Is Health Insurance Reimbursement Considered Income The quick answer is no at least not tax free without some serious tax consequences The IRS is going to treat the employer reimbursement of health insurance as income and insist that the

If your employer provides a health FSA that qualifies as an accident or health plan the amount of your salary reduction and reimbursements of your medical care expenses in Is health insurance reimbursement considered income Before we discuss insurance reimbursement tax treatment the answer is no Health insurance

Is Health Insurance Reimbursement Considered Income

Is Health Insurance Reimbursement Considered Income

https://take-command.imgix.net/hubfs/2529879/christin-hume-Hcfwew744z4-unsplash.jpg?q=50&auto=format&crop=faces%2Centropy&fit=max&w=1024

Benefits Of Health Insurance PLblog Benefits Of Health Insurance PL

https://www.plindia.com/blog/wp-content/uploads/2023/10/Blog-thumbnail_Benefits-of-health-insurance.png

Is Health Insurance Mandatory In Kenya Lifecare International Insurance

https://lifecareinternational.com/wp-content/uploads/2022/01/122556543_m-1536x1026.jpg

When an HRA complies with federal rules employers can reimburse medical expenses such as health insurance premiums with money free of payroll taxes for both the employer and employee An A health reimbursement arrangement HRA is a tax advantaged plan that employers use to reimburse employees for certain approved medical and dental expenses

Taxable Includible in gross income not excluded under any IRC section If the recipient is an employee this amount is includible as wages and reported by the employer on Form For most people their portion of employer sponsored health insurance premiums aren t enough to get deducted from taxable income Most group health

Download Is Health Insurance Reimbursement Considered Income

More picture related to Is Health Insurance Reimbursement Considered Income

Is Health Insurance Reimbursement Taxed As Income

https://take-command.imgix.net/hubfs/2529879/katie-harp-aGwT9nSiTWU-unsplash.jpg?q=50&auto=format&crop=faces%2Centropy&fit=max&w=1024

Health Insurance

https://lifeadvice.ca/public/front/img/images/insurance-board.gif

Is Health Insurance Reimbursement Taxable

https://www.peoplekeep.com/hubfs/Is health insurance reimbursement taxable_fb.jpg#keepProtocol

Employers with 50 or more full time employees or full time equivalents are required to offer affordable health insurance to their full time employees meaning that the employee s premiums cannot You can claim an itemized deduction for qualified medical expenses that exceed 7 5 of your adjusted gross income You can also take tax free health savings account HSA health care flexible

Health insurance is not taxable income even if your employer pays for it Under the Affordable Care Act the amount your employer spends on your premiums If an employee pays the premiums on personally owned health insurance or incurs medical costs and is reimbursed by the employer the reimbursement generally is

Where Is Health Insurance Free Vim Ch i

https://www.vimchi.info/wp-content/uploads/2022/02/Where-is-Health-Insurance-Free-featured.jpeg

Why Is Health Insurance More Expensive For Single People Assurance IQ

https://assurance.com/wp-content/uploads/2023/07/Health-Insurance-More-Expensive-for-Single-People.jpg

https://www.takecommandhealth.com/bl…

The quick answer is no at least not tax free without some serious tax consequences The IRS is going to treat the employer reimbursement of health insurance as income and insist that the

https://www.irs.gov/publications/p525

If your employer provides a health FSA that qualifies as an accident or health plan the amount of your salary reduction and reimbursements of your medical care expenses in

Tuition Reimbursement Vs Salary Raise What s The Difference

Where Is Health Insurance Free Vim Ch i

Is Travel Reimbursement Considered Income A Comprehensive Guide The

Healthcare Reimbursement Vector Infographics Stock Illustration

A Guide On Health Insurance Claim Process HDFC Sales Blog

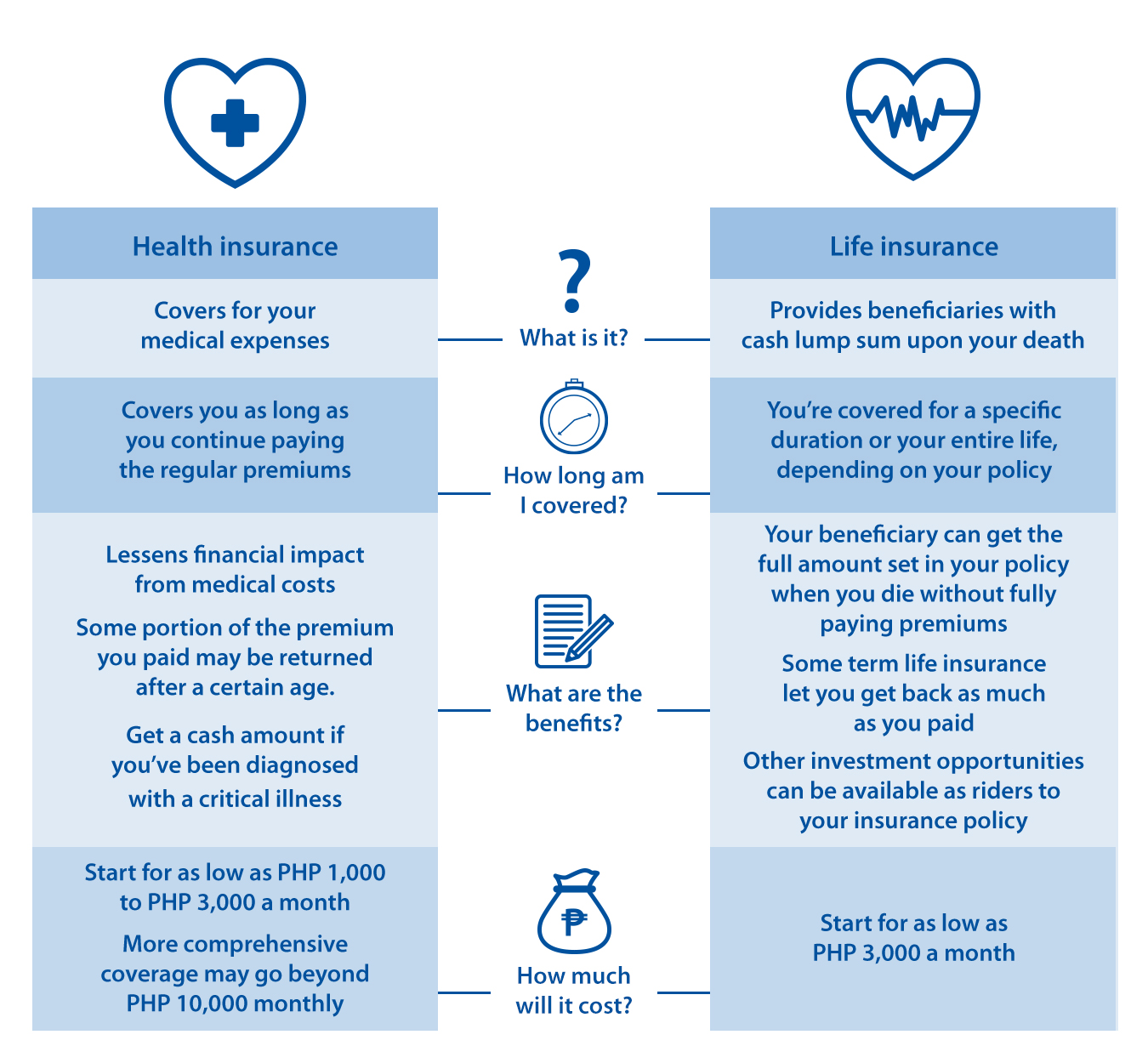

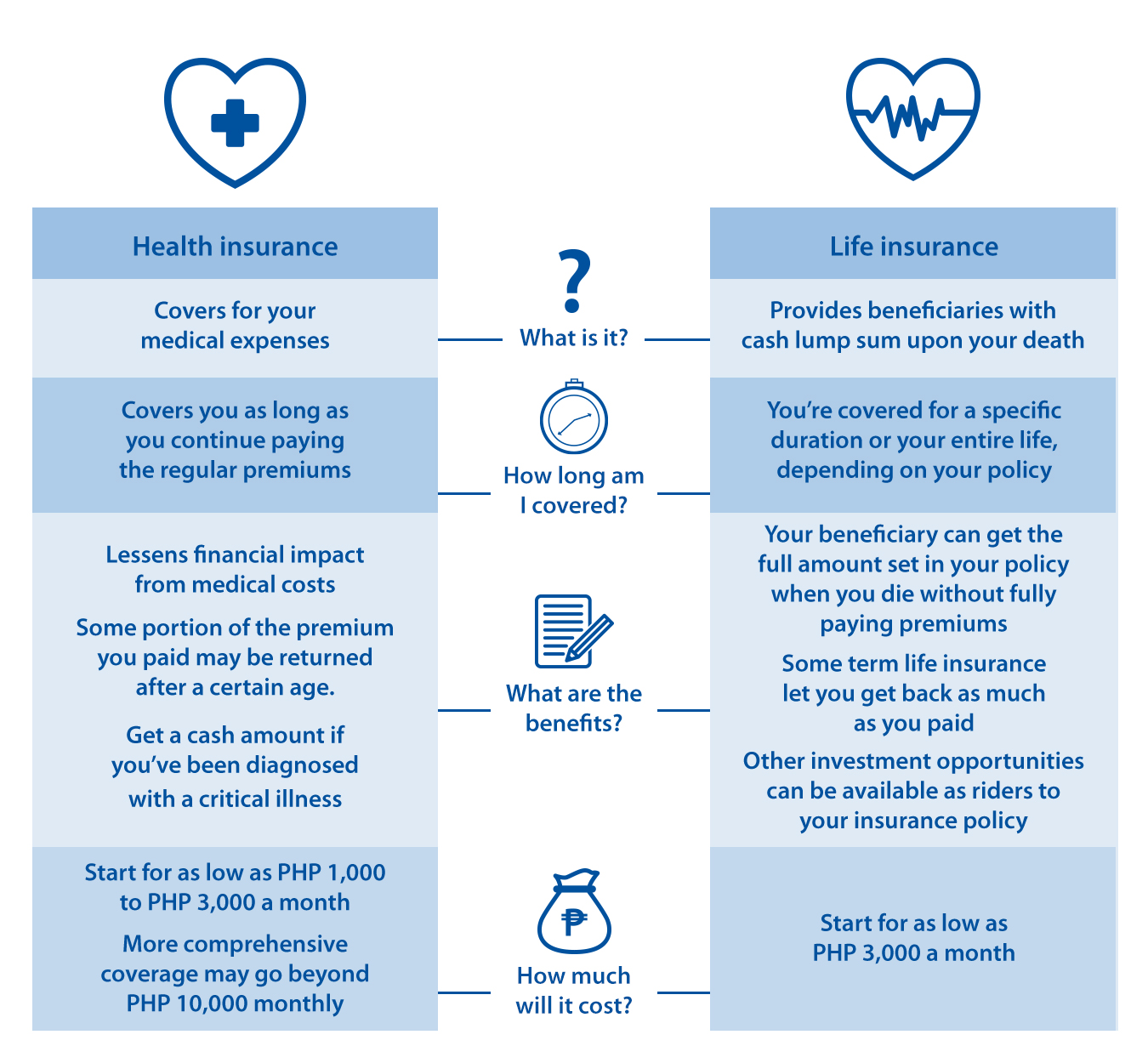

List Of 10 Life Insurance Vs Health Insurance

List Of 10 Life Insurance Vs Health Insurance

What Is Health Insurance And How Does It Work Dr Tyler Buckley

How To Choose The Right Health Insurance Plan Today s Top Flickr

Health Insurance 101 A Comprehensive Guide ConsumerIQ

Is Health Insurance Reimbursement Considered Income - But there s one more hurdle the medical expenses floor You can only deduct your total medical expenses that exceed 7 5 of your adjusted gross income