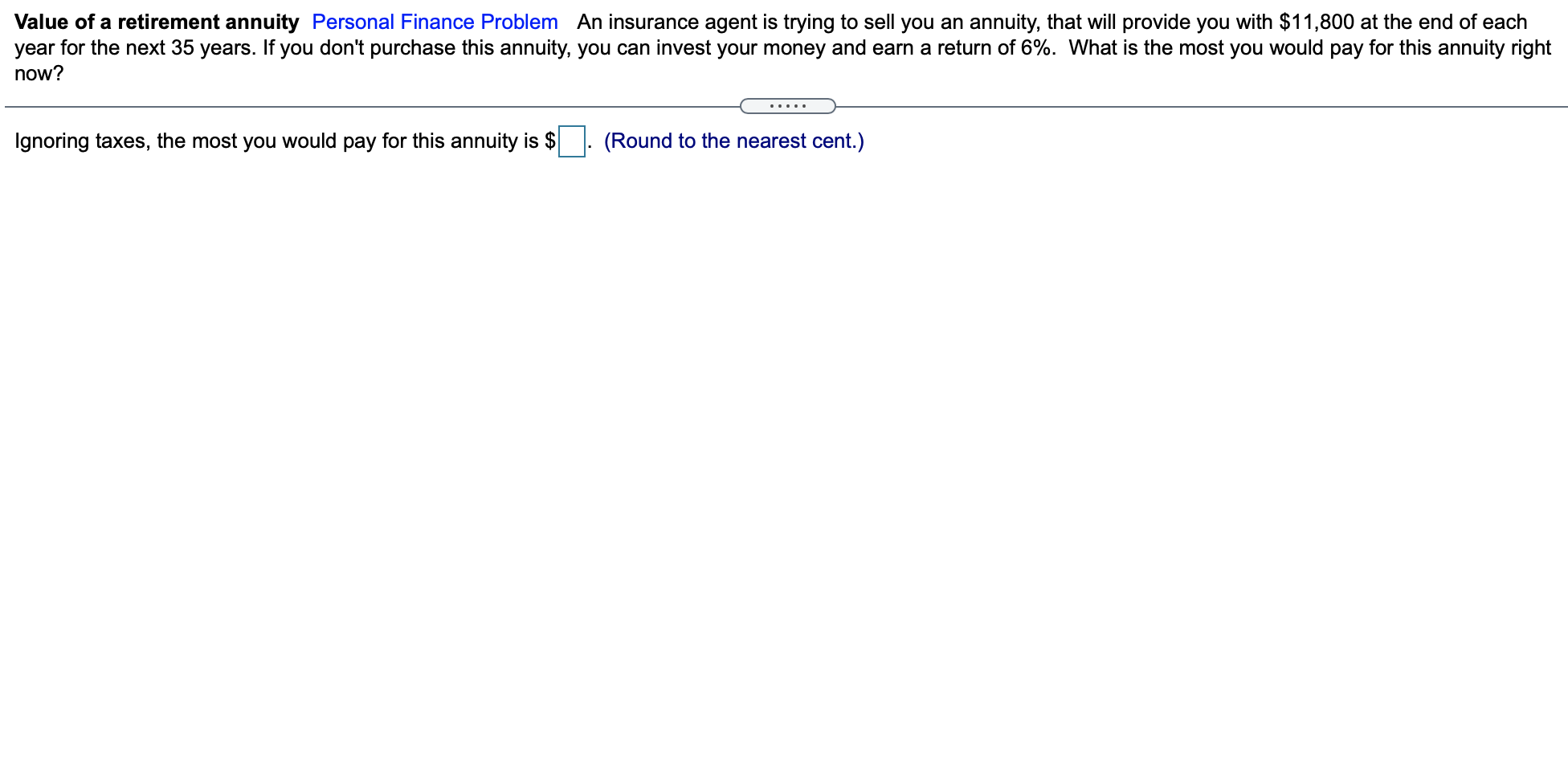

Solved Value Of A Retirement Annuity Personal Finance Chegg

Is A Retirement Annuity Tax Deductible - Annuities defer taxes to allow retirement savings to grow Read on to learn how are annuities given favorable tax treatment