Is Housing Loan Comes Under 80c Web 5 Feb 2023 nbsp 0183 32 This is why a home loan is eligible for tax deduction under Section 80C And when you buy a house on a home loan it comes with multiple tax benefits that

Web 26 Juli 2018 nbsp 0183 32 Home loan entitles Individuals to Deduction Under Section 80C of up to Rs 1 50 Lakh and Interest Deduction under section 24 of up to Rs 2 Lakh Articles deals Web 11 Jan 2022 nbsp 0183 32 Tax Benefits of Home Loan Section 24 Section 80C Section 80EEA Repayment of Home Loan comprises of 2 components Principal and Interest

Is Housing Loan Comes Under 80c

Is Housing Loan Comes Under 80c

https://www.hdfcsales.com/blog/wp-content/uploads/2021/10/benefits-of-paying-home-loan-emi.png

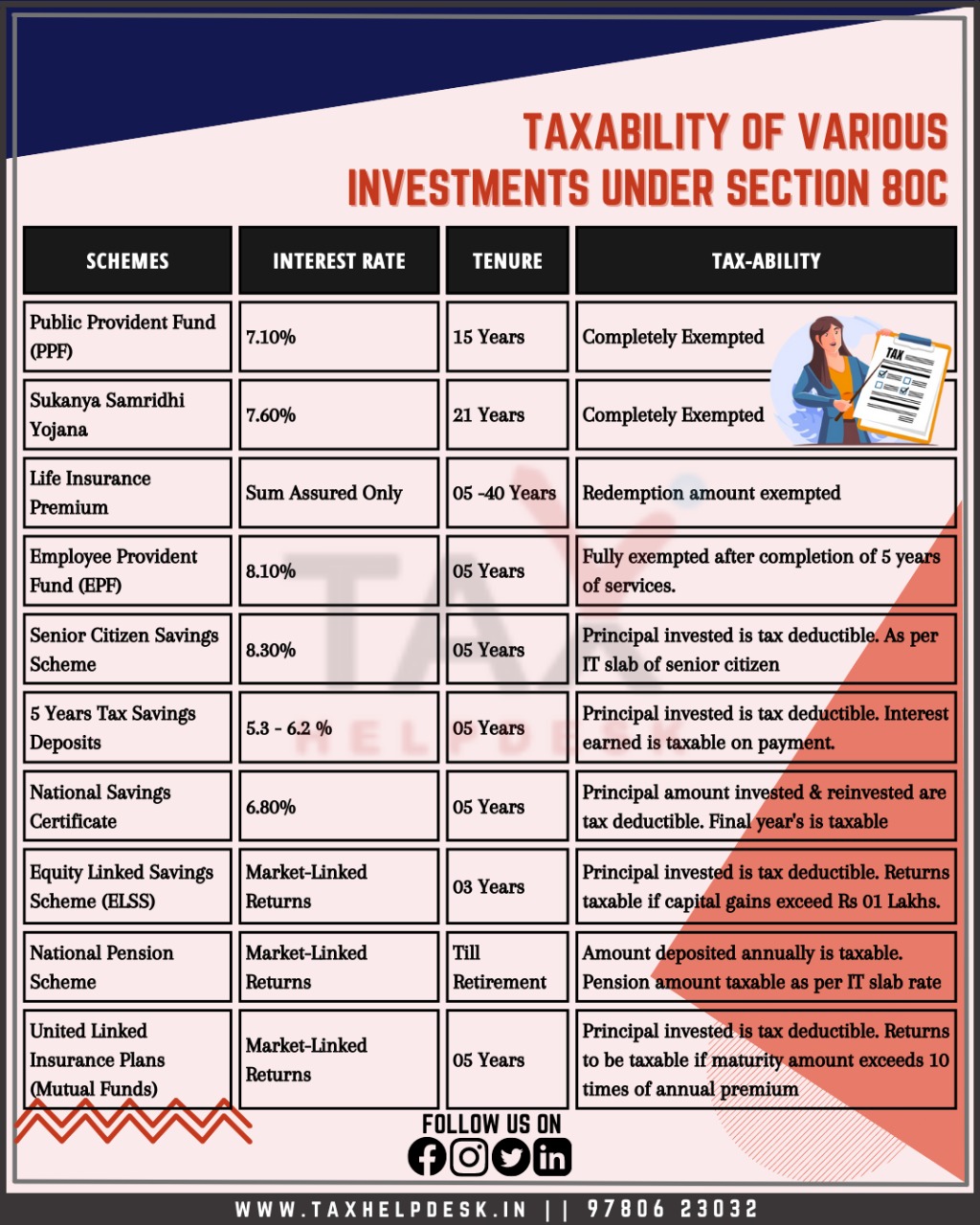

Understand About Taxability Of Various Investments Under Section 80C

https://www.taxhelpdesk.in/wp-content/uploads/2022/07/Investments-under-Section-80C.jpeg

5 Top 5 Points For

https://1.bp.blogspot.com/-bQzJ_9n04UY/YFS_OTB-aHI/AAAAAAAAAvQ/3E6y-HGxQQEbem4S8_Q1XeZiEQX16a_WwCNcBGAsYHQ/s980/housing-loan.jpg

Web 13 Jan 2023 nbsp 0183 32 Section 80C of the Income Tax Act 1961 Act provides for a deduction of up to INR 1 5 lakh from the total taxable income of Individuals and Hindu Undivided Web 16 Juni 2020 nbsp 0183 32 Deduction under section 80C Your home loan s Principal amount stamp duty registration fee or any other expenses is a part of Section 80C of the Income Tax

Web The deduction under section 80EE is available only to home owners individuals having only one house property on the date of sanction of the loan The value of the property Web Know tax saving on home loan under section 24 80EE and 80C Home loan customer should be aware of the home loan tax benefits as it could reduce the taxable income for

Download Is Housing Loan Comes Under 80c

More picture related to Is Housing Loan Comes Under 80c

Deductions U S 80C Under Schedule VI Of Income Tax India Financial

https://www.caindelhiindia.com/blog/wp-content/uploads/2021/07/80c.jpg

Tax Benefits On Home Loan Know More At Taxhelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2021/11/Tax-Saving-Benefits-of-having-property-through-Home-Loan-1.png

Income Tax Deduction Under Section 80C To 80U FY 2022 23

https://navi.com/blog/wp-content/uploads/2022/05/Section-80-of-the-Income-Tax-Act.webp

Web 17 Feb 2020 nbsp 0183 32 Housing finance also helps you save up on tax payments under the ITA sections of 80EEA 24 and 80C This article talks about the tax benefits under these Web 28 Dez 2023 nbsp 0183 32 Section 80C is the most popular income tax deduction for tax saving 80C deduction limit for the current FY 2023 24 AY 2024 25 is Rs 1 50 000 For claiming the tax benefit ITR filing is mandatory In this

Web Vor 2 Tagen nbsp 0183 32 Section 80C of the Income Tax Act allows for deductions up to Rs 1 5 lakh p a Under the section individuals can invest in several savings schemes to claim Web Yes home loan principal is part of Section 80C of the Income Tax Act Under this section an individual is entitled to tax deductions on the amount paid as repayment of the

How To Claim Business Loan Tax Deductions Under Section 80C IIFL Finance

https://www.iifl.com/files/iifl_insights/images/80-c-750x400.png

Taken Home Loan From These Sources You Won t Get Benefits Under

https://imgk.timesnownews.com/story/Home_loan_-_iStock.jpg?tr=w-600,h-450,fo-auto

https://cleartax.in/s/home-loan-tax-benefit

Web 5 Feb 2023 nbsp 0183 32 This is why a home loan is eligible for tax deduction under Section 80C And when you buy a house on a home loan it comes with multiple tax benefits that

https://taxguru.in/income-tax/faq-on-housing-loan-and-income-tax...

Web 26 Juli 2018 nbsp 0183 32 Home loan entitles Individuals to Deduction Under Section 80C of up to Rs 1 50 Lakh and Interest Deduction under section 24 of up to Rs 2 Lakh Articles deals

HOW TO SAVE TAX UNDER SECTION 80 C WHAT COMES UNDER SECTION 80C FULL

How To Claim Business Loan Tax Deductions Under Section 80C IIFL Finance

Section 80C Deductions List To Save Income Tax FinCalC Blog

Section 80C Deductions Save Up To 1 5 Lakhs On Taxes

Tax Savings Deductions Under Chapter VI A Learn By Quicko

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

How To Claim Both HRA Home Loans Tax Deductions With Section 24 And

80C

What Is Home Extension Loans Know About The Benefit And Eligibility

Is Housing Loan Comes Under 80c - Web The deduction under section 80EE is available only to home owners individuals having only one house property on the date of sanction of the loan The value of the property