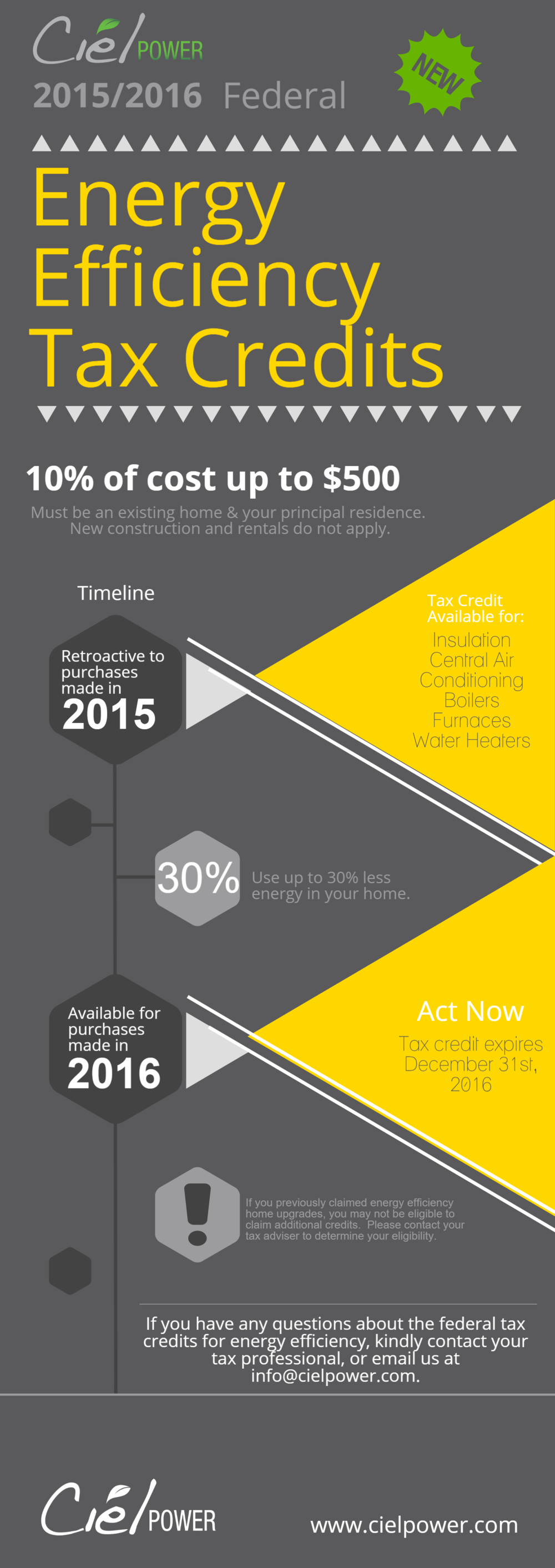

Is The Energy Tax Credit Refundable Both the Energy Efficient Home Improvement Credit and the Residential Clean Energy Property Credit are nonrefundable personal tax credits A taxpayer claiming a nonrefundable credit can only use it to decrease or eliminate tax liability

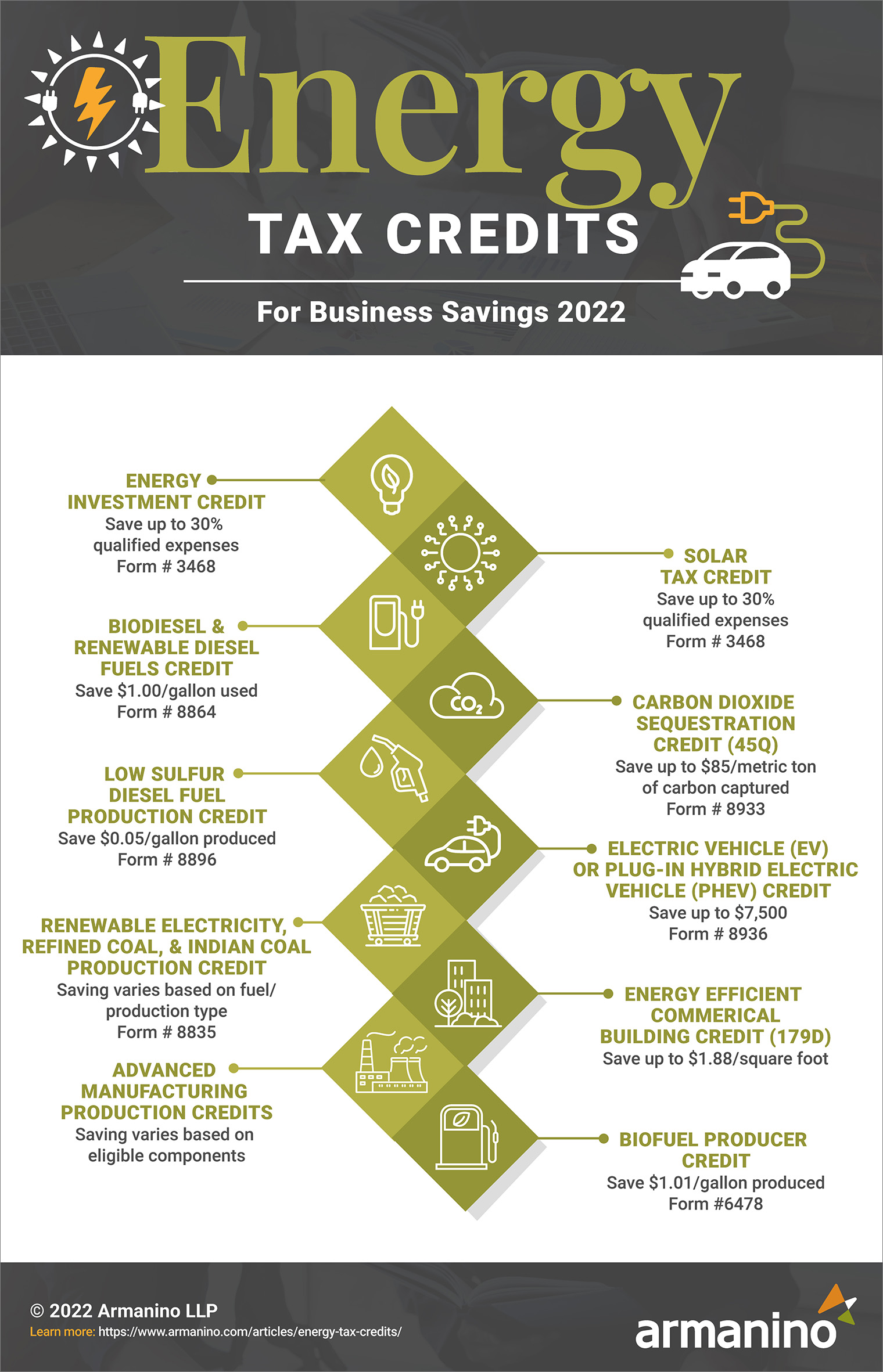

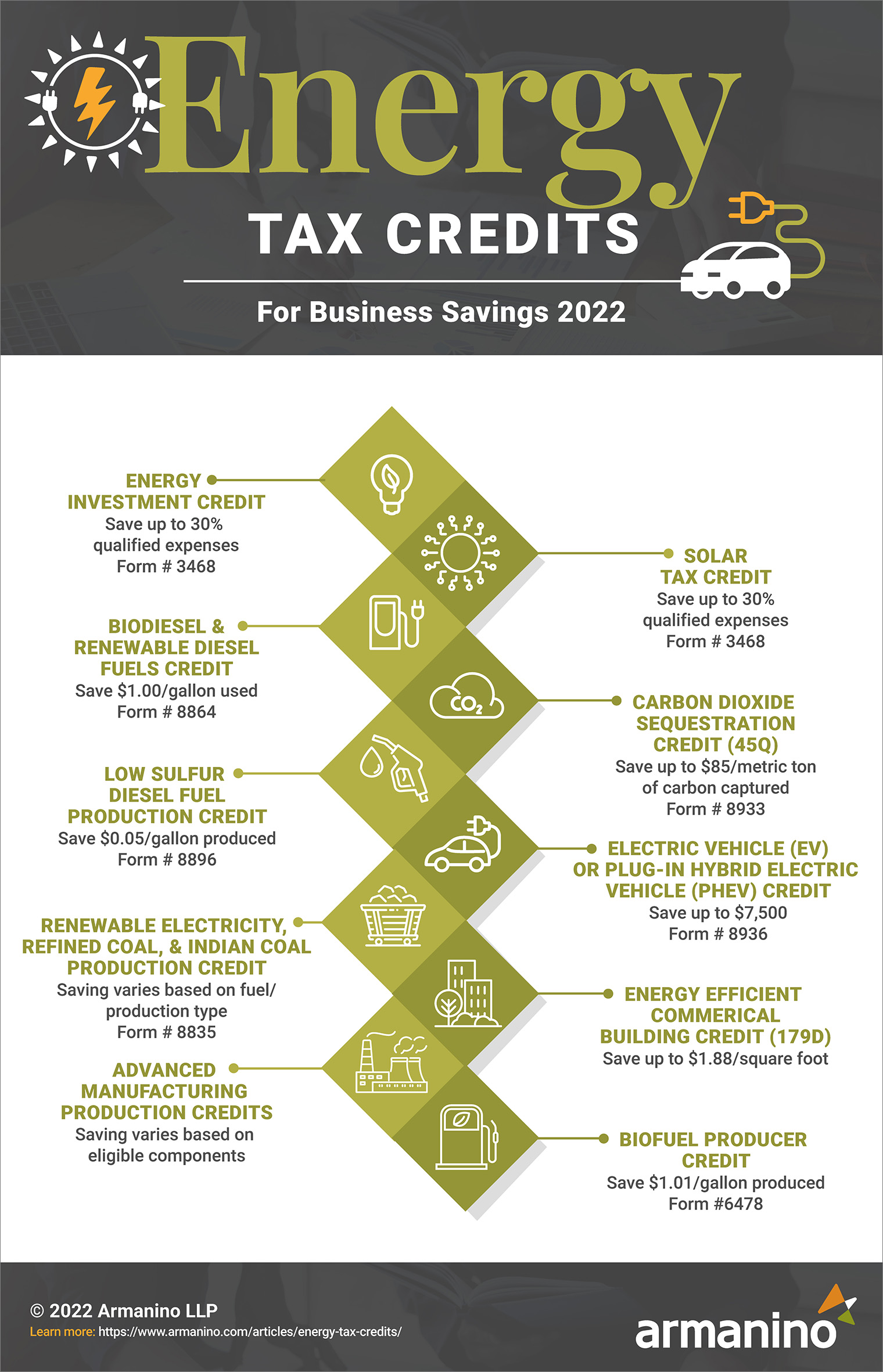

Generally taxpayers who receive rebates for the purchase of energy efficient homes will not include the value of those rebates as income on their tax returns however they will need to reduce the basis of the property when they sell it Key Takeaways An energy tax credit is a government incentive that reduces the cost for people and businesses to use alternative energy resources The credit amount either reduces the

Is The Energy Tax Credit Refundable

Is The Energy Tax Credit Refundable

https://www.armaninollp.com/-/media/images/articles/energy-tax-credits-infographic.jpg

What Qualifies For The Energy Tax Credit

https://s3media.angieslist.com/s3fs-public/HOUSE-~1.jpeg

Renewable Energy Tax Credits Iowa Utilities Board

https://iub.iowa.gov/sites/default/files/banner/renewable_tax_credits.jpg

Generally taxpayers who receive rebates for the purchase of energy efficient homes will not include the value of those rebates as income on their tax returns however they will need to reduce the basis of the property when they Q Who is eligible for tax credits A Homeowners including renters for certain expenditures who purchase energy and other efficient appliances and products Q What do consumers do to get the credit s A Fill out IRS Form 5695 following IRS instructions and include it when filing your tax return Include any relevant product receipts

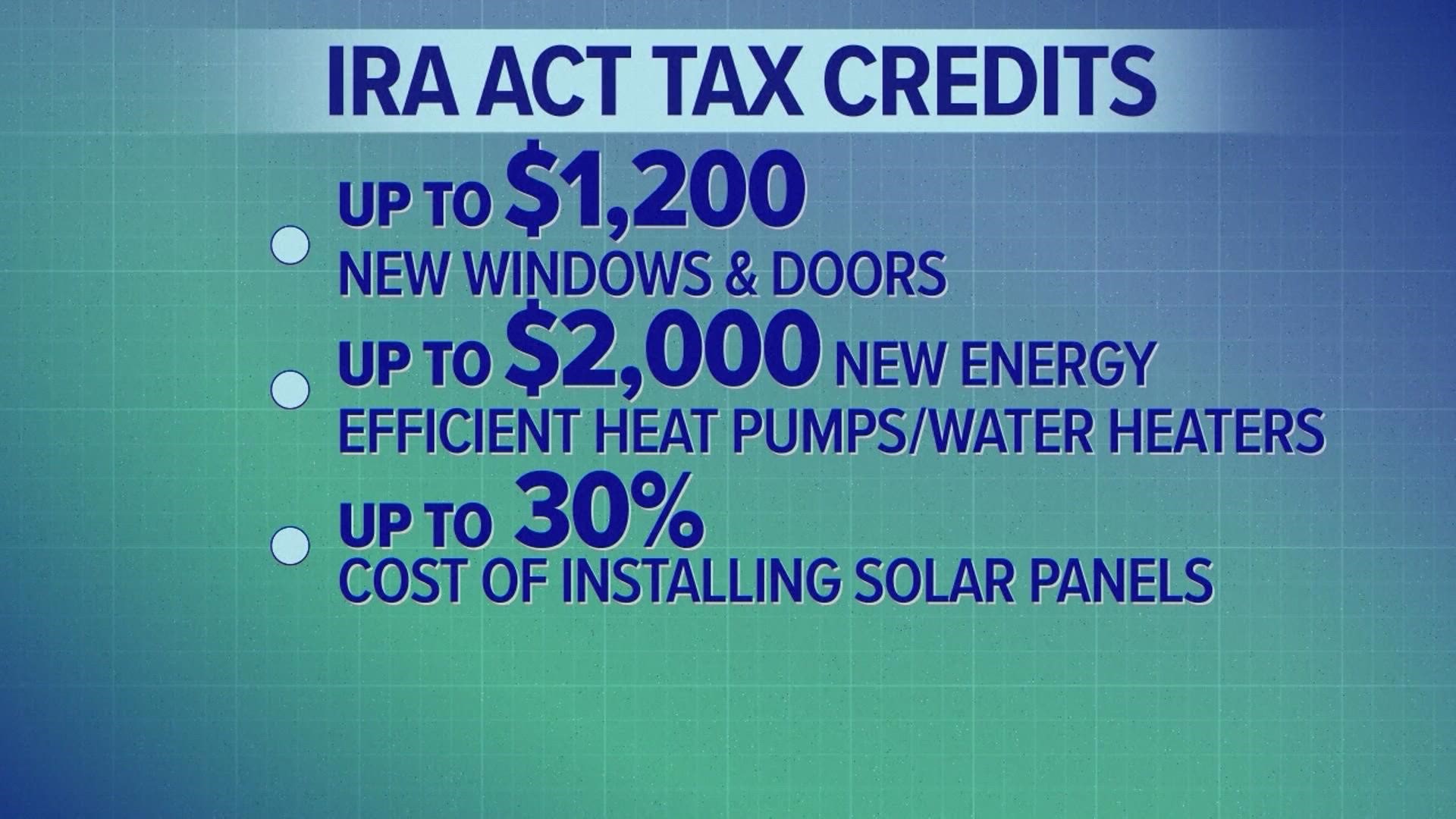

The Inflation Reduction Act IRA created a new monetization regime under Section 6417 that allows tax exempt entities to elect to claim 12 of the IRA s energy credits as refundable payments Three of the credits are also effectively refundable for all taxpayers for up to a five year period The Inflation Reduction Act also allows tax exempt and governmental entities to receive elective payments for 12 clean energy tax credits including the major Investment and Production Tax Credits as well as tax credits for electric vehicles and charging stations

Download Is The Energy Tax Credit Refundable

More picture related to Is The Energy Tax Credit Refundable

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

https://www.eesi.org/images/content/Summary_of_Clean_Energy_Credits.png

Inflation Reduction Act Increases Home Energy Tax Credits Wfaa

https://media.wfaa.com/assets/WFAA/images/e2c1cb63-8375-4e50-be65-6c75edcd8446/e2c1cb63-8375-4e50-be65-6c75edcd8446_1920x1080.jpg

What Is The Difference Between Non refundable And Refundable Tax

https://cdn.taxory.com/wp-content/uploads/2020/12/refundable-and-non-refundable-tax-credits-1080x590.jpg

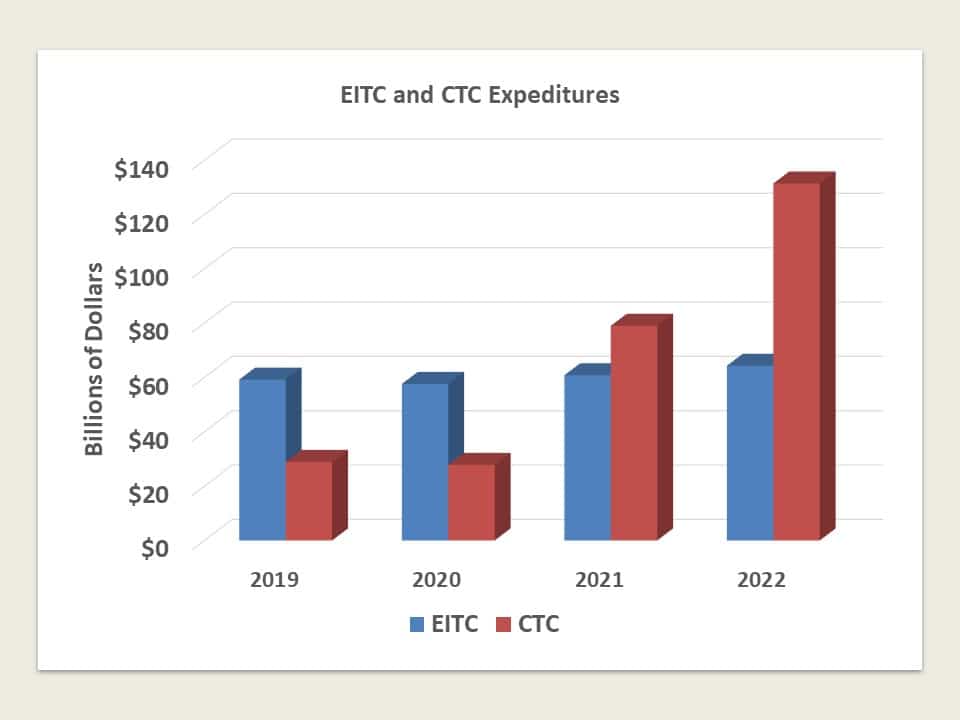

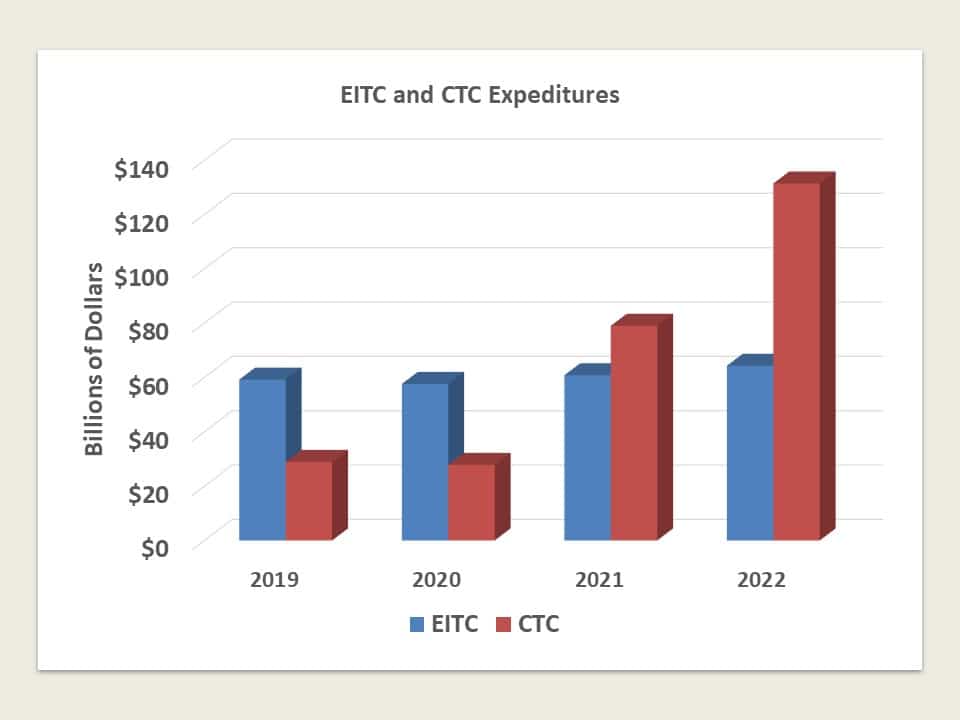

The IRS issued statistics on the Inflation Reduction Act clean energy tax credits for tax year 2023 Taxpayers have claimed more than 6 billion in credits for residential clean energy investments which include solar electricity generation solar water heating and battery storage and more than 2 billion for energy efficient home Individuals can claim a nonrefundable credit for a tax year in an amount equal to 30 of the sum of 1 the amount paid or incurred by the taxpayer for qualified energy efficiency improvements installed during the year known as energy efficient building envelope components plus 2 the amount of residential energy property expenditures

The federal tax credits for energy efficiency were extended as part of the Inflation Reduction Act IRA of 2022 So if you made any qualifying home improvements to your primary residence after December 31 2021 you may be eligible to claim them on your taxes when you file for 2022 Aug 8 2024 Americans claimed more than 8 billion in climate friendly tax credits under the Inflation Reduction Act last year according to new data released by the Treasury Department a

Home Energy Tax Credits Will Ease The Pain Of An Ailing A C

https://www.fredsheatingandair.com/wp-content/uploads/2017/03/TaxCredits-770x494.jpg

Solar Energy Tax Credit Basics

https://s2.studylib.net/store/data/009906505_1-1c8209be4201d8616781301da40ba34d-768x994.png

https://www.irs.gov/credits-deductions/frequently...

Both the Energy Efficient Home Improvement Credit and the Residential Clean Energy Property Credit are nonrefundable personal tax credits A taxpayer claiming a nonrefundable credit can only use it to decrease or eliminate tax liability

https://www.irs.gov/newsroom/irs-updates...

Generally taxpayers who receive rebates for the purchase of energy efficient homes will not include the value of those rebates as income on their tax returns however they will need to reduce the basis of the property when they sell it

Tax Credit Vs Tax Deduction What s The Difference Guide

Home Energy Tax Credits Will Ease The Pain Of An Ailing A C

Federal Solar Tax Credit What It Is How To Claim It For 2024

2023 Residential Clean Energy Credit Guide ReVision Energy

Unpacking The New Solar Energy Tax Credit BDO

Refundable Tax Credits

Refundable Tax Credits

Equipment Tax Credits For Primary Residences About ENERGY STAR

2015 2016 Federal Energy Efficiency Tax Credit Ciel Power LLC

Tax Credits Save You More Than Deductions Here Are The Best Ones

Is The Energy Tax Credit Refundable - The Inflation Reduction Act IRA created a new monetization regime under Section 6417 that allows tax exempt entities to elect to claim 12 of the IRA s energy credits as refundable payments Three of the credits are also effectively refundable for all taxpayers for up to a five year period