Is Discount Allowed An Operating Expense A discount allowed is when the seller grants a payment discount to a buyer A discount received is when the buyer is granted a discount by the seller

From the seller s perspective discounts allowed are considered an expense and are usually recorded in the company s financial statements under operating expenses For example if a business sells a product for 500 but allows a Hi there Discount received is not added on revenue This is because its not earned directly on goods sold It is treated as other revenue after gross profit Discount allowed is debatable

Is Discount Allowed An Operating Expense

Is Discount Allowed An Operating Expense

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/31db1c6c7298ab6d5178467ef36f77a7/thumb_1200_1697.png

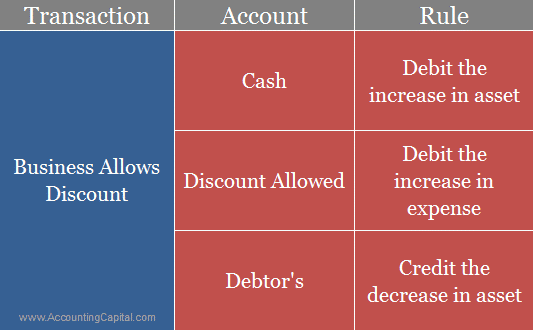

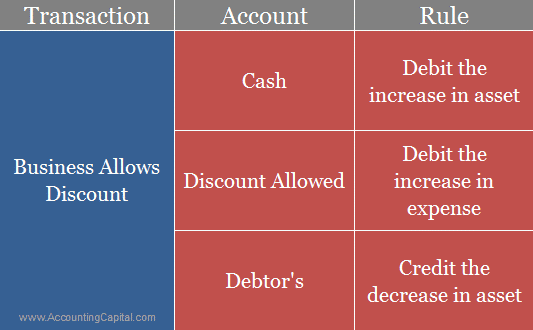

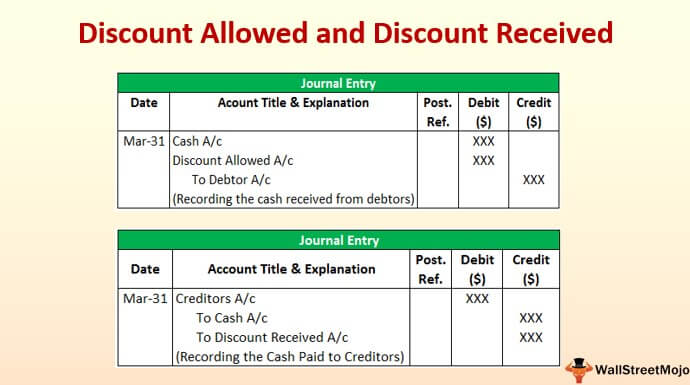

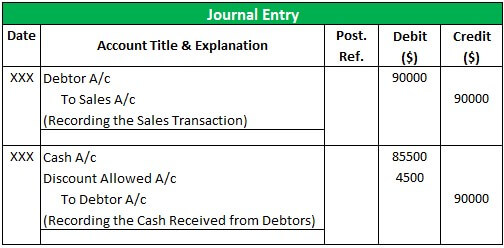

What Is The Journal Entry For Discount Allowed Accounting Capital

https://www.accountingcapital.com/wp-content/uploads/2018/08/Explanation-and-rules-for-journal-entry-for-discount-allowed.png

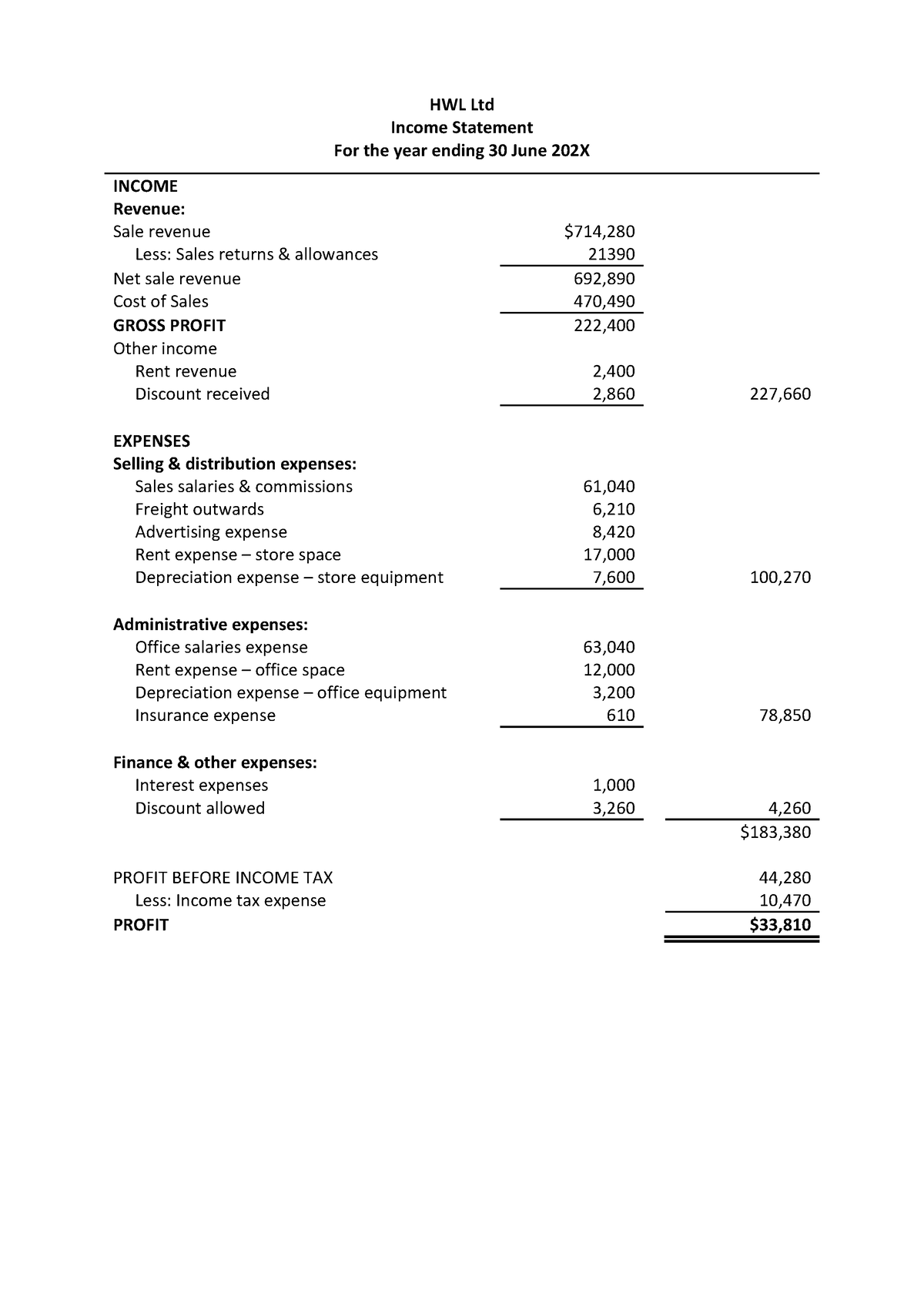

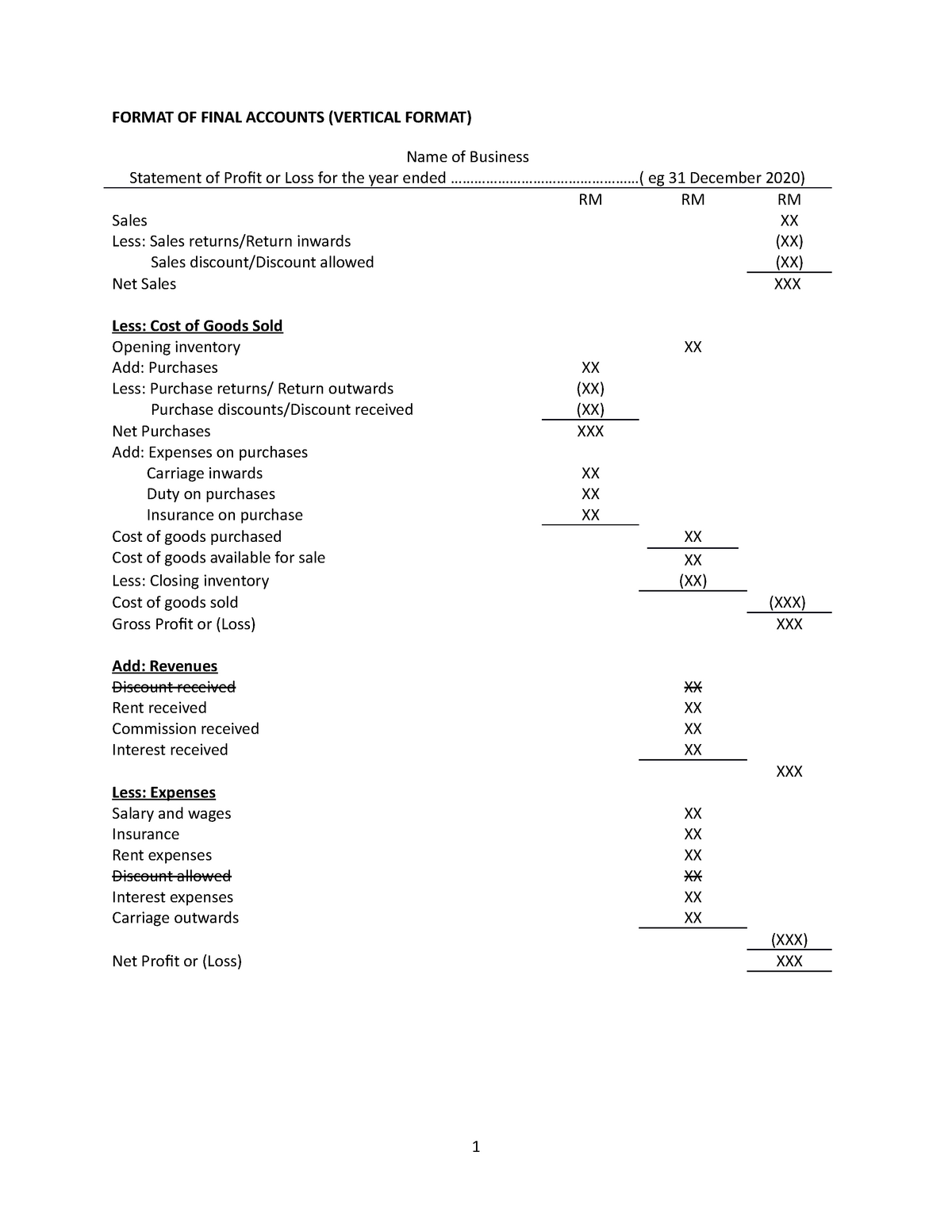

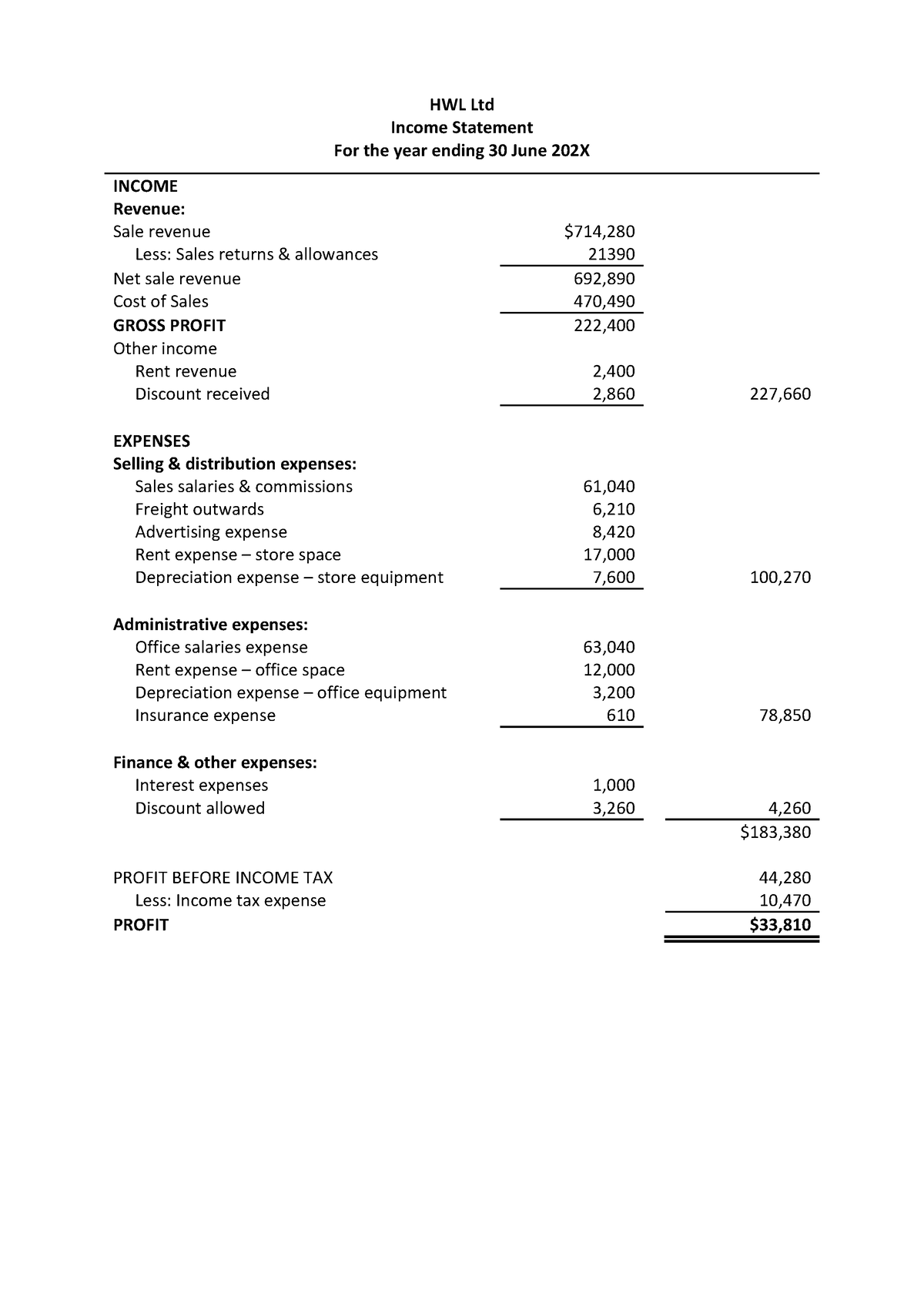

How To Treat Discount Allowed In Income Statement Aljazeera Medical

https://www.jmc.qa/wp-content/uploads/2022/11/zhexytozhaemadaegiteva.jpg

No Cash Discount Received or paid are not Operating Income Expense Only Trade Discount shown in the Purchase Sales Income is an operation item and needs to be adjusted with Sales discounts are not reported as an expense A company offers its business customer sales discounts of 1 10 net 30 For the recent year the company had gross sales of 510 000 and had sales discounts of 4 000 and sales returns

Discount allowed acts as an additional expense for the business and it is shown on the debit side of a profit and loss account Trade discount is not shown in the main financial statements however cash discount and other A discount allowed is when the seller offers a price reduction to the buyer For example a shop sells goods worth 200 to a customer but offers a 10 discount for paying within 10 days The

Download Is Discount Allowed An Operating Expense

More picture related to Is Discount Allowed An Operating Expense

Fomat Statement Of Profit Loss Details FORMAT OF FINAL ACCOUNTS

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/bd9893e5330603128733c71cfd725a93/thumb_1200_1553.png

Operating Expenses OpEx Formula And Calculator

https://wsp-blog-images.s3.amazonaws.com/uploads/2021/11/30185632/Operating-Expenses-Model.jpg

How To Use Pricing Strategies To Boost Sales Nihaojewelry Blog

https://blog.nihaojewelry.com/wp-content/uploads/2021/06/discount.jpg

Trade discounts are generally ignored for accounting purposes in that they are omitted from accounting records Following double entry is required to record the cash discount Debit It depends whether the discount is a trade discount or a discount for early payment If it is a trade discount received then it reduces the cost of the purchases and is not

A1 No Discount Allowed is usually reflected as an expense in the profit and loss account reducing the company s total revenue Q2 What is the difference between Discount Allowed Is sales discount an expense A sales discount is the reduction that a seller gives to a customer on the invoiced price of goods or services in order to incentivize early payment

Is Sales Discount An Expense Financial Falconet

https://www.financialfalconet.com/wp-content/uploads/2022/11/Is-sales-discount-an-expense.jpg

Difference Between Discount Allowed And Discount Received Compare The

https://www.differencebetween.com/wp-content/uploads/2017/03/Difference-Between-Discount-Allowed-and-Discount-Received-2.png

https://www.accountingtools.com › articles › what-is...

A discount allowed is when the seller grants a payment discount to a buyer A discount received is when the buyer is granted a discount by the seller

https://www.superfastcpa.com › what-are-discount...

From the seller s perspective discounts allowed are considered an expense and are usually recorded in the company s financial statements under operating expenses For example if a business sells a product for 500 but allows a

Discount Allowed Archives Tutor s Tips

Is Sales Discount An Expense Financial Falconet

Journal Entry For Discount Allowed And Received GeeksforGeeks

Discount Allowed And Discount Received Journal Entries With Examples

Discount Allowed And Discount Received Journal Entries With Examples

Study Tips Discounts Posting foundation Bookkeeping AAT Comment

Study Tips Discounts Posting foundation Bookkeeping AAT Comment

Is Cash Discount Shown In Cash Book

Discount Allowed And Discount Received

Solved Income Statement For The Years Ended December 31 Chegg

Is Discount Allowed An Operating Expense - Sales discounts are not reported as an expense A company offers its business customer sales discounts of 1 10 net 30 For the recent year the company had gross sales of 510 000 and had sales discounts of 4 000 and sales returns