Joint Home Loan Tax Benefit Calculator By going for joint home loans you can not only increase your loan eligibility but also become eligible for double tax benefits For large value home loans a single person may not even be able to take tax benefit for the entire interest payment made or principal repayment made

Deduction for Joint Home Loan If the loan is taken jointly each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment under Section 80C up to Rs 1 5 lakh each in their tax returns To claim this deduction they should also be co owners of the property taken on loan Taking a joint loan can help you increase the home loan amount and the chances of getting your home loan application approved are also higher Another significant benefit that joint home loans offer is substantial tax benefits that all

Joint Home Loan Tax Benefit Calculator

Joint Home Loan Tax Benefit Calculator

https://www.ashar.in/wp-content/uploads/2021/03/Tax-benefits-of-home-loans-image.jpg

How To Get Tax Benefit On Joint Home Loan Joint Home Loan Tax

https://i.ytimg.com/vi/VJM60Cgc2qw/maxresdefault.jpg

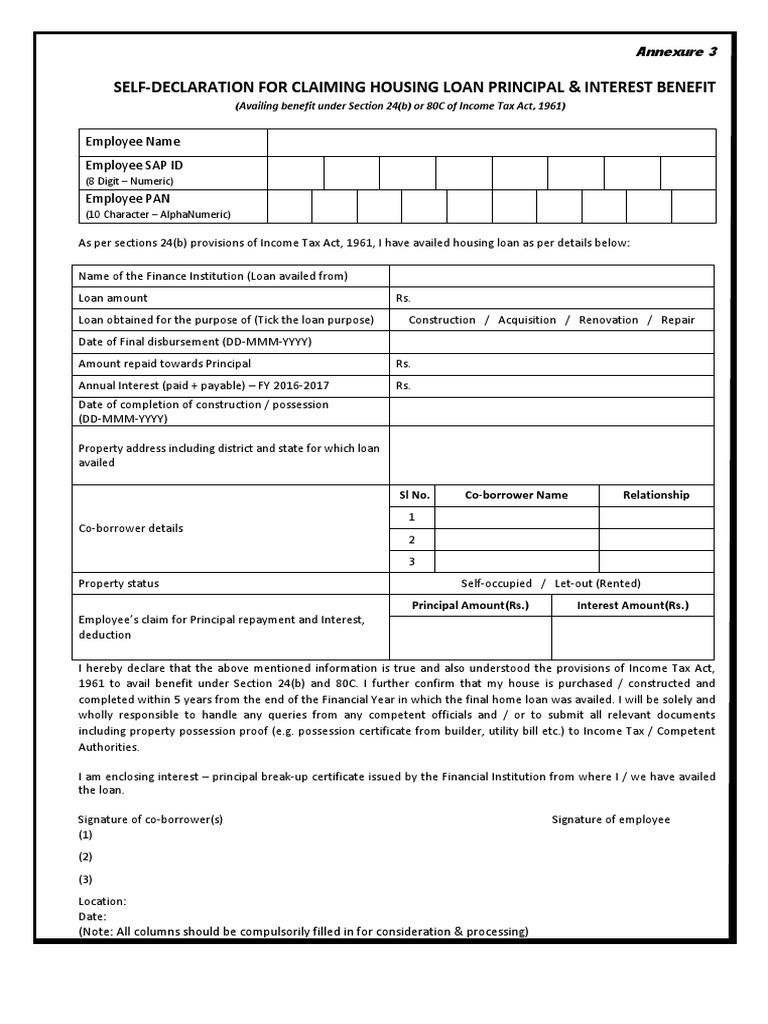

Self Declaration For Claiming Housing Loan Principal Interest Benefit

https://imgv2-2-f.scribdassets.com/img/document/558860084/original/8382a4f494/1672898190?v=1

Individuals can enjoy tax benefits in obtaining a home loan under the Income Tax Act Section 24 b Section 80 EE Section 80EEA and Section 80C 1961 In addition a joint home loan also brings many tax benefits resulting in significant savings Maximise your home loan tax benefits with our easy to use calculator Estimate potential savings and deductions to make informed financial decisions Explore your eligibility and optimise your tax planning effortlessly

Home loan tax benefit calculator is an online tool that helps you determine the exact amount to be paid after all the eligible tax deductions Check tax savings on home loans under sections 24 80EE 80C A joint Home Loan tax benefit calculator is a custom made tool that uses some basic details to provide an estimate of the following Total Income Tax Benefit Income Tax Amount Payable Before Home Loan Income Tax Amount Payable After Home Loan The home loan tax benefits calculator FY 2024 25 works based on the following

Download Joint Home Loan Tax Benefit Calculator

More picture related to Joint Home Loan Tax Benefit Calculator

Joint Home Loan Eligibility Tax Benefit Guide

https://assetyogi.com/wp-content/uploads/2017/06/joint-home-loan-eligibility-joint-home-loan-tax-benefit-889x500.jpg

How To Avail Joint Home Loan Tax Benefit Houssed

https://www.houssed.com/blog/wp-content/uploads/2022/08/how-to-avail-joint-home-loan-tax-benefit_blogimage.jpg

Joint Home Loan Tax Benefits On Joint Home Loan StayHome And Learn

https://i.ytimg.com/vi/oIy9y89qCGg/maxresdefault.jpg

Avail Income Tax Benefits on Home Loan under section 24 b 80C for up to Rs 2 00 000 Know home loan tax benefits for FY 2022 23 for second home loan joint home loan Are you a renter weighed down by taxes This calculator can demonstrate what you could be saving in taxes when you decide to buy instead of rent First enter a value of the home you wish to buy a loan amount an interest rate attached to that loan and so on

Calculate Tax benefit interest deduction and rebate Help you determine the tax saving opportunity on your home loan A home loan tax benefit calculator is an online tool that allows you to compute how much taxes you can save because of your housing loan Keep in mind that you can claim tax deductions separately on principal repayment and interest payment within a financial year

Tax Benefits On Home Loan Know More At Taxhelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2021/11/Tax-Saving-Benefits-of-having-property-through-Home-Loan-1.png

Home Loan Tax Benefits As Per Union Budget 2020 IndiakaLoans

https://www.indiakaloans.com/blog/wp-content/uploads/2020/02/Home-Loan-Tax-Benefits_Blog-Creative.jpg

https://emicalculator.net/tax-benefits-on-joint-home-loans

By going for joint home loans you can not only increase your loan eligibility but also become eligible for double tax benefits For large value home loans a single person may not even be able to take tax benefit for the entire interest payment made or principal repayment made

https://cleartax.in/s/home-loan-tax-benefit

Deduction for Joint Home Loan If the loan is taken jointly each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment under Section 80C up to Rs 1 5 lakh each in their tax returns To claim this deduction they should also be co owners of the property taken on loan

Maximizing Home Loan Tax Benefits In India 2023

Tax Benefits On Home Loan Know More At Taxhelpdesk

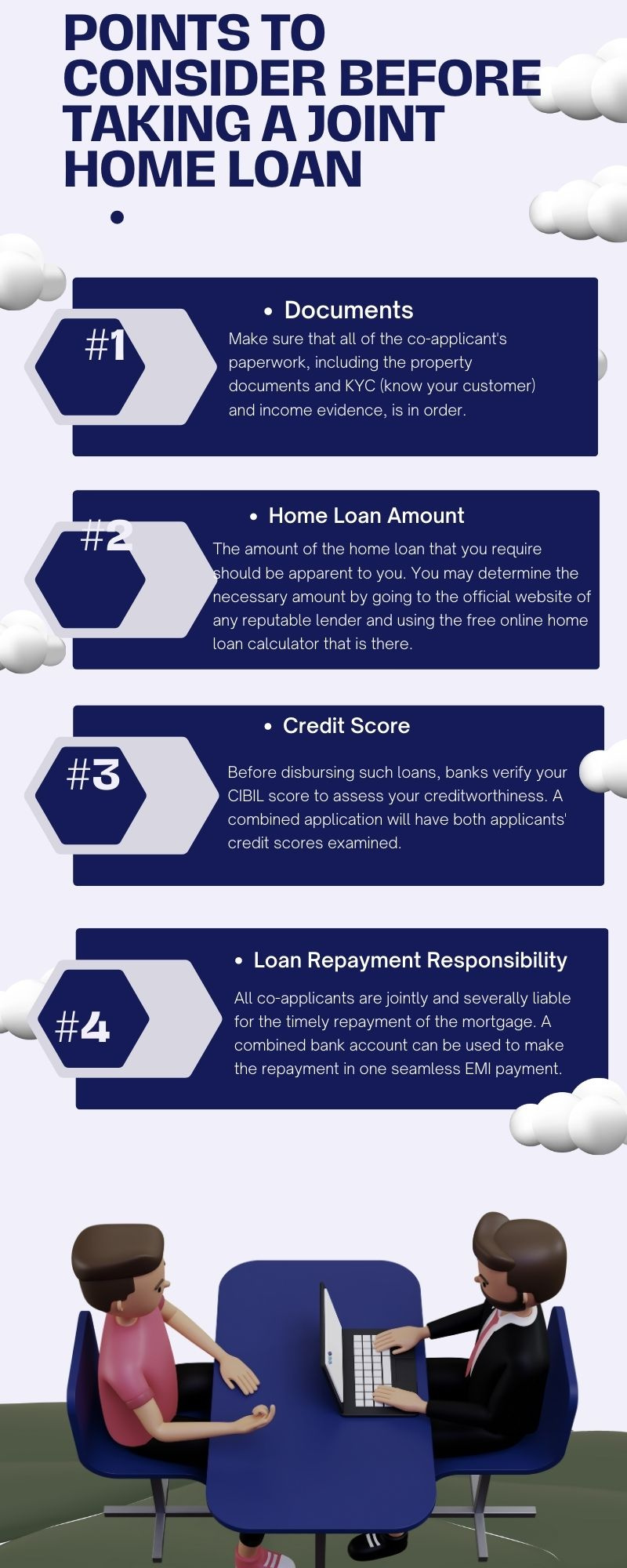

Points To Consider Before Taking A Joint Home Loan By Mohini Verma On

Joint Home Loan Declaration Form For Income Tax Savings And Non

Home Loan Tax Benefit 2023 24 Deduction Joint Home Loan Tax Benefit

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

Know Everything About Home Loan Tax Benefits

MauraIsaiah

What Is The Maximum Tax Benefit On Housing Loan Leia Aqui Is There A

Joint Home Loan Tax Benefit Calculator - Home loan tax benefit calculator is an online tool that helps you determine the exact amount to be paid after all the eligible tax deductions Check tax savings on home loans under sections 24 80EE 80C