Standard Tax Deduction 2024 Standard Deduction Amounts The standard deduction amounts will increase to 14 600 for individuals and married couples filing separately representing an increase of 750 from 2023

The IRS has released the standard deduction amounts for the 2024 2025 tax year Find the new rates and information on extra benefits for people over 65 For 2024 the additional standard deduction is 1 950 if you are single or file as head of household If you re married filing jointly or separately the extra standard deduction amount is

Standard Tax Deduction 2024

Standard Tax Deduction 2024

https://imageio.forbes.com/specials-images/imageserve/618be1b6d57aaf84e03b72d2/Standard-Deduction-2022/960x0.jpg?format=jpg&width=960

Should You Take The Standard Deduction On Your 2021 2022 Taxes

https://www.taxdefensenetwork.com/wp-content/uploads/2021/12/20212022-Standard-Deduction-.jpg

2021 Standard Deduction Over 65 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/form-1040-sr-seniors-get-a-new-simplified-tax-form-for-2019-2-1024x1024.png

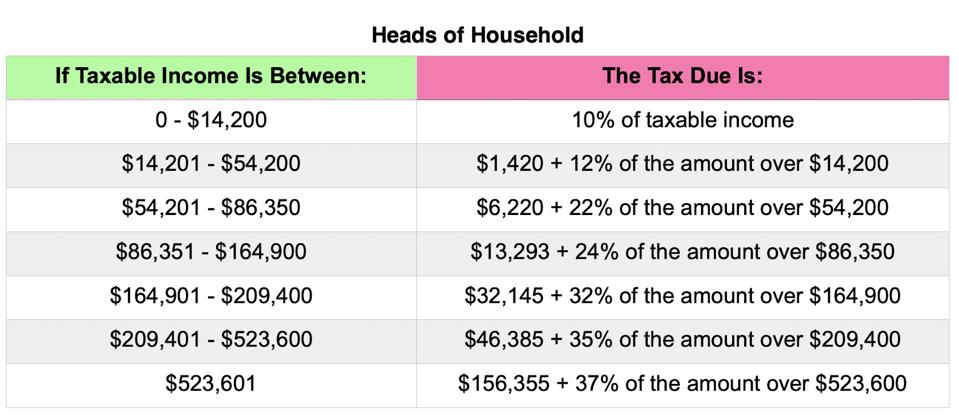

The standard deduction will increase by 750 for single filers and by 1 500 for joint filers Table 2 Seniors over age 65 may claim an additional standard deduction of 1 950 for single filers and 1 550 for joint filers 2024 Standard Deduction The standard deduction for 2024 is 29 200 for married individuals filing jointly and surviving spouses 21 900 for heads of households and 14 600 for single individuals and married individuals filing separately The standard deduction for a dependent is limited to the greater of 1 300 or the sum of 450 plus

The standard deduction for those over age 65 in tax year 2023 filing in 2024 is 15 700 for singles 29 200 for married filing jointly if only one partner is over 65 or 30 700 if both are The tax brackets standard deduction and the capital gains tax cutoff point for single and married filing jointly filing statuses will go up in 2025

Download Standard Tax Deduction 2024

More picture related to Standard Tax Deduction 2024

IRS Here Are The New Income Tax Brackets For 2023 Bodybuilding

https://image.cnbcfm.com/api/v1/image/107136825-1666125851699-6clBX-marginal-tax-brackets-for-tax-year-2023-single-individuals_1.png?v=1666125859

10 Tax Deduction Worksheet Worksheeto

https://www.worksheeto.com/postpic/2012/03/2015-itemized-tax-deduction-worksheet-printable_426931.png

What Are The New Irs Tax Brackets For 2023 Review Guruu Images And

https://boxelderconsulting.com/wp-content/uploads/2022/11/Screen-Shot-2022-11-17-at-12.20.59-PM-1024x469.png

The 2024 standard deduction is 14 600 for single filers and those married filing separately 21 900 for heads of household and 29 200 for joint filers and surviving spouses The standard deduction for a single person will go up from 13 850 in 2023 to 14 600 in 2024 an increase of 5 4 The top marginal tax rate in tax year 2024 will remain at 37 for single individuals with incomes greater than 609 350

How much is the standard deduction for 2024 The IRS released the 2024 standard deduction amounts for returns normally filed in April 2025 These amounts are provided in the chart below A deduction reduces the amount of a taxpayer s income that s subject to tax generally reducing the amount of tax the individual may have to pay Most taxpayers now qualify for the standard deduction but there are some important details involving itemized deductions that people should keep in mind

2022 Tax Rates Standard Deduction Amounts To Be Prepared In 2023

https://thumbor.forbes.com/thumbor/960x0/https://specials-images.forbesimg.com/imageserve/618c2bcb9a71897404eafb0f/Head-of-Household-tax-rates-2022/960x0.jpg%3Ffit%3Dscale

2023 IRS Inflation Adjustments Tax Brackets Standard Deduction EITC

https://www.wiztax.com/wp-content/uploads/2022/10/3.png

https://www.forbes.com/sites/kellyphillipserb/2023/...

Standard Deduction Amounts The standard deduction amounts will increase to 14 600 for individuals and married couples filing separately representing an increase of 750 from 2023

https://www.forbes.com/advisor/taxes/standard-deduction

The IRS has released the standard deduction amounts for the 2024 2025 tax year Find the new rates and information on extra benefits for people over 65

IRS Tax Brackets 2021 Table Federal Withholding Tables 2021

2022 Tax Rates Standard Deduction Amounts To Be Prepared In 2023

California 2024 Standard Deduction Roze Wenona

How Is Tax Deducted From Salary In Ghana TAX

2022 Tax Updates And A Refresh On How Tax Brackets Work Human Investing

Federal Tax Earnings Brackets For 2023 And 2024 Bestfinanceeye

Federal Tax Earnings Brackets For 2023 And 2024 Bestfinanceeye

What Your Itemized Deductions On Schedule A Will Look Like After Tax

IRS Releases 2021 Tax Rates Standard Deduction Amounts And More The

Printable Itemized Deductions Worksheet

Standard Tax Deduction 2024 - The standard deduction applies to the tax year not the year in which you file For tax year 2024 for example the standard deduction for those filing as married filing jointly is 29 200