Is Standard Deduction Applicable For All In New Tax Regime Is Standard deduction of Rs 50 000 available in new tax regime Yes Standard deduction of Rs 50 000 is available in new tax regime from FY 2023 24 starting from April 1 2023 How to claim standard deduction

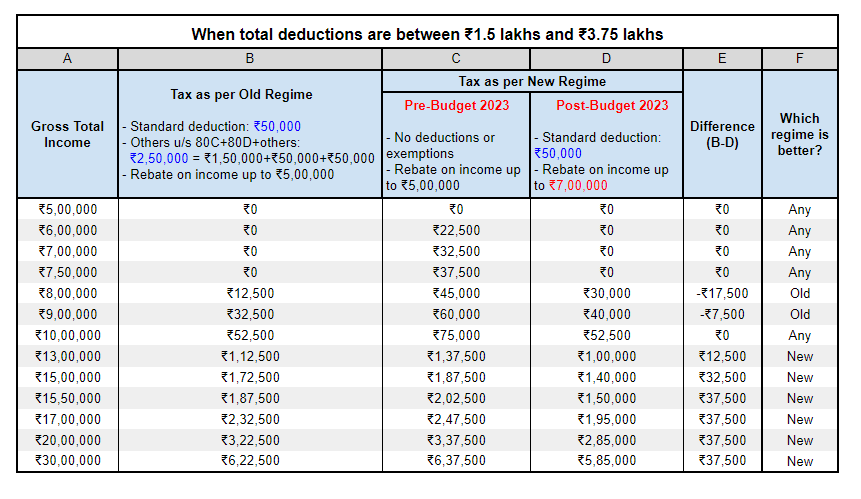

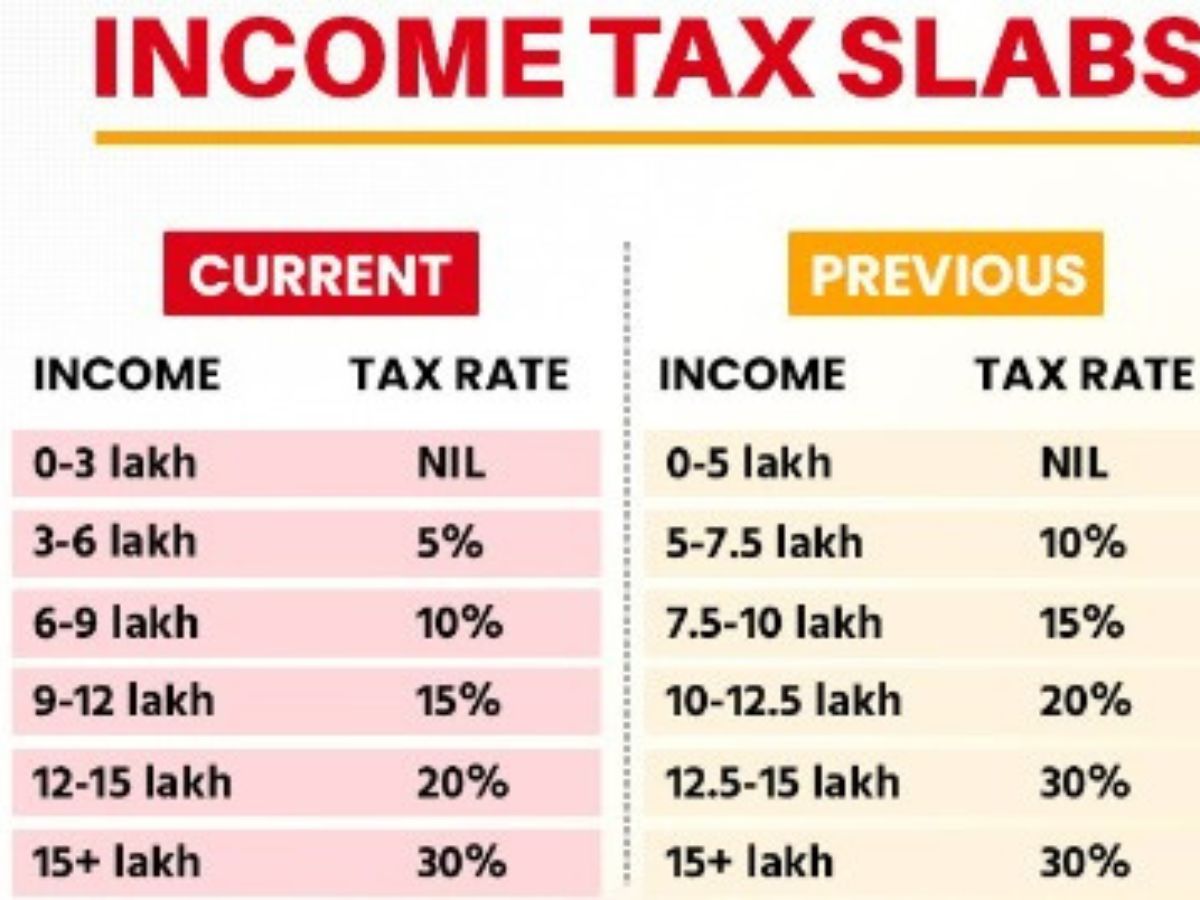

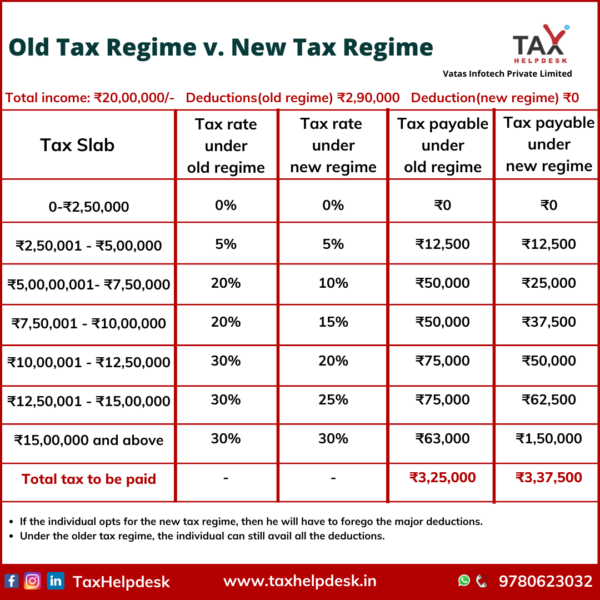

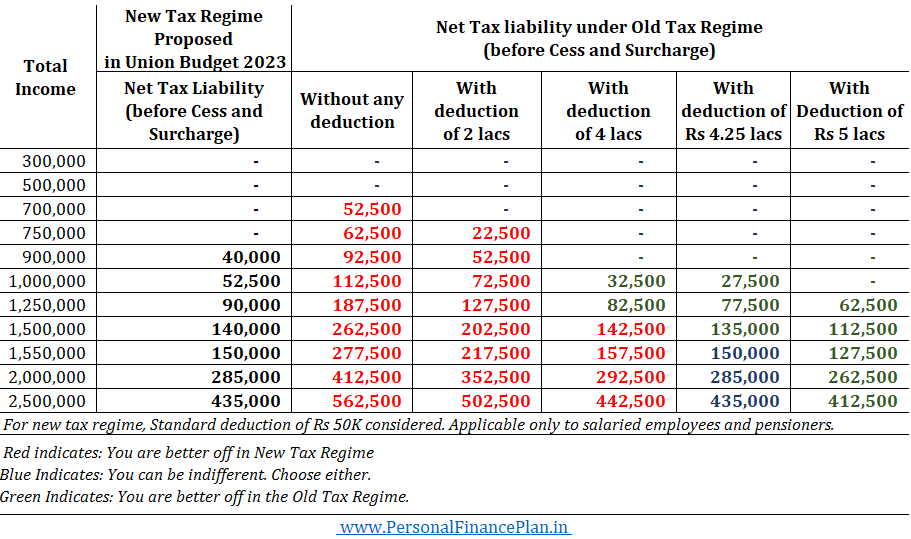

Standard Deduction and Family Pension Deduction Salary income The standard deduction of 50 000 which was only available under the old regime has now been extended to the new tax regime as well This along with the rebate makes 7 5 lakhs as your tax free income under the new regime The standard deduction of Rs 50 000 has been extended to the new tax regime as well The highest surcharge rate of 37 has been reduced to 25 under the new tax regime This move impacts taxpayers earning more than Rs 5 crore As a result their overall tax rate will decrease from 42 74 to 39

Is Standard Deduction Applicable For All In New Tax Regime

Is Standard Deduction Applicable For All In New Tax Regime

https://dollarkeg.com/wp-content/uploads/2023/01/how-to-calculate-taxes-with-standard-deduction.png

What Is Standard Deduction For Ay 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-12.jpg

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

Federal Income Tax Deduction Chart My XXX Hot Girl

https://www.investopedia.com/thmb/JjB8KxvTErLB2ZgozO3H_wkKoNA=/2338x2338/smart/filters:no_upscale()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg

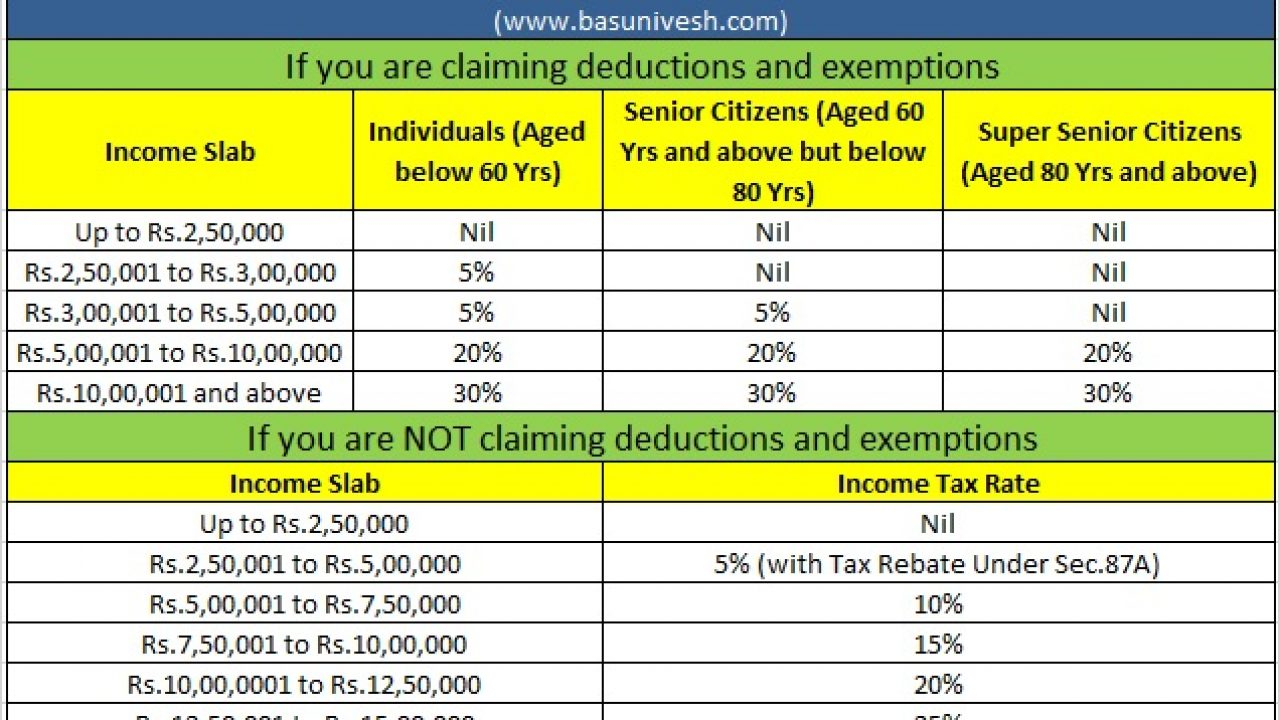

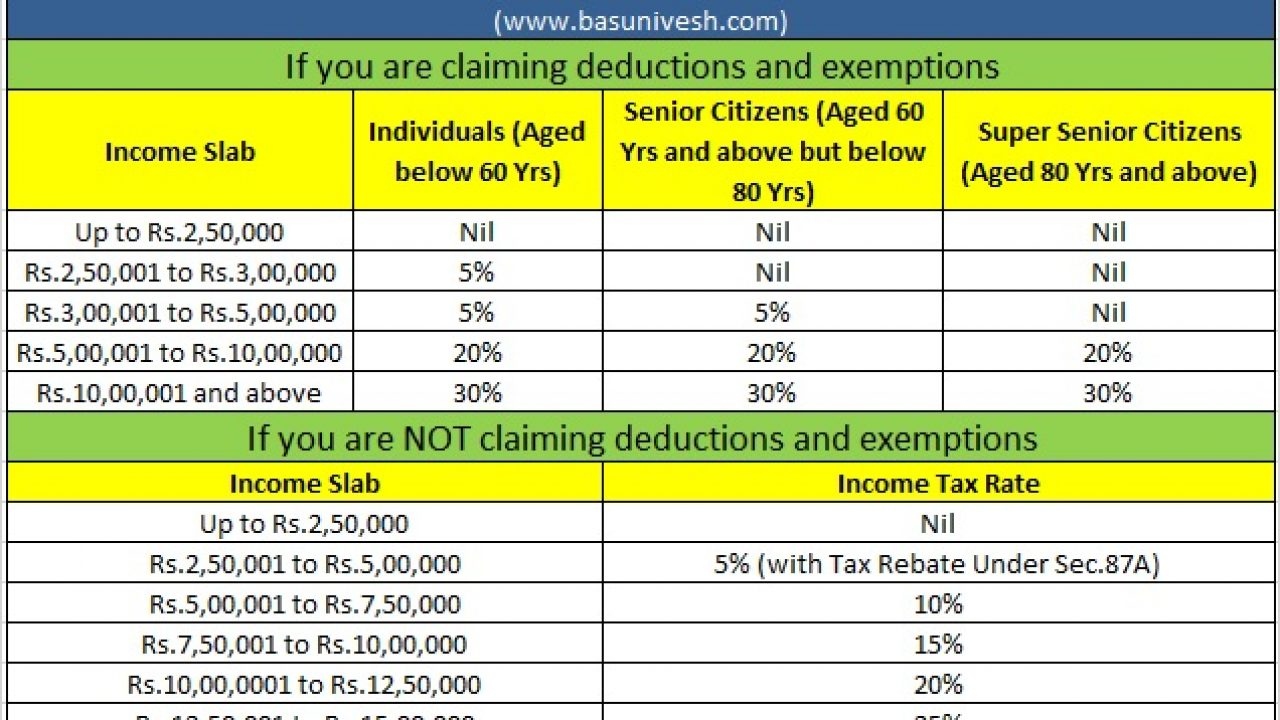

What are the changes in the standard deductions in the tax regime As per the Union budget 2023 2024 the standard deductions applicable to the taxpayers under the old regime will now be available for all under section 115BAC of the Income Tax Act 2 4 Available Deductions Exemptions a The new tax regime permits a standard deduction of Rs 50 000 for salaried persons and a deduction for a family pension being lower of Rs 15 000 or 1 3rd of the pension b Transport Allowance in case of an especially abled person

However in Budget 2023 it was announced that the standard deduction benefit of Rs 50 000 will be available for the salaried and pensioners under the new tax regime Similarly family pensioners can claim deduction of When will Standard Deduction under New Tax Regime apply The standard deduction benefit under the New Tax Regime will apply from AY 2024 25 i e for income tax return filing after FY 2023 24

Download Is Standard Deduction Applicable For All In New Tax Regime

More picture related to Is Standard Deduction Applicable For All In New Tax Regime

Tax Rates Absolute Accounting Services

https://imageio.forbes.com/specials-images/imageserve/618be1b6d57aaf84e03b72d2/Standard-Deduction-2022/960x0.jpg?format=jpg&width=960

Tax Planning Under The New Tax Bill Redwood Grove Wealth Management

https://redwoodgrovewm.com/wp-content/uploads/2018/10/Tax-Planning-Under-the-New-Tax-Bill.jpg

IRS Provides Tax Inflation Adjustments For Tax Year 2022 Income Tax

https://www.mondaq.com/images/article_images/1132100a.jpg

The number of deductions you can claim under the new tax regime is less than that of the older regime That said there are several deductions you can enjoy in the new regime such as Standard deduction of up to 50 000 Interest on a home loan for a let out property Family pension received 50 000 or 1 3 rd whichever is lower Amount While the new regime comes with lower income tax slab rates it takes away many of the tax benefits For instance you cannot claim some of the major tax deductions available under Chapter VI A of the Income Tax Act Moreover you have to let go of the standard deduction which under the old tax regime could be availed by any salaried

Deductions available under the revised new tax regime Not all deductions are available under the new slab rates e g 80C 80D etc Very few deductions are available a For salaried individuals standard deduction upto Rs 50 000 b On pension standard deduction of Rs 15 000 or 1 3rs of pension whichever is lower c Employer s Can we claim standard deduction in new tax regime Yes we can claim standard deduction of Rs 50 000 in new tax regime from FY 2023 24 onwards that will be applicable from AY 2024 25 This standard deduction is applicable to only salaried employees and pensioners Businessman will not get this deduction while calculating

Standard Deduction In New Tax Regime EXPLAINED FinCalC Blog

https://fincalc-blog.in/wp-content/uploads/2023/02/standard-deduction-and-tax-rebate-in-new-tax-regime-video-1024x576.webp

Old Vs New Tax Regime Which Is Better New Or Old Tax Regime For

https://assets1.cleartax-cdn.com/finfo/wg-utils/retool/5b974531-0e4b-4442-ab2f-b5505d877432.png

https://economictimes.indiatimes.com/wealth/tax/...

Is Standard deduction of Rs 50 000 available in new tax regime Yes Standard deduction of Rs 50 000 is available in new tax regime from FY 2023 24 starting from April 1 2023 How to claim standard deduction

https://cleartax.in/s/old-tax-regime-vs-new-tax-regime

Standard Deduction and Family Pension Deduction Salary income The standard deduction of 50 000 which was only available under the old regime has now been extended to the new tax regime as well This along with the rebate makes 7 5 lakhs as your tax free income under the new regime

Rebate Limit New Income Slabs Standard Deduction Understanding What

Standard Deduction In New Tax Regime EXPLAINED FinCalC Blog

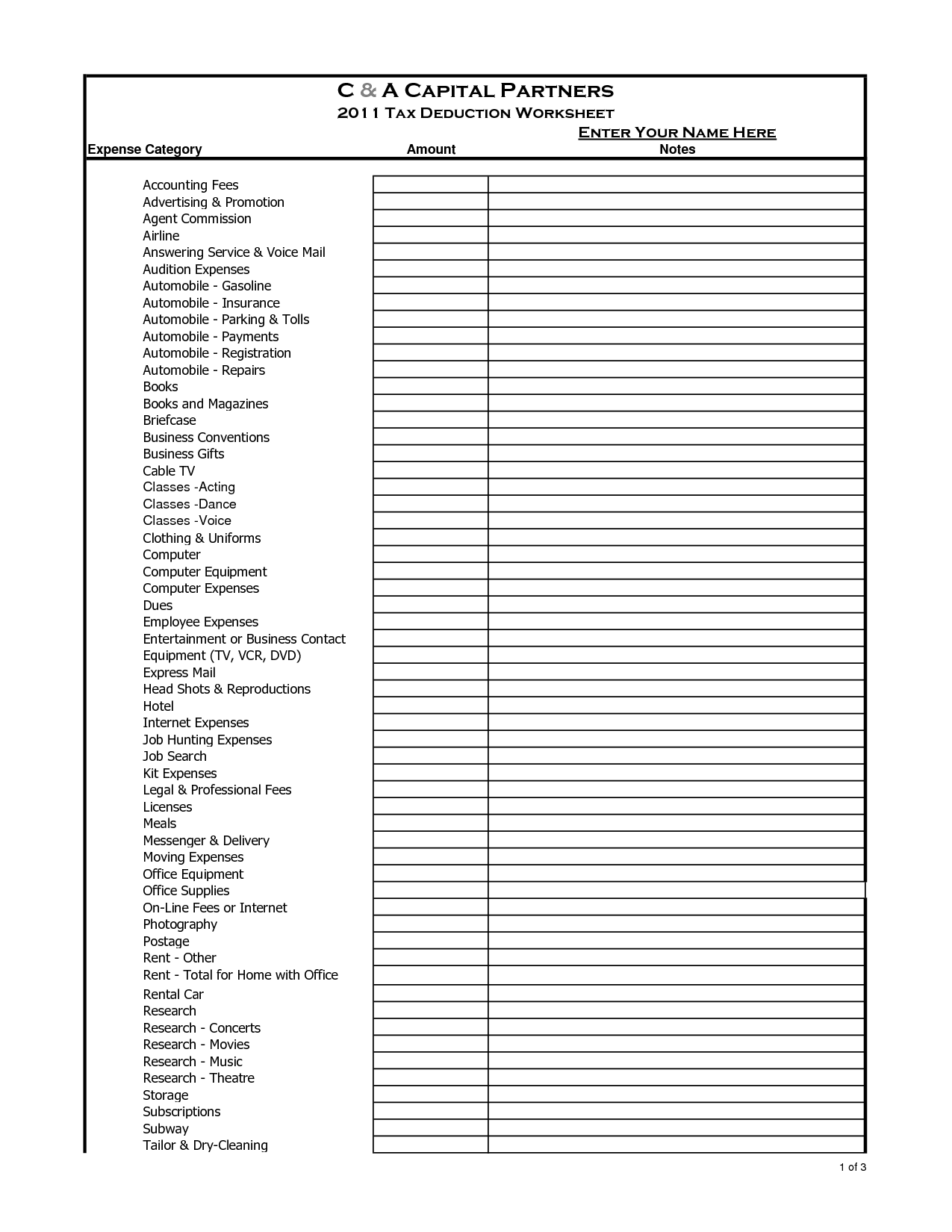

10 2014 Itemized Deductions Worksheet Worksheeto

Income Tax Return Which Tax Regime Suits You Old Vs New

Changes In New Tax Regime All You Need To Know

Deductions Under The New Tax Regime Budget 2020 Blog By Quicko

Deductions Under The New Tax Regime Budget 2020 Blog By Quicko

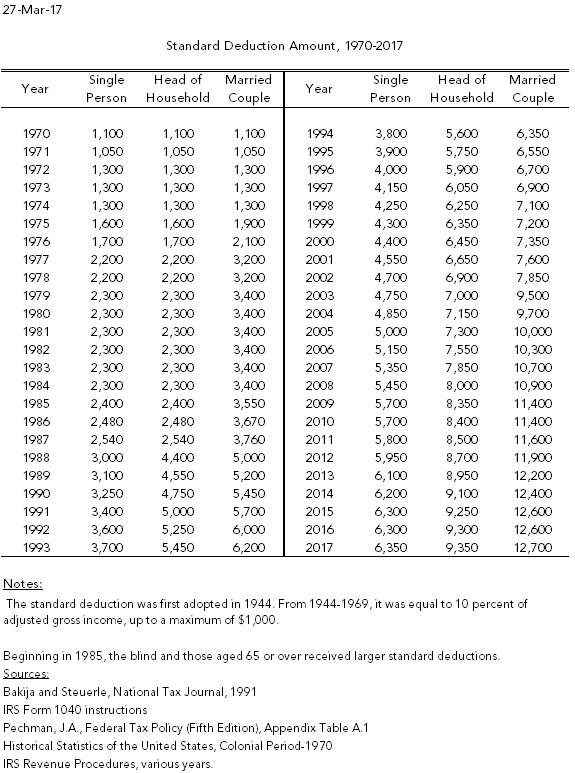

Personal Exemption And Standard Deduction 201

New Tax Regime Vs Outdated Tax Regime Which One To Select

Tax Deductions You Can Deduct What Napkin Finance

Is Standard Deduction Applicable For All In New Tax Regime - What are the changes in the standard deductions in the tax regime As per the Union budget 2023 2024 the standard deductions applicable to the taxpayers under the old regime will now be available for all under section 115BAC of the Income Tax Act