Redundancy Payment Tax Credits Redundancy payments and Tax Credits Other financial support This advice applies in England Wales and Scotland If you live in another part of the UK the law may differ

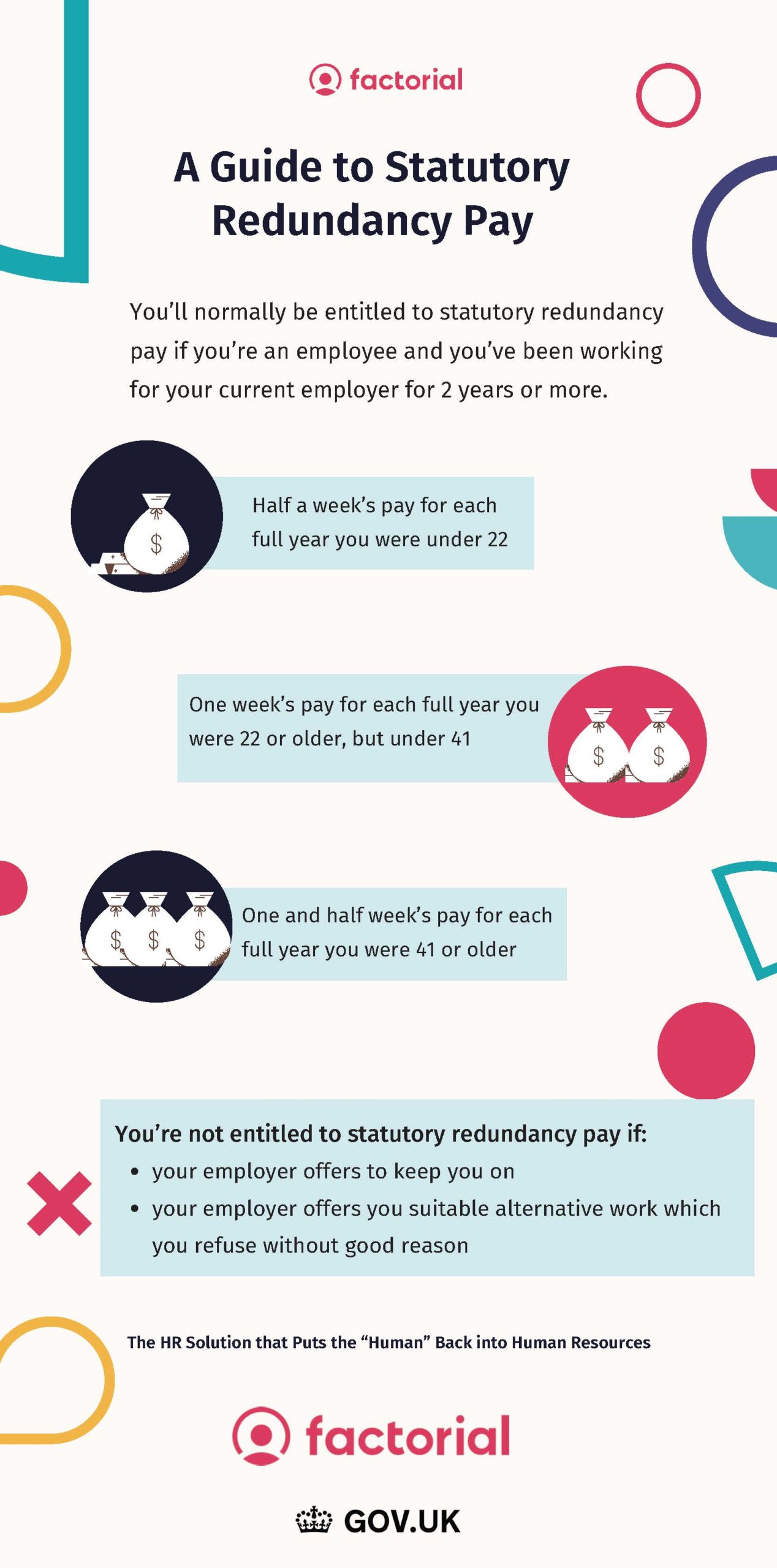

Statutory redundancy pay under 30 000 is not taxable What you ll pay tax and National Insurance on depends on what s included in your termination payment Whether it s statutory or contractual redundancy pay the first 30 000 you receive is tax free and no national insurance contributions are deducted either Do check you don t

Redundancy Payment Tax Credits

Redundancy Payment Tax Credits

https://www.redundancyclaim.co.uk/images/inline/1024x576/faqs/article-12-banner.jpg

REDUNDANCY UK Tax Planning With Your Redundancy Payment YouTube

https://i.ytimg.com/vi/JDsHD1IDX6g/maxresdefault.jpg

Redundancy Notice Sample Template Word PDF

https://www.wonder.legal/Les_thumbnails/redundancy-notice.png

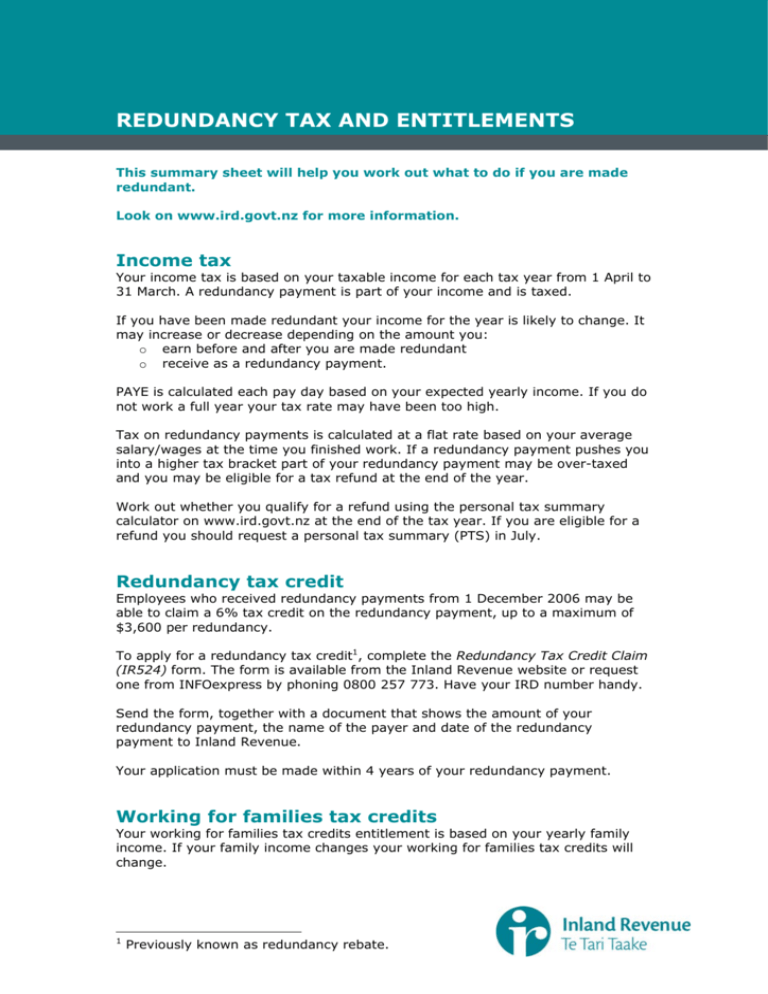

Tax credits For tax credits the income to be declared is the same as taxable pay for income tax So tax free redundancy amounts up to 30 000 can be ignored Possible Budgeting tools Working and Child Tax Credits If you already get tax credits you must tell the tax office HMRC that you are no longer in work This is called a change of

Overview When you claim tax credits you ll need to give details of your total income You ll also need to work out your income when you renew your tax credits each Updated on 6 April 2024 Redundancy Are you likely to lose your job Do you want to know how your redundancy package will be taxed and whether you will need to pay any

Download Redundancy Payment Tax Credits

More picture related to Redundancy Payment Tax Credits

How Is A Redundancy Payment Taxed Wingate Financial Planning

https://wingatefp.com/wp-content/uploads/2021/04/pexels-pixabay-209224-scaled-1-1024x683.jpg

Redundancy Payments And Tax Simmons Livingstone Associates

https://www.simmonslivingstone.com.au/wp-content/uploads/2020/06/JobKeeper-Your-most-asked-Questions-Web-10-1536x977.png

HOW REDUNDANCY PAYMENTS ARE TAXED

https://s3.studylib.net/store/data/008235229_1-43bc4650635de2de8c53ef7caa1696a0-768x994.png

Redundancy payments are taxed at the lump sum rate The ACC earners levy does not apply to redundancy payments Lump sum payments Last updated 02 Jun 2020 When Although redundancy pay is taxable tax credits only takes into account redundancy pay over 30000 If your husband is getting 20 23 thousand this amount

You might owe extra tax on your payout this is usually only if your redundancy payment exceeds 30 000 So before spending the cash on other things contact HM Revenue Article Tax on redundancy payments Redundancy payments are payments compensating an individual for the loss of their job They can be made in cash or

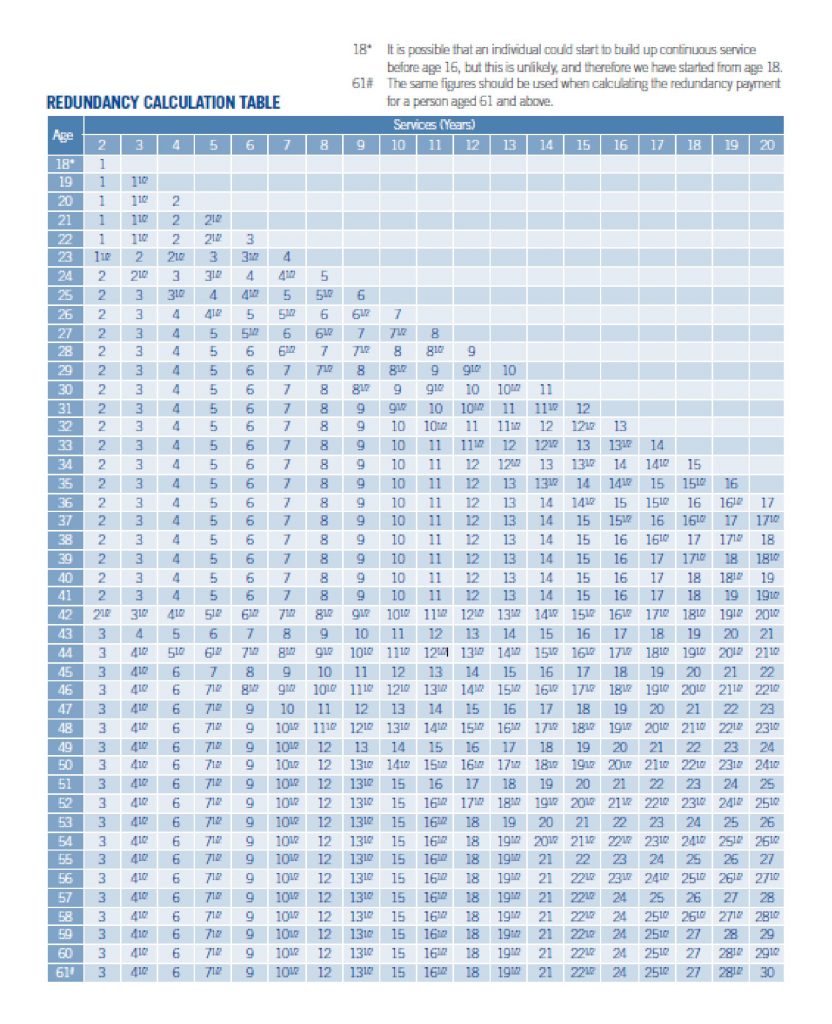

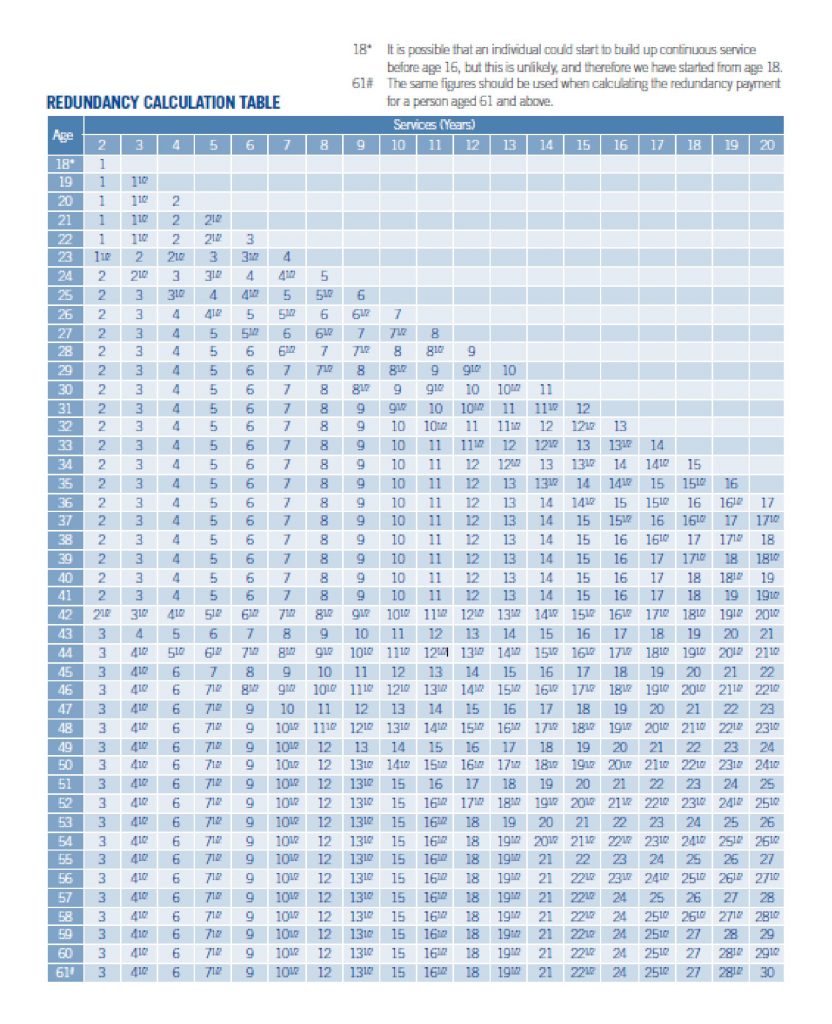

Redundancy Pay Calculations

https://select.org.uk/images/COVID-19/IMAGE-Redundancy-Calculation-Table-e1593768389477-832x1024.jpg

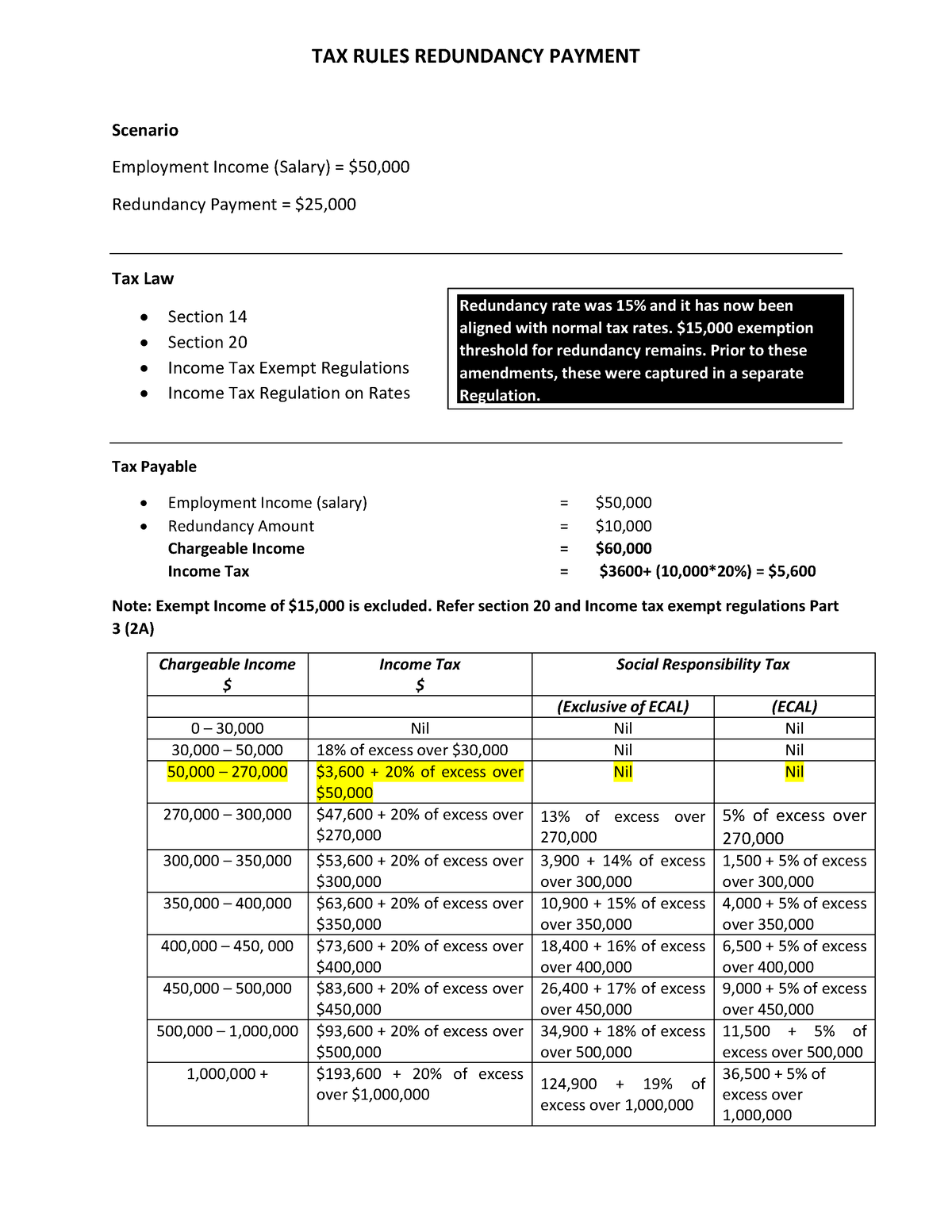

Taxation OF Redundancy Payment TAX RULES REDUNDANCY PAYMENT Scenario

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/911d3ffcd7494999fcadf5e6f1ad9321/thumb_1200_1553.png

https://workingfamilies.org.uk/articles/benefits...

Redundancy payments and Tax Credits Other financial support This advice applies in England Wales and Scotland If you live in another part of the UK the law may differ

https://www.gov.uk/redundancy-your-rights/tax-and-national-insurance

Statutory redundancy pay under 30 000 is not taxable What you ll pay tax and National Insurance on depends on what s included in your termination payment

Invoice Payment Free Stock Photo Public Domain Pictures

Redundancy Pay Calculations

Is My Redundancy Payment Tax Free

Simplifying The Complexities Of R D Tax Credits TriNet

Redundancy Calculator How Much Are Employees Entitled To Factorial

Suspension Of Employer s Obligation On Redundancy Payments Lifted

Suspension Of Employer s Obligation On Redundancy Payments Lifted

Comparing And Adjusting A Business QuickBooks File To Match A Tax Return

Tax Credits Are Hidden Benefit For Homeowners

Georgia Tax Credits For Workers And Families

Redundancy Payment Tax Credits - The maximum amount of statutory redundancy pay you can be entitled to overall is 19 290 while the length of service you ll be paid for is capped at 20 years