Medical Bills Income Tax Exemption For this medical expense you can claim up to RM1000 and it is applicable for any complete medical examinations done on you your spouse your children and

First assess the amount of the medical allowance and the exemption limit to determine the medical allowance deduction If the amount exceeds the limit Section 80D of the Income tax Act allows you to save tax by claiming medical expenditures incurred as a deduction from income before levy of tax You

Medical Bills Income Tax Exemption

Medical Bills Income Tax Exemption

https://www.signnow.com/preview/497/332/497332566/large.png

Preventive Check Up 80d Wkcn

https://emailer.tax2win.in/assets/guides/all_images/Section-80D-Summary.jpg

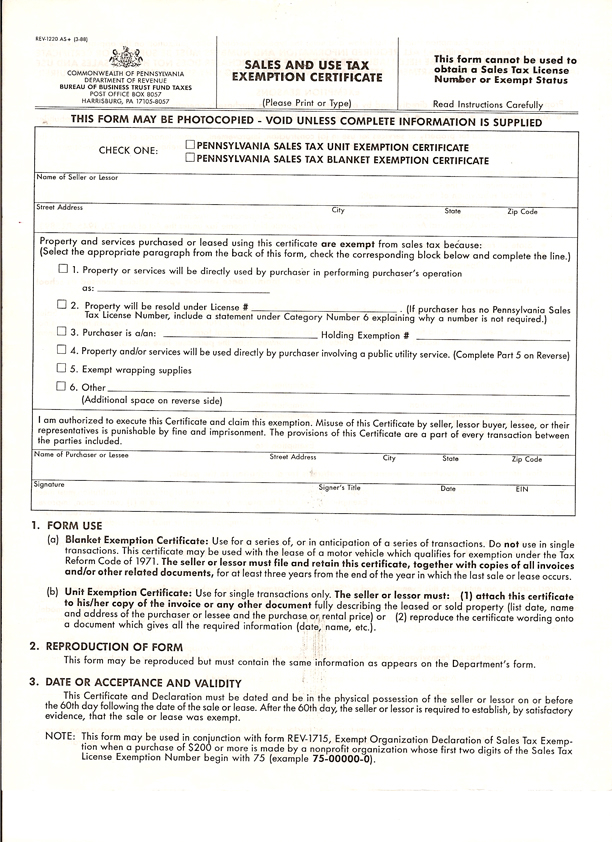

Pa Exemption Certificate Fill Out And Sign Printable PDF Template

https://www.exemptform.com/wp-content/uploads/2022/08/pennsylvania-tax-exempt-1.jpg

Medical expense deduction 2023 For 2023 tax returns filed in 2024 taxpayers can deduct qualified unreimbursed medical expenses that are more than 7 5 of their 2023 adjusted gross Get to know everything about Medical Bills Tax Exemption for AY 2018 19 Get details on reimbursement rules forms how to claim allowance for pensioners

Section 80D of the Income Tax Act 1961 provides tax deductions for medical expenditure made for the self and for his family members up to Rs 50 000 You can claim deduction under this section Medical Reimbursement is tax free perquisites under Section 17 2 till INR 15000 However the employee can incur an amount higher than INR 15 000 on medical

Download Medical Bills Income Tax Exemption

More picture related to Medical Bills Income Tax Exemption

Medical Bills Tax Exemption For AY 2019 20 Rules How To Claim

https://www.paisabazaar.com/wp-content/uploads/2017/06/img3.jpg

Income Tax Planning Last minute Tips To Save Tax Using Medical Bills

https://images.moneycontrol.com/static-mcnews/2021/03/shutterstock_424979290-770x433.jpg?impolicy=website&width=770&height=431

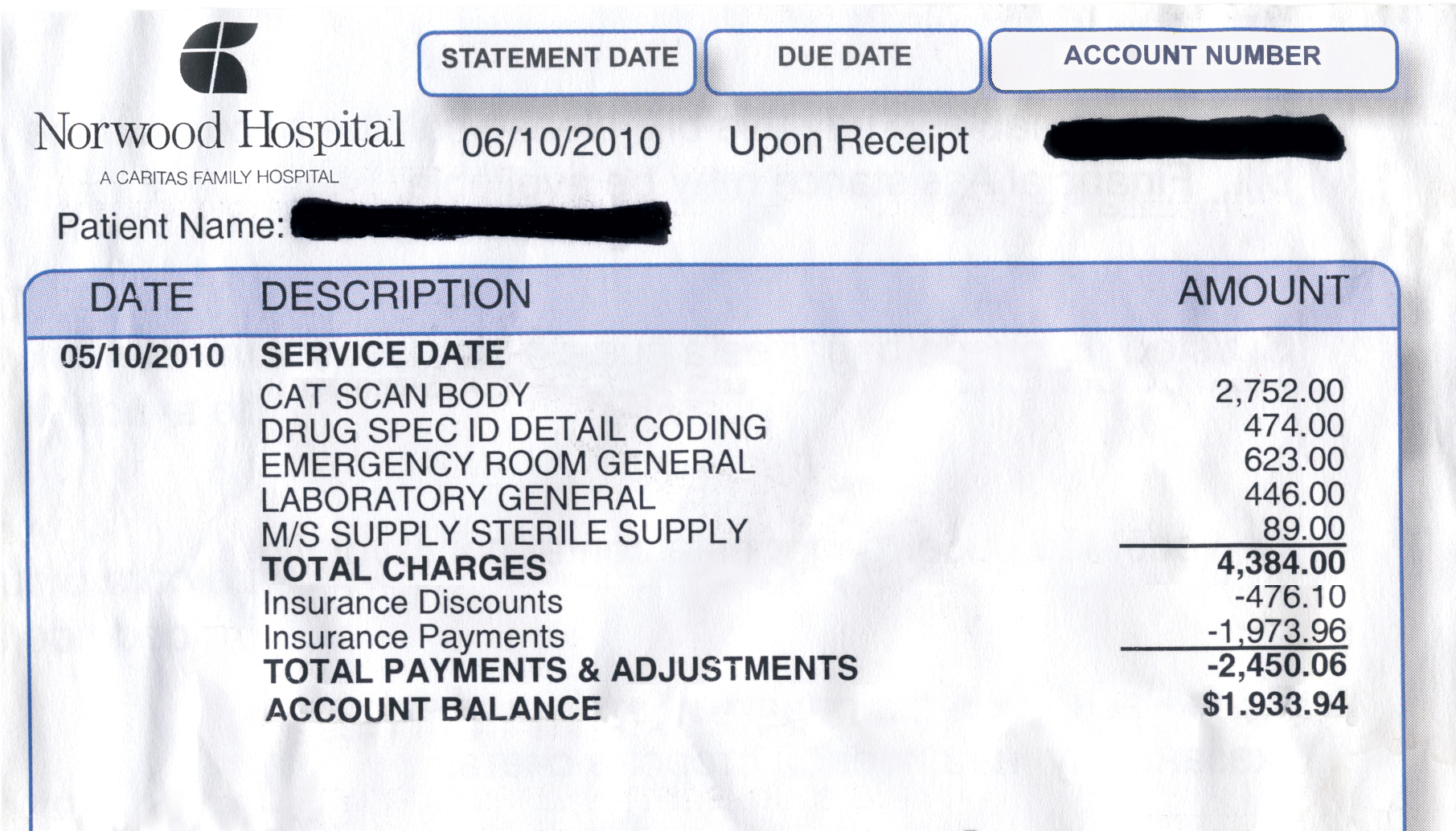

Anatomy Of A Medical Bill

https://cdn10.bostonmagazine.com/wp-content/uploads/sites/2/2010/12/norwood.jpg

Save E50K on senior citizens medical expenses Section 80D of Income Tax Act allows deduction of up to Rs 50 000 for medical expenses incurred for senior You do not have to pay tax on up to Rs 15 000 in a financial year if you submit medical bills for the same amount to the employer The main conditions for claiming this

In order to qualify for tax exempt status under the Income Tax Act of 1961 the following conditions must be met The money must have exclusively been used Medical care expenses include payments for the diagnosis cure mitigation treatment or prevention of disease or payments for treatments

Tax Exempt Donation Letter Sample Form Fill Out And Sign Printable

https://www.signnow.com/preview/497/332/497332572/large.png

Epf Contribution Table For Age Above 60 2019 Frank Lyman

https://static.pbcdn.in/cdn/images/articles/health/80d-deduction-is-allowed.jpg

https://www.imoney.my/articles/what-can-claim-tax-relief-medical

For this medical expense you can claim up to RM1000 and it is applicable for any complete medical examinations done on you your spouse your children and

https://fi.money/blog/posts/guide-to-medical...

First assess the amount of the medical allowance and the exemption limit to determine the medical allowance deduction If the amount exceeds the limit

The Revenue Department Issues A New Notice On Income Tax Exemption MPG

Tax Exempt Donation Letter Sample Form Fill Out And Sign Printable

California Tax exempt Form 2023 ExemptForm

Income Tax Benefits On National Pension Scheme All You Need To Know

2013 09 27

The Negative Income Tax NIT And The Welfare State An Effective

The Negative Income Tax NIT And The Welfare State An Effective

Income Tax Exemption U s 10 23C iiiac Allowable When 50 Of Total

Section 80DD Of Income Tax Act Deductions For Disabled Persons Tax2win

501 c 3 Tax Exempt Form Definition Finance Strategists

Medical Bills Income Tax Exemption - In fact medical cover is also available for the employee s family including spouse and children Medical reimbursement is an option available to employees