Solar Energy Tax Credit For Business This resource from the U S Department of Energy DOE Solar Energy Technologies Office SETO provides an overview of the federal investment and production tax credits for businesses nonprofits and other entities that own solar facilities including both photovoltaic PV and concentrating solar thermal power CSP energy generation

Importantly the ITC is a tax credit not a tax deduction However MACRS and bonus depreciation two other great incentives that help businesses go solar reduce your taxable earnings Here s what that means in practice with an example 100 000 solar panel system for a business with 100 000 in taxable income to keep the math simple The solar investment tax credit ITC is a tax credit that can be claimed on federal corporate income taxes for 30 of the cost of a solar photovoltaic PV system that is placed in service during the tax year 1 Other types of renewable

Solar Energy Tax Credit For Business

Solar Energy Tax Credit For Business

https://blog.geoscapesolar.com/hubfs/solar-energy-tax-credit-for-businesses.jpg

Commercial Solar Energy Tax Credit Alder Energy Solar

https://www.alder-energy.com/wp-content/uploads/2022/03/taxcreditimg.jpg

The Solar Tax Credit Explained 2022 YouTube

https://i.ytimg.com/vi/u46G0bvoXlY/maxresdefault.jpg

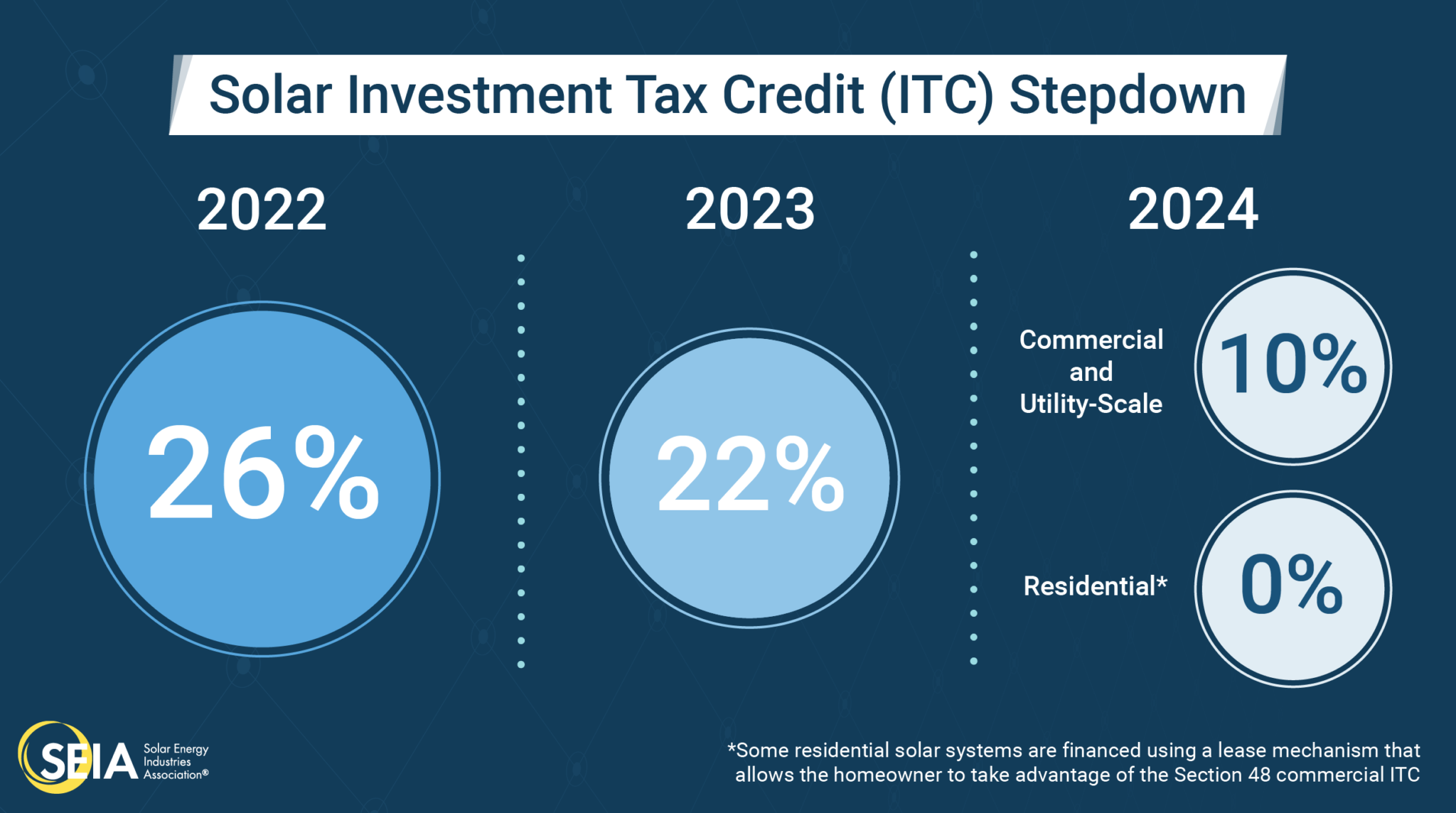

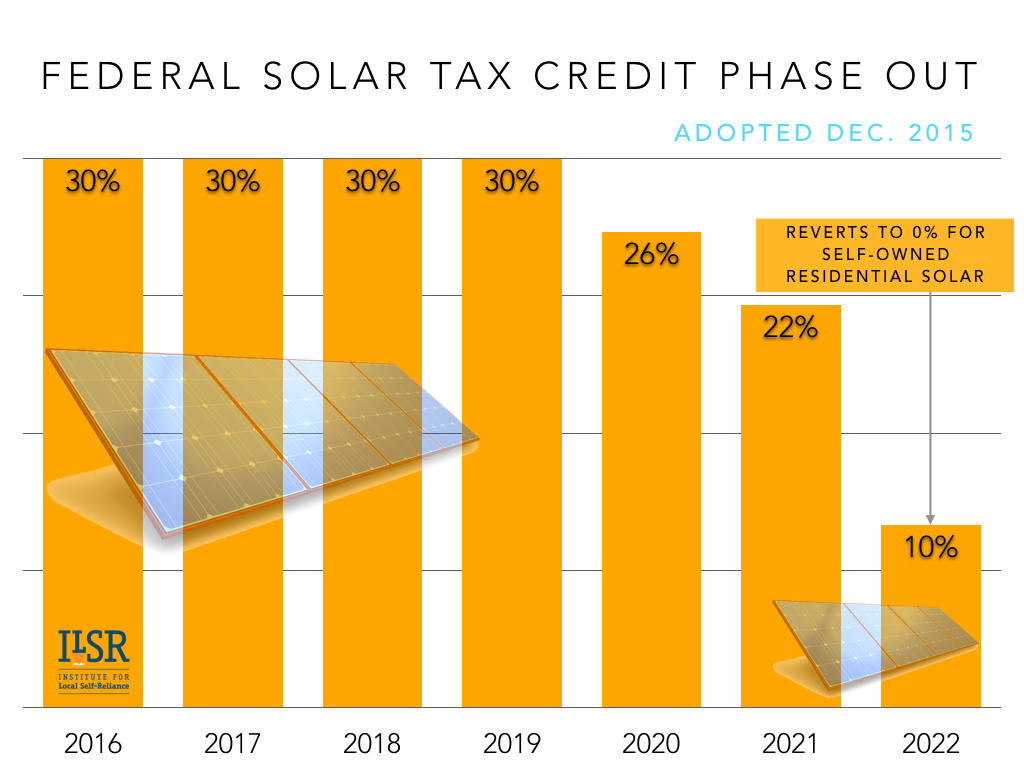

The ITC is a 30 percent tax credit for individuals installing solar systems on residential property under Section 25D of the tax code The Section 48 commercial credit can be applied to both customer sited commercial solar systems and large scale utility solar farms The ITC increased in amount and its timeline has been extended Those who install a PV system between 2022 and 2032 will receive a 30 tax credit That will decrease to 26 for systems installed in 2033 and to 22 for systems installed in 2034

Developed by the U S Department of Energy DOE Solar Energy Technologies Office SETO these guides provide overviews of the federal solar investment tax credit known as the ITC for homeowners businesses and solar manufacturers Federal Solar Tax Credits for Businesses Better Buildings Initiative This factsheet made by the Solar Energy Technologies Office will provide businesses with insight about the federal solar investment and production tax credits It deciphers bonus credits and labor requirements in the IRA includes information on project eligibility and more

Download Solar Energy Tax Credit For Business

More picture related to Solar Energy Tax Credit For Business

Federal Solar Tax Credits For Businesses Department Of Energy

https://www.energy.gov/sites/default/files/styles/full_article_width/public/2022-10/Summary-ITC-and-PTC-Values-Table.png?itok=_72eWNBC

Solar Tax Credit What You Need To Know NRG Clean Power

https://nrgcleanpower.com/wp-content/uploads/2022/05/ITC-Step-Down-2022-01.png

Solar Energy Tax Credit Explained Basit Siddiqi CPA

http://static1.squarespace.com/static/5ede50c58d672540f895f9c5/5ede511d2746a420fbc9f1f4/60c9f8ee89b8fe61809faf5b/1626412806790/gettyimages-1032683612.jpeg?format=1500w

Businesses can claim an upfront deduction of 125 per cent of the cost incurred to acquire qualifying assets used in the generation of electricity including supporting structures against their taxable income WHAT ARE THE REQUIREMENTS The business must own the asset The asset must be used in the production of income The Business Energy Investment Tax Credit ITC and Renewable Energy Production Tax Credit PTC allow businesses to deduct a percentage of the cost of renewable energy systems from their federal taxes These credits are available to taxable businesses entities and certain tax exempt entities eligible for direct payment of tax credits

For businesses the ITC is calculated on the gross installed cost of the solar power system equipment This means that before any state or utility rebates are deducted the ITC is first credited In the same example above if the total system cost reaches 18000 then the ITC is computed as 30 of this cost We offer a comprehensive approach in collaboration with our tax and consulting teams to help analyze the available federal state and local clean energy tax credits and incentives programs while checking for which ones your company could qualify for depending on where you do business

Federal Solar Tax Credit A Quick Rundown Next Energy Solution

https://nextenergysolution.com/wp-content/uploads/82527958_l-scaled.jpg

Equipment Tax Credits For Primary Residences About ENERGY STAR

https://www.energystar.gov/sites/default/files/TaxCredit_Residential.png

https://www.energy.gov/sites/default/files/2024-02/...

This resource from the U S Department of Energy DOE Solar Energy Technologies Office SETO provides an overview of the federal investment and production tax credits for businesses nonprofits and other entities that own solar facilities including both photovoltaic PV and concentrating solar thermal power CSP energy generation

https://www.energysage.com/business-solutions/...

Importantly the ITC is a tax credit not a tax deduction However MACRS and bonus depreciation two other great incentives that help businesses go solar reduce your taxable earnings Here s what that means in practice with an example 100 000 solar panel system for a business with 100 000 in taxable income to keep the math simple

How To Fill Out IRS Form 5695 To Claim The Solar Tax Credit Federal

Federal Solar Tax Credit A Quick Rundown Next Energy Solution

Solar Tax Credits Solar Tribune

Plan Your Solar Transition With A 30 Solar Tax Credit KC Green Energy

How Does The Solar Tax Credit Work SolarPower Guide Article

30 Solar Energy Tax Credit Ask A CPA YouTube

30 Solar Energy Tax Credit Ask A CPA YouTube

Colorado Government Solar Tax Credit Big History Blogger Photography

Congress Gets Renewable Tax Credit Extension Right Institute For

The Federal Solar Tax Credit What You Need To Know 2022

Solar Energy Tax Credit For Business - The U S government offers a solar tax credit that can help you recoup up to 30 of the cost of installing a solar power system The residential clean energy credit also covers other types of