Medical Expense Income Tax Deduction Verkko 16 marrask 2023 nbsp 0183 32 If you itemize your deductions for a taxable year on Schedule A Form 1040 Itemized Deductions you may be able to deduct the medical and dental

Verkko 20 lokak 2023 nbsp 0183 32 You can only deduct unreimbursed medical expenses that exceed 7 5 of your adjusted gross income AGI found on line 11 of your 2023 Form 1040 Verkko This publication explains the itemized deduction for medical and dental expenses that you claim on Schedule A Form 1040 It discusses what expenses and whose expenses you can and can t include in figuring

Medical Expense Income Tax Deduction

Medical Expense Income Tax Deduction

https://hp-prod-wp-data.s3.us-west-1.amazonaws.com/content/uploads/02x.jpeg

Tax Deduction Thailand 2022 Pay Less With Health Insurance

https://blog.lumahealth.com/hubfs/Blogs/Tax reduction/Tax deduction - banner.png

Income Tax Deduction

http://www.trutax.in/blog/wp-content/uploads/2018/02/income-tax-deduction.png

Verkko 29 huhtik 2023 nbsp 0183 32 Key Takeaways If you incurred substantial medical expenses not covered by insurance you might be able to claim them as deductions on your tax return These costs include health insurance Verkko 27 maalisk 2023 nbsp 0183 32 The rule for claiming a medical expense deduction is that you can only write off healthcare costs that exceed 7 5 of your adjusted gross income And

Verkko 25 lokak 2022 nbsp 0183 32 For tax years 2022 and 2023 individuals are allowed to deduct qualified and unreimbursed medical expenses that are greater than 7 5 of their adjusted Verkko 21 tammik 2021 nbsp 0183 32 If you spent 9 000 on deductible medical expenses 2 000 could be deducted since that s the difference left over after subtracting 7 000 Medical

Download Medical Expense Income Tax Deduction

More picture related to Medical Expense Income Tax Deduction

How To Claim The State Income Tax Deduction Tax Deductions Debt To

https://i.pinimg.com/originals/8a/f2/2a/8af22ab91051873a92fcbd6a535b0456.jpg

Special Tax Deduction Flexible Working Arrangement Mar 01 2022

https://cdn1.npcdn.net/image/16461036862a2b9367f2ff16eb9b748ff28b5b7ef8.jpg?md5id=956f9d4b926a8af07bf32de21edd8eee&new_width=1000&new_height=1000&w=-62170009200

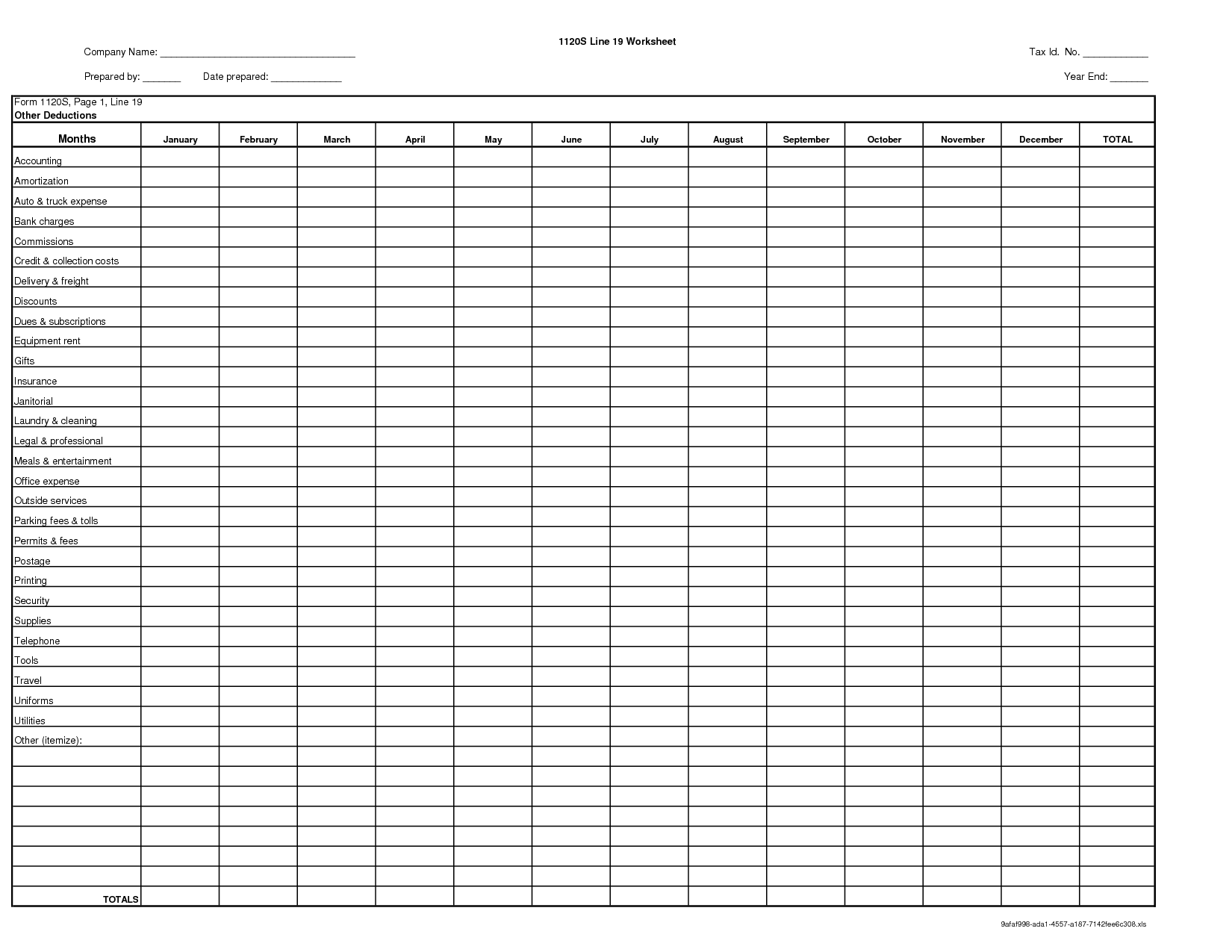

14 Best Images Of IRS Itemized Deductions Worksheet Tax Itemized

http://www.worksheeto.com/postpic/2011/02/business-tax-deductions-worksheet_472264.png

Verkko 2 p 228 iv 228 228 sitten nbsp 0183 32 President Trump s Tax Cuts and Jobs Act allowed taxpayers in 2017 and 2018 to deduct the total amount of medical expenses that exceed 7 5 of their Verkko 21 marrask 2019 nbsp 0183 32 Since the medical expenses credit is designed to assist Canadians who have significant expenses over the course of a year only a portion of your

Verkko 8 jouluk 2023 nbsp 0183 32 Deduction of Medical Expenses for Senior Citizens Section 80D For the welfare of senior citizens Resident aged 60 or above who don t have health Verkko 17 helmik 2023 nbsp 0183 32 Information about Publication 502 Medical and Dental Expenses including recent updates and related forms Publication 502 explains the itemized

Qualified Business Income Deduction And The Self Employed The CPA Journal

https://www.nysscpa.org/cpaj-images/CPA.2022.92.5.006.t001.jpg

ITR Filing Income Tax Exemption Deduction That Home Loan Borrowers

https://img.etimg.com/thumb/msid-103082793,width-1070,height-580,imgsize-1585531/photo.jpg

https://www.irs.gov/taxtopics/tc502

Verkko 16 marrask 2023 nbsp 0183 32 If you itemize your deductions for a taxable year on Schedule A Form 1040 Itemized Deductions you may be able to deduct the medical and dental

https://turbotax.intuit.com/tax-tips/health-care/medical-expenses...

Verkko 20 lokak 2023 nbsp 0183 32 You can only deduct unreimbursed medical expenses that exceed 7 5 of your adjusted gross income AGI found on line 11 of your 2023 Form 1040

Printable Itemized Deductions Worksheet

Qualified Business Income Deduction And The Self Employed The CPA Journal

How Does The Medical Expense Tax Credit Work In Canada

Income Tax Deductions For The FY 2019 20 ComparePolicy

2014 Itemized Deductions Worksheet

Pin Di Worksheet

Pin Di Worksheet

Investment Expense Tax Deduction Which Fees Can You Deduct

From Pan To Crypto New Income Tax Reforms That Take Effect On July 1

How To Claim IRS Medical Expense Tax Deductions In 2015 2016

Medical Expense Income Tax Deduction - Verkko 21 tammik 2021 nbsp 0183 32 If you spent 9 000 on deductible medical expenses 2 000 could be deducted since that s the difference left over after subtracting 7 000 Medical