Kentucky Income Tax Reduction The tax cuts of HB 1 stem from last year s HB 8 which cut the individual income tax rate from 5 to 4 5 in 2023 and triggers automatic reductions of 5 to that rate each year so long as

If these conditions are met for FY 2021 Kentucky s flat individual income tax rate of 5 percent will automatically be reduced to 4 5 percent starting January 1 2023 If these conditions are met again in FY 2022 this would be certified as sufficient to bring the individual income tax rate to 4 percent in 2024 though this further reduction Kentucky law lowers personal income tax rates for 2023 and 2024 and removes triggers for future rate cuts On February 17 2023 Kentucky Governor Andy Beshear signed into law H B 1 which lowers the state personal income tax rate to 4 5 retroactive to January 1 2023 and to 4 0 effective January 1 2024

Kentucky Income Tax Reduction

Kentucky Income Tax Reduction

https://www.signnow.com/preview/568/283/568283324/large.png

Jan 1 Kentucky Income Tax Slashed 5 WNKY News 40 Television

https://wpcdn.us-east-1.vip.tn-cloud.net/www.wnky.com/content/uploads/2022/12/v/g/bg-taxes-vomp400-00-00-00still001.jpg

How Do Iowa s Republican Tax Plans Compare Iowa Capital Dispatch

https://iowacapitaldispatch.com/wp-content/uploads/2022/01/gov-tax-chart.png

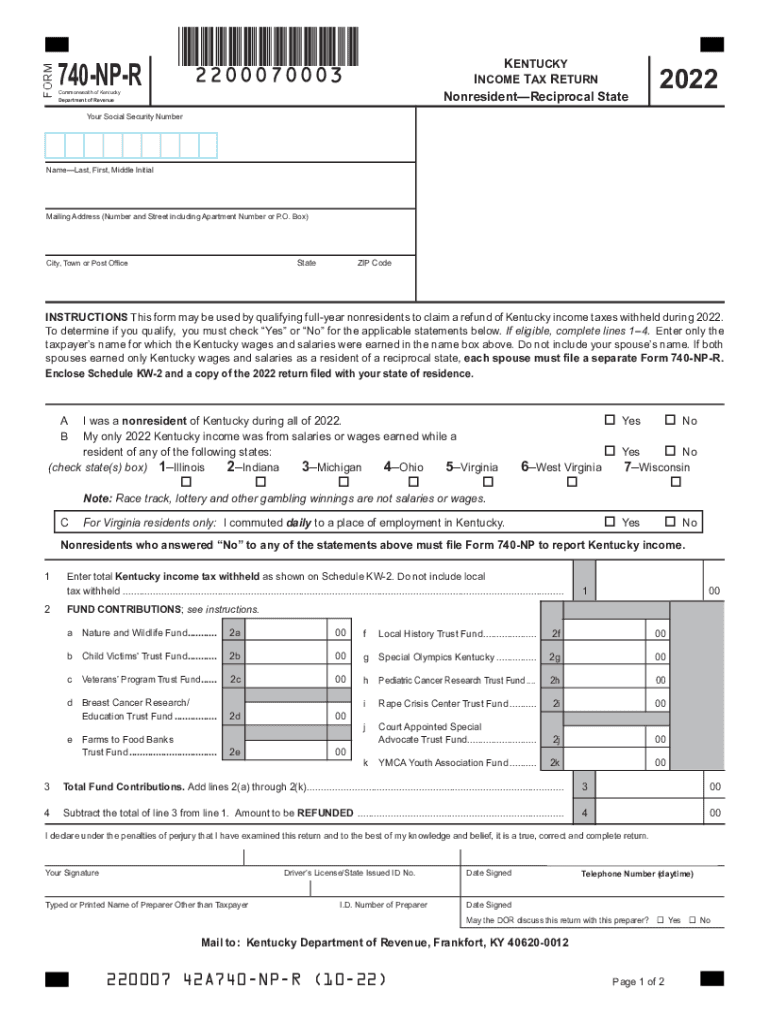

The bill would lower the individual income tax rate by a half percentage point to 4 effective Jan 1 2024 It follows up on last year s tax overhaul which reduced the tax rate from 5 to 4 5 at the start of this year The measure won Senate passage on a 30 5 vote after an hourlong debate On February 17 2023 Kentucky Governor Andy Beshear signed House Bill 1 HB 1 which amends Ky Rev Stat 141 020 2 d to codify the reduction of Kentucky s flat individual income tax rate from 5 to 4 5 for tax years beginning on or after January 1 2023 and to 4 for tax years beginning on or after January 1 2024 1

Executive summary Kentucky cuts personal income tax rate by 0 5 On Feb 17 2023 Gov Andy Beshear signed House Bill 1 providing a 0 5 individual income tax reduction effective Jan 1 2024 Kentucky is one of the first states in 2023 to provide an income tax rate reduction although likely not to be the last House Bill 8 reduced the state income tax from 5 to 4 5 effective this year At the start of 2023 Kentucky s personal income tax automatically went from 5 down to 4 5 House Bill 1 formalizes that reduction as

Download Kentucky Income Tax Reduction

More picture related to Kentucky Income Tax Reduction

Grocery Tax Reduced To 1 Beginning Jan 1 2023 Virginia Tax

https://www.tax.virginia.gov/sites/default/files/news-images/2022-12/grocery-tax-reduction.jpg

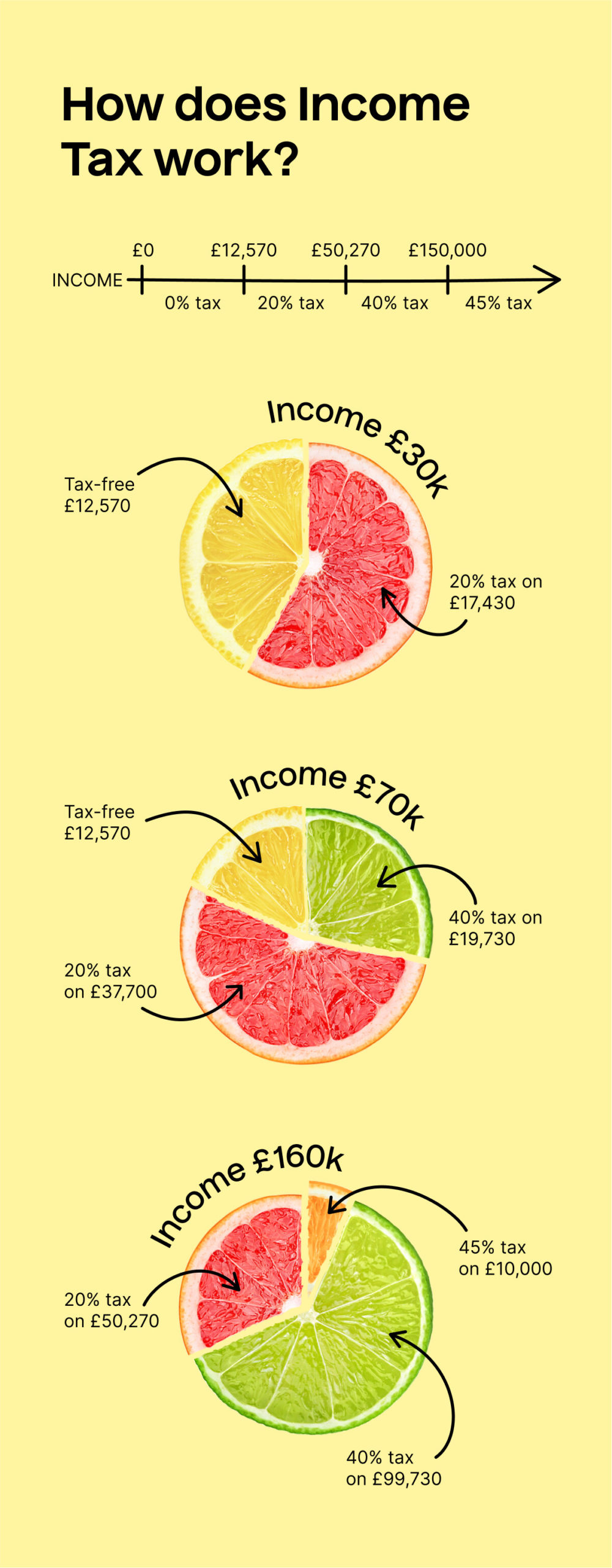

How To Pay HMRC Self Assessment Income Tax Bill In The UK

https://www.gatwickaccountant.com/wp-content/uploads/2022/08/How-to-Pay-HMRC-Self-Assessment-Income-Tax-Bill-in-UK.jpg

Income Tax Statistics 2023 Tax Brackets USA UK And More

https://www.enterpriseappstoday.com/wp-content/uploads/2022/10/Income-Tax-Statistics.jpg

FRANKFORT Ky AP The Kentucky Senate passed a bill Monday that would tap into the state s massive revenue surpluses to deliver more than 1 billion in income tax rebates to taxpayers The measure cleared the Senate on a 28 7 vote just days after being unveiled Kentucky taxpayers will see a reduction in income tax from 5 to 4 5 in January But critics say more cuts could lead to higher sales taxes and hurt low income people

FRANKFORT Ky AP Kentucky s individual income tax rate is set to remain the same in 2025 after the state failed to meet certain fiscal requirements that would have ushered in another reduction under a Republican plan to phase the tax out The measure signed by Beshear will lower the state s individual income tax rate by a half percentage point to 4 effective Jan 1 2024 It follows up on last year s tax overhaul which resulted in a reduction of the tax rate from 5 to

Tax Reduction Strategies For High Income Earners YouTube

https://i.ytimg.com/vi/cyAcUXadd_Q/maxresdefault.jpg

Kentucky Inheritance Tax Calculator

https://foreignusa.com/wp-content/uploads/kentucky-income-tax-rate.png

https://www.courier-journal.com/story/news/...

The tax cuts of HB 1 stem from last year s HB 8 which cut the individual income tax rate from 5 to 4 5 in 2023 and triggers automatic reductions of 5 to that rate each year so long as

https://taxfoundation.org/blog/kentucky-income-tax-reform

If these conditions are met for FY 2021 Kentucky s flat individual income tax rate of 5 percent will automatically be reduced to 4 5 percent starting January 1 2023 If these conditions are met again in FY 2022 this would be certified as sufficient to bring the individual income tax rate to 4 percent in 2024 though this further reduction

2023 Ky State Tax Form Printable Forms Free Online

Tax Reduction Strategies For High Income Earners YouTube

How To Compute Income Tax On Salary Kanakkupillai

Kentucky Enacts Personal Income Tax Rate Reduction Harding Shymanski

Income Tax Rates In The UK TaxScouts

Treatment Of Income From Different Sources AY 2023 24 FY 2022 23

Treatment Of Income From Different Sources AY 2023 24 FY 2022 23

Tax Protest Letter Template Resume Letter

Mucormycosis Taxscan Simplifying Tax Laws

Homeowner Special Tax Breaks

Kentucky Income Tax Reduction - On February 17 2023 Kentucky Governor Andy Beshear signed House Bill 1 HB 1 which amends Ky Rev Stat 141 020 2 d to codify the reduction of Kentucky s flat individual income tax rate from 5 to 4 5 for tax years beginning on or after January 1 2023 and to 4 for tax years beginning on or after January 1 2024 1