Rebate On Housing Loan Interest In Income Tax Web 1 sept 2014 nbsp 0183 32 Si vous 234 tes fiscalement domicili 233 en France vous pouvez b 233 n 233 ficier d une r 233 duction d imp 244 t pour certains investissements immobiliers locatifs concernant des

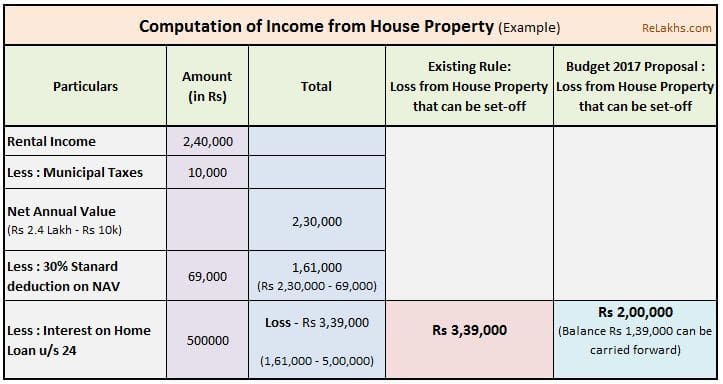

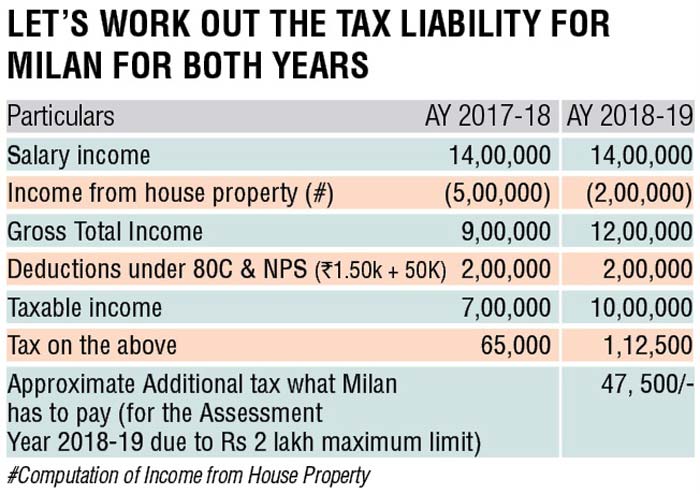

Web 4 avr 2017 nbsp 0183 32 Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution As per this section Web 25 mars 2016 nbsp 0183 32 What should be the Interest amount that I show on Housing Loan Is it Rs 2 33 684 19 FY 2017 18 Rs 56 741 74 20 of Prior Period Rs 2 90 425 93 Or Is

Rebate On Housing Loan Interest In Income Tax

Rebate On Housing Loan Interest In Income Tax

https://1.bp.blogspot.com/-oW8FNR-IJDU/XikG4UEcNwI/AAAAAAAAHps/3fzchCO4L400lsdyUEyhQ4S0xHA0wQ9tQCLcBGAsYHQ/s1600/FORM12C_2015_16_001.jpg

Income Tax Deductions List FY 2020 21 Save Tax For AY 2021 22

https://www.relakhs.com/wp-content/uploads/2017/02/Budget-2017-2018-loss-income-from-house-property-limited-to-2-Lakh-interest-on-home-loan-Section-24-rental-income-pic.jpg

Home Loan Tax Benefit Calculator FrankiSoumya

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

Web 31 mai 2022 nbsp 0183 32 You can enjoy home loan tax exemptions of up to Rs 2 lakh on the interest payment component This is useful during the initial repayments of your home loan when Web 5 sept 2023 nbsp 0183 32 Deduction can be claimed against home loan interest payment only What is Section 80EEA deduction limit The deduction limit is Rs 1 50 lakh per year What is the

Web the income tax department allows home buyers to claim certain tax deductions on the home loan principal and interest repayment the Sections of the Income Tax Act that allows Web If a home loan is taken jointly each borrower can claim deduction on home loan interest up to Rs 2 lakh under Section 24 b and tax deduction on the principal repayment up to Rs

Download Rebate On Housing Loan Interest In Income Tax

More picture related to Rebate On Housing Loan Interest In Income Tax

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

https://1.bp.blogspot.com/-oW8FNR-IJDU/XikG4UEcNwI/AAAAAAAAHps/3fzchCO4L400lsdyUEyhQ4S0xHA0wQ9tQCLcBGAsYHQ/w1200-h630-p-k-no-nu/FORM12C_2015_16_001.jpg

Tax Benefit On Home Loan Section 24 80EEA 80C With Automated

https://1.bp.blogspot.com/-1hmzbVNZKYo/XSHkKoX1yfI/AAAAAAAAJ48/rH6dqw_ChNcMLHBhRqZVUOtTkyFQPjeOQCLcBGAs/s1600/Picture-4%2Bof%2BArrears%2BRelief%2BCalculator%2B19-20.jpg

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

https://assets-news.housing.com/news/wp-content/uploads/2020/02/26180556/Section-80EE-662x400.jpg

Web 2 avr 2022 nbsp 0183 32 New income tax rules from April 2022 On new home loans sanctioned in FY23 first time home buyers won t be able to claim tax benefit under Section 80EEA as Web The housing loan EMI consists of principal amount as Rs 1 50 000 deductible under section 80C and interest amount as Rs 2 000 00 deductible under section 24 of the

Web 15 juin 2023 nbsp 0183 32 The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From Web Tax deduction under Section 80EE of the Income Tax Act 1961 can be claimed by first time home buyers for the amount they pay as interest on home loan The maximum deduction

What Are Reuluations About Getting A Home Loan On A Forclosed Home

https://www.paisabazaar.com/wp-content/uploads/2017/11/Tax-benefits-of-home-loan_2.jpg

Income Tax Exemption Calculator For Interest Paid On Housing Loan With

https://tdstax.files.wordpress.com/2016/12/8bb32-non2bgovt2bemployees2b2.jpg

https://www.impots.gouv.fr/particulier/deductions-liees-au-logement

Web 1 sept 2014 nbsp 0183 32 Si vous 234 tes fiscalement domicili 233 en France vous pouvez b 233 n 233 ficier d une r 233 duction d imp 244 t pour certains investissements immobiliers locatifs concernant des

https://cleartax.in/s/section-80ee-income-tax-deduction-for-interest...

Web 4 avr 2017 nbsp 0183 32 Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution As per this section

Home Loan Interest Rebate On Home Loan Interest In Income Tax

What Are Reuluations About Getting A Home Loan On A Forclosed Home

Mortgage Calculator Free Home Mortgage Calculator For Excel Calculate

Affordable Housing Low Ceiling On Value Limits Income Tax Benefits

Form 12BB New Form To Claim Income Tax Benefits Rebate

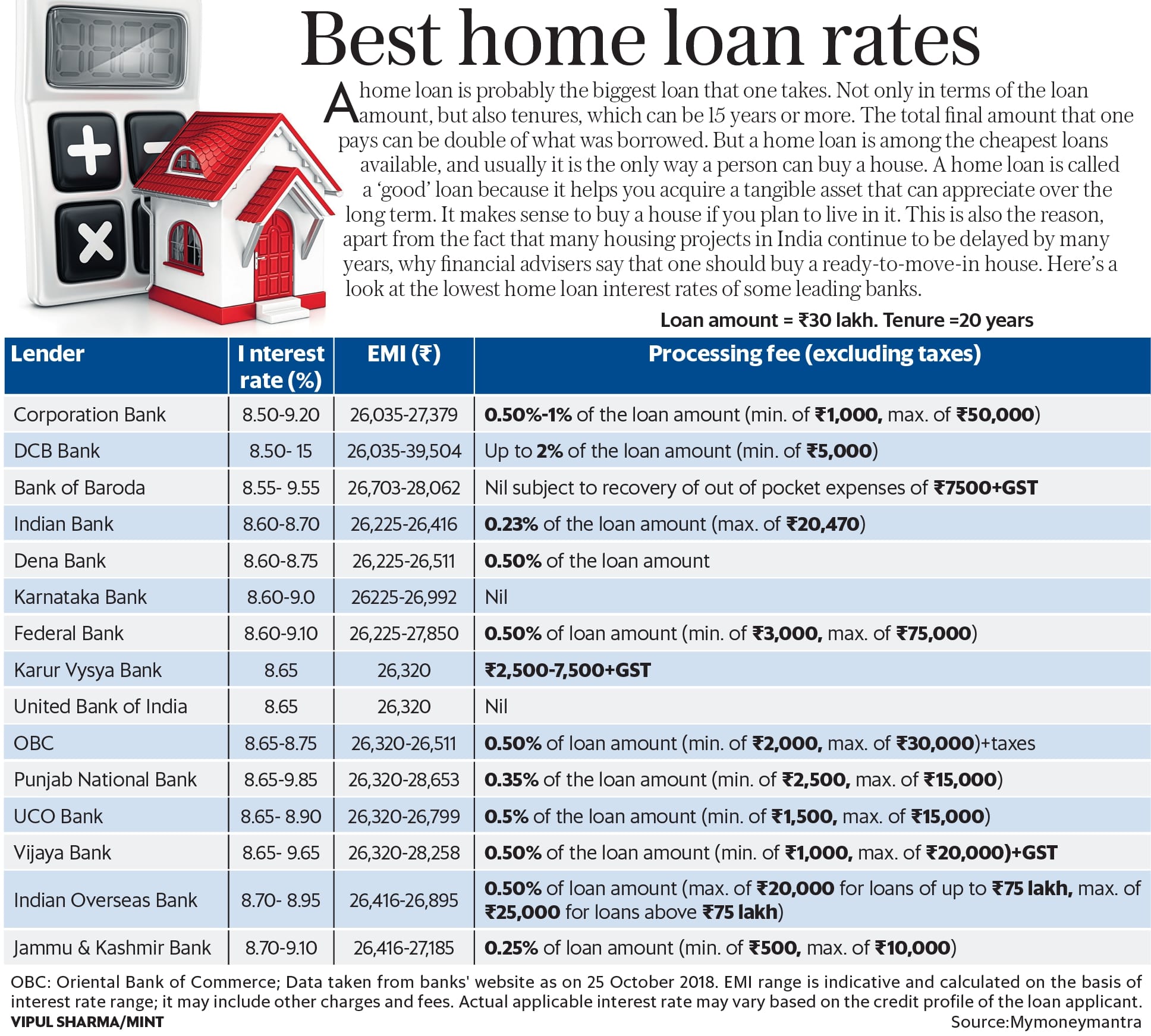

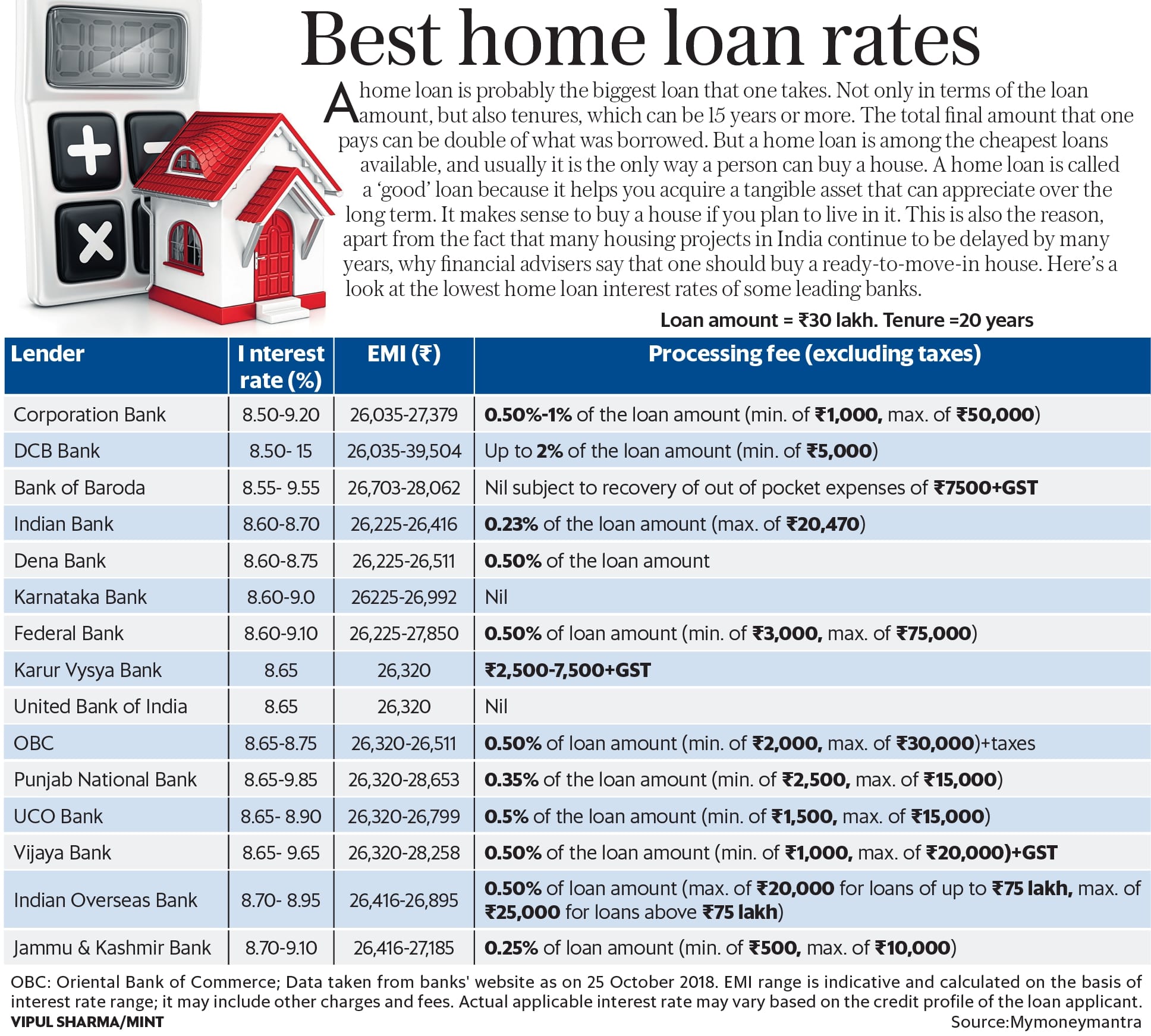

Public Bank Housing Loan Interest Rate 2019 Buying Your First Home

Public Bank Housing Loan Interest Rate 2019 Buying Your First Home

New Form 12BB For LTA HRA And Home Loan Interest Proofs To Be

Understanding The Tax Benefit Of Home Loan Interest

Comparing Interest Rates On Home Loan Archives Yadnya Investment Academy

Rebate On Housing Loan Interest In Income Tax - Web If a home loan is taken jointly each borrower can claim deduction on home loan interest up to Rs 2 lakh under Section 24 b and tax deduction on the principal repayment up to Rs