Ky Income Tax Deductions After adjusting for inflation the standard deduction for 2023 is 2 980 an increase of 210 This amount will be incorporated into 2023 tax forms and should be used for tax planning in the new year

Find out how much you ll pay in Kentucky state income taxes given your annual income Customize using your filing status deductions exemptions and more Use SmartAsset s paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes

Ky Income Tax Deductions

Ky Income Tax Deductions

https://static.twentyoverten.com/5a6f8baf540e7a39356c048b/ePVx9LIrqY/iStock-1249852638.jpg

Tax Deduction Tracker Printable Tax Deduction Log Business Etsy

https://i.etsystatic.com/34842725/r/il/d7a013/4058712943/il_fullxfull.4058712943_8i57.jpg

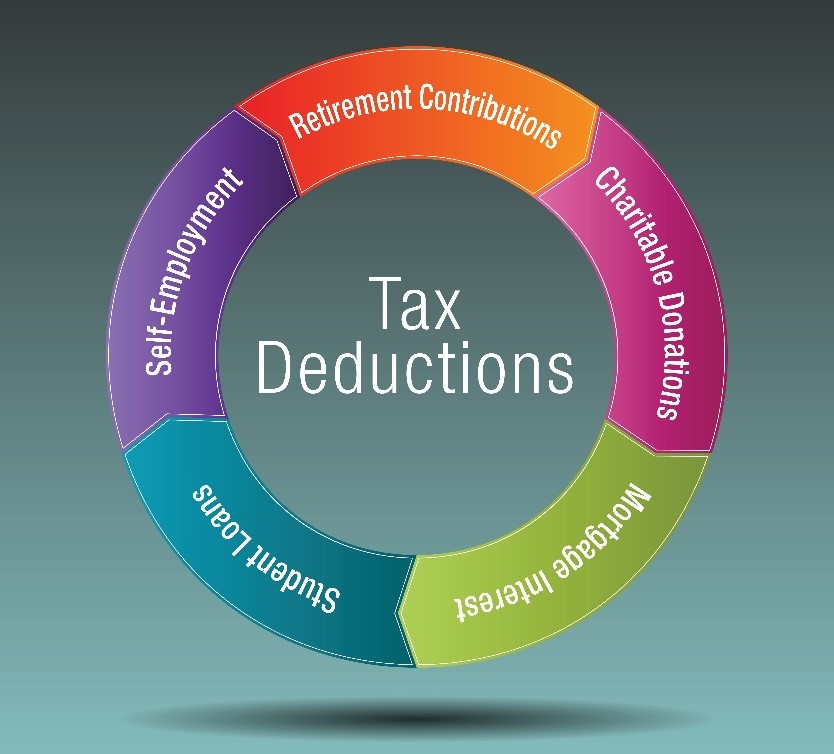

Tax Deductions Armstrong Economics

https://www.armstrongeconomics.com/wp-content/uploads/2020/09/Tax-Deductions-2048x1536.jpg

Income Taxes The Kentucky Department of Revenue is committed to helping you understand Kentucky income tax law changes keeping you updated and answering your questions Links to the Income Tax Fre quently Asked Questions FAQs may be found at right Use our income tax calculator to find out what your take home pay will be in Kentucky for the tax year Enter your details to estimate your salary after tax

Is social security income taxable on Kentucky individual income tax returns Can I deduct mortgage insurance premiums Has the deduction limit for cash charitable contributions been increased to 60 of the Kentucky adjusted gross income Is there any penalty relief for the new same as federal estimated tax rules for individuals for 2019 The Income tax rates and personal allowances in Kentucky are updated annually with new tax tables published for Resident and Non resident taxpayers The Tax tables below include the tax rates thresholds and allowances included in the Kentucky Tax Calculator 2022

Download Ky Income Tax Deductions

More picture related to Ky Income Tax Deductions

Income Tax Deduction Under 80C Lex N Tax Associates

https://lexntax.com/wp-content/uploads/2018/01/Deduction-Under-Income-Tax-1024x640-1.jpg

Your 2017 Tax Preparation Checklist The Motley Fool

https://g.foolcdn.com/editorial/images/436027/tax-form_tax-deductions_gettyimages-515708887.jpg

Standard Deduction For Salaried Employees Impact Of Standard

https://i.pinimg.com/originals/05/8c/32/058c32cbbbd99e3ad8dfee9a313112a1.jpg

The Income tax rates and personal allowances in Kentucky are updated annually with new tax tables published for Resident and Non resident taxpayers The Tax tables below include the tax rates thresholds and allowances included in the Kentucky Tax Calculator 2021 Calculate your Annual salary after tax using the online Kentucky Tax Calculator updated with the 2023 income tax rates in Kentucky Calculate your income tax social security and pension deductions in seconds

Pre tax deductions such as health insurance premiums retirement contributions and flexible spending accounts can lower your taxable income This will result in less federal income tax withheld from your paycheck In Kentucky the income tax is a flat rate of 5 There is no state payroll tax or local income tax Kentucky generally has a flat income tax rate for 2024 of 4 0 Last year the income tax rate was 4 5 Further 0 5 reductions are possible in future years if certain revenue and budget

Oct 19 Irs Here Are The New Income Tax Brackets For 2023 Free Nude

https://image.cnbcfm.com/api/v1/image/107136825-1666125851699-6clBX-marginal-tax-brackets-for-tax-year-2023-single-individuals_1.png?v=1666125859

Itemized Deductions Still Exist For 2018 Tax Return BMP CPA

https://www.bmp-cpa.com/wp-content/uploads/2019/01/tax-deductions.jpg

https://revenue.ky.gov/News/Pages/DOR-Announces...

After adjusting for inflation the standard deduction for 2023 is 2 980 an increase of 210 This amount will be incorporated into 2023 tax forms and should be used for tax planning in the new year

https://smartasset.com/taxes/kentucky-tax-calculator

Find out how much you ll pay in Kentucky state income taxes given your annual income Customize using your filing status deductions exemptions and more

Tax Deductions And Credits Related To Education Expenses

Oct 19 Irs Here Are The New Income Tax Brackets For 2023 Free Nude

Income Tax Deduction

WHICH IS BETTER TAX CREDITS OR TAX DEDUCTIONS Tax Professionals

What Mortgage Refinance Costs Can You Deduct From Your Taxes Lendgo

How To Fully Maximize Your 1099 Tax Deductions Steady

How To Fully Maximize Your 1099 Tax Deductions Steady

Tax Deductions Photo By LendingMemo Under CC 2 0 You Are F Flickr

List Of 14 Commonly Overlooked Personal Tax Deductions Credits For

How To Submit Your Personal Income Tax Return

Ky Income Tax Deductions - Find KY or Kentucky Standard Deductions KY Tax Forms and Income Tax Brackets and Rates by Tax Year