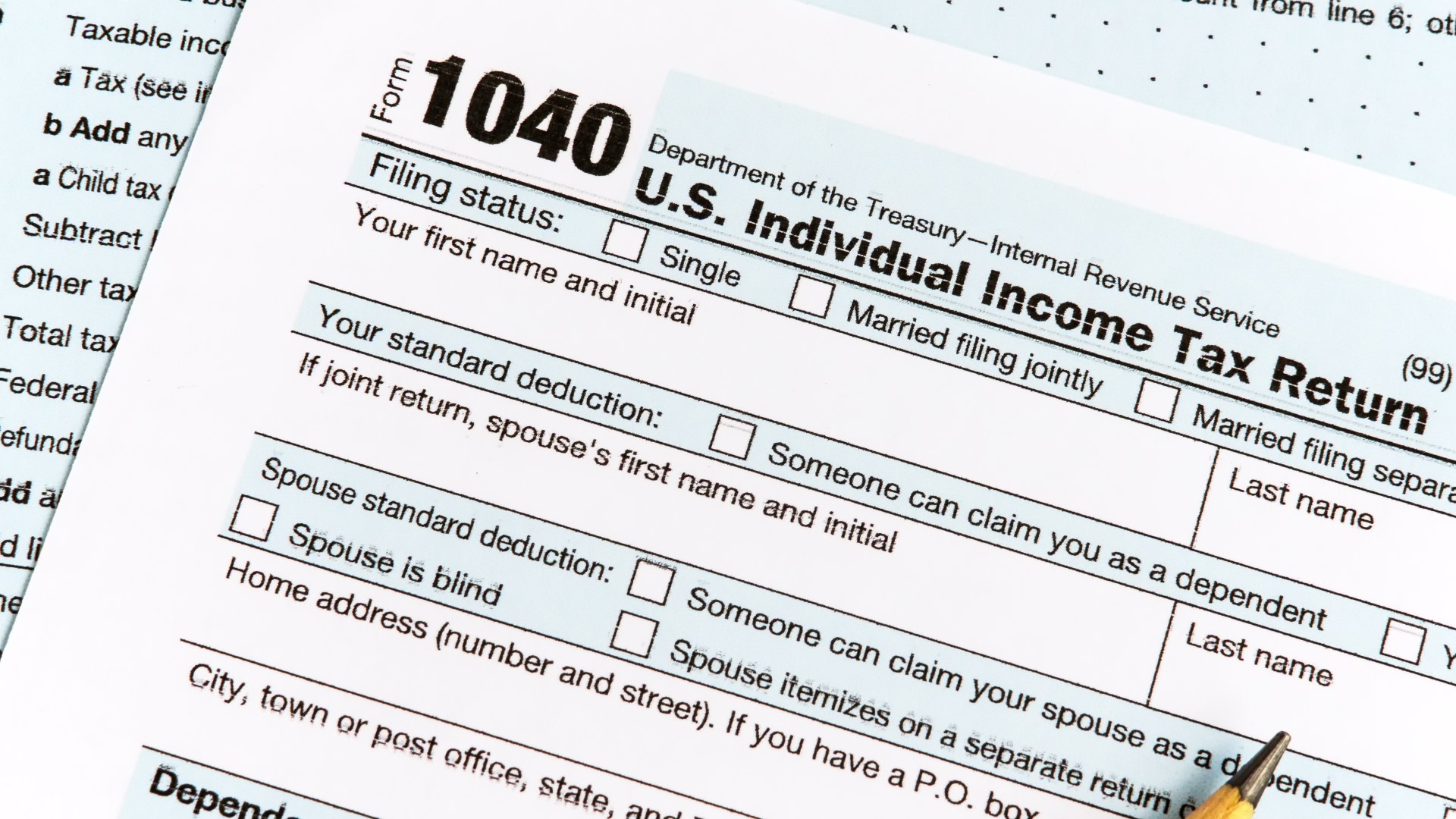

Medical Bills Income Tax Rebate Web 26 sept 2017 nbsp 0183 32 For tax returns filed in 2023 taxpayers can deduct qualified unreimbursed medical expenses that are more than 7 5 of their 2022 adjusted gross income So if your adjusted gross income is

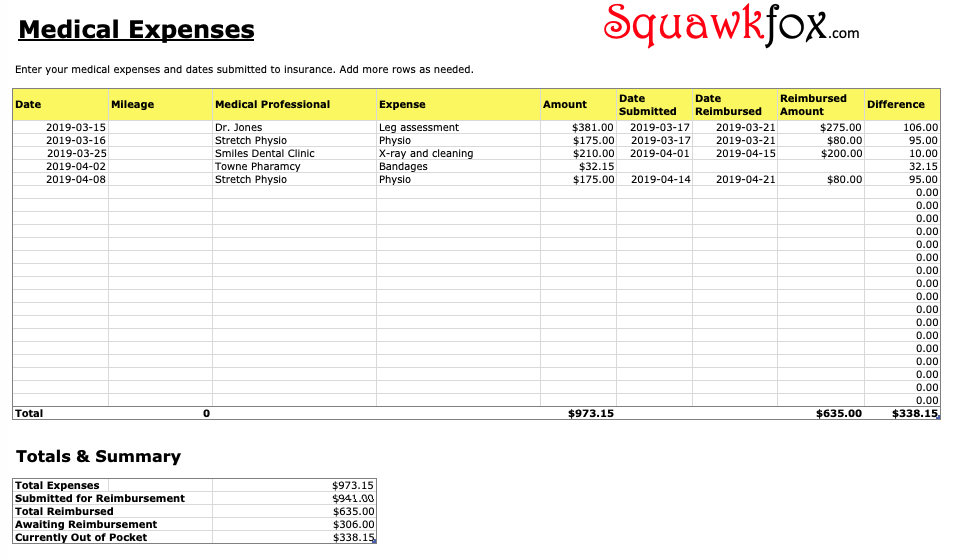

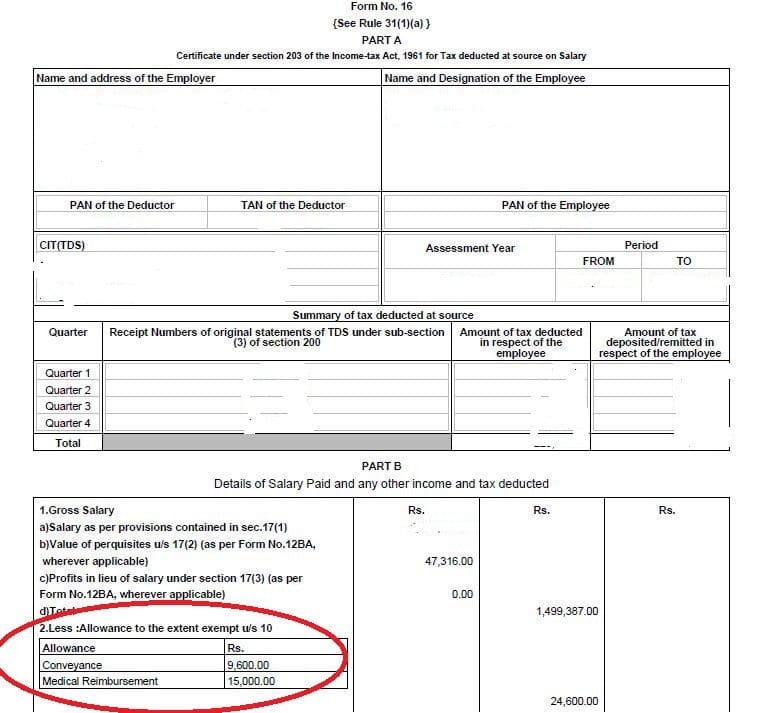

Web 12 janv 2023 nbsp 0183 32 The Deduction and Your AGI Threshold You can calculate the 7 5 rule by tallying up all your medical expenses for the year then subtracting the amount equal to 7 5 of your AGI For example if your Web 13 mai 2017 nbsp 0183 32 Medical Reimbursement is an arrangement under which employers reimburse the portion of the health expenses incurred by the employee The Income Tax

Medical Bills Income Tax Rebate

Medical Bills Income Tax Rebate

http://www.relakhs.com/wp-content/uploads/2014/11/Medical-allowance-form-16.jpg

Income Tax Deductions List FY 2019 20 How To Save Tax For AY 20 21

https://www.relakhs.com/wp-content/uploads/2019/02/Income-tax-benefit-on-health-insurance-premium-under-section-80D-FY-2019-20-AY-2020-21-medical-insurance.jpg

10 Pay Stub Format Sampletemplatess Sampletemplatess C83

https://www.squawkfox.com/wp-content/uploads/2010/11/medical-bills.png

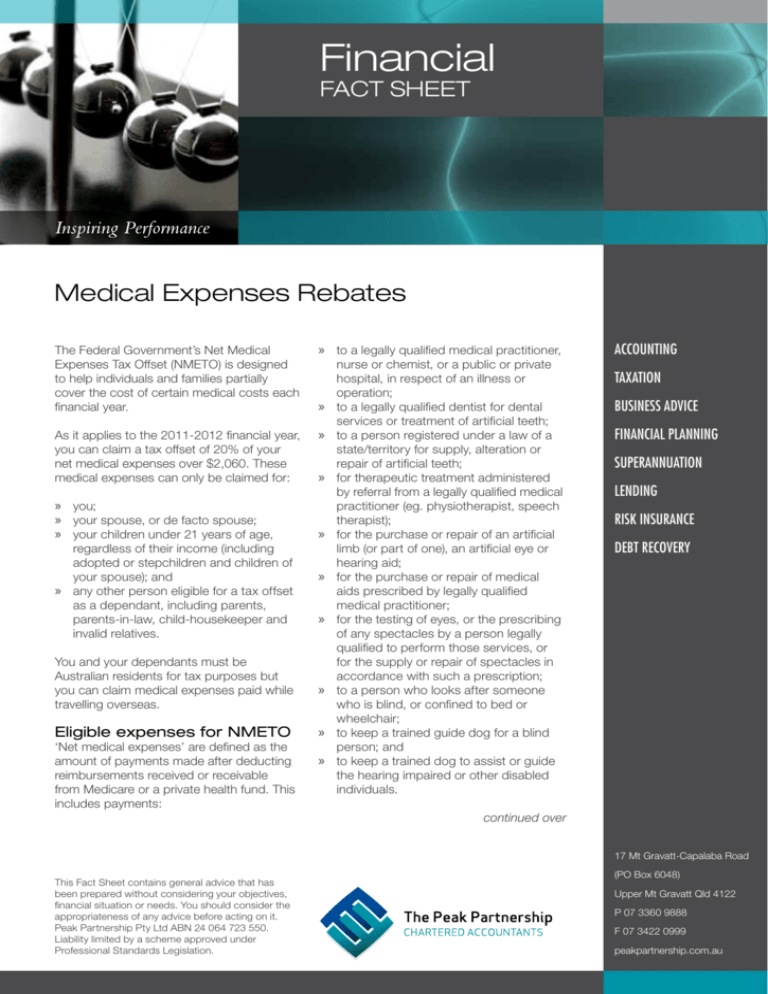

Web What is Section 80D Every individual or HUF can claim a deduction from their total income for medical insurance premiums paid in any given year under Section 80D This Web If you have spent less than Rs 15 000 then only the incurred expense is tax free E g if your medical expense in a year with supporting bills was Rs 9 000 you will get a tax exemption of Rs 9 000 only out of the

Web 1 Exemption from regular medical expenses It comes under section 10A of the Income Tax Act 196 The tax exemption limit is of up to Rs 15 000 If your employer provides Web 21 f 233 vr 2022 nbsp 0183 32 Section 80D of Income Tax Act allows deduction of up to Rs 50 000 for medical expenses incurred for senior citizens self spouses or dependent children If you are making payment of

Download Medical Bills Income Tax Rebate

More picture related to Medical Bills Income Tax Rebate

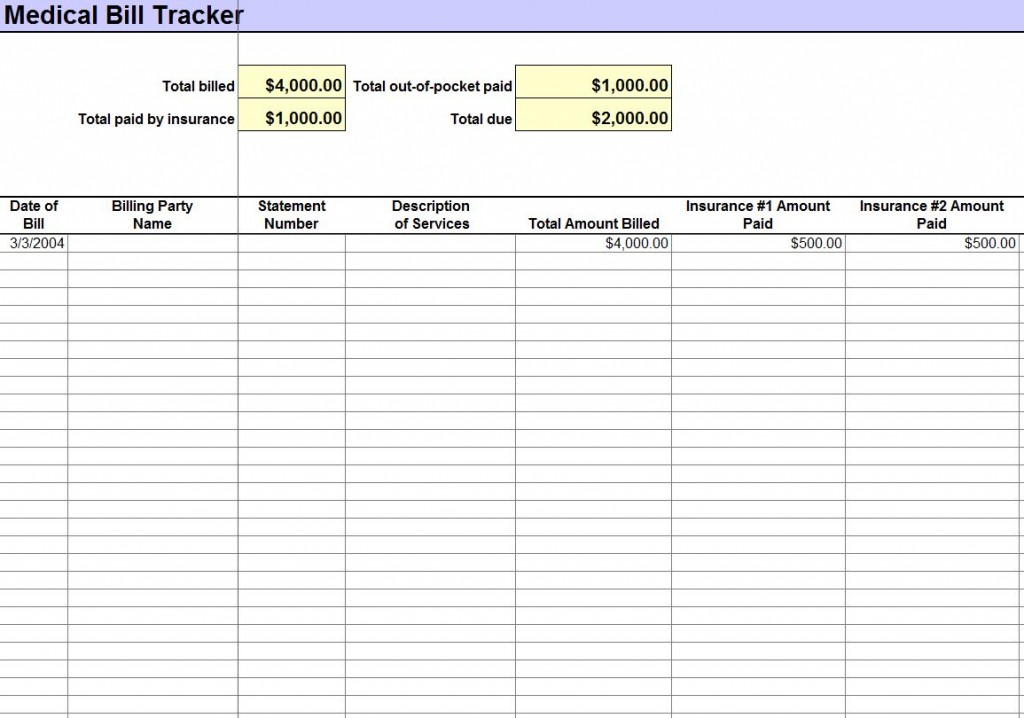

Medical Bill Format In Excel Sample Templates

https://exceltemplates.net/wp-content/uploads/2013/07/Medical-Bill-Template-1024x718.jpg

Medical Expenses Rebates

https://s3.studylib.net/store/data/008082010_1-c32f4bdb4afdf54db3e7d4bebd5ba95a-768x994.png

Section 80d Preventive Health Check Up Tax Deduction The Gray Tower

https://3.bp.blogspot.com/-4Id9T3np6TI/W7YTc5WnDBI/AAAAAAAASjk/QbYRDVMQcsQoXHoU4geurcLL1b1We92VgCLcBGAs/s1600/DEDUCTION%2BFOR%2BMEDICAL%2BINSURANCE%2BPREMIUM-PREVENTIVE%2BHEALTH%2BCHECK%2BUP%2B-MEDICAL%2BTREATMENT%2BSECTION%2B80D.png

Web 13 f 233 vr 2020 nbsp 0183 32 Income Tax Deduction for Medical Expenses Last updated February 13th 2020 05 46 pm This article provides a list of all income tax deductions and other Web 18 mai 2021 nbsp 0183 32 IR 2021 115 May 18 2021 The Internal Revenue Service today provided guidance on tax breaks under the American Rescue Plan Act of 2021 for continuation

Web 12 f 233 vr 2023 nbsp 0183 32 Fortunately if you have medical bills that aren t fully covered by your insurance you may be able to take a deduction for those to reduce your tax bill We ll take you through which medical expenses are Web 27 mars 2023 nbsp 0183 32 The rule for claiming a medical expense deduction is that you can only write off healthcare costs that exceed 7 5 of your adjusted gross income And that s where

Medical Insurance Receipt Format INSURANCE DAY

https://i.pinimg.com/originals/70/66/6f/70666f3b189c3838f65f24c09fe50c9e.jpg

![]()

Hospital Patient Medical Bill Tracker Template Word Excel Templates

https://www.wordexceltemplates.com/wp-content/uploads/2015/04/Patient-medical-bill-tracker.jpg

https://www.nerdwallet.com/article/taxes/medi…

Web 26 sept 2017 nbsp 0183 32 For tax returns filed in 2023 taxpayers can deduct qualified unreimbursed medical expenses that are more than 7 5 of their 2022 adjusted gross income So if your adjusted gross income is

https://www.thebalancemoney.com/medical-e…

Web 12 janv 2023 nbsp 0183 32 The Deduction and Your AGI Threshold You can calculate the 7 5 rule by tallying up all your medical expenses for the year then subtracting the amount equal to 7 5 of your AGI For example if your

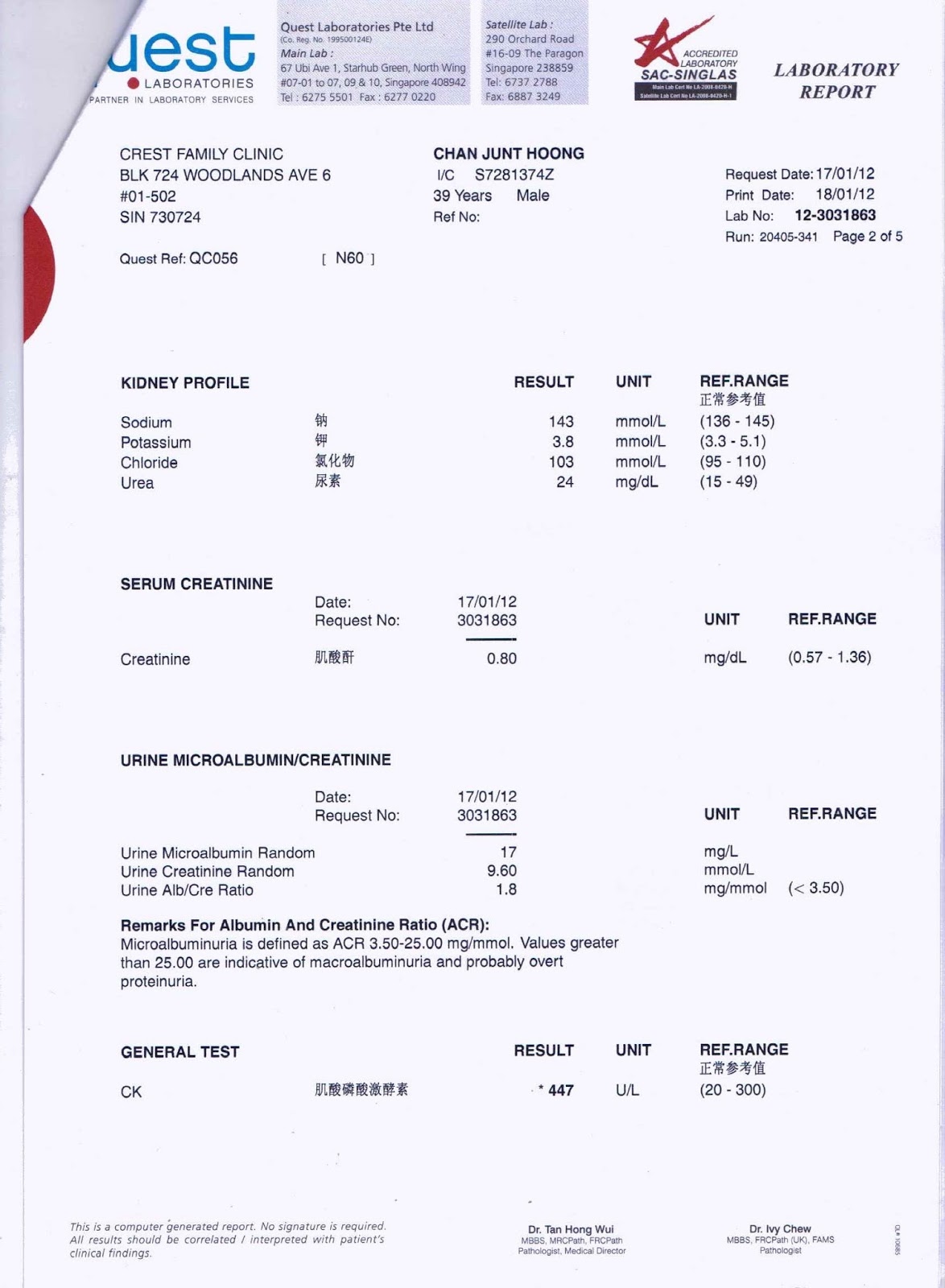

Chan Junt Hoong s Blog Continuation From Chan Junt Hoong s Mobile Blog

Medical Insurance Receipt Format INSURANCE DAY

Solved QUESTION TWO 30 MARKS The Following Information Is Chegg

Printable 25 Fake Medical Bills Format In 2020 With Images Invoice

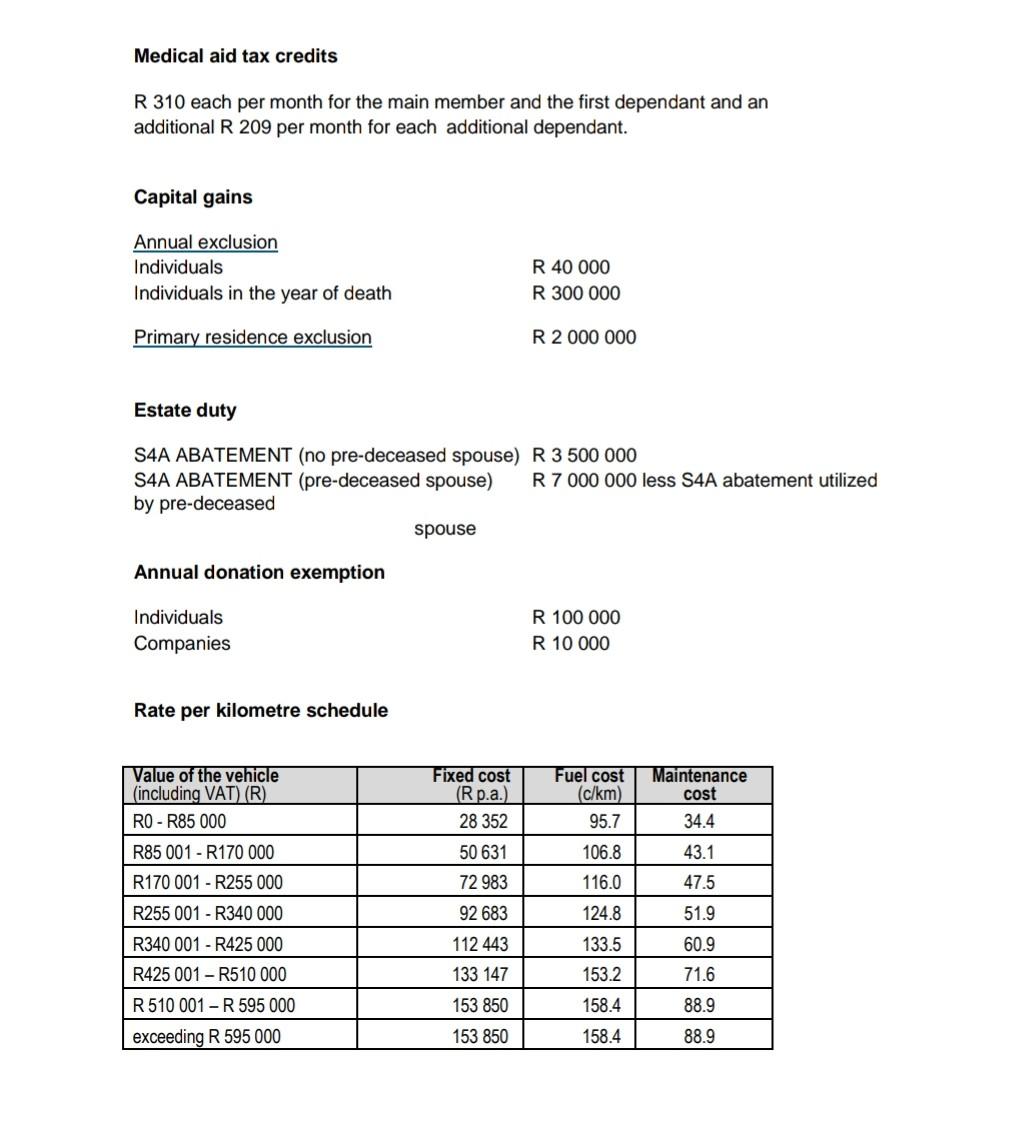

In SA Tax Credits For Medical Aid Contributions eBiz Money

Section 80 Deduction Deduction U s 80DD 80DDB 80U Tax2win Blog

Section 80 Deduction Deduction U s 80DD 80DDB 80U Tax2win Blog

South Carolina Taxpayers Could Soon Be Eligible For 100 Rebate Wcnc

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

2007 Tax Rebate Tax Deduction Rebates

Medical Bills Income Tax Rebate - Web Overview As an employer providing medical or dental treatment or insurance to your employees you have certain tax National Insurance and reporting obligations